Under the wave of income-generating assets, how will BGUSD reshape the RWA yield experience?

TechFlow Selected TechFlow Selected

Under the wave of income-generating assets, how will BGUSD reshape the RWA yield experience?

BGUSD, a new product that looks like a stablecoin but functions more like a financial tool, might be Bitget's important step forward in the CeFi financial system.

Author: Kazmin

In 2025, yield-bearing stablecoins have become one of the fastest-growing sectors in the crypto market. According to a Cointelegraph report, by mid-May, the market capitalization of such assets had surpassed $11 billion, accounting for 4.5% of total stablecoin market cap—up significantly from just 1% last year. This trend is spreading from on-chain DeFi to CeFi platforms, becoming a new tool for centralized institutions to retain user assets.

Against this backdrop, Bitget has launched BGUSD—a "yield-bearing stablecoin-like" product that circulates within the platform, generates yield, and imposes no lock-up restrictions. BGUSD is purchased using USDT/USDC and is essentially a self-issued yield certificate from the platform, representing users' rights to earnings from a yield pool. It combines wealth management returns, token functionality, and collateral utility. The underlying reference assets are a basket of tokenized RWAs (such as U.S. Treasuries), offering high security and liquidity.

This article will break down its design structure, operational mechanisms, and strategic significance, exploring whether it could become the closest asset form to a "wealth management U" within the CeFi ecosystem.

1. What Exactly Is BGUSD?

Before diving into the structural details of BGUSD, we can first understand its core characteristics through a set of key parameters:

Product nature: Platform-based yield certificate

Supported purchase currencies: USDT/USDC

Annualized yield: 5% for the first 30 days after launch, then 4%

Interest calculation: Daily settlement

Lock-up required: No

Redemption options: T+0 (daily limit of 10,000 BGUSD for non-VIP users) / T+3

Usage fees: Transaction fees apply for both purchase and redemption; purchases are free only during the first 30 days

Use cases: Futures margin, lending, Launchpool, staking, etc.

Exchange currency and fee: Can be exchanged 1:1 with USDC at a 0.1% fee

BGUSD is a yield certificate that circulates exclusively within the Bitget platform. Its core logic does not revolve around pegging asset value but rather confirming users’ “yield rights” to the platform’s yield pool—an institutionalized “platform wealth management token.”

BGUSD generates sustainable returns by allocating Bitget's proprietary funds into short-term U.S. Treasuries, repurchase agreements, and other traditional low-risk assets. Users can purchase BGUSD using USDT/USDC (USDC and BGUSD are exchangeable at a 1:1 rate; USDT conversion is based on the real-time USDC/USDT spot price), gaining the right to daily interest payments. The system calculates earnings based on the “lowest daily holding amount” and automatically deposits them into users’ spot accounts without requiring any on-chain actions or additional claims.

The purchase process resembles that of a typical platform wealth management product and can be completed directly in the "Wealth Management > On-chain Picks > BGUSD" section of the Bitget App. With low operational barriers, CeFi users can earn yields without needing a wallet. For example, a user holding 10,000 BGUSD would earn approximately 1.37 USDC per day at the initial annualized rate of 5%, totaling about 41.1 USDC over 30 days.

Key features of BGUSD also include:

● Automatic compounding interest mechanism: The platform takes hourly snapshots of holdings and uses the lowest daily balance as the interest base, with earnings credited daily;

● High liquidity with no lock-up: Supports T+0/T+3 redemption;

● Multi-scenario usability: Can be used as futures margin, for lending, staking, Launchpool participation, etc.

At its core, BGUSD is not an on-chain stablecoin but a CeFi-model asset combining yield rights, transferability, and platform credit structure—an ongoing experiment by centralized platforms.

2. What Does BGUSD’s “Bond-Like Design” Look Like?

BGUSD employs a hybrid model of “platform bond + token form.” While not a traditional bond, its fundamental logic revolves around a closed-loop mechanism of “yield rights issuance → fund allocation → yield distribution,” blending the stable return features of financial instruments with the liquidity functions of platform tokens.

