The token issuance platforms are in full swing, but have you actually made any money?

TechFlow Selected TechFlow Selected

The token issuance platforms are in full swing, but have you actually made any money?

Analyzing the strengths and weaknesses of top LaunchPad platforms, a "hundred-team battle" fought independently.

Authors: Jesse, BUBBLE

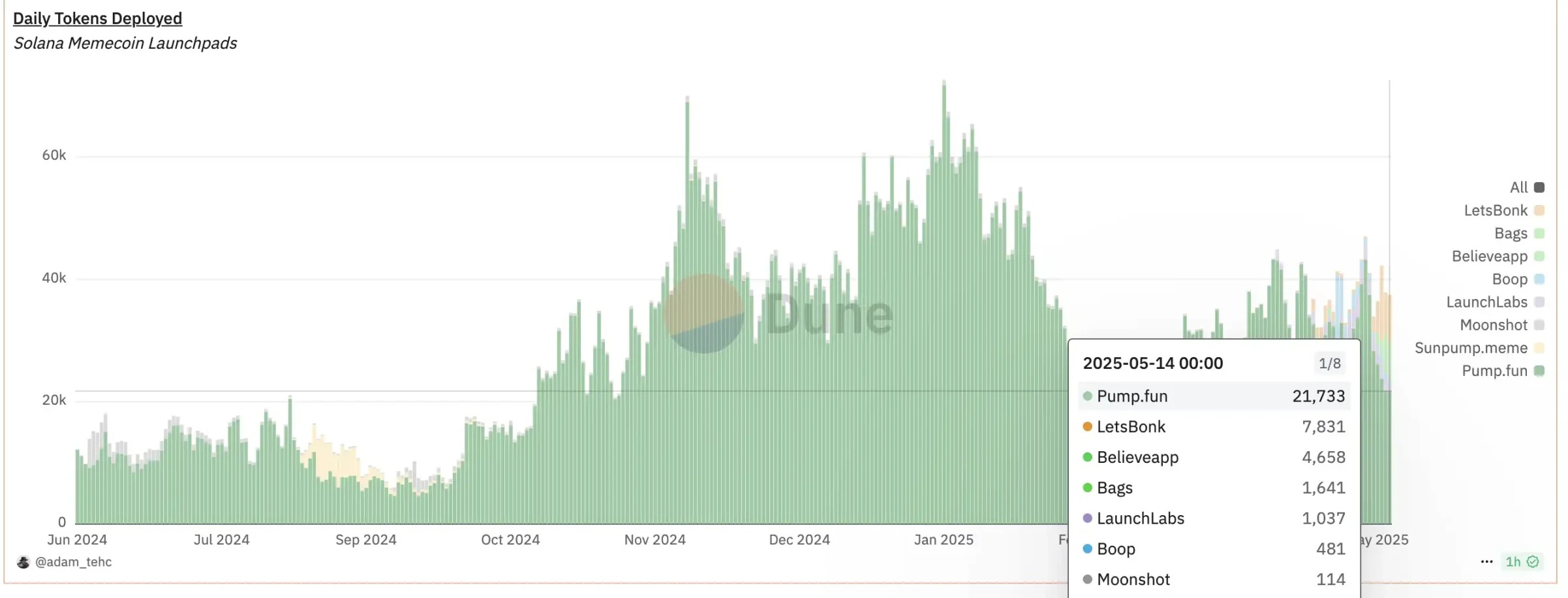

Over the past year, meme coin launchpad platforms on Solana have experienced explosive growth, rapidly forming a fiercely competitive landscape. Pump.fun, as one of the earliest platforms to rise, is seen as the catalyst behind Solana's "on-chain casino" boom. The platform allows any user to issue tokens without barriers, using bonding curve pricing to pioneer a fair issuance model with no presale and no team allocations.

