AI Agent cooling down, why Virtuals still have the potential to become a billion-dollar giant?

TechFlow Selected TechFlow Selected

AI Agent cooling down, why Virtuals still have the potential to become a billion-dollar giant?

Virtuals Protocol has achieved more with fewer resources than Pump.fun.

Written by: Primitive Astronaut

Translated by: Luffy, Foresight News

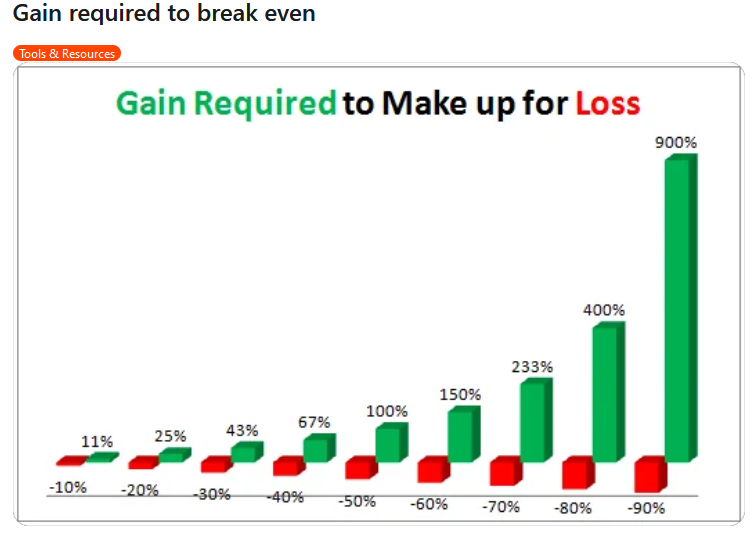

Have you ever seen that table showing how much gain is required to break even after investment losses? For example, when your position drops by 10%, you need an 11% increase to recover:

$100 → $90 = -10%

$90 → $100 = +11%

When down 20%, you need a 25% gain to break even:

$100 → $80 = -20%

$80 → $100 = +25%

When down 50%, you need a 100% gain, and so on. This relationship grows exponentially and is highly counterintuitive.

Many crypto investors still lack this basic financial knowledge.

Taking it further, the exponential nature becomes even more apparent in extreme cases of 99% or greater drawdowns:

-

At a 99% loss, you need a 100x return (+10,000%) to break even.

-

At 99.5% loss, you need 200x (+20,000%).

-

At 99.8% loss, you need 500x (+50,000%).

-

At 99.9% loss, you need 1000x (+100,000%).

-

At 99.99% loss, you need 10,000x (+1,000,000%).

This is why stop-loss discipline is essential for active traders. Despite last week’s setback at Virtuals Protocol (the price drop seen as a sign of technical weakness), I believe it will remain dominant for a long time.

I started with this point to emphasize how seemingly small differences—like between 99.8% and 99.9% losses—can represent massive real-world gaps.

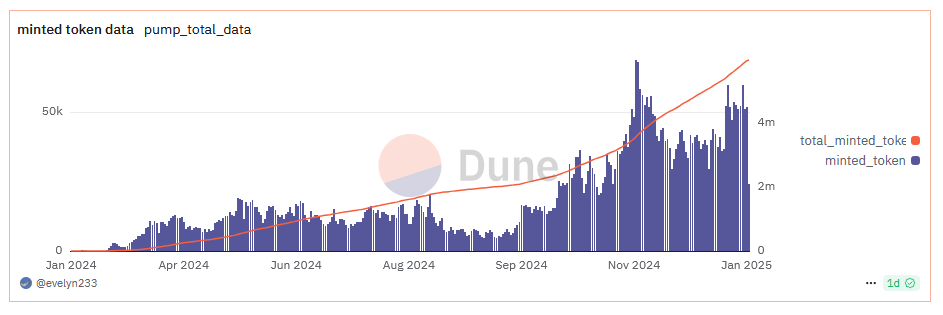

Now let’s look at token creation data on Pump.fun: since early January, there have been 6 million tokens created, averaging around 50,000 new tokens per day.

Now ask yourself: how many “legitimate” projects have emerged from Pump.fun? In this space, “legitimate” doesn’t mean much, but for argument’s sake, let’s define it as “market cap exceeding $10 million,” since most of us are here chasing the next 100x—and for many, that *is* what legitimacy means.

