In-depth Analysis of the Value and Participation Methods for AI Public Chain Vana

TechFlow Selected TechFlow Selected

In-depth Analysis of the Value and Participation Methods for AI Public Chain Vana

Vana uses private-key-based permission management to ensure data portability and control, eliminating intermediaries and creating fair value for all participants.

Author: Jesse, Core Contributor at Biteye

Over the past two decades, personal data has gradually evolved into the core currency of the internet economy. While enjoying free services, users often unknowingly cede control of their data to platforms, which in turn generate substantial economic gains through targeted advertising and data trading.

With the rapid advancement of artificial intelligence (AI) technologies, private data has become a key resource driving an AI-powered world. However, this ecosystem faces two prominent contradictions: the producers of data—individuals—rarely receive economic returns, while AI researchers struggle with access to high-quality datasets.

The early vision of the internet was an open ecosystem where users could fully control their own data. Yet, with the widespread adoption of cloud infrastructure and the convenience of free services, platforms have gradually monopolized digital identity management, establishing a centralized data economy.

This status quo clearly deviates from the original design principles of the internet.

1. Data Ownership and Its Significance

Today, two transformative forces are challenging the existing data monopoly: on one hand, the rapid development of AI is exponentially increasing the value of personal data; on the other, the rise of decentralized technologies offers individuals new tools to reclaim control over their data. Vana aims to lead this transformation as the first open protocol designed specifically for data sovereignty, ushering in a new era of the data economy.

Vana is an EVM-compatible AI blockchain focused on user sovereign data management and governance. Its core goal is to build a distributed network that enables users not only to own and govern the data they contribute but also to directly profit from its tokenization.

Vana empowers users with full data control while providing developers with compliant and high-quality data resources, creating a win-win ecosystem.

Leveraging private-key-based permission management, Vana ensures data portability and control, challenging the monopolies of Web2 centralized platforms by building a decentralized data market that eliminates intermediaries and creates fair value for all participants.

For Users

-

Data Monetization: Vana allows users to extract data from centralized platforms and aggregate it into decentralized data collectives. By participating in decentralized DataDAOs, users can earn economic rewards from data sharing.

-

Sovereignty and Portability: Users maintain full control over their data while unlocking diverse value streams, such as personalized AI services or data insights.

For Developers and Researchers

-

Access to High-Quality Data: Vana provides transparently governed, user-owned datasets, significantly improving data market efficiency.

-

AI Model Optimization: Developers can leverage compliant, portable datasets to drive AI innovation.

For the Overall Ecosystem

-

Efficient Data Market: Through aligned incentives and disintermediation, Vana fosters a fair and efficient data ecosystem.

-

Responsible Innovation: Ensures fair compensation for data contributors, promoting ethical and responsible data use in the AI economy.

Through its technical and ecological design, Vana transforms the realization of personal data value from passive to active. It not only challenges the centralization monopolies of the Web2 era while preserving their network effects but also brings a fairer, more transparent, and efficient future to the data economy.

2. How DataDAO Empowers AI Agents More Effectively

Unlike traditional digital assets, data's economic value depends on controlled access. Once data is publicly exposed, its market value rapidly depreciates. Traditional blockchains, emphasizing public verifiability, are ill-suited for handling sensitive data. Vana resolves this challenge by combining private data custody with public ownership architecture.

Vana maintains a global state network ensuring transparency in data ownership, quality verification, and revenue distribution. Its core functionalities include:

-

Data Ownership Records: Cryptographic proof of user data possession.

-

Access Permission Management: Defines conditions and scope for data access.

-

Validation Proofs: Ensures data quality, authenticity, and metadata integrity.

-

On-chain DataDAO Contracts and Token Balances: Enable governance and economic rights distribution.

Data remains encrypted and stored in secure environments or personal user servers. Platforms programmatically manage access permissions and ensure revenues flow back to data creators. Users can export their data, encrypt it, and join collective groups known as DataDAOs. Within these collectives, users negotiate commercial data usage with researchers or developers, ensuring contributors receive fair compensation.

