KOLs' token issuance and investor exploitation increasingly resemble a conspiracy ring, leaving retail investors with no recourse

TechFlow Selected TechFlow Selected

KOLs' token issuance and investor exploitation increasingly resemble a conspiracy ring, leaving retail investors with no recourse

Making money is really tough.

Written by: TechFlow

Yesterday, a Twitter Space conversation between two "crypto celebrities," Trump and Musk, drew millions of simultaneous viewers.

For most crypto participants, the biggest concern wasn't whether they discussed any constructive topics—it was what meme coin opportunities emerged during the hours-long livestream?

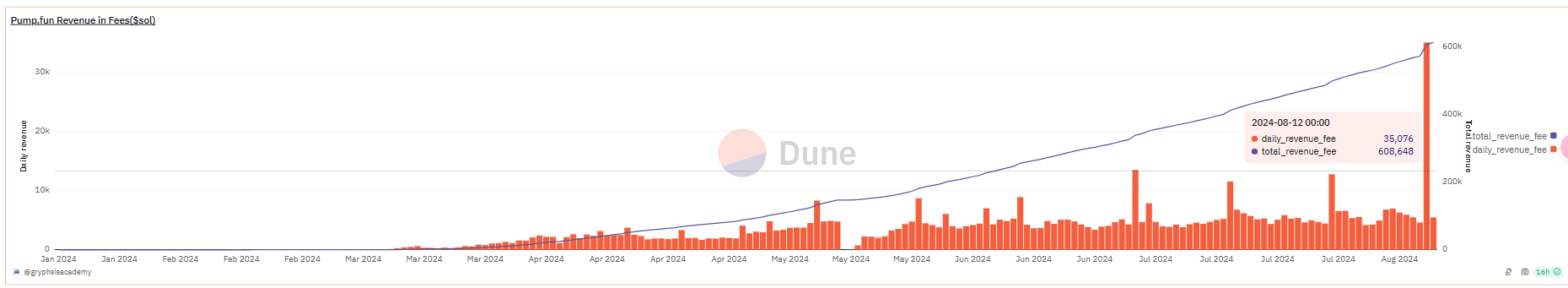

Judging by Pump.fun's performance, meme traders certainly weren’t disappointed :) According to Dune analytics dashboards, asset issuance volume and protocol revenue on Pump.fun spiked dramatically on the day of the broadcast.

Tokens related to Trump and Musk completely dominated the charts:

Indeed, viewers of yesterday’s livestream once again witnessed a spectacle of capitalizing on hype: halfway through Trump and Musk’s interview, numerous opportunistic memecoins had already completed their entire life cycle.

Memes continue to shine, becoming the first stop for monetizing global hot topics in crypto. For those participating in this wave of meme speculation, the first principle is crystal clear—make money. There’s absolutely no long-term vision about building projects or promoting ideals (unless you get stuck holding, of course).

Clear goals, simple principles, straightforward paths—apparently “chasing trends and jumping into dog coins” has all the favorable conditions. All that remains is human factors: “watch closely, be bold, run fast.” What else needs to be said? Take a gamble—what if you hit a golden dog? That might well reflect the real mindset of some on-chain PvP players.

Hehe, you stand on the bridge watching the scenery; someone else watches you from upstairs. The bright moon adorns your window, while you adorn someone else’s dream. Opportunities do exist—but is making money really that easy? When you’re trying to profit from the hype, you’ve already become someone else’s opportunity.

After the Hype: Are KOLs Accused of Colluding to Manipulate the Market?

$Yeah’s Dump Triggers Investigation

Trump and Musk undoubtedly hold massive influence in the crypto world. However, once the conversation ended—with no mention of cryptocurrency—the associated meme frenzy quickly cooled down. Yet in Chinese-speaking communities, the aftermath continued to unfold, with growing criticism directed at KOLs colluding to launch and dump memecoins.

Take $Yeah as an example. Within just a few hours yesterday, it surged and then gradually collapsed to zero. Given such rapid price movements combined with the inherent nature of pump-based memecoins, only a tiny minority likely profited significantly—inevitably leaving many losers behind. As a result, some Twitter users pointed fingers directly at specific KOLs, asserting that $Yeah was most likely a coordinated harvesting operation by a KOL network.