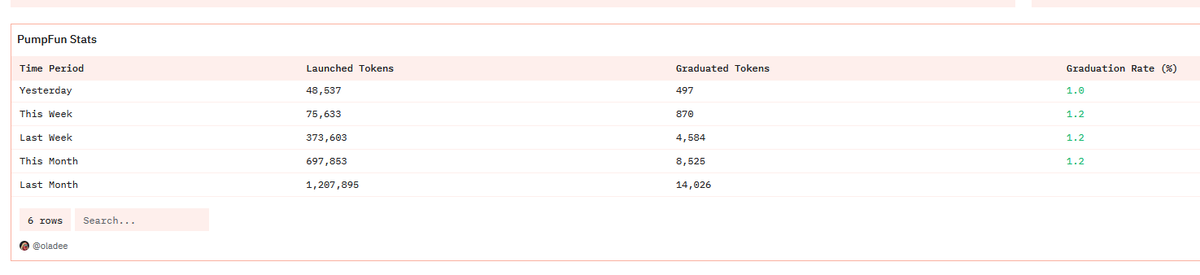

On average, only about 1% of daily projects on Pump.fun reach the so-called “graduation” threshold of $70,000 market cap. And many dump shortly after hitting or slightly surpassing that level.

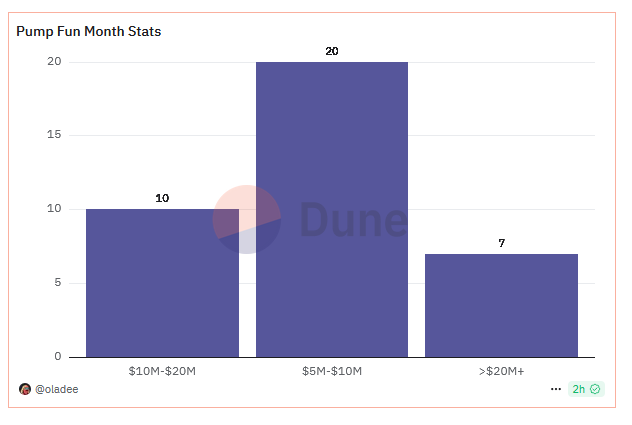

Consider last month—one of the busiest periods in Pump.fun’s history:

Only 10 projects surpassed $10 million market cap, with just 7 breaking $20 million. That means only 0.0014% of all projects launched on Pump.fun last month reached $10M+, implying 99.9986% failed to meet that bar.

Now compare this with Virtuals’ numbers and draw a simple conclusion.

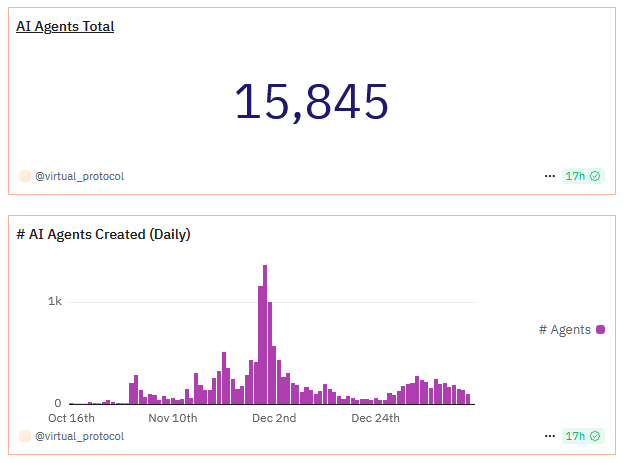

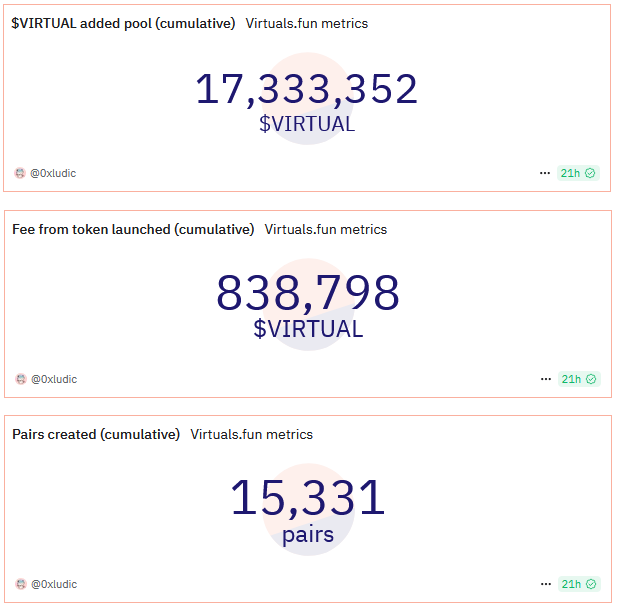

Since its launch on October 16, Virtuals Protocol has launched 15,845 AI agents—roughly one-third of what Pump.fun launches in a single day. Last month, Virtuals averaged about 175 new agents per day.