Each DataDAO customizes its Proof of Contribution based on data type, measuring data value through metrics including (but not limited to):

-

Financial Data: Transaction accuracy, record completeness, and consistency.

-

Social Media Data: User engagement levels, account activity duration, and content interaction rates.

-

Health Data: Data freshness, measurement frequency, and device precision.

Data validation is performed by the Satya network, composed of Trusted Execution Environments (TEEs), enabling privacy-preserving data quality verification. Additionally, some DataDAOs employ zero-knowledge proofs (zk-proofs) to further enhance privacy and security.

When developers purchase data access rights, contributors receive proportional compensation via governance tokens. This mechanism ensures ongoing economic returns for data contributors, who retain decision-making power in governing data usage. The data market incentivizes high-quality contributions, enabling fair pricing and increased efficiency.

Vana introduces highly liquid, decentralized Data Liquidity Pools (DLPs). Users collectively share data while retaining encrypted control. Through smart contract-driven mechanisms, non-fungible data within DataDAOs is mapped into tradable tokens—marking an innovative leap in crypto history. Whenever a new tokenized asset emerges, market attention and capital swiftly follow. Historically, NFTs brought tokenization to art, with pieces like Bored Apes and Art Blocks selling for millions, captivating investors. In the current cycle, Pendle’s tokenization of yield revitalized DeFi, becoming the standout DeFi protocol of 2024. Pioneers in each asset class enjoy the highest premiums. Now, Vana pioneers a new frontier by unlocking the potential of unstructured data—a likely reason top exchanges listed Vana immediately upon launch.

2025 will undoubtedly be the year of the AI Agent. AI Agents represent the next evolution of dApps, a shift comparable to the transition from desktop to mobile devices over the past decade—but faster and larger in scale. Data is the new oil of the AI era, making Vana’s narrative particularly compelling. AI model performance hinges more on training data quality than on computational power or architectural innovation alone. This reality is reshaping AI development priorities: data quality has become the core bottleneck for AI progress.

AI Agents face a common challenge: garbage in, garbage out. Without high-quality training data, even the most sophisticated AI agents cannot function effectively. This underscores the critical need for a trusted data foundation.

This is precisely where Vana becomes essential. Vana is not just another AI project—it aims to establish user data ownership and supply high-quality AI training data. Through DataDAOs, users can stake $VANA tokens to support the creation of premium datasets, incentivizing participation in shaping AI training data.

The importance of this mechanism for AI Agents is clear: higher-quality training data directly translates into stronger AI performance. Community-driven curation also ensures data diversity and reliability, guaranteeing long-term sustainability.

Currently, ai16z garners attention due to backing from a16z, while Virtual leverages Base’s liquidity to become a hot AI Agent launchpad. Vana has secured $25 million in funding from top-tier VCs including Coinbase Ventures, Paradigm, and Polychain—putting its resources on par with ai16z and Virtual. Participation in DataDAOs built on Vana requires staking $VANA, effectively functioning as a data-focused Launchpool. Investors stake VANA in promising DataDAOs, supporting their growth while earning staking rewards. Future DataDAOs may airdrop tokens to supportive VANA stakers (dFusion AI Protocol has already announced a 1:1 airdrop to Vana stakers). Each DataDAO must reach a minimum staking threshold of 10,000 $VANA to qualify for rewards, further driving deflationary pressure on VANA. AI Agents are undoubtedly the hottest topic today, and as market awareness grows around the critical role of input data quality, Vana’s value discovery is only beginning.

Through innovative designs like DataDAOs and DLPs, Vana is redefining the infrastructure of the data economy, enabling fair circulation of high-quality data and fostering a more responsible environment for AI innovation.

