Elon Musk denies DOGE's connection with the U.S. government—has Dogecoin hit rock bottom?

TechFlow Selected TechFlow Selected

Elon Musk denies DOGE's connection with the U.S. government—has Dogecoin hit rock bottom?

Dogecoin is undergoing complex market dynamics, including institutional positioning, discussions around deflationary mechanisms, expansion of payment ecosystem, and technical-level stress tests.

By Lawrence

On March 30, at a town hall meeting hosted by him in Green Bay, Wisconsin for the American Political Action Committee, Musk clearly distinguished between the Department of Government Efficiency (DOGE) and the Dogecoin cryptocurrency.

"To my knowledge, the government has no plans to use Dogecoin or any other cryptocurrency," he said. "Although their names are similar, in reality, our goal is to improve government efficiency by 15%."

Musk further explained the origin of the name, citing internet suggestions. "I initially wanted to call it the Commission on Government Efficiency, but that felt too boring," he said. "Then the internet suggested 'Department of Government Efficiency,' and I thought they were right."

As Musk definitively denied any connection between the Department of Government Efficiency (DOGE) and Dogecoin during the town hall meeting, a cognitive war triggered by the shared acronym quietly erupted. This battle involving technical analysis, policy narratives, and capital leverage is now subjecting Dogecoin to its ultimate test at historic lows.

Naming Paradox: The Quantum Entanglement of Political Symbols and Digital Assets

The Acronym Cognitive War

The shared DOGE acronym between the Department of Government Efficiency and Dogecoin was no accident. On the eve of the agency's establishment in August 2024, Musk deliberately preserved narrative links to the crypto community through a naming poll launched on X. This collision between political engineering and meme culture represents Musk’s ultimate manipulation of attention economics—by creating semantic chaos, he simultaneously creates public opinion buffers for policy experiments and injects sustained topic momentum into Dogecoin.

Cognitive Arbitrage Through Visual Symbols

The fleeting appearance of a Shiba Inu logo on the DOGE official website in February 2025 stands as one of the most sophisticated cases of cognitive manipulation in modern financial history. A mere 72-hour visual hint directly triggered an instantaneous 14% price surge, enabling arbitrageurs to harvest $70 million amid information asymmetry. This "policy memefication" reveals a new paradigm of market manipulation: when political and financial symbols become quantum entangled, existing regulatory definitions of "market manipulation" can no longer contain such multidimensional attacks.

The Reflexivity Trap of Narrative Economics

Within 24 hours after Musk’s clarification statement, sentiment around DOGE-related tweets plummeted from +68 to -42, yet addresses holding over 100,000 DOGE逆势 increased holdings by 1.13 billion coins. This divergence—panic selling by retail investors versus stealth accumulation by institutions—exposes a fatal flaw in narrative economics: short-term emotions are easily manipulated by symbols, while whales have already established cross-market hedging mechanisms.

Chain-Level Warfare: Silent Accumulation by Whales and Retailers’ Cognitive Deficit

Bifurcation in Coin Distribution

In the past 30 days, addresses holding 10,000 to 100,000 DOGE reduced their holdings by 2.3 billion coins, while those with over 1 million DOGE added 4.1 billion. This "de-retailization" process has reached a historical peak, with the top 1% of addresses increasing their share of circulating supply from 58% to 67%, forming a highly concentrated control structure. Notably, among 17 newly emerged "super whale" addresses, 12 completed OTC transactions via Coinbase Prime, indicating traditional institutions are quietly building positions.

The Code in UTXO Age Distribution

Dogecoin’s "zombie coins"—those inactive for over one year—now account for 43% of total supply, a record high. These long-term holders have an average cost basis of $0.05–$0.08; despite a 60% price drop, they still maintain floating profits exceeding 200%. The existence of these "sunken coins" makes conventional washout patterns ineffective in forming a bottom—only extreme events might trigger a capitulation.

A Paradigm Shift in On-Chain Behavior

An unprecedented "hoarding-staking" hybrid strategy has emerged on the Dogecoin network: net outflows from the top 20 exchanges have remained positive for nine consecutive weeks, while locked value in decentralized staking contracts has surged 340%. The shift from a transactional asset to an income-generating asset could reshape valuation models. If annual staking yields stabilize above 8%, DOGE may evolve into a "crypto high-yield bond," attracting conservative institutional capital.

Fundamental Revolution: The Race Between Deflationary Narratives and Payment Ecosystem Development

A Paradigm Shift in Supply Mechanism

In February, Billy Markus, co-founder of Dogecoin, revealed that DOGE might implement a deflationary mechanism through community consensus. Potential pathways include developers submitting code modification proposals (GitHub Pull Request), followed by consensus-building among the community and miners, and finally protocol upgrades. Currently, DOGE’s total supply stands at approximately 146.78 billion, with an annual issuance of 5 billion coins, and inflation rate gradually declining as total supply grows. Markus emphasized that DOGE’s supply mechanism is more flexible than Bitcoin’s and could eventually outperform fiat systems in the long run. If the deflation plan succeeds, it could provide long-term price support for DOGE. However, the proposal currently faces strong resistance from miners.