I couldn’t find a Dune dashboard tracking how many Virtuals agents exceeded $10 million market cap, so I manually counted: at the time of writing, 35 agents on Virtuals Protocol have reached or exceeded $10 million market cap. Out of 15,845 total agents, that’s 0.22%! Meaning 99.78% of Virtuals agents haven’t broken the $10M mark.

Now recall my earlier point about the huge, counterintuitive gap between 99.78% and 99.9986%. Of course, this is just a rough estimation exercise.

But you get the idea: compared to blindly investing in Pump.fun projects, blindly investing in Virtuals Protocol projects offers significantly higher odds of substantial returns.

Still, you wouldn’t invest blindly, right?

Let’s now reach the real conclusion.

As a launchpad, Virtuals outperforms others across the board. And in this case, there are even more dimensions we haven’t yet compared. For instance:

-

Pump.fun earned $400 million in fees over a year, while Virtuals Protocol earned $55 million in fees in just three months.

-

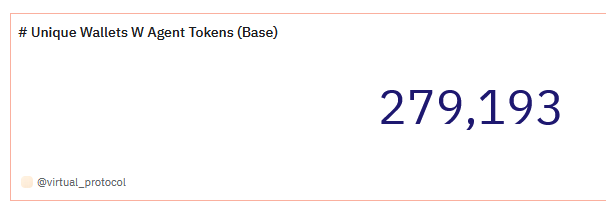

Pump.fun sees around 300,000 daily active users and had 8 million unique wallet addresses over a year. Meanwhile, fewer than 300,000 unique wallets hold Virtuals agent tokens (only 280,000).

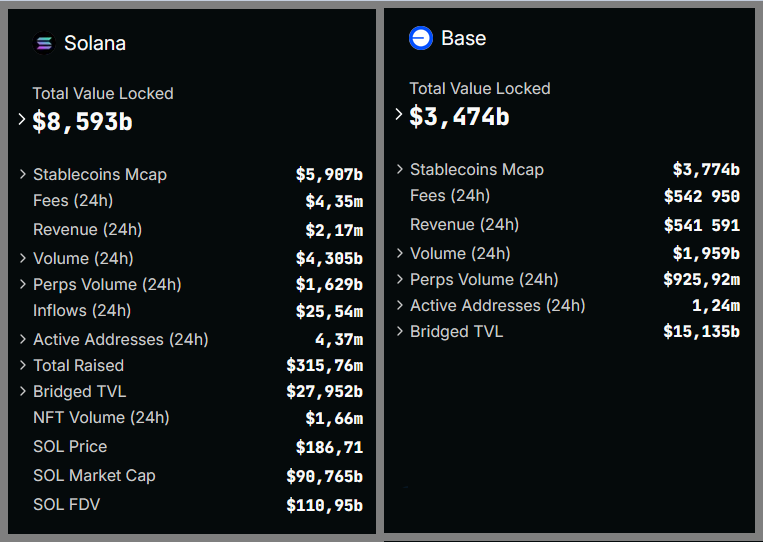

In short, Virtuals achieved far more with fewer resources. And we’re not even factoring in the differences between Solana and Base chains in user activity, trading volume, and total value locked (TVL):

Data source: DefiLlama

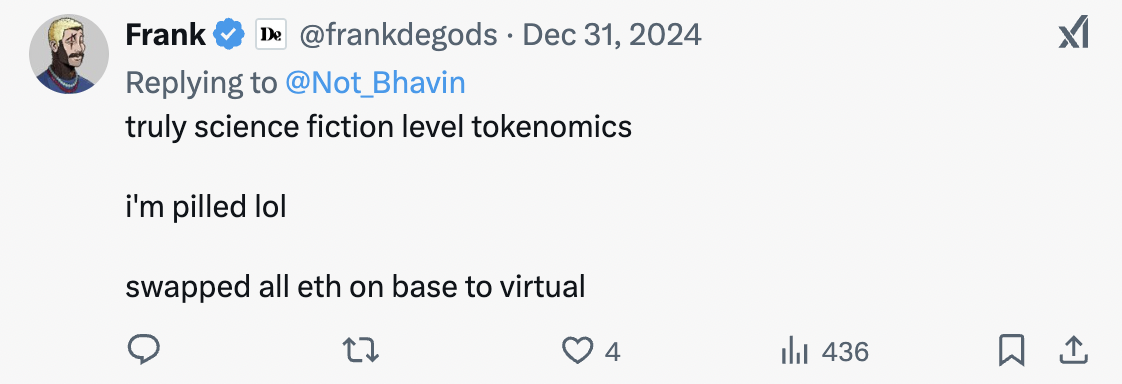

However, the gap is narrowing as more major players announce (or have already begun) shifting their AI agent investments to Base. Even early skeptics like @frankdegods and @notthreadguy have changed their stance toward Base-based projects.

