Interpreting the DragonFly 2025 Airdrop Report: Crypto Airdrops, the Cake America Hasn't Yet Eaten

TechFlow Selected TechFlow Selected

Interpreting the DragonFly 2025 Airdrop Report: Crypto Airdrops, the Cake America Hasn't Yet Eaten

Neither American users nor the government have benefited from the airdrop.

In 2025, have you ever profited significantly from a crypto airdrop?

If not, don't feel bad—some people aren't even eligible to participate in airdrops at all, such as users in the United States.

It's hard to believe, but the professional "airdrop farming" industry has flourished within Chinese-speaking communities, while in the U.S., regulatory restrictions mean most crypto projects deliberately exclude American users when designing their airdrop policies to avoid legal risks.

Today, with the U.S. government introducing increasingly crypto-friendly policies, presidential-level engagement on digital assets, and more American companies accumulating Bitcoin, the United States has never held greater influence in the global crypto market.

These policy shifts are reshaping the landscape of airdrop markets and setting precedents for innovation in other countries.

Against this backdrop, leading venture capital firm Dragonfly released its "State of Airdrops Report 2025," aiming to quantify how U.S. policy impacts airdrops and the broader crypto economy through data and analysis.

TechFlow summarizes and interprets the core insights from this report below.

Key Finding: U.S. Users and the Government Are Not Benefiting From Airdrops

-

U.S. Users Restricted by Geographic Blocking:

-

Number of Affected Users: In 2024, approximately 920,000 to 5.2 million active U.S. users (5%-10% of U.S. crypto holders) were blocked from participating in airdrops or using certain projects due to geographic restrictions.

-

Proportion of Global Crypto Addresses Held by Americans: In 2024, 22%-24% of global active crypto addresses belonged to U.S. users.

-

-

Economic Value of Airdrops:

-

Total Airdrop Value: Across 11 sample projects, the total value of airdrops was approximately $7.16 billion, with around 1.9 million users globally participating. The median amount received per address was about $4,600.

-

Income Loss for U.S. Users:

-

In 11 geographically restricted airdrop projects, estimated income loss for U.S. users ranged between $1.84 billion and $2.64 billion (2020–2024).

-

According to CoinGecko’s analysis of 21 geographically restricted airdrops, potential income losses could reach as high as $3.49 billion to $5.02 billion (2020–2024).

-

-

-

Tax Revenue Loss:

-

Individual Tax Losses:

-

Federal tax loss: Approximately $418 million to $1.1 billion (2020–2024).

-

State tax loss: Approximately $107 million to $284 million.

-

Total tax loss: Around $525 million to $1.38 billion, excluding capital gains taxes that would result from token sales.

-

-

Corporate Tax Losses:

-

Due to relocation of crypto firms overseas, the U.S. is missing out on substantial corporate tax revenue. For example, Tether (issuer of USDT) reported profits of $6.2 billion in 2024. If fully subject to U.S. taxation, it could have contributed roughly $1.3 billion in federal taxes and $316 million in state taxes.

-

-

-

Impact of Crypto Company Relocations:

-

Cryptocurrency companies are choosing to register and operate overseas due to regulatory pressure, further exacerbating U.S. tax revenue losses.

-

Tether is just one case illustrating the broad negative economic impact of industry-wide relocations from the U.S.

-

Why Are Airdrops Restricted in the U.S.?

The restrictive regulatory environment in the United States limits the airdrop market due to legal uncertainty and high compliance costs. Key reasons include:

1. Unclear Regulatory Framework

U.S. regulators like the SEC and CFTC tend to establish rules through enforcement actions rather than clear legislation. This “enforcement-first” approach makes it difficult for crypto projects to predict which activities are legal—especially novel mechanisms like airdrops.

2. Airdropped Tokens May Be Classified as Securities

Under U.S. securities law, the SEC uses the Howey Test to determine whether an asset qualifies as a security. The key elements of the Howey Test are:

-

Investment of Money: Whether users paid money or other resources to obtain the asset;

-

Expectation of Profit: Whether users expect to profit from price appreciation or efforts by others;

-

Reliance on Efforts of Others: Whether profits depend primarily on the work of the issuer or third parties;

-

Common Enterprise: Whether investors share in pooled profits and risks.