Lightning Campaign in Payment Infrastructure

The number of merchants using the Dogebox payment system has surpassed 1,800, with daily transaction volume reaching 2.4 million. If DOGE completes API integration with Square and Stripe before Q2 2025, it could become the first cryptocurrency accepted by 5% of physical merchants across the United States. However, regulators are closely scrutinizing its anti-money laundering compliance. The CFPB has requested KYC data for all transactions exceeding $10,000.

Political Leverage in ETF Battles

The approval process for three DOGE ETFs has become a bargaining chip between the Trump administration and the SEC. White House aides revealed that the DOGE initiative might be used as leverage—"support for financial innovation"—to secure SEC approval for spot ETFs. If this political arbitrage succeeds, it could funnel tens of billions of dollars in institutional capital into Dogecoin, fundamentally transforming the market structure.

Technical Squeeze: Life-or-Death Battle at the $0.16 Support Level

Temporal Compression in Symmetrical Triangle

On the daily chart, Dogecoin’s symmetrical triangle pattern formed since November 2024 is entering its final convergence phase. The intersection zone of $0.16–$0.18 has become the decisive battleground between bulls and bears. Historically, this pattern breaks out with an 87% probability—but the breakout direction depends entirely on external catalysts.

Alignment of Weekly RSI and Candlestick Patterns

For months, Dogecoin’s Relative Strength Index (RSI) has been steadily declining across multiple timeframes. On social media platform X, crypto analyst Trader Tardigrade observed an intriguing phenomenon on Dogecoin’s weekly candlestick chart. He believes the RSI may rebound from current levels, signaling potential for DOGE to break above the $1 mark.

The Miners’ Last Line of Defense

On-chain data shows that the current price of $0.16 approaches the shutdown threshold for three major mining pools. A breakdown below this level would force $320 million worth of mining equipment offline, triggering a positive feedback loop of a "death spiral." However, Glassnode data indicates that the top five mining pools have established $180 million in protective positions within the $0.15–$0.16 range, suggesting core capital is fiercely defending this floor.

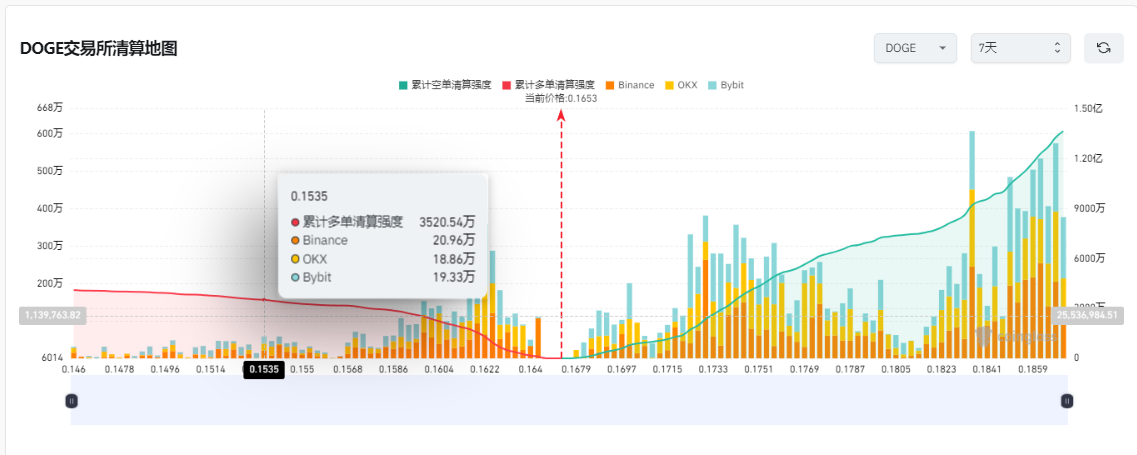

Undercurrents in Derivatives Markets

Coinglass data shows a significant drop in Dogecoin futures open interest and funding rates turning negative. This extremely bearish structure, combined with persistently negative funding rates (-0.03%), suggests the market has already priced in the worst-case scenario. Together with exchange liquidation data, the derivatives market may be poised for a short squeeze, implying Dogecoin could have already reached a阶段性 bottom.

Ultimate Revelation: Seeking Order Within Chaos

When Musk insisted on naming his government reform initiative DOGE, he may have already unlocked the wealth code of the post-truth era: in a world where consensus is rarer than code, bottoms are not merely technical levels, but critical tipping points of collective cognition. Dogecoin is undergoing the most complex stress test in crypto civilization’s history—it is both the gravedigger of old paradigms and the midwife of a new order.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News