Global Bitcoin ETF holdings surpass 1 million BTC—what are the top holding institutions?

TechFlow Selected TechFlow Selected

Global Bitcoin ETF holdings surpass 1 million BTC—what are the top holding institutions?

Who Exactly Are the Big Holders of Bitcoin Spot ETFs?

Author: Huo Huo

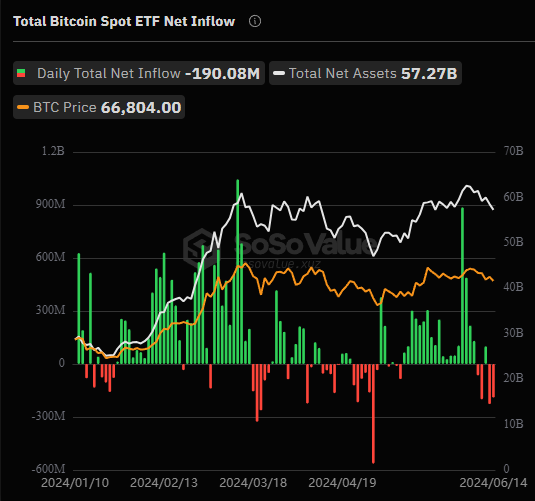

In early 2024, spot Bitcoin ETFs were officially approved, marking the beginning of traditional financial capital flowing into the crypto world. As of June 1, global Bitcoin ETF holdings surpassed 1 million BTC. By June 14, the total net assets of spot Bitcoin ETFs reached approximately $57.2 billion.

Source: https://sosovalue.xyz

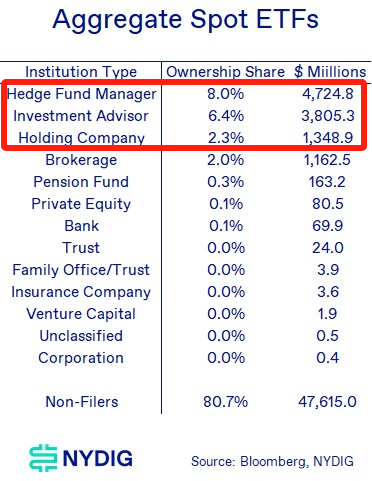

According to the 13F filings (reports disclosing equity holdings by investment institutions managing over $100 million in assets) submitted to the SEC as of May 15, in Q1 2024, a total of 929 institutions held positions across all reported spot Bitcoin ETFs—less than 20% of the total market. The remaining 80.7% of spot ETF holders remain unidentified. The number of institutional holders of spot Bitcoin ETFs has even surpassed that of gold ETFs, and disclosed asset values have already reached hundreds of billions of dollars, highlighting traditional finance's growing attention to crypto assets.

Today, based on these filings, TechFlow provides an overview of the top three hedge funds, investment advisory firms, holding companies, and some well-known institutions in terms of Bitcoin ETF holdings.

State Government Investment Funds and Banks (Over $100 Million)

1) Wisconsin State Retirement System ($100 Million)

The first U.S. state government fund to purchase spot Bitcoin ETFs, the Wisconsin Investment Board (SWIB), filed its quarterly 13F report with the SEC, becoming the first state entity to disclose Bitcoin investments. The filing shows that in Q1 2024, SWIB purchased 94,562 shares of BlackRock’s iShares Bitcoin Trust (IBIT), worth nearly $100 million. The board also acquired Grayscale Bitcoin Trust (GBTC) shares valued at approximately $64 million.

Established in 1951, SWIB currently manages over $156 billion in assets according to its website. It oversees assets for the Wisconsin Retirement System (WRS), the State Investment Fund (SIF), and other state trust funds.

2) U.S. Bancorp ($15 Million)

U.S. Bancorp is a U.S. bank holding company and parent of U.S. Bank National Association—the fifth-largest bank in the United States, operating more than 3,000 branches primarily in the western and midwestern regions. According to its latest 13F filing, the firm’s total investments amount to $71.8 billion.

U.S. Bancorp holds over $15 million in spot Bitcoin ETFs. Specifically, it owns approximately 87,744 shares of Fidelity’s FBTC ($5.4 million), 46,011 shares of Grayscale’s GBTC ($2.9 million), and 178,567 shares of BlackRock’s IBIT ($7.2 million).

3) JPMorgan Chase & Co. (~$1 Million)

JPMorgan Chase & Co., founded in 2000 and headquartered in New York City, is one of the largest financial institutions in the U.S., with around 5,100 branches under its commercial banking division. In October 2011, it became the largest U.S. financial services firm by asset size. Operating in over 50 countries, its business spans investment banking, securities trading, asset management, commercial financial services, and private banking.