The overall operating mechanism can be broken down into five key components:

1. Platform-managed RWA allocation: Bitget invests its own capital into highly liquid, low-risk real-world assets (RWA) such as short-term U.S. Treasuries, providing sustainable yield support. Unlike common algorithmic interest models in DeFi, RWA-based returns rely on the predictable income of traditional finance (e.g., federal funds rate), offering stable and controllable yield paths while shielding user funds from on-chain risks.

2. User subscription for yield rights: Users purchase BGUSD with USDT/USDC, gaining rights to daily yield distributions—not ownership of the underlying assets. Structurally similar to “structured deposits” in banking, users participate passively, with returns sourced from the platform’s yield pool.

3. Daily settlement and automatic disbursement: The system records BGUSD holdings hourly and uses the lowest daily balance as the interest base to prevent arbitrage. Yields are settled daily and automatically distributed without user intervention, creating a near-compounding passive income stream that enhances fairness and transparency.

4. Multi-functional use enhancing flexibility: Unlike single-purpose wealth products, BGUSD is designed as a multi-functional platform token usable across U-margined futures, lending, staking, Launchpool, and more. Combining traits of both investment tools and platform tokens, it increases asset reuse efficiency.

5. Platform-backed dual-channel redemption: Users can redeem BGUSD for USDC at a 1:1 ratio via T+0 or T+3 options, with the platform assuming responsibility for liquidity and pricing. A 0.1% fee applies, ensuring a stable and efficient withdrawal process.

Through this closed-loop structure, BGUSD establishes a “quasi-financial instrument” system that operates without on-chain smart contracts. It enables tokenized yield generation while maintaining high freedom in internal fund allocation and circulation. By preserving CeFi’s controllability and incorporating the flexibility of on-chain assets, BGUSD represents a notable “bond-like + stable asset” design in the CeFi space—though its entire operation remains heavily dependent on platform credibility and operational capability.

3. Similarities and Differences Between BGUSD and Stablecoins

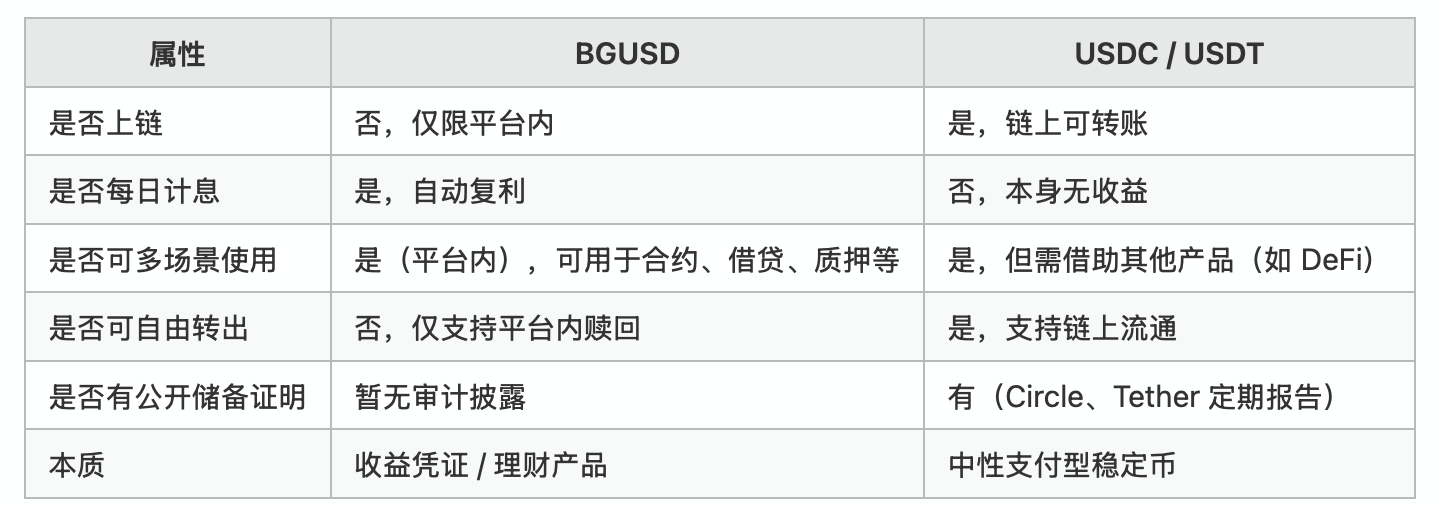

Despite ending in “USD,” which may initially suggest a stablecoin, BGUSD differs significantly from stablecoins in product structure, yield mechanism, and circulation method. In functional design, it blends attributes of stable assets and yield certificates, positioning itself more as a wealth management asset.