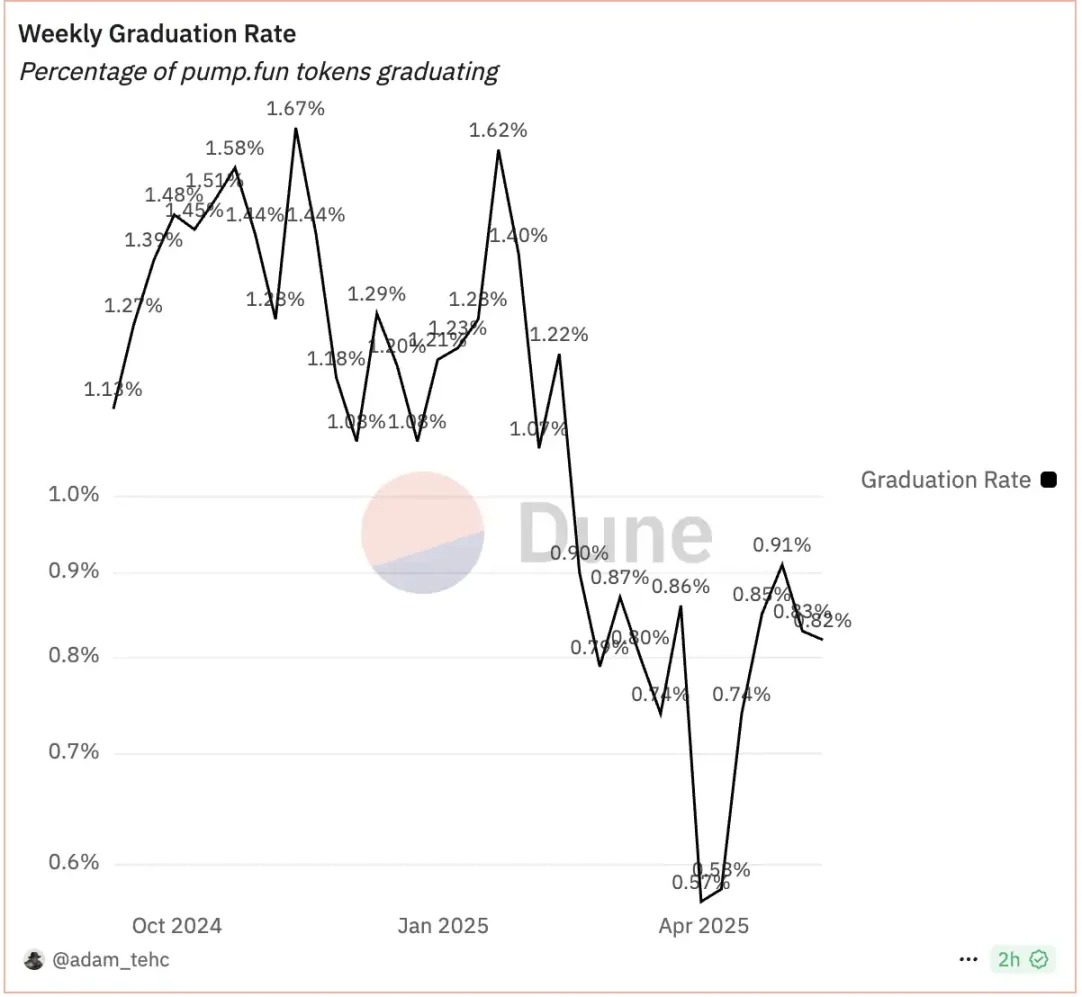

Leveraging Solana’s advantages of low cost and high-speed transactions, Pump.fun ignited the meme coin frenzy in 2024. In just 13 months, users issued over 8 million tokens on the platform. At its peak on October 24, 2024, more than 36,000 tokens were created in a single day—averaging 25 new tokens per minute. This unprecedented scale of token creation allowed Pump.fun to dominate the market temporarily, earning Solana the nickname of the largest on-chain "casino." However, Pump.fun’s success also brought underlying concerns. On one hand, a flood of low-quality projects emerged, with less than 1% graduating successfully, while the vast majority of tokens disappeared shortly after launch. On the other hand, although the platform profited handsomely, most users suffered losses: statistics show nearly 90% of users either lost principal or earned less than $100 from meme coin trading, while the platform collected approximately $98 million in fees within just six months.