I recommend paying close attention to @jessepollak’s announcements about Base’s future roadmap. It’s impressive, and Coinbase is watching closely. Base aims to deliver superior DeFi expansion compared to other Ethereum Virtual Machine (EVM) chains, soon enabling tokenization of multiple fiat currencies, Coinbase stock ($COIN), and numerous liquidity pools! Many forget that Base is still in its infancy.

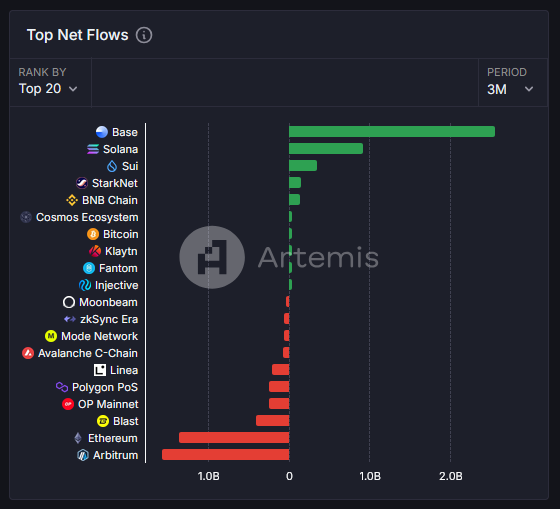

Over the past few months, capital has steadily flowed into Base.

Last but not least: Virtuals’ tokenomics. You should really study them—they represent a genuine competitive advantage and first-mover edge.

Their launchpad functionality creates a high-quality ecosystem and a powerful tokenomic flywheel. This flywheel generates significant revenue for the team through fees and token appreciation, providing ample capital for reinvestment and upgrades (G.A.M.E and CONVO features will surely be enhanced in the coming months). Crucially, this flywheel also benefits every agent token created on the platform.

Recently, the Virtuals team seems to be focusing more on gaming within the AI agent space. In my view, this is a smart move—it aligns with their original vision and core expertise, and given the cyclical nature of market narratives, gaming could easily make a comeback during the next phase of speculative frenzy. They’re also building narratives compatible with mainstream Web2 adoption. After all, non-player characters (NPCs) have vast potential applications, don’t they?

Their platform is ready for deployment on Solana!

My weekend research into Solana made me realize how intense the trading activity and volume are there—I’d been focused on Base throughout late 2024. I was also impressed by the advancements in Solana trading tools and overall user experience.

Yet I noticed today’s market is far more predatory than six months ago. Exit scams are becoming increasingly sophisticated. Seeing my own 99% losses, I could only mutter “well played.” Overall trading activity leans heavily toward extreme speculation. I’ve been in this space since 2017—a speculator at heart—but I prefer intelligent, thoughtful speculation.

On Base, everything moves slower—the transactions, transfers, token approvals, price swings.

But UI/UX keeps improving, and tools continue to evolve. Right now, Base remains early-stage. Lower popularity means less predation, making it feel more like player-versus-environment (PvE) rather than player-versus-player (PvP).

This also means abundant opportunities exist on Base. As highlighted earlier with the 99.78% vs. 99.9986% comparison, opportunities stand out more clearly in this lower-noise environment. Plus, the influx of idle capital migrating from Ethereum is a strong tailwind.

Compared to similar projects on Solana, Virtuals hosts far fewer scammers. Compare last week’s AICC fiasco with today’s DTRXBT project launched by @beast_ico and @ghost93_x—Virtuals incorporates community members in a more mutually beneficial way, including retail investors.

Virtuals continues attracting serious, reputable, doxxed developers. Of course, like anywhere else, some creators may still rug pull. But listen to @NickPlaysCrypto's interview, and you’ll see that not all newcomers are fraudsters—even today.

I won’t offer a formal conclusion. My point is clear enough. Draw your own takeaways, and hopefully, I’ll see you soon on Virtuals’ battlefield. To me, this story is far from over. For those already involved, the best is yet to come.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News