CryptoPunks ignite the NFT summer—fleeting celebration or trend reversal?

TechFlow Selected TechFlow Selected

CryptoPunks ignite the NFT summer—fleeting celebration or trend reversal?

The narrative around NFTs is always romantic, but reality is mostly harsh.

By TechFlow

The NFT market, long forgotten, is re-entering the public spotlight.

At 5:00 AM on July 21, an address spent 2,082 ETH (worth $7.91 million) to purchase 45 CryptoPunks NFTs—an unusually conspicuous move in a market that has long been stagnant, illiquid, and devoid of new IPs.

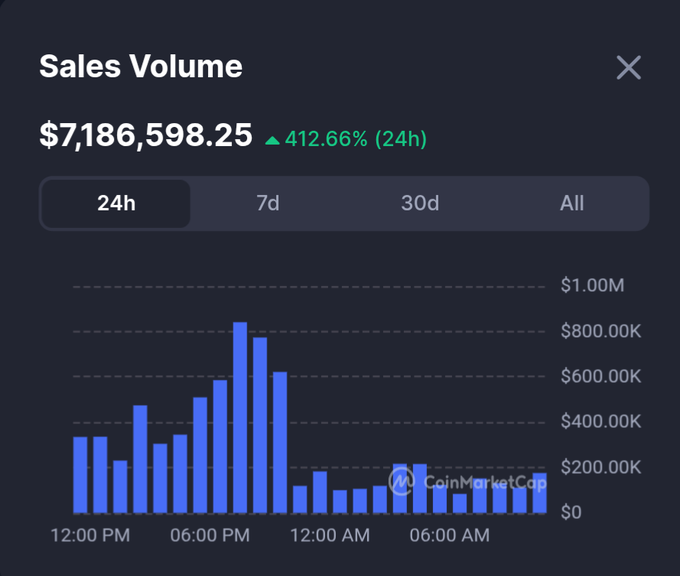

The market reacted swiftly to news of the large-scale CryptoPunk acquisition. Over the past 24 hours, NFT trading volume surged by 412%. In the past two weeks alone, the price of Pudgy Penguins' token Pengu has risen over 157%.

The meme season wind has already blown into the NFT market.

But is this phenomenon a precursor to a revived NFT Summer, or a solid signal of a bull market?

NFT Market Heats Up Again

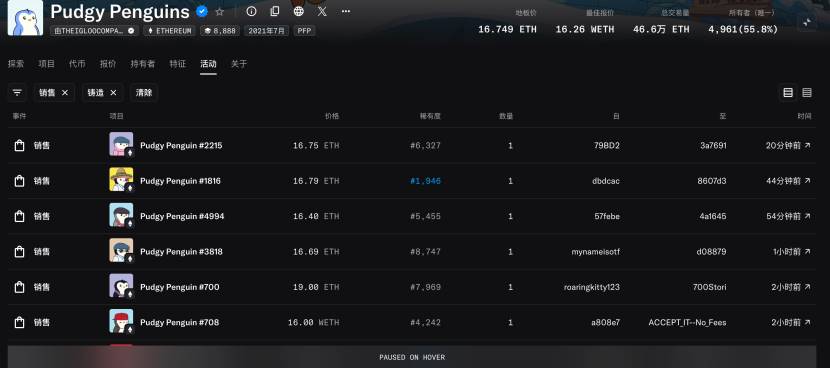

It's not just CryptoPunks—trading volumes and floor prices of former blue-chip NFT projects have seen significant increases over the past 24 hours.

As of 5:00 PM on July 21, the total market cap of the NFT market reached $6.68 billion, up 28.1% within 24 hours, with 24-hour trading volume surging 368.4% to $45 million. Key data for major blue-chip NFT projects are as follows:

CryptoPunks floor price: 47.9 ETH (~$182,000), up 16.9% in 24 hours, with 24-hour trading volume at 4,090 ETH (~$15.5 million).

Pudgy Penguins floor price: 16.75 ETH (~$63,600), up 16.5% in 24 hours, with 24-hour trading volume at 1,698 ETH (~$6.43 million).

Bored Ape Yacht Club floor price: 13.24 ETH (~$50,300), up 20.8% in 24 hours, with 24-hour trading volume at 934 ETH (~$3.53 million).

Moonbirds floor price: 1.94 ETH (~$7,372), up 32.1% in 24 hours, with 24-hour trading volume at 528 ETH (~$2 million).

Azuki floor price: 2.43 ETH (~$9,234), up 27.4% in 24 hours, with 24-hour trading volume at 367 ETH (~$1.39 million).

Though hard to believe, the NFT market is indeed warming up. Both trading data and discussion热度 show an upward trend. While it’s understandable that rising BTC and ETH prices result from continuous external capital inflow, the resurgence of the once-dead NFT sector has caught most people off guard, sparking intense market debate.

Rotation or Peak?

With ETH's recent sustained rise, optimistic investors interpret the NFT market's return to the spotlight as "sector rotation":

After achieving above-expected returns from ETH and ETH-based assets, investors are turning their attention back to the NFT market, naturally favoring blue-chip NFT projects.

A mainstream view holds that market growth has fueled latent demand, while NFTs themselves have evolved from crypto art into "utility tools." More developers are applying NFTs to asset issuance, DeFi, and DAO governance. The rise of NFTs may further fuel ETH's momentum.

Countless investors previously trapped in the NFT market are now hoping for the return of NFT Season.

Besides those who believe in a renewed NFT boom, there are many skeptical voices questioning this rally.

The bearish argument sees the NFT market surge as echoing the late-bull phase of previous cycles—"meme chaos"—where widespread meme asset rallies historically signaled the transition from bull to bear markets.

Experience suggests that rising NFT markets indicate capital entering a "garbage-picking" phase, foreshadowing a near-term market peak before entering a correction period.

Whether optimistic or pessimistic, one thing is undeniable: the market widely senses something brewing behind these moves—something big might be coming.

When NFTs Become Strategic Reserves Like BTC and ETH

Recently, more and more companies have begun listing cryptocurrencies as strategic corporate reserves. Stocks of firms announcing crypto strategic reserves have mostly risen, prompting speculation: could NFTs also appear on corporate reserve lists?

On July 21, YugaLabs co-founder Greg Solano posted a tweet hinting that companies listing NFTs as strategic reserves are on the horizon.

Today, U.S.-listed company GameSquare Holdings announced increasing its crypto asset management fund from $100 million to $250 million, adding a new yield strategy focused on ETH ecosystem NFTs, with an initial allocation of $10 million targeting annual returns of 6%-10%.

These consecutive developments seem to validate the possibility that "NFTs becoming corporate strategic reserves like BTC and ETH" could become reality. Going forward, we may see more companies adding NFTs to their strategic portfolios—after all, if they're entering Web3, how can they lack a stylish "Web3 business card"?

Additionally, Ethereum officially launched its 10th-anniversary commemorative "The Torch" NFT on July 21, allowing users to mint one starting July 30. Whether this will pour more fuel on the current NFT fire remains to be seen in future market movements.

Image source @Ethereum

The narrative around NFTs is always romantic, but reality is often harsh.

Is the NFT market recovery injecting catalysts for further altcoin season gains, or signaling an upcoming market correction phase? We don't know.

But one thing is certain: this sector once thought dead has returned to public view, prompting countless trapped "collectors" to open their wallets again, recalling the glory days of "crypto art" euphoria.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News