Is this just sour grapes from losing money—or is there truth to it? Regardless of the actual facts, this incident sparked widespread debate across Chinese crypto circles about KOLs using memecoins as tools for group-driven market manipulation. From yesterday into today, retail backlash and internal conflicts within KOL communities have continuously played out... By the time of writing, this has become a trending topic and meme across various chat groups.

Overt and Covert Harvesting: The Rise of the "Cabal"

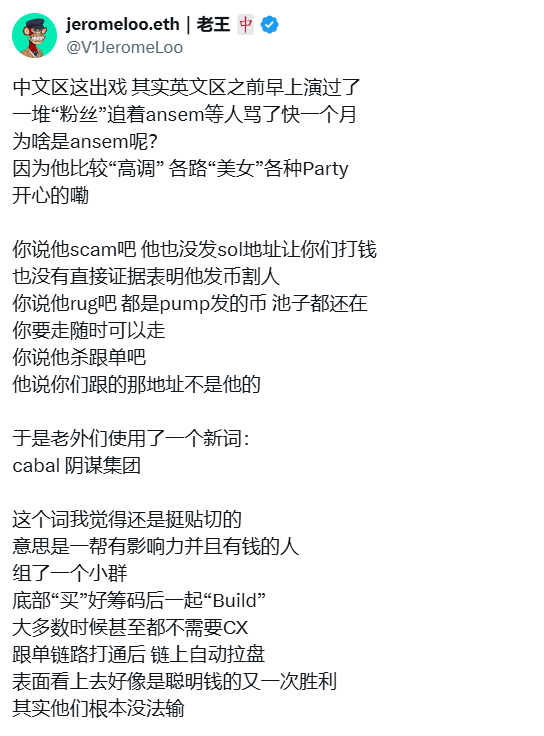

While people dig through on-chain records, unearth past histories, and engage in online flame wars, some Twitter users note that the kind of collusive dumping now being criticized is something Westerners have long mastered:

A series of Western KOLs, represented by Ansem, have fully cracked this system—exploiting human psychology and fast-reacting markets without technically breaking any rules. They can sit back, earn effortlessly, remain undefeated, and at worst earn the label of a “conspiracy group” (cabal).

As long as there's no concrete evidence and no logical flaws, who can truly accuse anyone of wrongdoing?

Compared to the bloodless, opportunistic tactics used by Western cabals, certain Chinese KOLs employ far more direct and brutal methods:

Fundraising → Launch token → Dump → Wait for hype to fade → Launch another token → Dump again → Wait for new “believers” to fund the next round...

This aggressive, face-to-face slashing naturally draws widespread backlash:

But as they say, there’s nothing new under the sun—when it comes to harvesting韭菜 (cauliflower), the knife technique doesn’t matter. Whether subtle or blunt, in the end, it’s always the韭菜who shed tears.

Has the Logic Behind Memecoins Changed?

Prior to the Pump.fun boom, the quality of a memecoin was judged by whether its concept made for a nice ticker symbol. Participation even carried somewhat of a medium-to-long-term vibe, since strong concepts could inspire ideas of “community building.”

Nowadays, evaluation criteria have shifted: how much smart money bought in early, how influential the promoting KOLs are... This naturally leads to increasingly shorter memecoin lifespans and intensified PvP dynamics.

The “sell immediately after profit” mentality is replacing diamond hands. This shift isn’t unique to memes—even in broader crypto, think of how people dump tokens immediately upon unlocking or receiving airdrops when confidence fades. Whether big whales, mid-sized players, or small retail, everyone increasingly understands the PvP truth: “Selling is permanent profit; not selling risks total loss.” Faith in memecoins is gradually eroding.

In the past, a sign of topping market cycles was seeing countless low-quality tokens flying around, with players rushing into any contract based solely on CA. Now, major players don’t even need to tirelessly promote across groups. One-click launch platforms combined with countless on-chain bots following smart money make harvesting convenient and automated.

Unnoticeably, participation logic in memecoins has evolved—from “playing memes to avoid being rekt by VCs and old-timers” to “playing memes to avoid being rekt by others means you must exit before everyone else.”

When memecoins themselves become tools for harvesting others, how long will genuine, lasting enthusiasm last? Will the culture of fairness and freedom slowly fade away amid endless PvP battles?

The answers remain unknown—but one thing is clear: making money is getting harder.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News