3. Value Analysis of Vana

Beyond the previously discussed values—such as pioneering data tokenization in Web3, supplying high-quality data for AI Agents, and serving as a DataDAO Launchpool—we can also assess Vana’s positioning within the broader internet technology ecosystem. Notably, Justine Moore, partner at a16z, published a noteworthy list of AI projects, with Vana being the sole Web3 AI project included—even though a16z has not invested in it.

AI = Data + Models + Compute. Currently, the model space is dominated by OpenAI and Anthropic, while compute is monopolized by NVIDIA, with challengers like Hyperbolic leveraging distributed computing. The data layer, however, remains AI’s foundational and most critical component—the "new oil" of the AI era. Without data, the AI engine cannot start. Unlike models and compute, no single company currently holds a dominant position in the data赛道.

In the internet age, digital footprints reveal more than self-perception: algorithms analyze subtle cues—like Facebook likes or GPS logs—to predict personality traits, income levels, and even mental health with greater accuracy than friends or family. Seemingly trivial behaviors—such as shopping times or social media tone—unintentionally expose emotions, preferences, and deeper truths. Personalized information targeting based on digital data can effectively influence behavior—for instance, significantly boosting savings among low-income populations. Thus, unlocking data potential is crucial.

In the Web3 landscape, merely “owning your data” is no longer a compelling proposition. What matters is how data value can deliver tangible benefits to users. The profits of Web2 tech giants stem largely from data control—Google’s precise ad targeting, Ant Financial’s big-data-driven financial services. Reddit earned over $200 million by selling user-generated content for AI training. Many Web2 companies are fundamentally big data firms. Alphabet (Google’s parent) has a market cap of $2.39 trillion, Facebook $1.15 trillion, Twitter $55.68 billion, and Reddit $29.6 billion. On Vana’s platform, researchers can access not only Twitter or Reddit data but also high-value, sensitive data like health and financial records—all without compromising privacy. As network effects grow under token incentives, Vana is poised to become the central hub for high-quality data, democratizing AI access beyond elite control. Vana’s impact on AI could rival Bitcoin’s disruption of traditional finance.

Moreover, Vana treats unstructured data as tradable financial assets, building secondary markets around DLPs—including spot trading, lending, options, and futures. This opens an entirely new asset class, unprecedented in both traditional finance and DeFi. Such a market is impossible on Nasdaq or CME, as no Web2 tech giant would self-disrupt by relinquishing core data profits. Public data loses value instantly or triggers privacy risks, not to mention the cumbersome KYC processes of centralized exchanges. These pain points are precisely what Vana solves—and currently, only Vana can.

New assets often bring speculative bubbles, much like recent narratives such as DeSci and AI Agents triggering FOMO. Rising DLP market caps will attract new participants, whose feedback will improve user experience and refine DataDAO operations, strengthening the entire ecosystem.

Silicon Valley’s success stems from betting on visions of a better life. Compared to established internet companies, Vana is still small—but its mission is vast. Cryptocurrencies enable global investors to participate in early-stage high-potential projects. Currently, Vana’s circulating market cap stands at just $500 million.

4. The Vana Ecosystem Flywheel

The $VANA token is the cornerstone of this economic system, serving functions in network security, transaction fees, DLP staking, data access payments, and protocol governance.

When AI enterprises access data, they use $VANA to purchase and burn DLP-specific tokens. This burn mechanism establishes a direct economic link between network usage and token value, ensuring value flows back to data contributors and the broader ecosystem.

Additional incentive structures further drive protocol adoption—for example, rewarding top-performing DataDAOs to boost ecosystem activity. To date, the Vana Foundation has supported 12 active DataDAOs and received over 300 accelerator applications. These DAOs span diverse use cases—from Twitter data and synthetic data to genomic and browser data—demonstrating the broad potential of the Vana protocol.

