Top 5 Global Contract Rankings: CoinW's Path to Breakthrough Through "Micro-Innovation, Precise Operations"

TechFlow Selected TechFlow Selected

Top 5 Global Contract Rankings: CoinW's Path to Breakthrough Through "Micro-Innovation, Precise Operations"

Delve into the underlying breakthrough logic of CoinW as a "major derivatives exchange."

Author: TechFlow

Introduction

The Coinglass "2024 Exchange Derivatives Market Report"指出:

In 2024, the global crypto derivatives market set a new record, with average daily trading volume exceeding $100 billion—far surpassing spot market volumes.

Futures trading has become the core battleground for major exchanges. Those who can build moats in futures will be better positioned to take the lead in the next phase.

However, building a sustainable competitive advantage in the futures market is no easy feat. An undeniable trend is that current mainstream exchanges’ futures products are becoming increasingly homogenized—product interfaces and features are highly similar, matching engine performance differences continue to narrow, and major coin futures offerings significantly overlap… Even as the entire futures market enters an era of “incremental innovation + refined operations,” we still observe several emerging platforms accelerating their breakout among hundreds of global exchanges:

In CoinGecko’s global cryptocurrency exchange rankings, CoinW ranks 24th overall, while entering the TOP 5 on the global derivatives exchange leaderboard. This divergence between “comprehensive scale ranking” and “dedicated futures ranking” highlights CoinW’s breakthrough in the niche futures market, prompting deeper interest in its unique advantages in futures trading.

As a well-established exchange with eight years of stable operation, CoinW has consistently adhered to a core strategy of “long-termism, security-first, and user experience priority,” committed to providing global traders with a safer, more stable, and more engaging futures trading environment. With over 15 million registered users across more than 200 countries and regions, and maintaining an unbroken record of zero major security incidents over eight years, CoinW has built a solid foundation of trust that supports strong user retention and capital accumulation.

In terms of futures business, annual year-on-year growth of futures users exceeds 20%, with monthly retention rates above 80%—achieving both “growth speed” and “growth quality.”

On the occasion of CoinW's eighth anniversary, we examine its underlying logic behind becoming a leading futures exchange through multiple dimensions: market performance data, product design philosophy, risk control systems, and user experience optimization strategies.

Product Innovation Drives Growth, Functional Details Shape Experience

User experience is key to attracting users and keeping them engaged.

But good user experience goes beyond whether a product interface looks nice or functions smoothly—it reflects how deeply a platform understands real user needs. It tests the R&D team’s insight into the habits and preferences of different levels of traders, and requires meticulous attention to detail across the entire product ecosystem.

As a core business segment, CoinW's futures trading follows the product design principle of “continuous innovation, user experience first.” From fee structures to functionality and support responsiveness, it aims to deliver an efficient, low-friction, seamless one-stop futures trading experience.

In optimizing its fee structure, CoinW offers extremely low transaction fees: While most platforms charge a 0.02% maker fee for futures, CoinW reduces this to just 0.01%, further lowering user trading costs and enhancing capital efficiency.

In terms of futures functionality, beyond ensuring secure and efficient order matching, CoinW establishes differentiated competitive advantages through continuous “micro-innovations” focused on user experience.

On one hand, CoinW provides comprehensive, all-scenario one-stop functional services, aiming to make every step of the trading process convenient and intelligent: Whether enabling users to freely split and merge positions for granular portfolio management, or offering one-click reverse opening during market shifts, CoinW strives to help traders capture market opportunities faster and manage risks more flexibly through thorough and thoughtful feature design—increasing profitability in volatile markets.

On the other hand, copy trading remains one of the most important aspects of futures trading. Based on blockchain transparency, futures copy trading allows users to instantly replicate strategies from professional traders, effectively connecting newcomers with experienced players and enabling bidirectional value circulation:

-

For novice copiers: Lowered entry barriers and increased profit potential by leveraging the expertise of seasoned traders

-

For experienced leaders: Additional income from profit-sharing and ongoing community influence

CoinW’s futures copy trading function lowers barriers to encourage active participation from both new and experienced users: Copiers need only 1 USDT to instantly follow star traders and expert KOLs; leaders face zero entry barriers, with profit-sharing settled daily.

