Behind Monero's $1.5 Billion Market Cap Surge in One Day: Why Hackers Are No Longer Fond of Bitcoin?

TechFlow Selected TechFlow Selected

Behind Monero's $1.5 Billion Market Cap Surge in One Day: Why Hackers Are No Longer Fond of Bitcoin?

After stolen funds were injected, market cap surged—Is Monero a breeding ground for crime or a continuation of "crypto ethos"?

Author: BUBBLE

Yesterday, Monero ($XMR), the so-called "ancient" privacy coin, surged dramatically after a long period of dormancy. It skyrocketed 30% in a single day, reaching a peak price of $329—the highest level since 2021. What is this 11-year-old cryptocurrency, and why has it suddenly surged?

The Most OG Privacy Coin

In 2013, Nicolas van Saberhagen published the "CryptoNote" protocol. Building on this foundation, Monero was launched in April 2014 and later upgraded to RandomX in 2019.

Monero employs technologies such as ring signatures, stealth addresses, and RingCT (Ring Confidential Transactions) to conceal transaction senders, recipients, and amounts. This high degree of anonymity gives it strong advantages in privacy protection. Its modular code structure has even earned praise from Wladimir J. van der Laan, one of Bitcoin’s core maintainers.

However, while preserving privacy, these features make it difficult for Monero to meet regulatory requirements for anti-money laundering (AML) and counter-terrorism financing (CTF). As one of the most well-known privacy coins, Monero embodies a dual nature. On one hand, its emphasis on privacy, decentralization, and scalability resonates deeply with those who champion "libertarianism." On the other hand, this same characteristic has made it a haven for criminal activity.

Favored by Criminals

In late summer 2016, following the arrest of Silk Road founder Ross William Ulbricht, law enforcement agencies gained mastery over Bitcoin traceability techniques. Major darknet markets like AlphaBay began abandoning Bitcoin in favor of harder-to-track Monero. North Korea's hacking group Lazarus Group also preferred using Monero to "launder" stolen assets. This propelled Monero’s market cap from $5 million to $185 million and triggered rapid growth in trading volume—the first major surge in its history.

2020 marked Monero’s second wave of popularity. That year, terrorist organization ISIS updated its website to stop accepting Bitcoin donations, switching instead to more private cryptocurrencies like Monero. The reason? Large holdings of Bitcoin could prove difficult for a designated terrorist group to transfer or cash out. A Chainalysis report confirmed this, noting that ISIS held less than $100,000 worth of Bitcoin—consistent with most other terrorist organizations. In the same year, darknet market sales rose 70% year-on-year, with Monero becoming one of the primary payment methods due to its privacy features, accounting for 45% of transactions—nearly matching Bitcoin.

From darknet transactions and scams to ransom payments in kidnappings and exit routes for hacked funds, Monero has gained notoriety through widespread adoption in underground economies. In 2020, XMR’s price climbed from around $50 at the beginning of the year to $150 by year-end, peaking at $450 in mid-2021.

Key to Freedom

Although Monero has long been associated with crime, it remains merely a technological tool. The Monero development team consistently upholds a stance of “code neutrality,” emphasizing that “Monero is designed for everyday use by ordinary people. Any technology can be misused—just like cash.” They assert no cooperation with criminal activities nor any ties to criminal organizations.

In another sense, Monero fully embodies Bitcoin’s original ideal of “financial freedom,” earning strong support among tech-savvy libertarians who value “privacy above all,” “decentralization,” and resistance to censorship. Many within the community believe Monero, rather than Bitcoin, is the true realization of Satoshi Nakamoto’s vision.

John McAfee, creator of the first antivirus software, was among them. “Monero is one of the truly anonymous cryptocurrencies, whereas Bitcoin isn’t really anonymous,” he stated publicly on multiple occasions before his death, expressing admiration for Monero’s technical capabilities and privacy features. Monero’s anonymity and untraceability closely aligned with McAfee’s lifelong advocacy for “privacy libertarianism.”

Even “Bitcoin Jesus” Roger Ver defected. In his first public interview after being released on bail in 2024, he announced he had abandoned Bitcoin and now favored privacy-focused coins like Monero. “Most people today use custodial wallets—they’re not really wallets at all, just accounts, offering no more privacy than your account at Bank of America or PayPal. Fortunately, there are alternative cryptocurrencies like Monero that offer stronger privacy protection.”

