The "New Food Delivery War" in the Crypto Market: A Comprehensive Comparison from Food Delivery Subsidy Logic to Crypto Wealth Management Competition

TechFlow Selected TechFlow Selected

The "New Food Delivery War" in the Crypto Market: A Comprehensive Comparison from Food Delivery Subsidy Logic to Crypto Wealth Management Competition

From internet food delivery to crypto finance, subsidy wars reflect platforms' battle for users and market share expansion.

This past summer, the food delivery war in mainland China was in full swing. The price of a milk tea, after stacking platform coupons, could cost just a few dollars—or even be "free." Multiple food delivery platforms spared no expense to subsidize users, using generous incentives to cultivate consumer habits and ultimately build market scale. Today, this same logic has been replicated in the field of crypto wealth management. The crypto "subsidy war" has officially begun.

Recently, Justin Sun, global advisor at Huobi HTX, stated on social platform X regarding high-yield wealth management: "100% of high-yield interest comes from group subsidies" and "we can afford the subsidies." This has undoubtedly pushed the fierce territorial competition among trading platforms into a white-hot phase. More than 15 years after Bitcoin's creation, top-tier crypto exchanges—the apex of the "food chain"—are now engaging in a new round of intense internal competition.

The Crypto "Food Delivery War": High-Yield Subsidies and the Logic of Territory Expansion

Reviewing public data from several major trading platforms reveals that high-yield wealth management has become a key tactic for user acquisition. Similar to the internet-based food delivery wars, trading platforms use subsidies in the early stages of competition to rapidly gather users, gain liquidity advantages, and then leverage fund accumulation and ecosystem expansion to solidify long-term moats.