Many airdropped tokens meet these criteria (e.g., users anticipate price increases), leading the SEC to classify them as securities. This subjects issuers to burdensome registration requirements, exposing them to heavy fines or criminal liability if unregistered. To avoid such risks, many projects simply block U.S. users.

3. Complex Tax Policies

Current tax laws require users to pay income tax upon receiving an airdrop based on the token’s market value—even if they haven’t sold it yet. This unreasonable tax burden, combined with future capital gains taxes, further discourages U.S. participation in airdrops.

4. Widespread Geographic Blocking

To avoid being deemed offering unregistered securities to U.S. persons, many projects implement geographic blocking against U.S. users. While protective for project teams, this practice also reflects how U.S. regulation suppresses innovation.

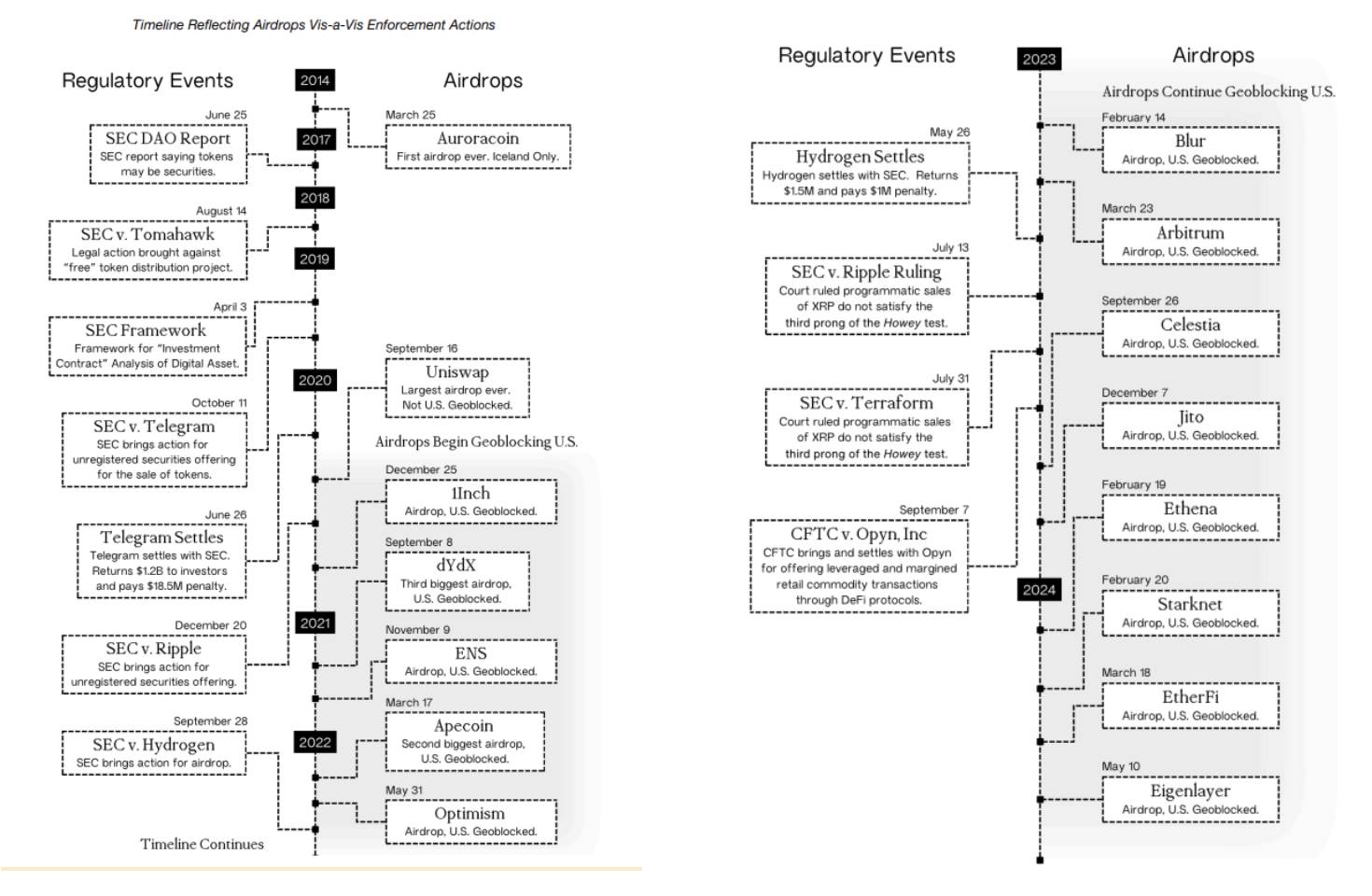

The report also meticulously outlines, chronologically, how U.S. crypto regulations have evolved in attitude toward airdrops and highlights key incidents where major airdrops excluded U.S. participants.

How Do Crypto Projects Block U.S. Users?

These measures protect project compliance and help prevent unintentional violations. Common methods include:

1. Geoblocking

Geoblocking sets virtual boundaries to restrict access based on location. Projects typically use IP addresses, DNS country settings, payment information, or even language preferences during online purchases to identify user locations. Users identified as being in the U.S. are denied access.

2. IP Address Blocking

IP blocking is a core technical method of geoblocking. Each internet-connected device has a unique IP address. When users attempt to access a platform, firewalls automatically block IP addresses registered in the U.S.

3. VPN Blocking