By the end of 2024, Pump.fun had accumulated official revenue exceeding $223 million (about 1.15 million SOL), continuously converting received SOL into cash. Within just a year and a half, the platform’s fee account sold around 3.403 million SOL (approximately $629 million), making it the second-largest source of sell pressure after Solana’s early investors FTX/Alameda. Such massive capital outflows sparked community concerns about the platform’s sustainability and ecological impact. In response to Pump.fun’s dominant position, market participants moved quickly, pushing the entire Meme Launchpad sector into intense competition. Within the Solana ecosystem, established decentralized exchange Raydium launched LaunchLab to compete with Pump.fun; popular meme coin BONK introduced its own launchpad LetsBonk.fun; and on-chain aggregator Jupiter also attempted to roll out similar services.

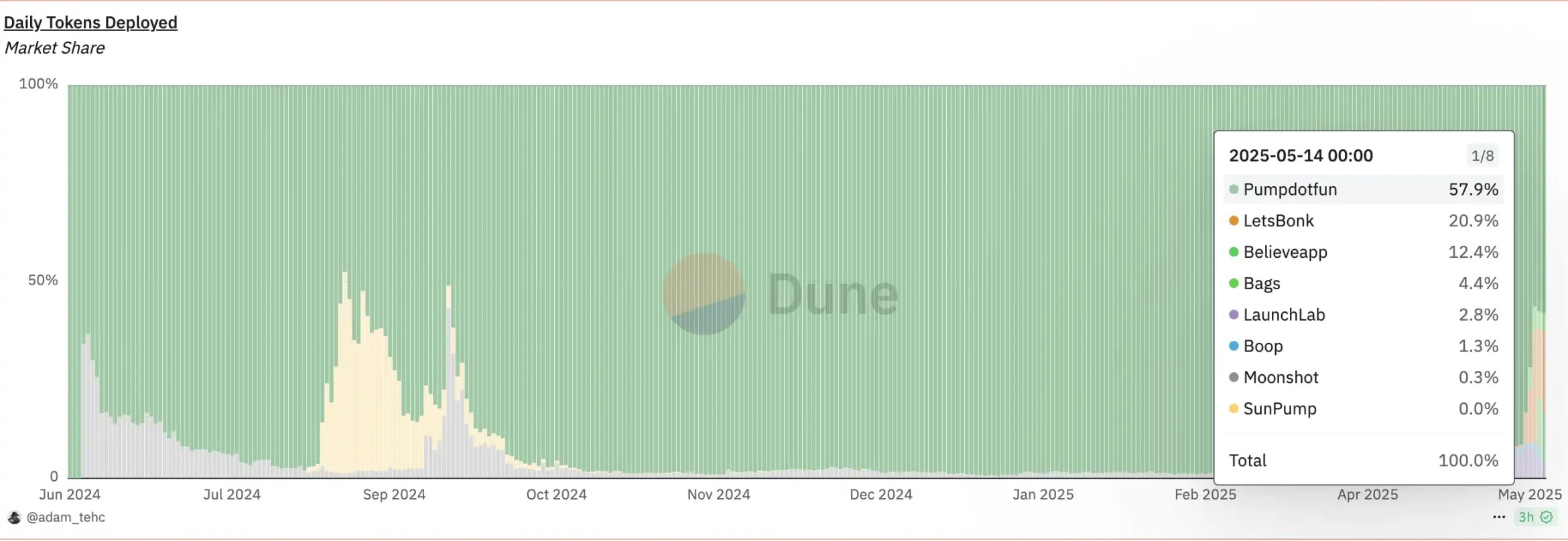

Daily token deployment data, sourced from @adam_tehc's DUNE dashboard

Challenges Facing Pump.fun

As a pioneer in one-click meme coin launching, Pump.fun established the foundational operational model. Users need only fill in basic information such as token name and symbol, enabling automatic deployment of token contracts and liquidity pools without requiring coding skills—significantly lowering the barrier to entry. The platform uses various bonding curve pricing models to balance initial prices with market demand, allowing issued tokens to be traded immediately in its AMM pool without requiring upfront liquidity provision.

The platform innovatively introduced an LP share burn mechanism: when a new token reaches a specific market cap threshold, part of its liquidity is automatically transferred to a Raydium trading pool and the corresponding LP tokens are burned, preventing project teams from withdrawing liquidity and running away—thus enhancing liquidity security.