The reason for this “mismatched perception” lies in BGUSD mimicking the USD-denominated format of stablecoins to ensure stable valuation and standardized asset experience within the platform. However, in essence, it functions more like a “structured yield certificate” issued by the platform, representing users’ entitlement to earnings from the platform’s yield pool—not a neutral, freely tradable, payment-ready on-chain asset.

The table below outlines key differences between BGUSD and mainstream stablecoins USDC/USDT, further highlighting its true nature as a “wealth product, not a stablecoin.”

Among major centralized exchanges today, few offer products identical to BGUSD. While Binance, OKX, and Bybit provide yield-generating options in their Simple-Earn, OKX-Earn, and similar sections, allowing users to earn returns on stablecoins, none issue standalone “yield tokens.” These alternatives require manual operations and carry higher usage barriers.

Thus, BGUSD represents an attempt under the CeFi framework to merge stable assets with yield mechanisms—improving capital efficiency while redefining the “token + wealth management” asset model within platforms. Such products blur the boundary between stablecoins and financial products, marking a strategic extension by crypto platforms in user experience and asset design.

4. Comparing BGUSD With Other Platform Products

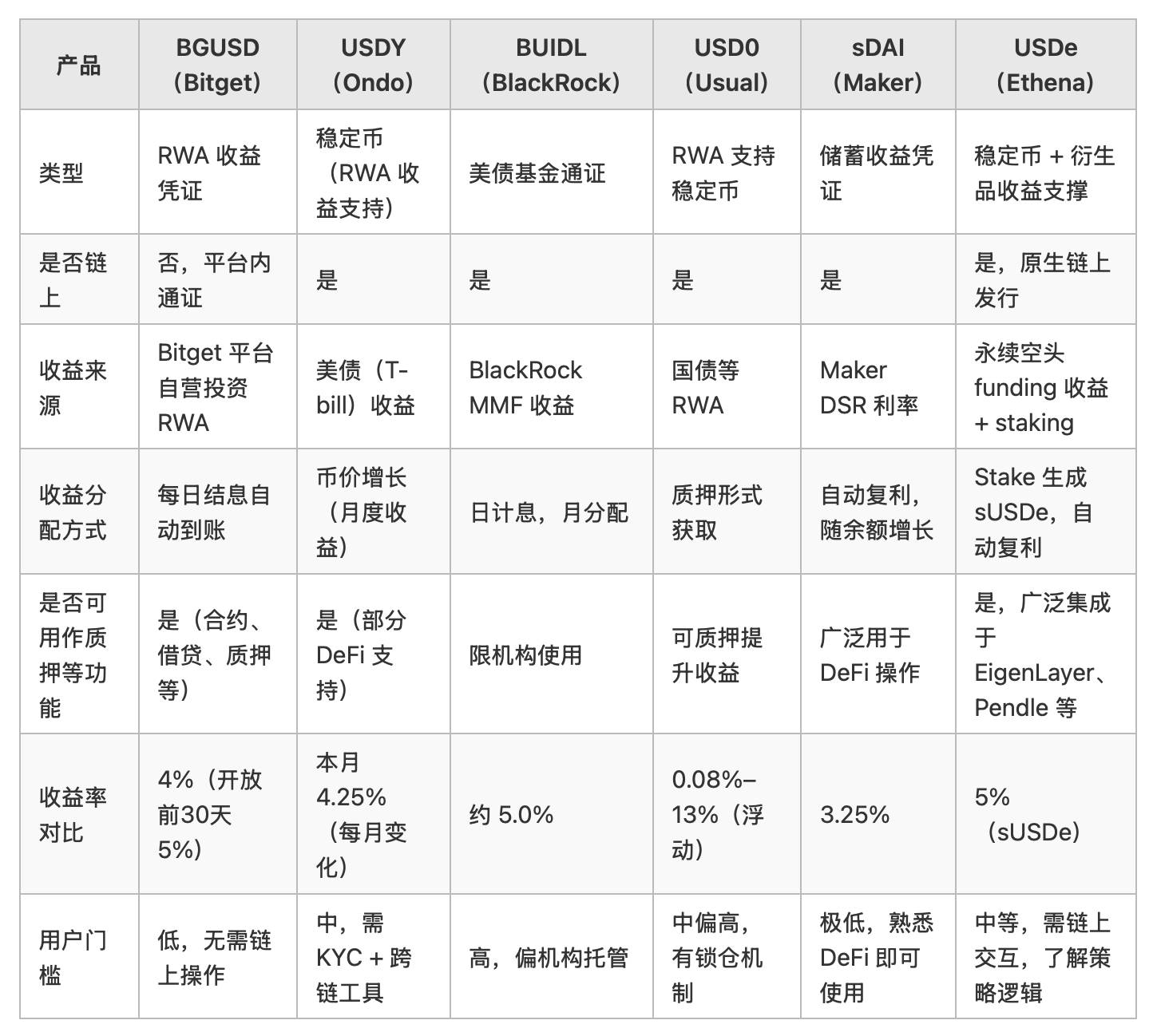

To better understand BGUSD’s position and design logic within the CeFi landscape, it is useful to compare it horizontally with several representative yield-bearing assets under current on-chain or institutional compliance frameworks. Although these products vary in mechanism, most use RWA (real-world assets) as underlying collateral and deliver traditional financial returns to crypto users through different methods.

We examine several structurally distinctive products: Ondo Finance’s USDY, BlackRock’s BUIDL, the Treasury-backed stablecoin USD0, Maker DAO’s sDAI, and Ethena’s algorithmic stablecoin USDe. They share partial similarities and differences with BGUSD across dimensions such as asset structure, yield model, usability openness, and user accessibility.