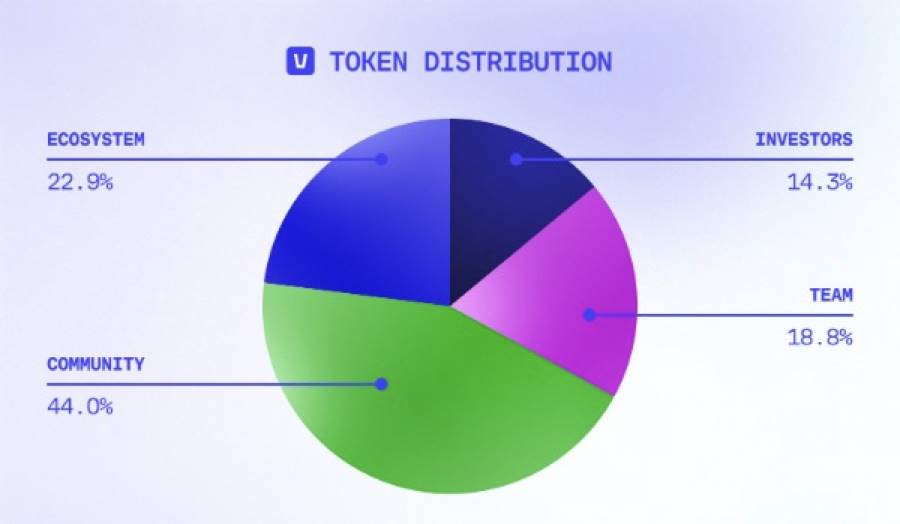

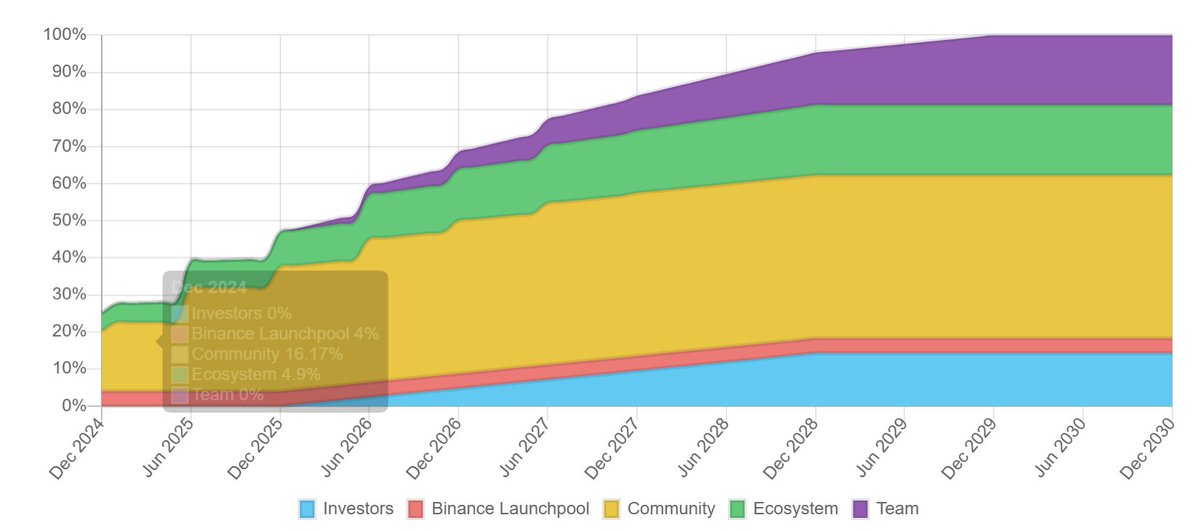

Vana emphasizes community strength, allocating 44% of tokens to the community, with 20.3% already released at TGE—one of the few projects in 2024 to deliver significant short-term benefits to participants. Investor allocations are locked for the first year and then vest over three years, reflecting strong confidence in the technology and model. The team receives 18.81% of tokens, locked for the first year and vested over four years—ensuring long-term commitment to Vana’s development.