In regions where cryptocurrency usage is active, some e-commerce platforms and independent merchants accept Monero as payment—for example, certain tech-related online stores (selling hardware wallets or crypto-themed tech products) or physical retail outlets. Community member Schmidt even shared a receipt showing his purchase of low-fat organic cocoa drink at Spar using Monero.

Note: SPAR is one of the world’s largest food retail chains, founded in 1932 by Adriaan van Well in the Netherlands. With over 13,900 stores across 48 countries, the Kreuzlingen branch in Switzerland has drawn attention for accepting cryptocurrencies including Bitcoin and Monero.

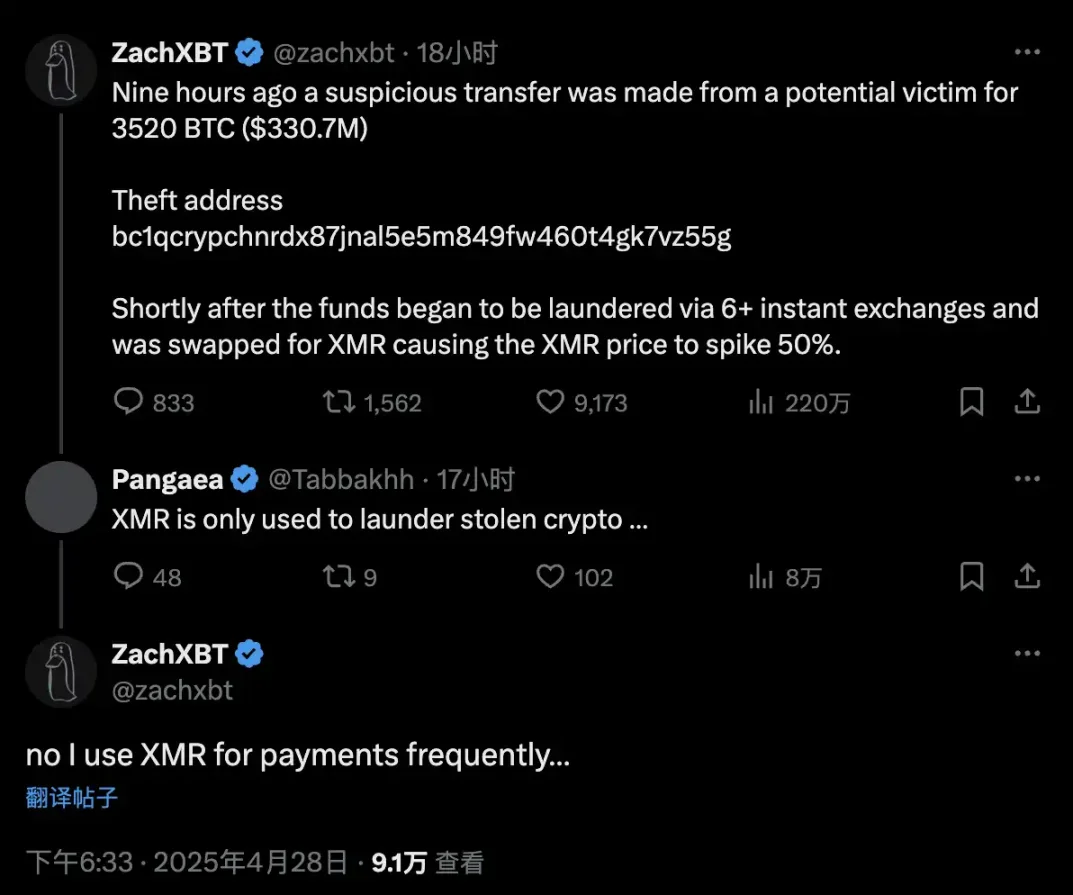

When commenters labeled Monero as a cryptocurrency used solely for “money laundering,” prominent on-chain investigator ZachXBT pushed back: “No, I frequently use Monero to make payments myself.” Clearly, he is also among its supporters.

Pump and Dump or Value Discovery?

Influx of Stolen Funds

On-chain investigator ZachXBT posted on social media: “Nine hours ago, a suspicious transfer of 3,520 BTC (approximately $330.7 million) occurred from an address. These funds were then laundered through more than six instant exchanges and converted into Monero, causing the price of Monero to spike by 50%.”