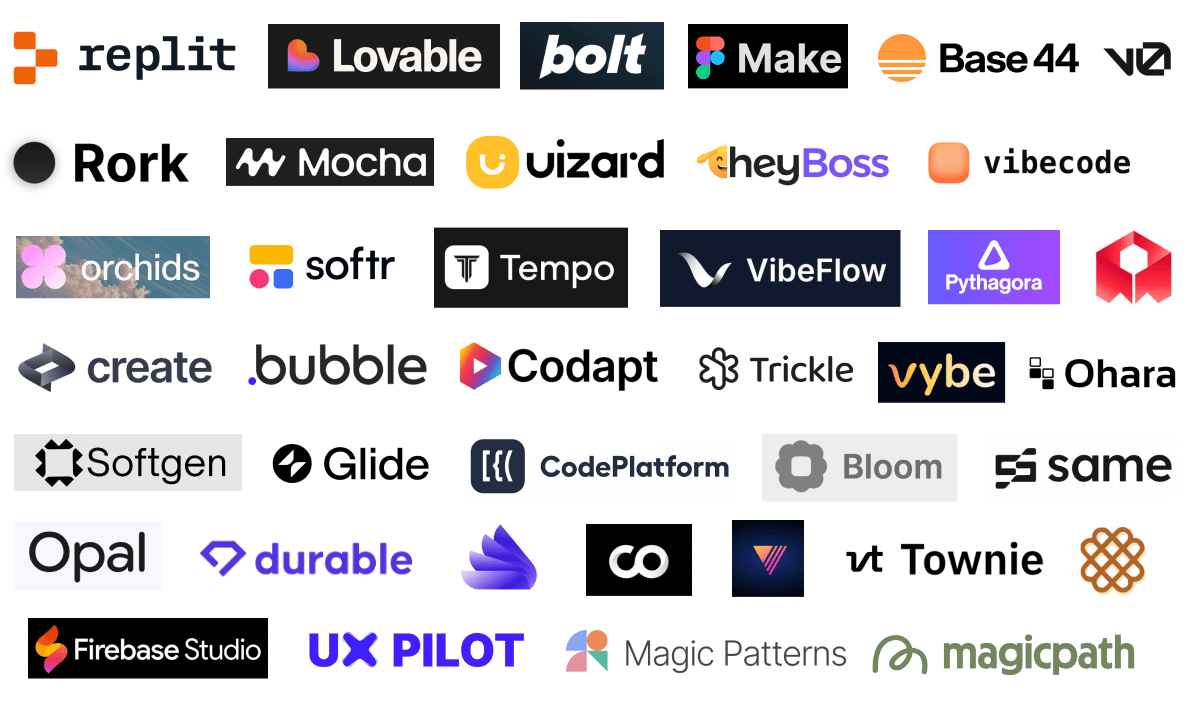

In terms of market dynamics, nearly all leading platforms have joined this battle. From C2C services to wealth management campaigns, from spot trading to derivatives, exchanges are deploying every possible method to acquire new users, reactivate existing ones, retain funds, and boost trading activity. Focusing solely on wealth management offerings, Binance attracts large deposits through tiered interest rates and fixed lock-up periods; OKX offers higher rates on its 180-day fixed products; KuCoin leans toward medium- to long-term staking; Bybit provides moderate yields on stablecoins and BTC; while Huobi HTX enters the arena with more direct, high-yield, flexible products. Each platform employs different strategies, but the underlying logic remains consistent: using interest as a form of subsidy to capture users and grow asset规模.

The rationale lies in the similarity between trading platforms' business models and those of food delivery or ride-hailing apps—more users and greater fund accumulation lead to deeper markets and richer product offerings, creating a virtuous cycle. Subsidies based on "burning money for users" are not wasteful spending but rather upfront investments made to secure future market share. Once users establish fund deposits and usage habits on a particular platform, switching costs rise significantly. Subsequent services such as trading, lending, and wealth management can all be conducted within the same ecosystem, allowing the platform to generate long-term profits and create win-win outcomes with users.

Building Differentiated Advantages in Wealth Management Subsidies—A Case Study of Huobi Earn

Amid the reality of subsidy warfare, major platforms adopt distinct strategies to build differentiated strengths. Let’s conduct a simple horizontal comparison using specific coin interest rates. Take ETH as an example: Huobi HTX’s Flexible Earn offers up to 6% APY for holdings between 0–0.2 ETH, far surpassing Binance’s 1.47% and Bybit’s 0.8%. Although OKX also reaches 5% in a similar range, it requires a 180-day fixed term. Comparisons show that Huobi HTX offers broader coverage, extending high-yield advantages across stablecoins like USDT and USDD, major coins including ETH, BTC, and XRP, and even DOGE, SHIB, and TRUMP—making it easier to find favorable earning opportunities across a wider range of assets.

Beyond offering high annualized subsidies, here are other differentiated advantages of Huobi HTX:

● Wider coin coverage with continuous new listings: Compared to other platforms, Huobi HTX offers significantly more earning options—not only mainstream and stablecoins but also tokens from emerging projects. The platform launches new coin earning campaigns almost weekly, giving it a strong competitive edge. Whether conservative investors holding stablecoins or users chasing volatility through new tokens, everyone can find suitable products in Huobi Earn.

● Greater flexibility and zero deposit门槛: Many of Huobi Earn’s high-yield products—including flexible offerings for USDC, USD1, USDD, and TRUMP—require no long-term locking, start from zero门槛, have no upper investment limit, and allow instant deposits and withdrawals. Users aren’t forced into long lock-up cycles like on other platforms, resulting in higher capital efficiency.

● Transparent and robust security: Beyond yield and flexibility, Huobi HTX publishes monthly Merkle Tree Proof of Reserves (PoR) and has maintained a reserve ratio of 100% or higher for three consecutive years. This means users enjoy high-yield subsidies while operating within a secure and transparent asset protection framework, minimizing potential risks.

Long-Term Value Beyond High-Yield Subsidies

Although some voices question whether such subsidies can be sustained long-term, experience from the food delivery subsidy wars suggests this competitive logic won’t disappear anytime soon. Moreover, for exchanges, high-yield subsidies are merely a user acquisition tool—the real value lies in ongoing user engagement and the sustained prosperity of the platform ecosystem after users have settled in.

High-yield wealth management is not simply a "giveaway" campaign; it reflects the evolving competitive landscape of the entire crypto industry. From food delivery to crypto finance, subsidy wars are fundamentally about capturing users and expanding market share. With higher yields, broader asset coverage, and more flexible product designs, Huobi HTX is building a differentiated advantage in the crypto wealth management race.

The crypto "new food delivery war" has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News