Virtual Private Networks (VPNs) can hide a user’s real IP address for privacy, but project operators monitor traffic from known VPN servers. If an IP shows abnormally high or diverse usage patterns, platforms may blacklist it to prevent U.S. users from bypassing restrictions via VPNs.

4. KYC (Know Your Customer) Verification

Many platforms require KYC procedures, asking users to submit identity documents proving non-U.S. residency. Some projects even ask users to sign wallet-based attestations declaring they are not U.S. persons. Originally intended to combat money laundering and illegal financing, KYC has become a key tool for excluding U.S. users.

5. Explicit Legal Disclaimers

Some projects explicitly state in their terms or airdrop announcements that U.S. users are prohibited from participating. This “good faith effort” aims to demonstrate that the project has taken steps to limit access, thereby reducing legal liability.

-

Despite these efforts, U.S. regulators (such as the SEC and CFTC) have not provided clear compliance guidance, leaving project teams uncertain about what constitutes “sufficient” blocking measures.

-

Blocking measures also increase operational costs and compliance risks. For example, relying on third-party geolocation services (like Vercel) may lead to errors and unintended violations, with ultimate responsibility still falling on the project team.

What Is the Economic Impact of U.S. Exclusion From Crypto Airdrops?

How significant are the economic losses caused by U.S. regulatory restrictions?

To quantify the impact of geoblocking on U.S. residents' participation in cryptocurrency airdrops and assess broader economic consequences, the report estimates the number of U.S. crypto holders, evaluates their participation levels in airdrops, and defines the potential economic and tax revenue losses resulting from geographic exclusion.

Specifically, the report analyzed 11 geoblocked airdrop projects and one non-geoblocked control project, conducting in-depth data analysis across user numbers and economic value.

