Half of mining machines have reached shutdown price—will Bitcoin rebound or remain dormant?

TechFlow Selected TechFlow Selected

Half of mining machines have reached shutdown price—will Bitcoin rebound or remain dormant?

Bitcoin miners face a survival test at the shutdown price; when prices fall below the electricity cost threshold, miner shutdowns could reduce market selling pressure and trigger a price rebound.

Author: Luke, Mars Finance

In the depths of night, mining farms echo with an unceasing roar, like a symphony without an end. Yet as Bitcoin hovers around $85,000, beneath this jungle of computational power, undercurrents stir—over half of all mining rigs stand on the edge of a cliff, facing a brutal choice: keep burning electricity to mine, or decisively hit the shutdown button? This silent battle reveals the most fundamental survival law in the cryptocurrency market—the shutdown price. Once hailed as a reliable bottom indicator, today it wavers amid the flood of rapid miner upgrades. Can Bitcoin still rebound based on shutdown price? The answer may lie within this clash between computing power and cost.

Shutdown Price: The Oxygen Line for Miners

In Bitcoin’s digital world, miners are pioneers who earn their living through computational power, while electricity is the oxygen they breathe. Shutdown price acts like the minimum oxygen level in this jungle. Once Bitcoin’s price falls below a critical threshold, mining revenue can no longer cover electricity costs, forcing miners to halt operations.

Precise Formula for Shutdown Price:

Shutdown Price = (Daily Power Consumption of Miner × Electricity Price) ÷ (Daily Bitcoin Output × Pool Fee Coefficient)