These products represent distinct design philosophies:

● USDY and USD0: Both backed by Treasury-based RWA, falling under stable-yield DeFi products. USDY follows a compliance-focused path, while USD0 emphasizes staking incentives and requires familiarity with DeFi operations.

● BUIDL: Launched by BlackRock, the world’s largest asset manager, mirroring returns from its money market fund (MMF). One of the most compliant RWA applications to date, its institutional-oriented issuance limits access primarily to custodial platform users.

● sDAI: A native passive yield certificate from Maker DAO, deriving returns from the Dai Savings Rate (DSR). Known for flexibility, transparency, and no lock-up, but lacks RWA backing and is sensitive to Maker’s monetary policy shifts.

● USDe: Built on derivatives hedging strategies, independent of RWA. Users stake USDe to receive sUSDe, currently yielding ~5% annually. Innovative in design but exposed to funding rate volatility risks.

While BGUSD lacks on-chain attributes, it offers users within the exchange environment a comparable experience by allocating platform-owned funds into RWA—low volatility, highly predictable returns, automated payouts, and circulating functionalities such as contract collateral and staking participation.

In effect, BGUSD is a “usability translation” of DeFi yield asset logic within CeFi. Its investment rationale aligns with USDY and BUIDL, but its user journey resembles sDAI—users need no knowledge of on-chain structures, wallets, cross-chain tools, or gas fees to “earn yields with one click.”

This design lowers entry barriers and, backed by platform credibility, delivers a user experience akin to traditional financial products—packaging complex financial infrastructure into an intuitive, easy-to-use digital token. It’s not merely a product improvement but an integration of DeFi and TradFi models.