Meanwhile, the principle of “micro-innovation” continues within copy trading, where multiple differentiated designs create CoinW’s comprehensive and flexible copy trading ecosystem: As the industry’s first copy trading mini-program, lightweight Telegram-based copy trading makes futures trading even more accessible. Deep integration with Telegram further socializes the trading experience. Signal-based copy trading allows leaders to efficiently publish strategies, while copiers can sync with one click on mobile, boosting efficiency.

In responding to user inquiries and resolving issues, CoinW offers 7x24 hour customer support with multilingual service including Chinese, English, Japanese, French, and Spanish, establishing efficient feedback mechanisms across global user communities to ensure all problems are promptly addressed and resolved.

Opportunities in the futures market change in an instant. If we view futures trading as a race:

Low fees allow users to start light; a comprehensive suite of features acts as a universal toolkit; one-click copy trading serves as a strategy replication accelerator; and 7x24 multilingual support functions as a reliable pit stop—all centered around the user. Every aspect of this product design helps traders avoid detours and run faster and steadier.

Furthermore, in May 2025, CoinW launched the industry’s first systematic real-time compensation mechanism for traders—the “Futures Protection Fund”—aimed at providing additional risk mitigation and subsidy safeguards, adding a protective “soft cushion” to the track so traders fear falling (liquidation) less and can therefore run more boldly and confidently.