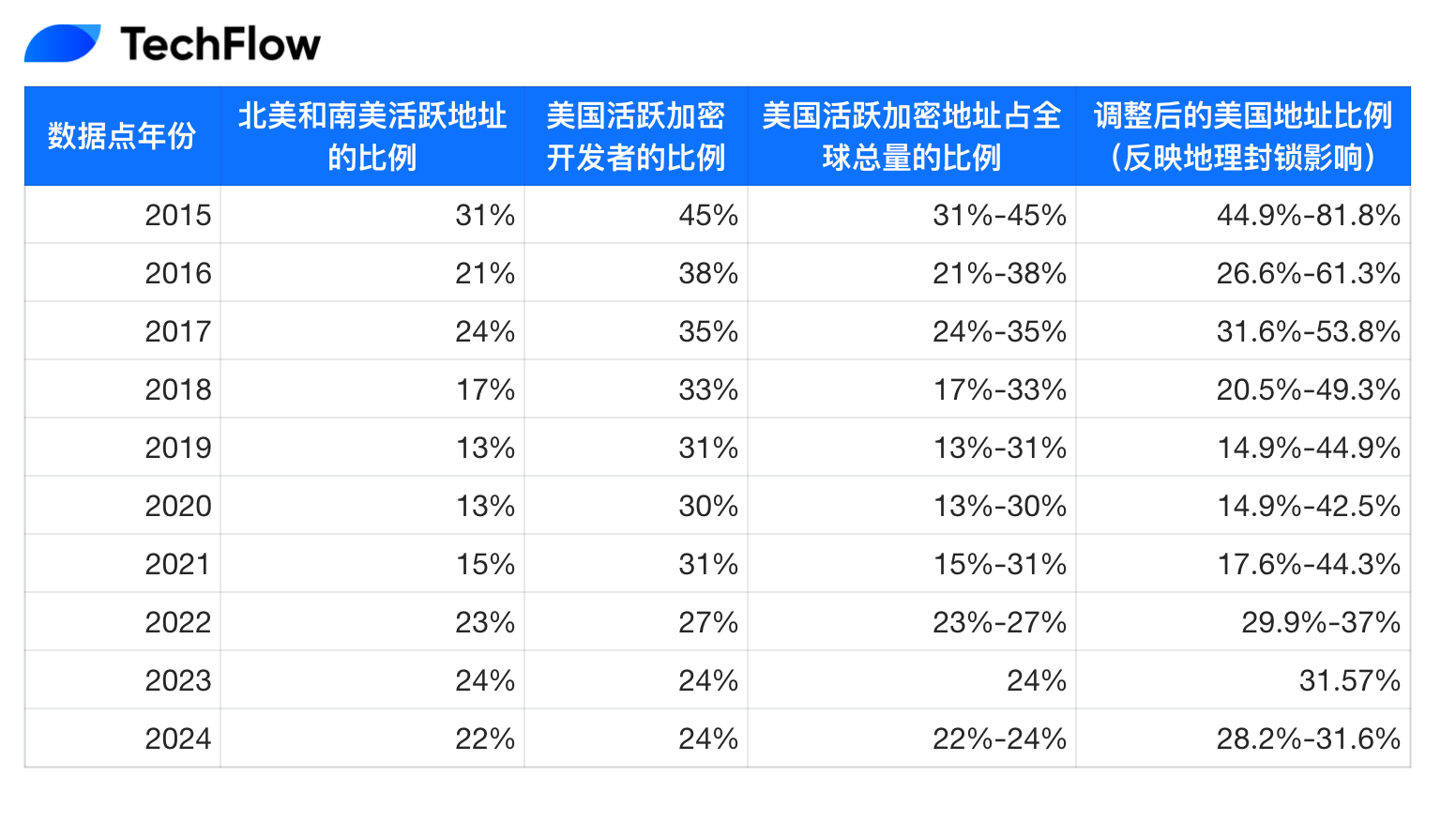

1. U.S. User Participation in Crypto

Among an estimated 18.4 million to 52.3 million U.S. crypto holders, approximately 920,000 to 5.2 million active U.S. users per month in 2024 were affected by geographic restrictions, limiting their ability to participate in airdrops and engage with various projects.

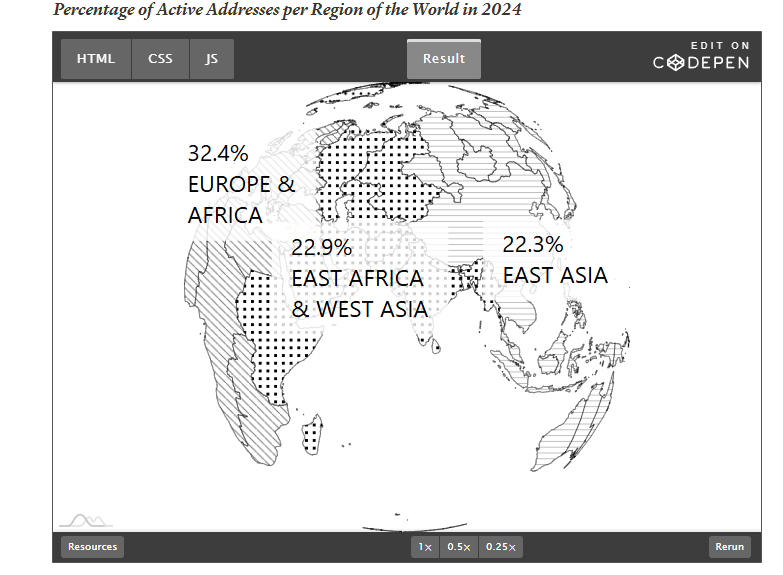

(Original image from report, translated by TechFlow)

As of 2024, an estimated 22% to 24% of all global active crypto addresses belong to U.S. residents.