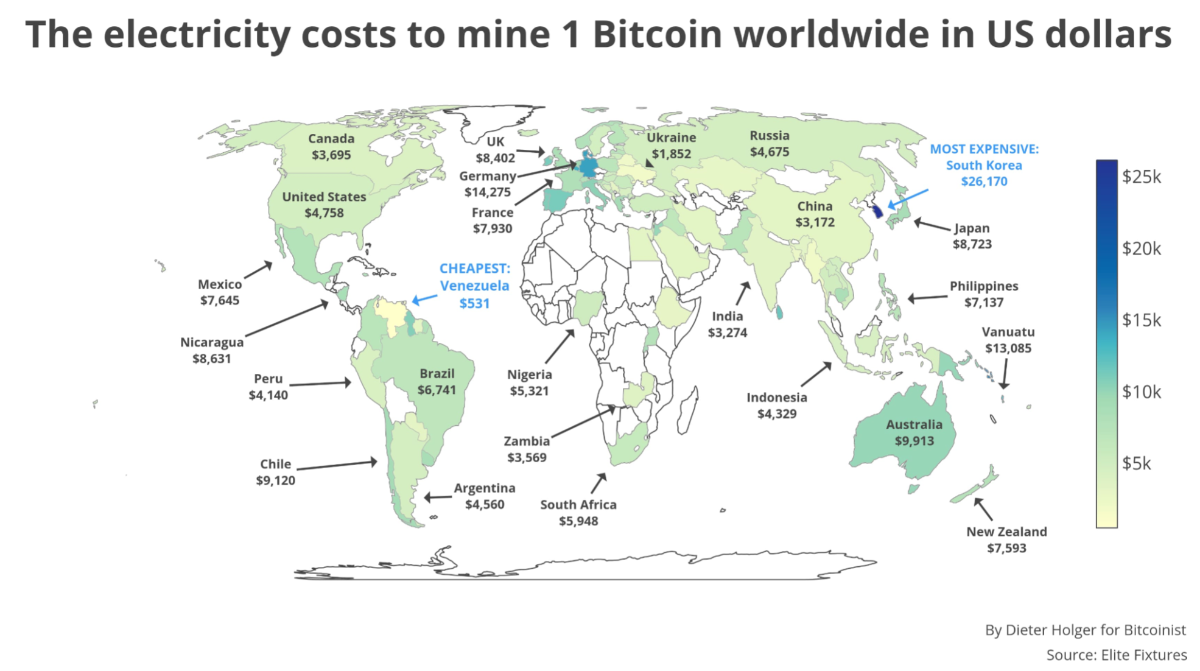

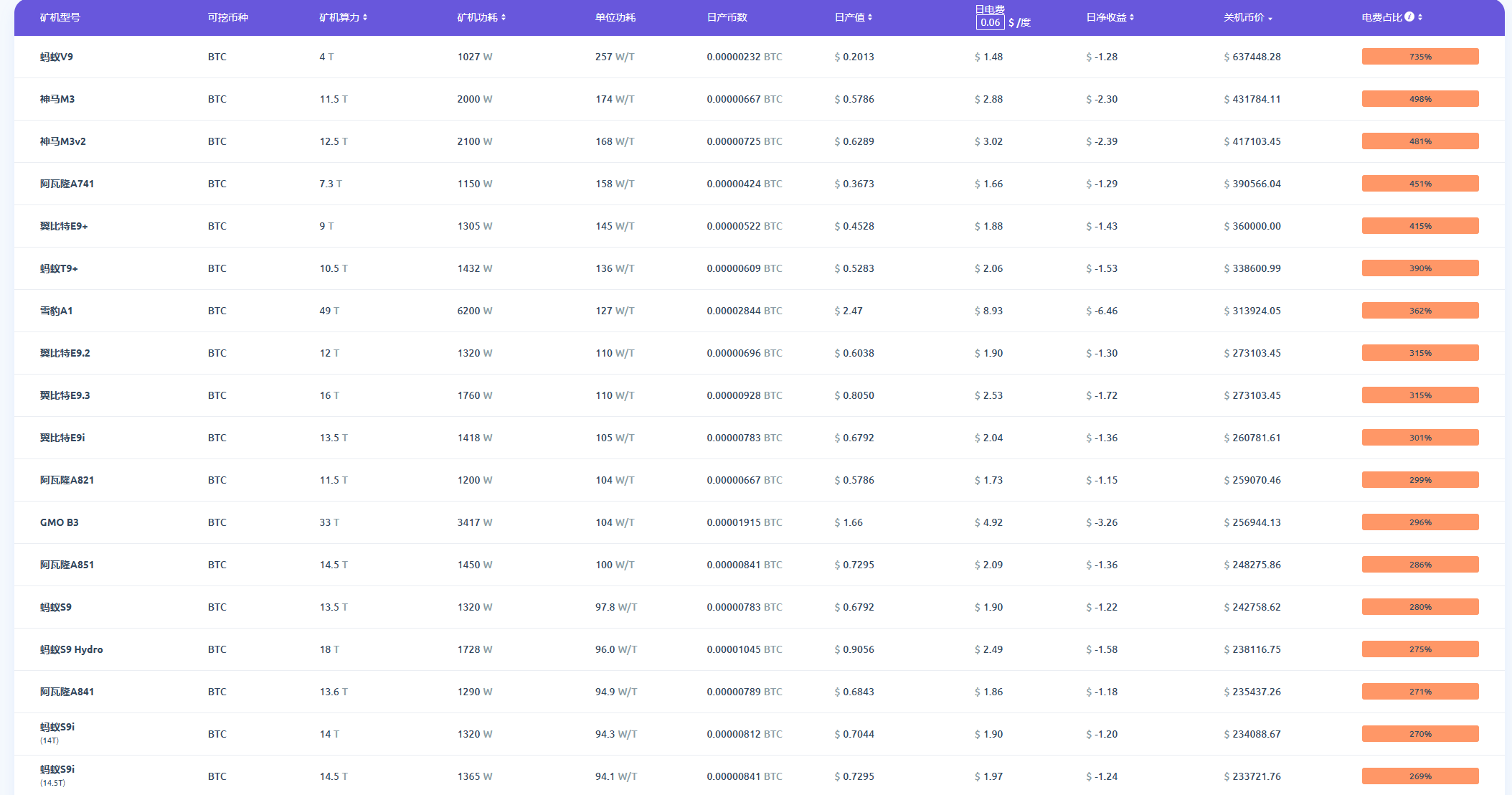

Take the Antminer S19 as an example: consuming 72 kWh per day (electricity priced at $0.06/kWh), producing approximately 0.0002 BTC daily—the calculated shutdown price closely approaches $85,000, aligning perfectly with current market prices. This is no coincidence, but a reflection of half the industry hanging by a thread.

Yet shutdown price has never been a static number. It migrates with miners seeking cheaper electricity, dances to the rhythm of Bitcoin network difficulty adjustments, and constantly reshapes itself under the impact of next-generation miners. Like a dynamic performance, when older miners shut down, total network hash rate drops, allowing survivors to breathe easier due to reduced competition; every two weeks, difficulty adjustments act like a conductor’s baton, maintaining steady block production; meanwhile, new models like the Antminer S21 XP emerge, slashing electricity cost share to just 35%, sharply lowering the industry’s break-even line. It is this confluence of factors that makes shutdown price a hidden compass for detecting market bottoms.