With its “no-code issuance, instant trading” experience, Pump.fun rapidly gained popularity in 2024, spawning numerous creative meme tokens, some delivering hundredfold or even thousandfold returns, attracting many speculators. By collecting transaction fees, the platform became one of the most profitable on-chain applications of 2024.

However, as it evolved, issues with Pump.fun gradually surfaced: fewer than 1% of over 8 million issued tokens successfully “graduated” to external liquidity pools; user returns became severely polarized, creating a zero-sum game; the platform converted fees into cash and continuously dumped SOL, exerting downward pressure on the Solana network; while its fully anonymous and unmoderated model aligns with crypto ethos, it introduces regulatory and trust risks. As a result, Pump.fun’s growth slowed in early 2025, with daily trading volume dropping from a January peak of $544 million to $270 million in February—a nearly 50% decline.

Pumpfun’s weekly graduation rate continues to trend downward

The LaunchPad Grind – LaunchLab, Boop, Believe

Raydium LaunchLab’s On-Chain Degen Strategy

Raydium LaunchLab is one of Pump.fun’s most direct competitors within the Solana ecosystem. Raydium itself is a major AMM protocol on Solana, which previously benefited from Pump.fun projects contributing 41% of its swap fee revenue. But as Pump.fun launched its own PumpSwap, Raydium saw significant declines in traffic and trading volume.

In March 2025, Raydium released LaunchLab, widely viewed as a direct counter to Pump.fun. The platform shares core mechanics with Pump.fun—both support one-click token launches and bonding curve pricing—but includes targeted optimizations.

It supports multiple pricing curves, allowing project creators to choose linear, logarithmic, or exponential models based on token positioning; sets lower transaction fees at just 1%, compared to Pump.fun’s 2%, with no additional migration costs; lowers the graduation threshold to 85 SOL (around $11,000), enabling transfer into Raydium’s AMM pool; introduces a creator revenue-sharing mechanism where founders of graduated tokens can continue receiving up to 10% of trading fees; and strengthens ecosystem integration through innovations like fee buybacks of the platform token RAY, LP lock-up support, and diversified pricing options.

On the day of the announcement, RAY surged 14%, reflecting strong market expectations for Raydium LaunchLab. While officially framed as offering an “alternative choice,” the platform has successfully drawn some projects away, weakening Pump.fun’s dominance.

In addition, platforms such as LetsBonk.fun (a collaboration with the BONK community), Meteora, Boop, and Genesis Launches are also aggressively breaking through, driving the entire Launchpad market into a phase of full-scale competition.