Figure 1: Token Allocation Breakdown

Figure 2: Token Unlock Schedule

5. Current Participation Methods

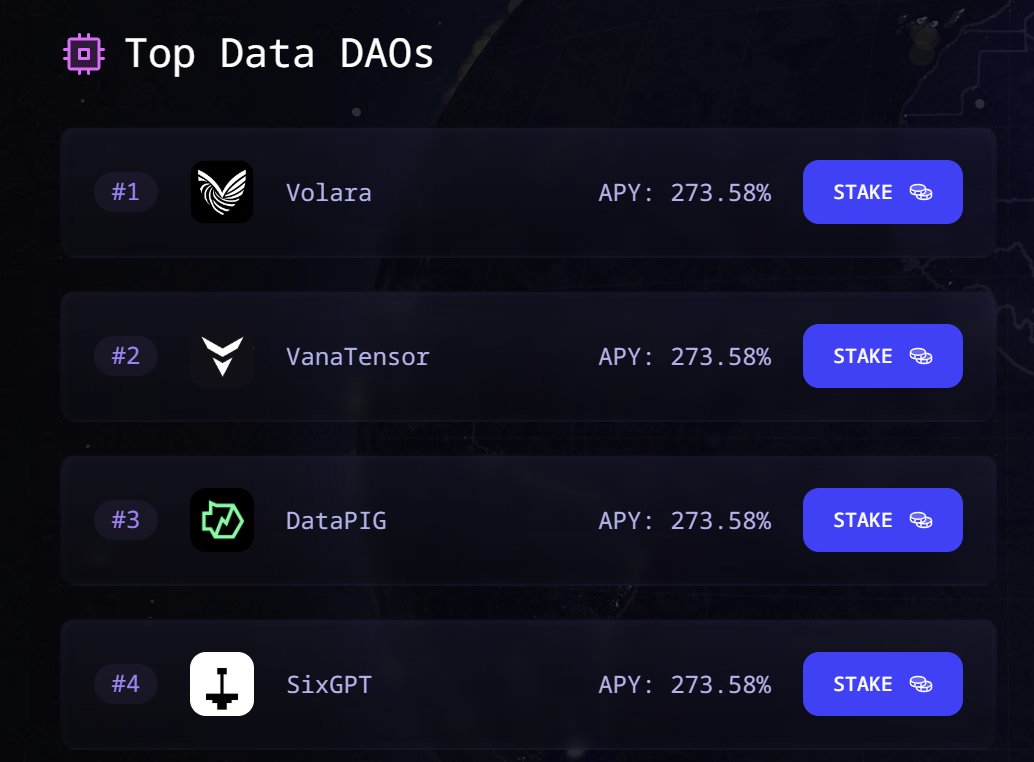

Vana operates a DataDAO reward system designed to ensure fair value distribution and incentivize high-quality data contributions. The system runs in 21-day cycles, rewarding the top 16 performing DataDAOs. Rewards are distributed proportionally based on each participant’s stake and multiplier, ensuring only the most valuable and trusted datasets receive rewards—driving continuous optimization and innovation.

Vana has allocated 15% of the total $VANA token supply to this reward program, to be gradually released over three years. The distribution structure is as follows:

-

50% goes to $VANA stakers supporting the top 16 DataDAOs.

-

50% is deposited into DataDAO treasuries to fund operations, incentivize data contributions, and enhance staking rewards.

This structure ensures sustained support for the most valuable DataDAOs while promoting overall ecosystem health.

To encourage long-term commitment, Vana implements a staking multiplier mechanism. The longer users stake, the higher their multiplier, reaching a maximum after 63 consecutive days. This increases the weight of their stake in reward calculations, aligning staker incentives with DataDAO success and enhancing system sustainability.

How to Participate in the DataDAO Ecosystem?