Futures Protection Fund: An Effective Safety Net Amid Loss Anxiety

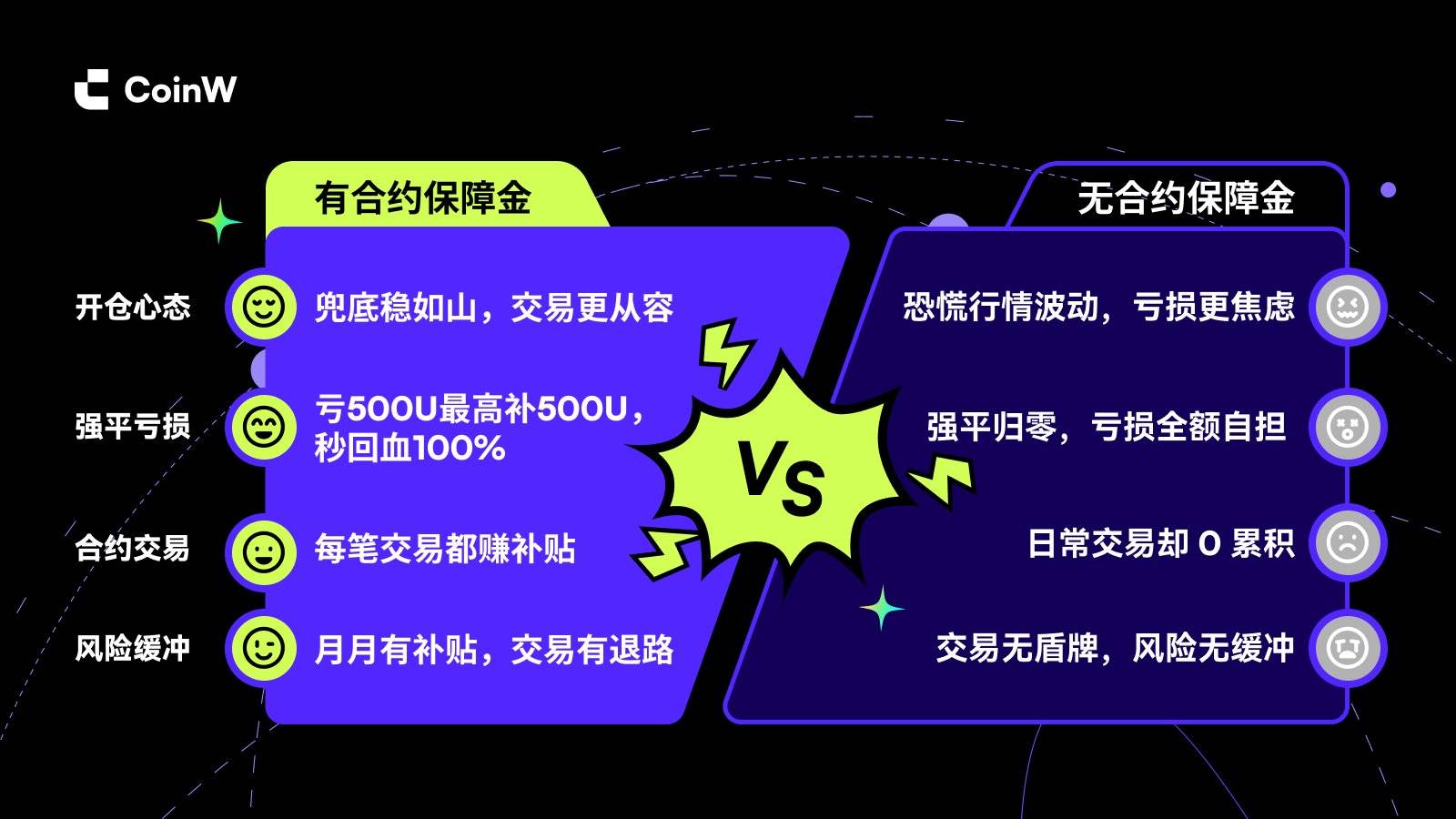

Historically, the futures market operates under a “user bears own risk” model. For many users, this either deters them from trying due to fear of loss, or leads to traumatic experiences after liquidation losses.

Under such loss anxiety, a key point of differentiation emerges: risk hedging or buffering mechanisms in futures trading.

CoinW’s launch of the “Futures Protection Fund” not only meets this user demand but also fills a critical market gap.

So, how does the Futures Protection Fund protect users?

As a dedicated subsidy program for futures traders, CoinW allocates $500,000 USDT each month into a central protection fund. When users suffer liquidation, they can claim up to $500 USDT in subsidies based on personal accumulated eligibility, which can be used to offset losses, fees, or margin requirements, thereby reducing trading losses.

The logic is simple, and participation is even simpler—every user who experiences it easily recognizes CoinW’s deeply ingrained “user-first” product philosophy.

In terms of participation, CoinW sets no barriers. Futures users automatically join the program by clicking the [Enter] button on the Futures Protection Fund page.

Regarding subsidy amounts, CoinW has established clear calculation rules: Subsidy eligibility depends on three key factors—trading volume, daily check-ins, and new user referrals. Higher trading volume yields higher subsidy caps. Users complete a daily check-in by trading at least 100 USDT in futures, earning fixed daily rewards. Inviting new users to join the program increases protection额度 (quota).

Starting from Phase III of the Futures Protection Fund, CoinW adopted a more advanced system algorithm to build a dynamic shield throughout the entire trading lifecycle, ensuring subsidies reach users who actively contribute to futures trading. The system automatically adjusts accumulation speed based on a user’s current subsidy balance—the lower the balance, the faster it grows. Meanwhile, fee-to-subsidy conversion efficiency is fully upgraded, achieving “dual acceleration” when combined with trading volume, allowing users to earn more subsidies for the same trading expenditure.

In terms of subsidy redemption, CoinW emphasizes efficiency, transparency, and fairness: Each phase has a fixed $500,000 USDT pool, distributed on a first-come, first-served basis. Once enrolled, users who experience liquidation can immediately claim their eligible subsidy, which arrives instantly without requiring customer service intervention. Within each cycle, users can increase their subsidy quota by boosting trading volume or inviting friends, and can monitor their personal quota and total prize pool balance in real time via the official page.

In essence, the Futures Protection Fund creates a safer, more stable, and more satisfying trading environment—one that acts like a soft cushion CoinW has laid across the uncertain landscape of futures trading: Before trading, it greatly alleviates users’ fear of negative balances; with a safety net in place, users can boldly explore profit opportunities. In the unfortunate event of liquidation, it provides real monetary compensation for a safe landing—enhancing CoinW’s appeal to new users and strengthening capital retention.

This also symbolizes an emerging shift in crypto trading philosophy: placing user trading security and psychological assurance at the core of the business model—shifting from a “platform免责 mindset” to a “user protection mindset,” from “users bear all risk” to “platform shares the risk.” CoinW is both the pioneer and leader of this transformation.

To date, CoinW has invested a cumulative $2 million USDT into the Futures Protection Fund. Several standout metrics demonstrate that the product’s value has stood the test of market and user validation: According to data released by CoinW, the fund has protected over 40,000 users, disbursed over $970,000 USDT in total, achieved a 100% success rate in extreme market protection, and maintained a 100% user asset safety rate.

At the same time, since launching this feature, both new futures users and overall futures trading activity have significantly increased.