This triggered massive liquidations of short contracts, forcing traders to buy back assets amid rising spot demand, further amplifying upward pressure. These combined factors may explain Monero’s sudden recent surge.

Positive Project Developments

Some analysts point to growing anticipation around Monero’s EP159 and EP160 upgrade proposals as another contributing factor. These upgrades aim to make Monero more compliance-friendly by enabling users to prove transaction validity without revealing sensitive personal information. The community hopes these improvements could lead major regulated centralized exchanges (CEXs) like Binance and Coinbase to relist Monero, which was delisted from many platforms following the EU’s updated AML regulations in 2024.

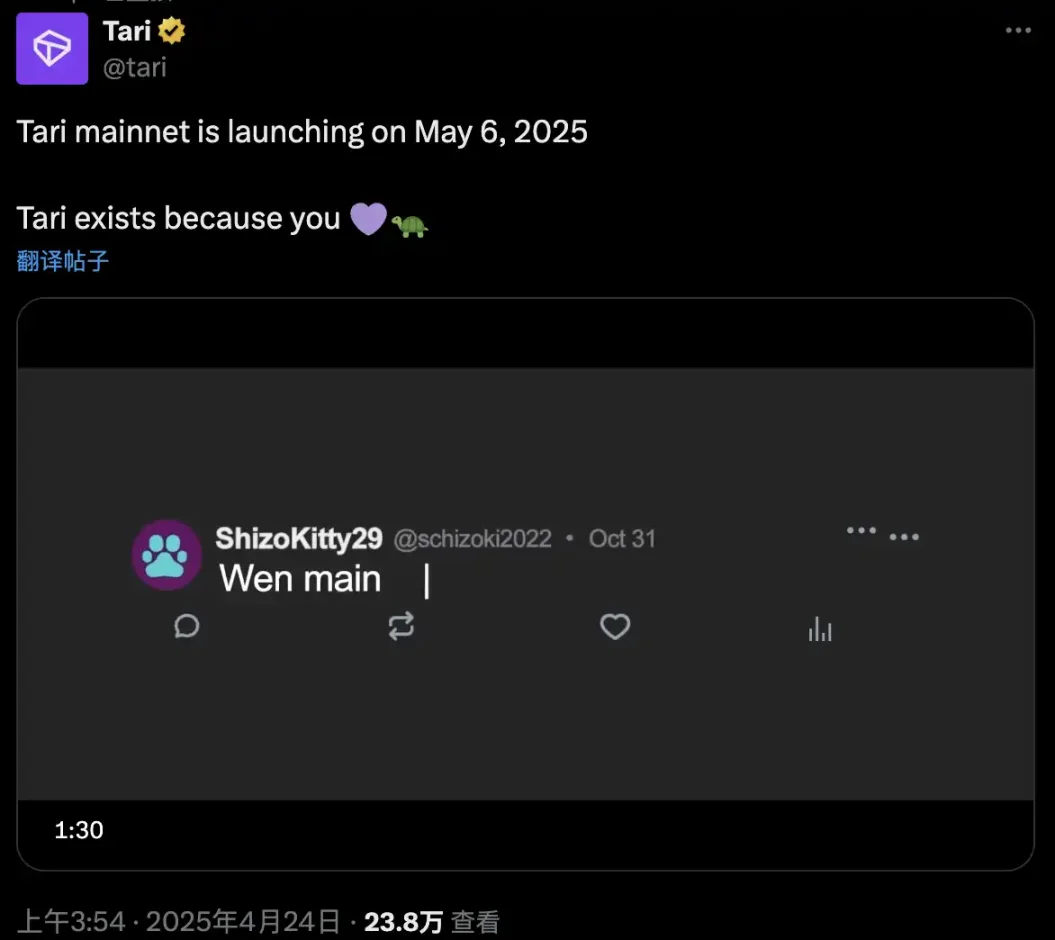

Additionally, Tari—the first DeFi project emerging within the Monero ecosystem—is set to launch its mainnet on May 6 and implement merged mining with Monero. Many members of the Monero community are eagerly anticipating its arrival.

Once a tool is created, moral judgments赋予 it multiple meanings. Monero reflects the current state of cryptocurrencies—a constant balancing act between “freedom” and “regulation,” wavering between “human rights” and “crime.” Human virtue and malice are infinitely magnified here. As Einstein once said about nuclear weapons: “Science and technology are double-edged swords—they can benefit humanity or destroy the world.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News