Historical Code: The Rebound Fires Lit by Shutdown Price

Reviewing Bitcoin’s historical record, shutdown price resembles a mysterious lighthouse—whenever price touches its beam, a turnaround often follows.

December 2018

Bitcoin plunged from $20,000 to $3,150. Bitmain’s S9 miners (shutdown price ~$3,500) shut down en masse. In the following six months, the price rebounded to $14,000—a 344% increase.

March 2020

"Black Thursday" halved Bitcoin’s price to $3,800, causing a 30% drop in global hash rate. After the shutdown wave, Bitcoin launched an epic bull run, surging to $65,000 within 15 months.

Bear Market of 2022

When prices fell below $20,000, North American listed mining firms were forced to sell Bitcoin reserves to pay electricity bills. However, after hash rate dropped by 26%, prices began rebounding in early 2023.

Why does this "shutdown equals bottom" pattern repeat so reliably? The answer lies in the market's self-healing mechanism: miners sell roughly 900 BTC daily to cover electricity costs, and during a shutdown wave, this selling pressure vanishes; simultaneously, institutions view shutdown price as a "cost floor," attracting bottom-fishing capital; difficulty adjustment acts like a spring—the deeper it compresses, the stronger the rebound. Yet this familiar script now faces uncertainty under the shadow of newer mining hardware.

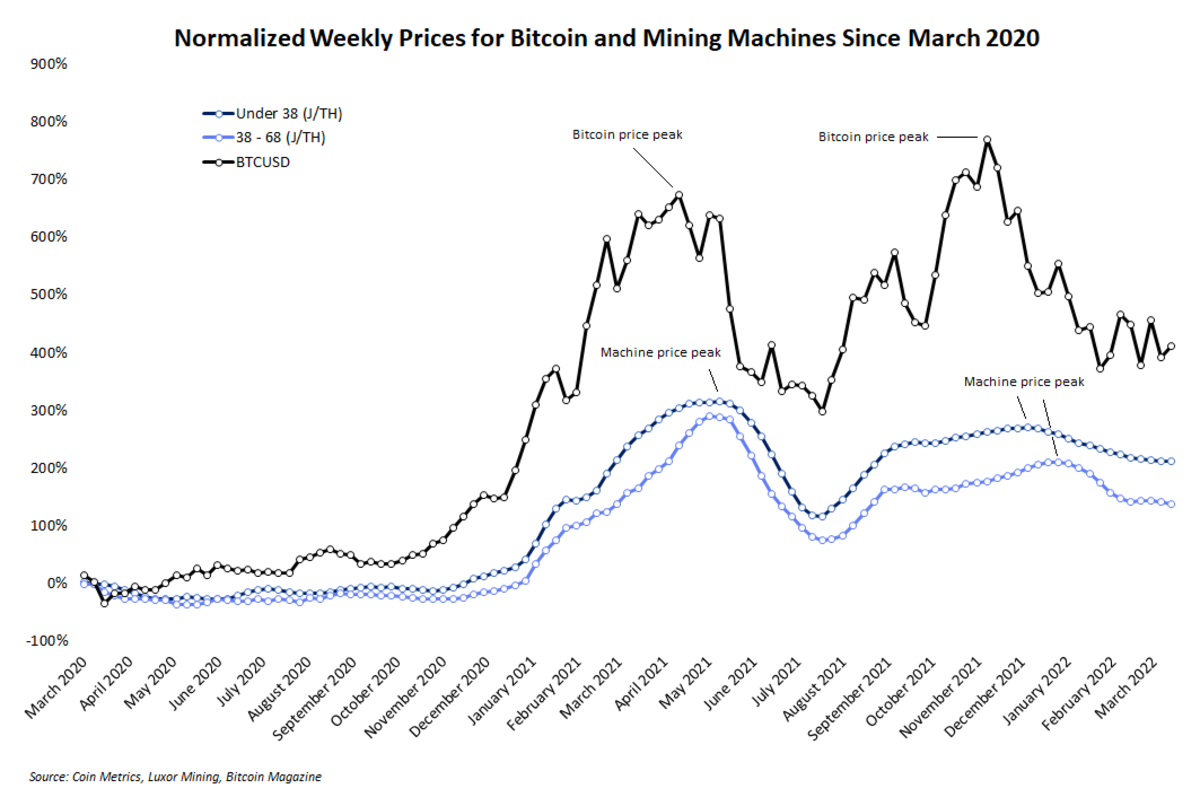

Miner Evolution: The Game-Changer Breaking the Shutdown Spell?