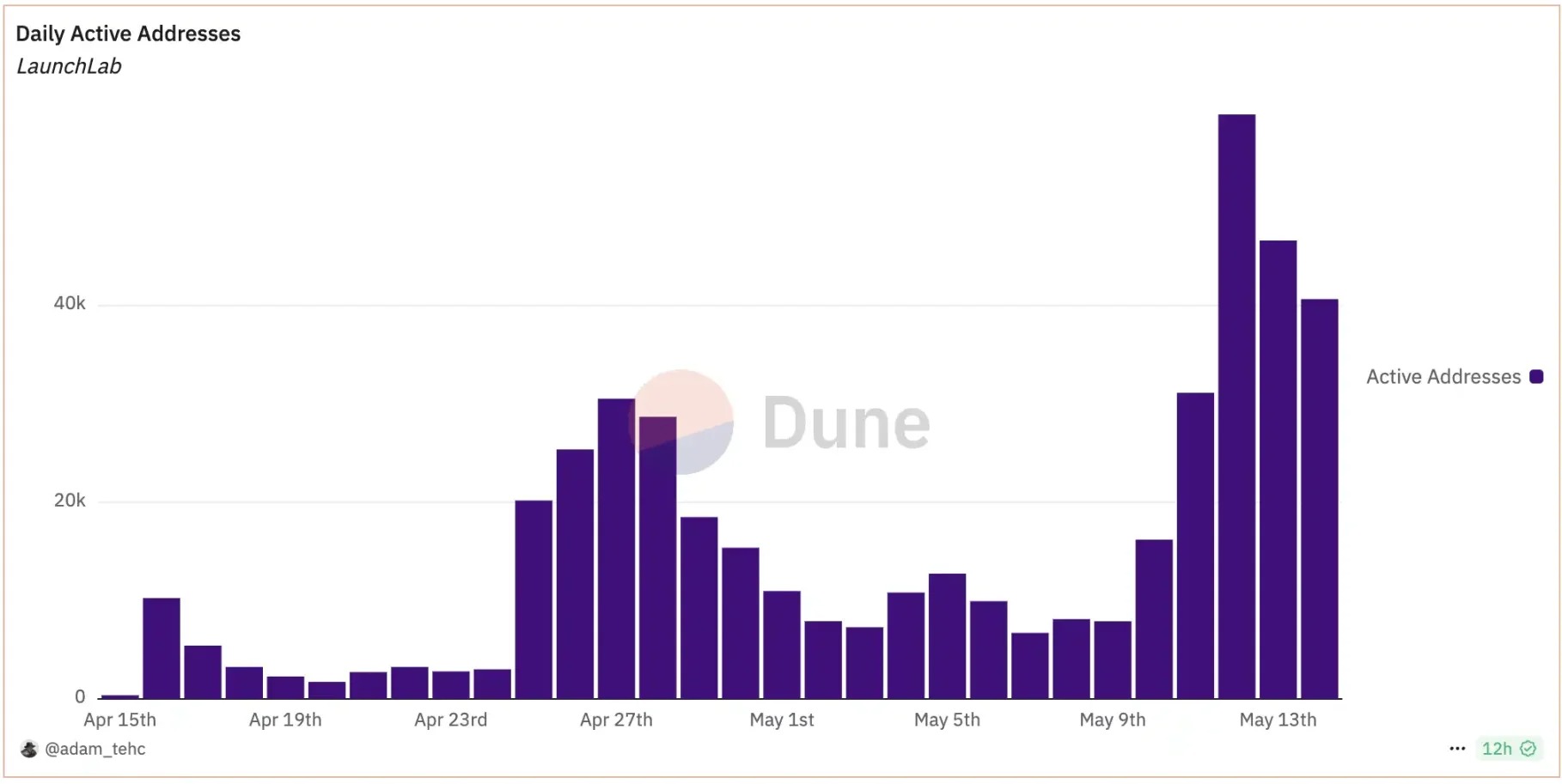

LaunchLab sees rapid growth in daily active users

Believe: A New Path Through Creative Storytelling and Productized Narratives

As the Meme Launchpad space becomes increasingly crowded, the resurgence of Believe has drawn widespread industry attention.

Founded by Australian entrepreneur Ben Pasternak, Believe evolved from Clout, a social token platform. Ben had previously built several successful apps but Clout faded quickly due to overreliance on celebrity influence. In late April 2025, Ben returned with the upgraded Believe platform, shifting its philosophy from “Believe in Someone” to “Believe in Something,” emphasizing belief in ideas and creativity—marking a strategic pivot from social asset trading to a creative incubation factory.

Ben described the transformation: “This is a shift from Influence to Trust. We’re no longer hyping celebrities—we’re seeking meaningful projects.”

Believe employs a unique product mechanism, using social media as the entry point for token launches, seamlessly bridging Web2 and Web3. Users simply need to @LaunchACoin on X along with a token name, and the system automatically creates a token using Meteora’s bonding curve—no need to log into a DApp or fill out forms. This “discussion-to-token” interaction model allows any valuable idea to instantly become a token, drastically lowering participation barriers. The platform also features a “B-point” mechanism: when a token’s cumulative fee revenue hits a critical threshold, founders can withdraw funds to support development; if not reached, it’s treated as market rejection. While B-point isn’t a fixed number, its logic resembles Kickstarter-style crowdfunding: “trading heat equals market vote.”

Imran Khan, founding partner at Alliance DAO, commented: “When a founder or Scout tags @LaunchACoin, a token is born. The market then values it based on how important the problem it aims to solve really is.” In short, market热度 determines a project’s fate.

In terms of revenue structure, Believe has introduced several innovative designs. It charges a 2% transaction fee, differing from other LaunchPads in that this 2% tax remains embedded in the token contract post-launch. Its distribution is highly incentive-driven: 1% goes to the token creator (founder), 0.1% rewards the Scout (the user who first discovered or promoted the token), and the remaining 0.9% stays with the platform. This mechanism not only provides immediate income assurance for creators but also, for the first time, includes “token discoverers” in revenue sharing—greatly incentivizing the community to actively identify and promote quality ideas.