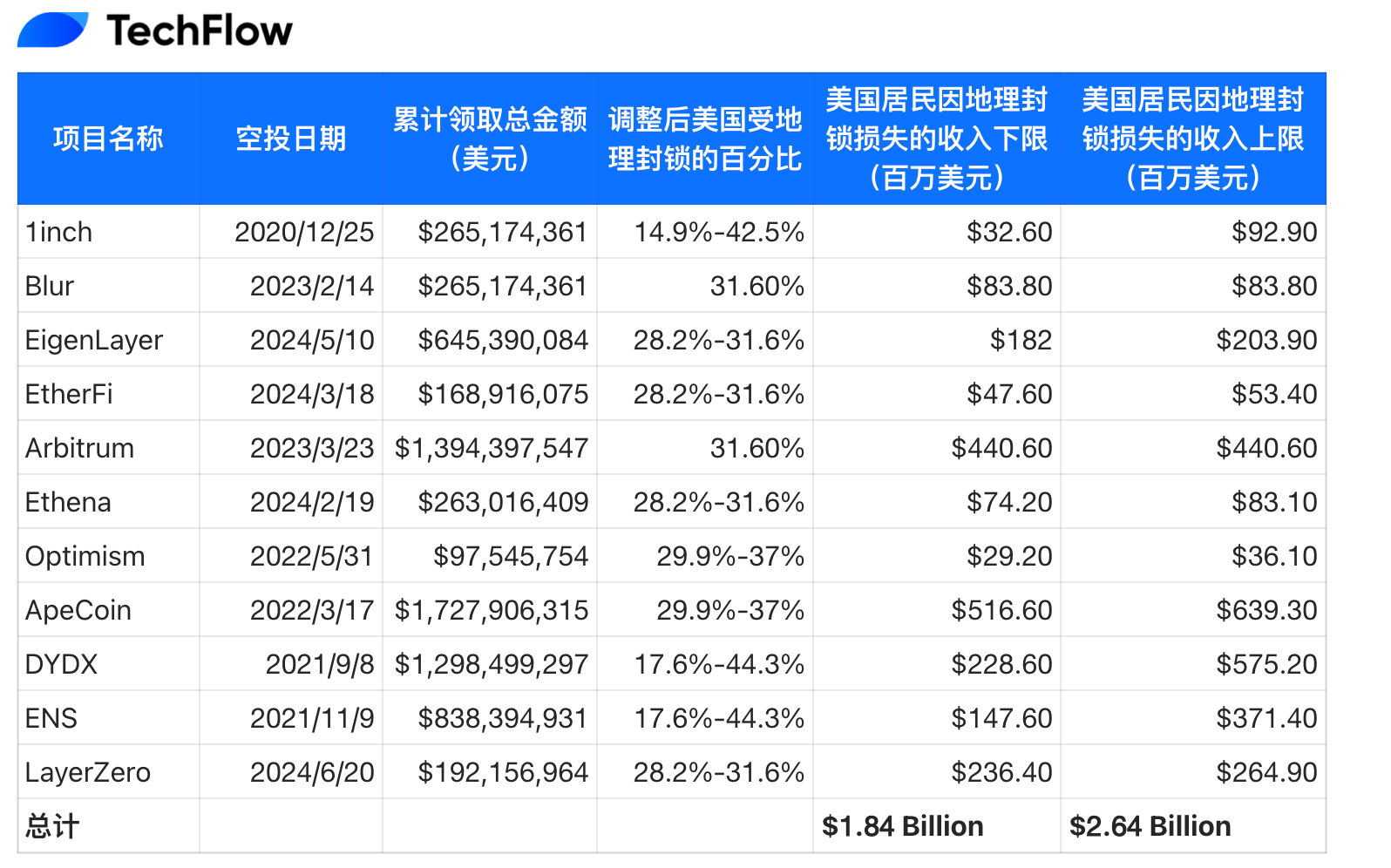

The 11 sampled projects generated a total airdrop value of approximately $7.16 billion, with around 1.9 million users globally claiming rewards. The median claim value per qualifying address was about $4,600.

