Opinion: LetsBonk dominates in the short term, while PumpFun may switch strategies to stage a comeback

TechFlow Selected TechFlow Selected

Opinion: LetsBonk dominates in the short term, while PumpFun may switch strategies to stage a comeback

Memecoin market declines, PumpFun's strategic shift could make it the biggest winner.

Author: miya

Compiled by: TechFlow

First, this is not an attack on LetsBonk; I believe the Bonk team led by Tom has done an excellent job winning favor in the memecoin space, to the point where any counterattack seems meaningless. LetsBonk has won the memecoin war and will continue to maintain its dominance.

PumpFun is currently seen as winning. Your initial reaction might be to laugh at me for not understanding the market. But before drawing conclusions, let’s look at some data that actually shows PumpFun is not winning.

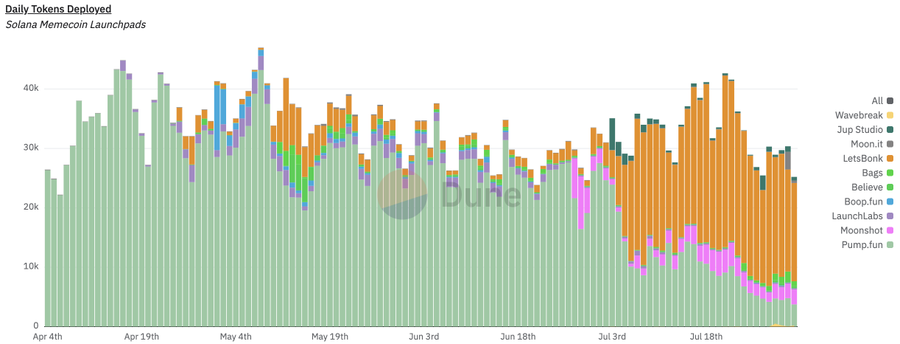

LetsBonk has not only captured market awareness in daily token launches but has also become the absolute leader in the token launch space.

LetsBonk currently leads by approximately 3.7 times in number of tokens launched and has successfully captured 65.1% of the market share within just one month. Additionally, LetsBonk's token distribution events are about 7.8 times those of PumpFun. While PumpFun has higher issuance volume per distribution event, LetsBonk has become the more expected-value-positive (+EV) platform for launching trades.

So why is PumpFun perceived as winning right now? All metrics and charts seem to show a gap. Let me explain:

It’s time to take a broader perspective to understand why PumpFun’s strategy has been executed so perfectly to date.

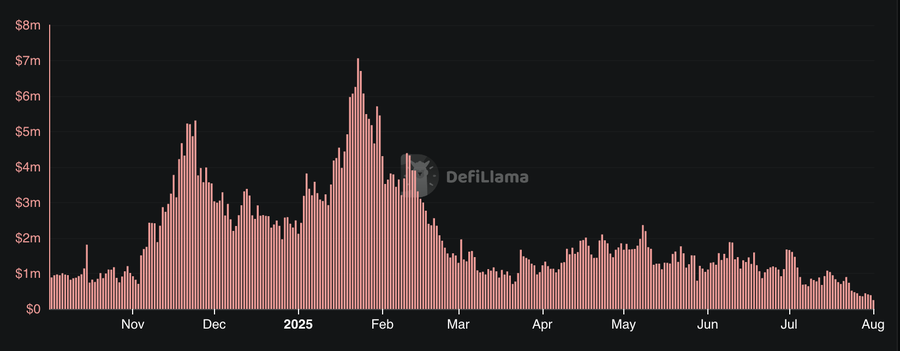

PumpFun’s revenue has plummeted from $7.07 million to $469,000, a drop of $6.601 million, with a 93.4% decline in 24-hour peak revenue.

Memecoins are dying. Since February 2025, the entire market has been in continuous decline. This isn’t just reflected in PumpFun’s 93.4% drop in 24-hour revenue—it’s also affecting LetsBonk. The overall market size is shrinking.