5. Who Is BGUSD For? What Value Does It Offer Users?

BGUSD’s core advantage lies in integrating “yield generation, token circulation, and platform functionality” into a single asset unit. This makes it naturally suitable for users seeking higher capital efficiency without navigating the complexities of on-chain operations. Below are several typical user profiles:

1. CeFi-preferred users: Accustomed to managing assets on exchanges, unfamiliar with on-chain wallets and cross-chain processes. BGUSD’s “automatic interest payout + no lock-up” features meet their needs for returns and flexibility.

2. Long-term idle fund holders: Keep stablecoins as reserves but do not deploy them in yield strategies. BGUSD allows these “idle assets” to generate daily passive income while remaining instantly accessible.

3. Highly active, capital-efficient users: Frequently engage in futures trading, lending, etc., and seek “multi-use” functionality for their funds. BGUSD’s dual role as a yield-generating asset and platform token supports flexible deployment.

4. Stablecoin holders not yet in yield products: Have avoided yield strategies due to complexity or risk concerns. BGUSD-like assets offer a low-barrier automated yield solution.

5. Conservative, return-certainty seekers: Avoid high-risk on-chain strategies and prefer simple, stable returns. BGUSD’s one-click purchase and daily compounding mechanism perfectly suit this preference.

Overall, BGUSD represents an attempt at “tokenizing wealth management”—encapsulating yield rights into a token form usable across multiple platform scenarios, enhancing user experience while extending the lifecycle of capital within the ecosystem.

6. Risk Structure Behind the Yield

Although BGUSD establishes a complete yield loop, as a CeFi product, its operation still relies on platform credibility and fund management capability—forming its most critical trust foundation.

Unlike open, compliant pathways of on-chain RWA projects, BGUSD functions more like a “closed internal structure” financial token, with room for improvement in institutional transparency and regulatory interface. This design reduces user friction and strengthens product integration, aligning with Bitget’s strategy of attracting Web2 users.

Overall, BGUSD does not replicate traditional stablecoins or on-chain strategies but represents a structured attempt to integrate yield, liquidity, and user-friendly experience. Its innovation stems precisely from this “not-yet-fully-defined” platform model.

Users should make rational decisions based on their own risk tolerance, liquidity needs, and level of trust in the platform before using BGUSD.

Conclusion: BGUSD as a Structured Attempt by CeFi in Yield-Bearing Assets

The launch of BGUSD marks a strategic expansion by Bitget in the yield-bearing asset space and an active exploration of RWA yield integration. While on-chain systems emphasize “transparency, composability, automation,” BGUSD takes a user-experience-first approach, using a platform token format to reconstruct an asset model centered on “simplicity, yield generation, and deployability.”

It requires no complex wallet operations or understanding of on-chain protocols—no cross-chain transfers, no collateralization. With just one purchase action, users convert stablecoin holdings into compounding, participatory, and redeemable yield certificates. Throughout this process, users need not understand U.S. Treasuries, repo agreements, RWA, or DeFi interest models, yet they clearly perceive asset growth through daily credited returns. This reimagined experience reflects a key trend toward mass adoption in crypto finance.

In on-chain finance, products like sDAI, USDY, and USDe emphasize transparency and yield composability, while BUIDL and USD0 represent experimental compliance pathways for mapping traditional financial assets (RWA) onto blockchains. In contrast, within the CeFi context, BGUSD offers a viable alternative with lower learning curves and higher internal circulation efficiency. It is not a mere copy of on-chain logic but a structured innovation that integrates user behavior patterns with platform fund operations.

It is not a stablecoin, yet may foreshadow a multifunctional evolution of stablecoins;

It is not a wealth management product, yet delivers a comparable user experience;

It cannot go on-chain, yet becomes the most “monetary-functional” internal token within the platform.

For exchanges, BGUSD reorganizes the platform’s financial architecture: it turns “yield rights” into programmable digital assets, transforming yield from an operational act into an asset class. For users, BGUSD serves as an entry point to “digital wealth management” without changing identities—an arguably trustworthy “yield-bearing token” within the centralized financial environment.

Whether BGUSD will become an industry standard remains to be seen. But one thing is certain: it has opened a new frontier in CeFi financial product innovation—one worth watching, testing, and potentially emulated by more platforms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News