The table below breaks down the amounts by project name.

(Original image from report, translated by TechFlow)

2. Income Loss Due to U.S. Non-Participation in Airdrops

(Original image from report, translated by TechFlow)

Based on the airdrop data above, U.S. residents are estimated to have missed out on potential income ranging from $1.84 billion to $2.64 billion from the sample group between 2020 and 2024.

-

Tax Revenue Loss

Due to airdrop restrictions, estimated tax revenue losses between 2020 and 2024 range from $1.9 billion (lower bound of report sample) to $5.02 billion (upper bound from CoinGecko research).

Using individual tax rates, corresponding federal tax revenue losses are projected to be between $418 million and $1.1 billion. Additionally, state tax revenue losses are estimated at $107 million to $284 million. Overall, total U.S. tax revenue losses over these years amount to $525 million to $1.38 billion.

Offshore tax loss: In 2024, Tether reported profits of $6.2 billion, surpassing traditional financial giants like BlackRock. If Tether were headquartered in the U.S. and fully subject to U.S. taxation, its profits would incur a 21% federal corporate tax rate, generating approximately $1.3 billion in federal tax revenue. Additionally, considering an average state corporate tax rate of 5.1%, another $316 million in state taxes would be collected. Altogether, Tether’s offshore status alone may result in annual potential tax losses of around $1.6 billion.

-

Crypto Companies That Have Left the U.S.

Some companies have completely exited the U.S. market, including:

Bittrex: Shut down its U.S. operations, citing “regulatory uncertainty” and increasing enforcement actions—particularly from the SEC—as making continued operations “unfeasible.”

Nexo: After 18 months of unproductive dialogue with U.S. regulators, gradually phased out its products and services for U.S. customers.

Revolut: The UK-based fintech company suspended cryptocurrency services for U.S. customers, citing changes in the regulatory environment and ongoing uncertainty in the U.S. crypto market.

Other companies are preparing for worst-case scenarios (i.e., persistent lack of regulatory clarity and continuous enforcement-driven oversight) by establishing overseas operations or shifting focus to non-U.S. consumers. These include:

Coinbase: As the largest U.S. crypto exchange, it opened operations in Bermuda to benefit from a more favorable regulatory environment.

Ripple Labs: Engaged in a years-long legal battle with the SEC. By September 2023, 85% of open job positions were located overseas, and by year-end 2023, the proportion of U.S.-based employees dropped from 60% to 50%.

Beaxy: In March 2023, after the SEC sued the exchange and its founder Artak Hamazaspyan for operating an unregistered exchange and brokerage, the company announced it would suspend operations due to the uncertain regulatory climate.

Constructive Recommendations

-

Establish a “Safe Harbor” framework for non-fundraising crypto airdrops:

-

Issuers must provide detailed information on tokenomics (supply, distribution model), governance mechanisms, risks, and any usage limitations.

-

Insiders must observe a minimum three-month lock-up period to prevent insider trading or front-running.

-

Tokens should only be distributed through non-monetary contributions (e.g., service provision, network participation, or prior eligibility). Direct monetary transactions void safe harbor eligibility.

-

-

Extend the scope of Rule 701 under the U.S. Securities Act to cover participants on tech platforms who receive crypto tokens via airdrops or as compensation for services.

-

Align the tax treatment of crypto airdrops with existing rules for credit card rewards or promotional gift cards to ensure fairness and reasonableness.

-

Airdropped tokens should not be treated as taxable income upon receipt.

-

Taxes should only be levied when tokens are sold or exchanged for other assets, at which point they have liquidity and measurable market value.

-

-

Leverage the political transition period created by election cycles as a unique opportunity for regulatory innovation.

-

The SEC should establish clear rules defining when digital assets qualify as securities; abandon “regulation by enforcement” and “regulation by intimidation,” and shift toward formal rulemaking. Provide clear compliance guidelines so crypto startups can innovate with confidence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News