New Features Brewing, Ecosystem Synergy Empowering: Continuously Building the Most User-Friendly Futures Trading Platform

With the 8th-anniversary celebration concluded, a new phase of evolution begins. Through clear strategic planning, CoinW has demonstrated strong growth momentum in its futures business.

According to the official roadmap, the next steps in CoinW’s futures product iteration include:

-

Continuously upgrading the Futures Protection Fund: Providing more users with a safety cushion during extreme market conditions and encouraging bolder experimentation with diverse trading strategies.

-

Launching the Smart Money feature: Using intelligent algorithms to track profitable on-chain addresses and KOL moves in real time, supporting one-click following of trades, along with algorithmic recommendations, leaderboards, and real-time alerts—delivering a “zero knowledge gap profitability” experience.

-

Launching Strategy Square: Partnering with globally renowned financial institutions, professional quant teams, and top strategy developers to offer high-return, low-risk stable quant strategies. Users can one-click follow high-win-rate strategies, while individual developers can share in profits—building an open quant ecosystem with diverse wealth-building options.

Looking beyond the futures ecosystem to the broader picture, on its 8th anniversary, CoinW announced the completion of a full-stack ecosystem integration upgrade—transforming from a single trading gateway into a trusted one-stop crypto finance ecosystem, generating powerful synergies that further empower its futures business.

Through this full-stack integration, CoinW’s four key products under its four core directions become clearly defined:

Trading Platform CoinW: As a comprehensive trading platform, CoinW supports both spot and futures trading, combining AI-driven strategies with multi-layered risk controls to achieve smart order routing and optimized matching—offering users efficient and secure trading experiences within a centralized environment.

On-chain Asset Platform GemW: An on-chain asset aggregation platform enabling one-click access to the blockchain without requiring standalone wallets or Gas tokens. Transactions can be executed directly via contract addresses, with LENS-model-integrated on-chain data, social sentiment, and project analysis helping users discover promising assets.

Blockchain Infrastructure DeriW: A public chain infrastructure based on Rollup architecture, supporting 80,000 TPS, offering zero-Gas perpetual contracts and transparent on-chain matching, while establishing high-yield LP liquidity pools to deliver efficient, low-cost on-chain trading experiences.

Proprietary Trading Platform PropW: The first proprietary trading platform designed specifically for crypto traders, allowing traders to use platform-provided capital for trading. Through a systematic trading evaluation system, traders demonstrate their skills and qualify for substantial capital backing. PropW offers top performers up to 90% profit sharing.

Through full-stack ecosystem integration, CoinW merges the efficiency of centralized systems with the transparency of on-chain operations, offering users a full-lifecycle trading support system—from narrowing knowledge gaps and reducing trial-and-error costs to managing risk boundaries and enhancing sustainable returns.

As CoinW deepens its construction of a “one-stop crypto finance ecosystem,” the influx of capital and traffic driven by the four products—through lowered barriers, optimized core performance, and enhanced strategic capabilities—will provide solid support for CoinW’s futures market and broader derivatives business, reinforcing its position as a leading futures exchange and continuously evolving toward a more innovative and vibrant futures trading ecosystem.

Conclusion

Competition among crypto exchange platforms has no finish line. In the endless pursuit of greater safety, lower barriers, higher efficiency, and superior user experience, the best milestone is always the next one.

Eight years of journey—from 0 to 1, then to +∞, from isolated breakthroughs to ecosystem integration. CoinW has delivered a remarkable performance, proving to the market that competition in the futures arena is not just about technology, speed, and scale, but a sustained marathon centered on user experience, product innovation, and trust-building. The choices of 15+ million users, an eight-year accident-free record, and a daily futures trading volume exceeding $5 billion are not just victories of data—they are positive returns on CoinW’s steadfast commitment to long-termism.

After pioneering the Futures Protection Fund and leading the way in platform-shared risk responsibility, what further innovative paradigm shifts will CoinW drive—not only in the futures space but across the broader crypto financial markets?

With new engines like the Futures Protection Fund, Smart Money copy trading, and Strategy Square now activated, CoinW’s futures trading experience reaches new heights. Combined with strategic synergy across CoinW, GemW, DeriW, and PropW, a high-speed formation of a one-stop crypto finance ecosystem spanning centralized and decentralized, on-chain and off-chain worlds is underway. CoinW is now chasing its next milestone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News