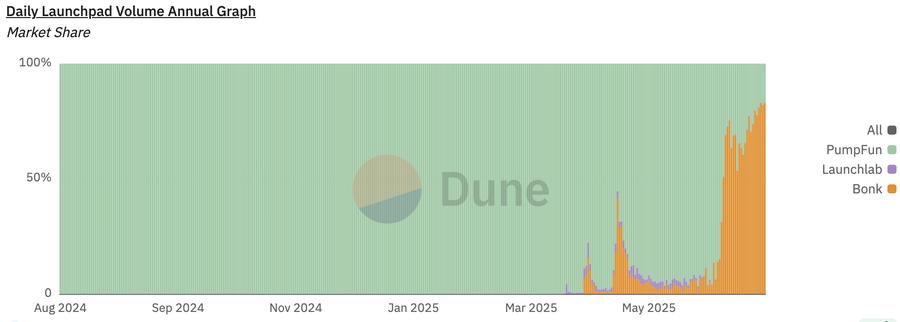

Volume share may look like this:

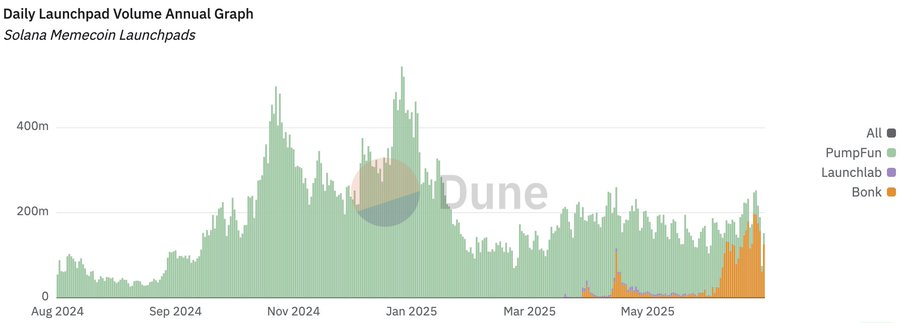

The actual market size both are competing for looks like this:

This chart doesn't even account for the significant rise in bot activity—the real decline in genuine user trading volume is even more severe.

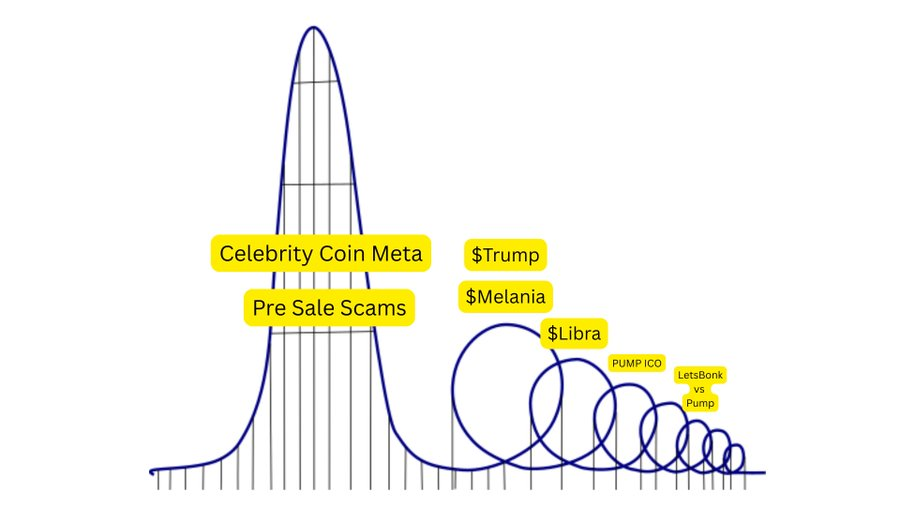

Risk appetite for Solana memecoins has been steadily declining since the release of celebrity coin meta data. Major mining events like MELANIA and LIBRA have accelerated this trend.

Retail risk appetite.