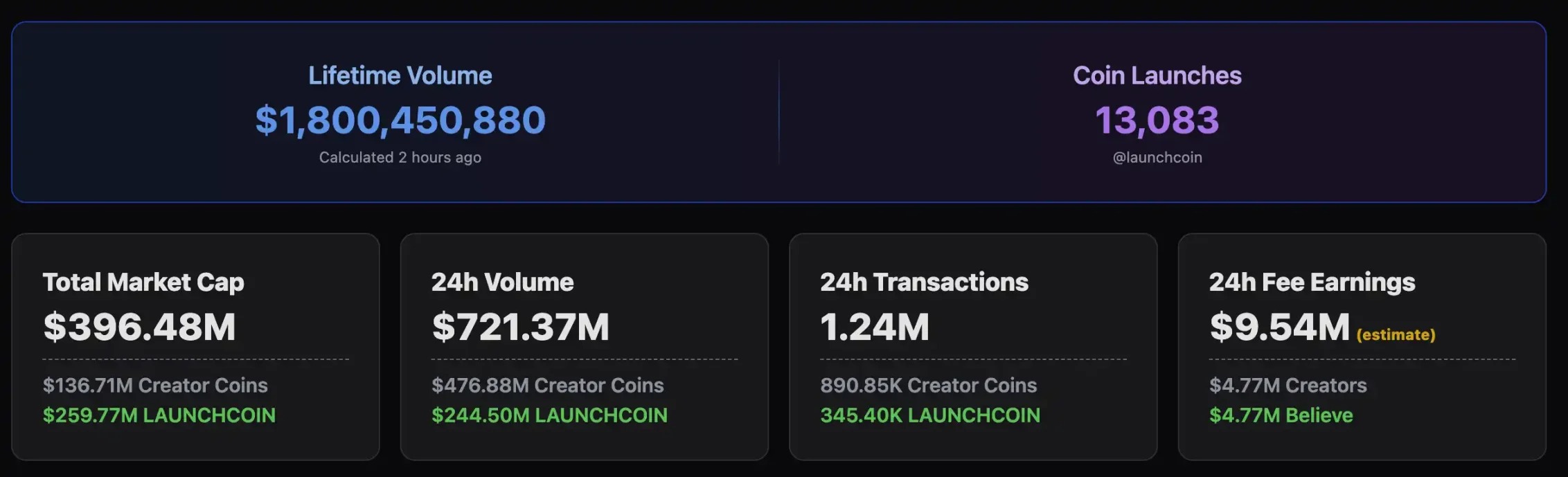

Since launch, Believe has recorded $1.8 billion in total trading volume, generating $9.5 million in direct income for creators, including $4.7 million from Believe token trades.

According to BelieveScan dashboard data, Believe earned ~$10 million in fees over the past 24 hours

While enabling open token launches, Believe also attempts to govern platform order to avoid becoming a haven for spam tokens.

On creator incentives, Believe chooses to share value directly: 1% of each transaction fee goes straight back to the creator; there are no reserved holdings or controlled supply ratios—founders define distribution freely; it implements a Scout reward system to decentralize content discovery; and the platform proactively displays metrics like trading volume and creator earnings to enhance transparency. The involvement of Web2 entrepreneurs further enhances Believe’s meta appeal: figures like Alex Leiman (RizzGPT) and renowned hacker Ruben Norte have both launched personal tokens on the platform, each briefly reaching multi-million dollar valuations—helping shift Believe’s image from a pure meme playground toward a “creative value testbed.”

This narrative logic was particularly evident during the LaunchCoin incident. Originally Ben’s personal token PASTERNAK, it was renamed LaunchCoin upon platform launch and given functional significance. On listing day, LaunchCoin surged 200x, surpassing a $200 million market cap, sparking heated community debate.

Some users saw it as a sign the platform was formally entering a governance token phase; others questioned whether Ben exploited his founder status for profit. Ultimately, Ben gradually sold most of his holdings, netting around $1.3 million. The fate of LaunchCoin triggered intense community discussion around the core theme of “trust.” Whether supporters or critics, the controversy successfully re-centered Believe in public discourse and validated interest in its core value proposition.