Step 1: Explore the Data Hub

Visit datahub.vana.com to view all registered DataDAOs eligible for rewards. The Data Hub serves as the gateway to discover, understand, and interact with the Vana ecosystem. Here, you can explore available datasets, learn about contributors and their validation methods, and compare DataDAO performance and rankings.

Step 2: Stake $VANA Tokens

Select a DataDAO and stake $VANA tokens to support it. If the DataDAO ranks in the top 16, stakers receive rewards. Each DataDAO must meet a minimum staking threshold of 10,000 $VANA to qualify for rewards.

Step 3: Track and Optimize

Use the dashboard to monitor your staked amount, multiplier growth, and the performance of your supported DataDAO.

Step 4: Earn and Reinvest

As DataDAOs earn rewards, users receive proportional shares based on stake size and multiplier. These earnings can be reinvested to increase future influence and returns, or partially cashed out based on financial needs.

Currently, the annual percentage yield (APY) for staking VANA reaches as high as 273.58%. For risk-averse users, additional profits can be earned through contract hedging and funding rate arbitrage. In the future, Vana stakers may receive token airdrops from DataDAO sub-projects.

Vana’s DataDAO ecosystem already hosts several innovative projects. Users can earn $VANA incentives by participating in these DataDAOs.

Featured Projects

1. @VanaTensor

Backed by Vana, @VanaTensor provides users with high-quality synthetic data and rewards contributors who share verified, valuable datasets.

2. @datapiggy

DataPig is an AI platform that transforms transaction data into meaningful insights. Through its DataDAO ecosystem, users convert their transaction data into valuable assets and participate in a growing on-chain economy.

3. @Volaraxyz

Volara turns users’ Twitter data into valuable assets, offering data owners expanded utility opportunities.

4. @sixgpt

SixGPT supports synthetic data generation for AI model training and is enhancing its capabilities using real human chat data from @flur_protocol, advancing platform intelligence.

5. @vChars_AI

vChars AI converts Telegram data into personalized AI characters, allowing users to create customized virtual avatars that interact with them.

6. @OpenyourMindDAO

MindDAO is the first decentralized autonomous organization exploring how Web3 impacts emotions, aiming to create the world’s largest user-owned mental health dataset.

7. Auto DLP

An DataDAO launched by @DLPLabs, Auto DLP allows drivers to connect their @DIMO_Network accounts, securely share vehicle data, and earn rewards by advancing automotive AI innovation.

8. @dFusionAI

dFusion’s knowledge base enables users to safely monetize chat data while retaining full ownership and control.

9. @primedatadao

A method for users to contribute Amazon shopping data and earn $VANA.

10. @NakaMining

The first genetic data collection on Vana, revolutionizing health science through community-driven breakthroughs. Users can contribute genetic data.

11. @Finquarium

Traders can contribute exchange trading data and earn rewards.

Beyond DataDAOs, Vana has launched a Uniswap V3 fork called Data DEX, dedicated to data trading, enabling users to buy and sell $VANA and DLP tokens. Traders and liquidity providers can leverage powerful analytics tools to make informed decisions and optimize strategies.

As an AI blockchain focused on the data economy, Vana will see many more ecosystem protocols built around DLPs in the future.

6. Looking Ahead

The launch of Vana’s mainnet marks a pivotal turning point. For the first time, users have the opportunity to challenge tech giants’ data monopolies, reclaim control over their data, and reshape the AI economy. Through decentralized collective data sharing, individuals can provide datasets matching—or even surpassing—those of centralized platforms in scale and quality.

Vana’s vision extends beyond economic compensation—it seeks to redefine data ownership, sharing, and monetization. In this new paradigm, data flows freely, sovereignty remains with individuals, and AI models are trained on user-owned data—with contributors directly benefiting.

Vana lays the foundation for a collectively built, self-sovereign internet and an open, equitable data economy. New benchmarks in emerging sectors often command market premiums. As the new year begins and capital returns to markets, when AI momentum resumes, Vana may well ride the wave to new heights.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News