As the Antminer S21 XP lowers shutdown price to $29,757, older models like the Whatsminer M30S+ gasp near $85,000—an intense "computational Darwinism" elimination game unfolds. From the Antminer S9 in 2016 (28nm chip, efficiency 100J/TH) to the S21 XP in 2024 (5nm chip, efficiency 15J/TH), energy efficiency has improved nearly sevenfold over eight years—a leap comparable to moving from steam engines to maglev trains. New miners not only lower their own costs but also push older models off stage through sheer computational dominance. According to the Cambridge Centre for Alternative Finance, once S21 series miners account for 20% of global hash rate, the central shutdown price could drop by 40%. This raises a question: if future shutdown prices fall to $30,000 while Bitcoin trades between $40,000 and $60,000, will the classic "shutdown-driven rebound" ever happen again?

The impact of this mining arms race goes beyond numbers. Morgan Stanley analysts noted in a report: "Improving miner efficiency is reshaping Bitcoin’s cost curve—shutdown price volatility may shrink from tens of thousands to just thousands of dollars." Meanwhile, large-scale mining farms lock in profits via futures hedging and access to cheap power, further dulling shutdown price sensitivity. It seems history’s spell is being quietly broken by technology and capital.

Crossroads of Shutdown Price: Rebound or Silence?

Opinions diverge on shutdown price’s future. On one side are the "obsolescence theorists," arguing that miner upgrade speed now outpaces price fluctuations, eroding shutdown price’s anchoring effect; the rise of Bitcoin spot ETFs further blurs the link between miner selling pressure and price. On the other are the "evolution theorists," who believe technological gains will eventually hit physical limits of chip fabrication (approaching 1nm), while rising global electricity costs—especially under carbon neutrality policies—will offset some efficiency gains. CoinMetrics data shows that in 2023, the global Bitcoin miner market reached $5 billion, up 25% year-on-year, yet electricity costs have risen 15% over the past five years. Regardless of which camp prevails, shutdown price is quietly transforming: its range narrows, rebound cycles shorten from months to weeks, and "super miners" equipped with new hardware and low-cost power increasingly dominate the market.

So, can Bitcoin still rebound on shutdown price? At the current price of $86,900, the answer is unclear. Shutdown price has repeatedly sparked rebounds in the past, but now faces new challenges. If prices fall further, next-gen miners like the Antminer S21 XP (shutdown price ~$29,757) may hold firm, while mass shutdowns of older rigs could reduce selling pressure, attract capital, and trigger a modest recovery. But if prices remain range-bound—say between $80,000 and $90,000—the traditional triggering effect of shutdown price may gradually fail, and Bitcoin’s trajectory will depend more on macroeconomic forces and market sentiment. As BitMEX founder Arthur Hayes put it bluntly: "Don’t expect shutdown price to rescue the market like before—the future swings will come from external capital battles."

Meanwhile, market analysis adds further nuance. Bitcoin posted its largest three-day drop since the FTX collapse (-15%). Markus Thielen, founder of 10x Research, warned in a Wednesday client report that in worst-case scenarios, Bitcoin might fall to $72,000–$74,000 before rebounding. He points to the Short-Term Holder On-Chain Price (average purchase cost of addresses holding BTC for less than 155 days—currently around $82,000) as a key demand zone. Historically, in bull markets Bitcoin rarely stays below this level long-term, whereas bear markets often see prolonged pressure here.

Thielen also notes a lagged correlation between Bitcoin and global central bank liquidity indicators—tightening liquidity could deepen declines, but support already touched at $82,000 may lay the groundwork for a rebound.

Epilogue: Survival Lessons from the Hash Rate Jungle

For ordinary investors, the evolution of shutdown price offers a vivid survival lesson. When the market cheers "shutdown price reached," remember to verify dominant miner models and hash rate distribution; metrics like "inventory / debt ratio" in earnings reports from miners such as Marathon and Riot may reveal hidden signs of selling pressure. More importantly, shutdown price is not a crystal ball, but an X-ray of market ecology—revealing the interplay of hash rate, cost, and human behavior. Just as the Bitcoin network always follows the longest chain, shutdown price will continue to evolve through miners’ pursuit of profit and relentless technological advancement. A rebound may no longer be guaranteed—but the adventure in this jungle of computational power will never end.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News