It's fair to say memecoins are no longer what they once were. For a deeper analysis on why the situation is worse than it appears, check my previous three-part series.

Original article link: Solanas 'Crime Gap'

The memecoin supercycle has entered its definitive end phase.

For a company aiming to operate beyond two years, memecoins are not an ideal future investment. Memecoin trading has evolved into not just an ordinary casino, but a highly negative expected-value (-EV) betting ground.

"Oh, but they’re addicted—just extract more capital from traders."

Let me offer a simple analogy: imagine you go to a restaurant with beautiful decor, low prices, and excellent service, making you feel like you're in heaven. But every time you leave, you feel terrible. Would you keep choosing that dining experience?

Look around—even the most gambling-addicted players are leaving the memecoin market because they know they’ll ultimately be "tortured." Savvy market participants have developed highly advanced tools and enjoy informational advantages (like FNF and insider coins), further widening the gap against ordinary traders. This is an irreversible path: insider advantage grows, while capital accessible to regular traders diminishes.

Now back to the headline: Why is PumpFun winning?

Let me ask you this: if you were Alon (PumpFun CEO), what different choices would you make?

Option 1: Use your strong treasury to buy back $PUMP.

Alright, suppose he sets up a $200 million fund to conduct TWAP (time-weighted average price) buybacks of $PUMP over the next 31 days, using generated fees for 100% revenue buybacks. Is everything solved? No, not at all. The memecoin market continues to decline, and PumpFun still carries the heavy brand image of a "memecoin launchpad." Buying back $PUMP won’t restore market risk appetite to previous highs or bring back the liquidity needed to support organic "viral coins." Will it boost sentiment short-term? Possibly. Will it revive the memecoin market? No. This would be a capital-intensive commitment into a declining market—unsustainable in the long run.

Option 2: Airdrop $PUMP to users and create new liquidity.

Again, the only outcome is injecting capital into a declining market and shrinking market share. PumpFun risks distributing free funds that not only can’t be recovered but could even end up in competitors’ hands.

Alon has almost perfectly executed this hypothetical strategy thus far.

PumpFun must evolve. Competing in a lifeless memecoin gambling arena makes no sense.

Now, let’s examine what’s currently happening.

LetsBonk allocates most of its fees to BONK and GP but lacks a large treasury. Insiders hold significant allocations in BONK, USELESS, and other projects—an effective way for them to cash out and profit via the launchpad. Regardless of what happens next, they may attract attention but lack financial backing.

They might be losing the memecoin war, but given the market’s extremely low expectations for this sector, winning this war might actually be worse than losing it.

@rasmr_eth suggested that PumpFun should create a $200 million "hit project" (e.g., ChillHouse) on PF. But I see this as unnecessary investment, further indicating PumpFun is still fighting for a dying market. I believe PumpFun has already abandoned hopes of reviving memecoins—otherwise, they wouldn’t have stopped tweeting for a week straight or withdrawn from competition with LetsBonk.

While I don’t know PumpFun’s internal moves right now, I do know Solana Labs is preparing for ICM: bringing utility back to its chain during the upcoming bear cycle.

No matter what narrative unfolds next, PumpFun is financially well-prepared to stay ahead of any other player.

I also find the idea that Alon would abandon PumpFun utterly ridiculous.

PumpFun owns a mature brand, extensive connections within the Solana ecosystem, and a clear corporate structure. No one walks away from a well-functioning company just because they’ve cashed out a certain amount. That notion has no basis in business development (BD) and is merely spread by speculators accustomed to "cash-out events." Although I don’t expect Alon to reinvest all revenue back into the business, I’m confident PumpFun will successfully attempt to conquer Solana’s next market during the coming bear cycle.

I believe $PUMP is one of the few assets worth holding long-term through the upcoming bear market. If you think this cycle will last another year, the current price is a reasonable entry point.

I hold $PUMP in spot as a hedge against my potential misjudgment of the cycle ending soon. I can hardly think of another highly liquid altcoin better suited for this bet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News