The trust-based narrative emphasizes the value behind ideas, discouraging pure greater-fool speculation, and attracts more rational builders and entrepreneurs. The aligned economic model ensures creators, Scouts, and the platform all benefit—binding participants financially and continuously incentivizing high-quality content. Under this mechanism, many Web2 talents bringing actual products have started issuing tokens.

Yet real community feedback shows that after launch, bots often acquire most of the supply. Due to initially high taxes reducing sell-side liquidity, strong projects can quickly reach $5–10 million market caps before taxes drop—and bots holding large positions begin dumping en masse. As a result, many tokens spike to tens or even hundreds of millions in market cap but lack sustainability. Some in the community argue that while creators, Scouts, and the platform benefit, retail investors ultimately foot the bill.

Ben hopes Believe can strike a dynamic balance between “empowering real-value projects” and “curbing blind speculative bubbles.” While doubts remain about its long-term viability, Believe has already carved out a distinct identity in the fierce Meme Launchpad battle through mechanism innovation, viral events, and standout performance metrics.

Key Differences Among Top Platforms

After Pump.fun’s initial dominance and subsequent imitation by others, the current Meme Launchpad market now hosts several leading players. Below is a comparative analysis across key dimensions among Pump.fun, Raydium LaunchLab, Boop, and Believe.

Issuance Method and Barriers

Pump.fun, LaunchLab, and SunPump all use DApp-based one-click issuance, requiring users to log in and complete token details. Believe completely breaks from the DApp paradigm, triggering token creation via Twitter social interactions—no platform visit required.

In terms of accessibility, Boop, Pump.fun, and LaunchLab impose almost no requirements—anyone can launch anytime. Believe appears permissionless but effectively applies a “natural filtering” through social networks—early creators and participants tend to be those following figures like Ben or Alex.

Regarding “graduation thresholds”: Pump.fun originally set it at $69,000 market cap; LaunchLab starts at 85 SOL (~$11,000), though offers a minimum 30 SOL launch mode—lowering the bar; Believe has no fixed threshold, instead judging market acceptance via “B-point” fee revenue.

Fee Structure and Distribution Mechanism

Pump.fun charges a 2% transaction fee, initially keeping all proceeds. Starting May 2025, it began returning 50% to creators. LaunchLab charges 1%, with 25% used to buy back platform token RAY, and founders can apply for up to 10% additional rewards. Believe charges 2% embedded in the token contract, distributing 1% to creators, 0.1% to Scouts, and retaining 0.9% for the platform. Data shows Believe offers the highest creator payout among all platforms and pioneers Scout revenue sharing—allowing discoverers to earn ongoing rewards.

Community Participation and Governance

Pump.fun follows extreme libertarianism—no moderation, no governance—relying on organic community efforts for promotion, but this also makes it vulnerable to manipulation by whales, resulting in “most retail lose, few win.”

Raydium LaunchLab leverages its AMM background to tap DeFi community resources and drives ecosystem circulation through platform token incentives; Boop relies on Dingaling’s prior community influence.

Believe experiments with community consensus mechanisms. Through token-based governance and Snapshot voting, it enables collective decisions on whether tokens should enter DEX liquidity pools or receive promotional support—forming an early framework of “launch-as-governance.” If matured, this could give Believe far stronger user stickiness than current mainstream platforms.

Creator Economic Models

In creator incentives, Believe and LaunchLab are most compelling. Believe’s 1% instant fee return plus Scout rewards create a flywheel effect: launch → attract new users → launch again.

LaunchLab retains creators through low barriers, high flexibility, and RAY buybacks. Pump.fun, lacking early incentive structures, has lost some appeal in this evolving environment.

Market Outlook for LaunchPads

As the Meme Launchpad market transitions from explosive growth to maturity, several key trends are emerging, offering guidance for platform competition and industry evolution.

Data Hype Subsides, Precision Competition Begins

On-chain data indicates the meme coin issuance frenzy is cooling. For example, Pump.fun’s daily trading volume and token launches have clearly declined since early 2025, making “get-rich-quick” stories difficult to replicate at scale.

This suggests the era of brute-force growth is ending. Competition will shift toward refined operations—platforms that can consistently generate hits, improve creator ROI, and enhance user experience will gain advantage ahead of the next wave. Pump.fun’s user behavior data (halved trading volume) shows that even first-mover advantage erodes if platforms fail to improve participant P&L structures and emotional engagement.

Business Model Shifts from “Extract” to “Shared Success”

Pump.fun’s early business model was simple and extractive: platform collects fees while users face extremely low win rates, creating a “platform wins, users lose” imbalance. In contrast, newer platforms like Believe and LaunchLab adopt creator- and community-friendly growth strategies.

For instance, Believe returns 1% of fees directly to founders, encouraging continuous content creation; LaunchLab builds a self-sustaining ecosystem loop via fee sharing and RAY buybacks. Future Launchpads will emphasize shared success among platform, creators, and users—forming genuine “content-incentive networks.”

Pump.fun’s recent introduction of creator revenue sharing reflects how this new model is forcing older players to adapt.

Multi-Chain Landscape Becomes Normal, Each Ecosystem Cultivates Its Own Meme Soil

As competition intensifies among Solana-based platforms (Pump.fun, LaunchLab, BONK), other blockchains are accelerating their own Meme Launchpad deployments: Tron’s SunPump, Solana’s Boop, Base’s Genesis Launches, and even projects from ICP and Avalanche ecosystems are testing the waters.

Fundamentally, meme issuance platforms have become tools for blockchains to compete for active users. Meme coins, with their low barriers and strong virality, are naturally suited for generating on-chain traffic.

In the future, major blockchains may each develop one or two dominant Meme Launchpads, deeply integrated with wallets, social tools, and NFT utilities—becoming key indicators of ecosystem vitality and user loyalty.

Community Culture and Narrative Will Become Platform Moats

The core of memes lies not in technology, but in storytelling—and platforms are no exception:

Pump.fun rose on “extreme freedom and openness” but suffered from rampant manipulation and poor-quality projects;

Raydium emphasizes “fair launch and technical optimization,” positioning itself as a “revenger” to win back native users;

Boop leverages personal brand “Dingaling” and $Boop ecosystem reinvestment to focus on core token value capture;

Believe pursues a “trust and value” path, aiming to attract Builders by treating creativity as the origin of memes.

In the future, community culture will directly determine what kind of users a platform attracts: degens (pure speculators), KOLs (signal-followers), builders (value-oriented), or general users (entertainment-focused). Platform differentiation will extend beyond product mechanics into emotional consensus and cultural atmosphere.

In daily token deployment share, Pumpfun’s market dominance has dropped from near-monopoly to 57%

From Meme to ICM: A New Startup Incubation Path Emerges

Although 99% of meme coins today remain short-term speculative plays, some projects are beginning to attempt the “meme-to-product” transition. Some founders use collected fees as seed funding to build teams and develop prototypes; some platforms, like Believe, encourage roadmap execution through mechanisms like “releasing funds upon hitting B-point”;

Communities are starting long-term observation and governance of select tokens—LaunchCoin, for example, holds experimental value in governance, revenue sharing, and functionality expansion. If even a small fraction of meme projects successfully evolve into real products via Launchpads, the symbolic impact would be profound: proving Launchpads can do more than spawn speculative tokens—they can incubate actual Web3 ventures. At that point, Launchpads would no longer be mere “issuance tools,” but “infrastructure for project cold starts.”

Conclusion

Meme Launchpads stand at the cusp of transitioning from chaotic explosion to refined operation. Pump.fun’s monopoly has been broken, with platforms like Raydium LaunchLab and Believe gaining ground through differentiated strategies, gradually capturing user and creator mindshare.

The future winner may not be the one with the lowest fees, but the one that builds a content flywheel, fosters community consensus, and establishes trust mechanisms. Believe, through its social distribution model, Scout incentives, and governance experiments, has begun constructing its own moat, demonstrating strong iteration and growth potential. Of course, this remains a marathon race. The platform that ultimately prevails will need to balance cultural alignment, creator collaboration, ecosystem governance, and compliance.

As Ben Pasternak said: “We’re not just building a platform—we want to make monetization possible for every good idea.” That might just be the most promising direction for the next stage of Meme Launchpads.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News