JPMorgan currently holds approximately $1 million in ProShares BITO, BlackRock IBIT, Fidelity FBTC, Grayscale GBTC, and Bitwise BITB ETFs.

Hedge Funds – $4.7 Billion

Hedge funds represent the largest category among spot Bitcoin ETF holders, accounting for 8.0% of total holdings—approximately $4.7 billion.

1) Millennium Management (~$1.9 Billion)

Among major hedge fund buyers, Millennium Management stands out. Founded in 1989 and headquartered in New York City by Israeli-American financier Israel Englander, it is now one of the world’s largest hedge funds.

The firm holds five Bitcoin ETFs with a combined value of ~$1.9 billion:

$844.2 million in BlackRock’s IBIT;

$806.7 million in Fidelity’s FBTC;

$202 million in Grayscale’s GBTC;

$45 million in ARK’s ARKB;

$44.7 million in Bitwise’s BITB.

Bloomberg ETF analyst Eric Balchunas described Millennium as the “king” of Bitcoin ETF holders, noting its holdings are 200 times the average of the top 500 new ETF investors. These Bitcoin ETF holdings represent about 3% of the fund’s total AUM.

2) Schonfeld Strategic Advisors (~$480 Million)

Founded in 1988 and headquartered in New York by Steven Schonfeld, Schonfeld began as a proprietary trading firm and evolved into a multi-strategy hedge fund known for diversified strategies and innovative approaches, managing $13 billion in assets.

Schonfeld holds a total of $479 million in Bitcoin ETFs: $248 million in IBIT and $231.8 million in FBTC.

3) Boothbay Fund Management ($380 Million)

Boothbay Fund Management, founded in 2011 and based in New York by Ari Glass, is a multi-strategy hedge fund focused on diversified methods to achieve stable returns.

Boothbay has invested $377 million in spot Bitcoin ETFs: $149.8 million in IBIT, $105.5 million in FBTC, $69.5 million in GBTC, and $52.3 million in BITB.

Besides Bitcoin ETFs, Boothbay’s portfolio includes various ETFs such as SPDR S&P 500 ETF Trust and iShares Russell 2000 ETF.

4) Bracebridge Capital ($340 Million)

Bracebridge Capital, founded in 1994 and based in Boston, Massachusetts, is a hedge fund managing global equities, bonds, FX, futures, and other asset classes. Known for its global macro strategy and deep market insights, it serves institutional clients with high-quality asset management.

Bracebridge currently holds $262 million in ARK 21Shares Bitcoin ETF and $81 million in BlackRock’s IBIT.

5) Aristeia Capital LLC ($163.4 Million)

Aristeia Capital LLC, founded in 1997 and headquartered in the U.S., is a renowned hedge fund and investment manager. It specializes in diversified strategies including equities, bonds, derivatives, and other instruments, recognized for strong performance and rigorous risk control, aiming for long-term growth across market cycles.

Aristeia Capital LLC holds $163.4 million in IBIT.

6) Graham Capital Management ($98.8 Million)

Graham Capital Management is a well-known U.S.-based hedge fund, founded in 1994 in Connecticut by renowned investor Kenneth Tropin.

As a leading systematic hedge fund, Graham focuses on quantitative and rule-based strategies to generate absolute returns across market environments, managing substantial assets globally across equities, fixed income, commodities, and FX. It is also recognized for disciplined risk management and client-centric service.

Graham holds $98.8 million in IBIT and $3.8 million in FBTC.

7) IvyRock Asset Management (Ivy Rock Asset Management) ($19 Million)

IvyRock Asset Management, founded in 2009 and headquartered in Hong Kong, primarily focuses on Asian markets, managing various funds through its asset management arm.

IvyRock holds nearly $19 million in BlackRock’s spot Bitcoin ETF IBIT.

Investment Advisory Firms – $3.8 Billion

Investment advisory firms collectively hold approximately $3.8 billion in spot Bitcoin ETFs.

1) Horizon Kinetics LLC ($946 Million)

Among disclosed advisory firms, Horizon Kinetics LLC holds the largest position. An independent investment advisor founded in 1994 and based in New York, it manages assets across mutual funds, separate accounts, and alternative investments.

A notable feature of Horizon Kinetics is its focus on unconventional and inefficient markets, often seeking undervalued or misunderstood opportunities such as small-cap stocks, international equities, and niche sectors to profit from long-term trends and market inefficiencies.

Horizon Kinetics holds $946 million exclusively in Grayscale’s GBTC, ranking first among advisory firms and second-largest holder overall (the largest being Susquehanna International Group, discussed later).

2) Morgan Stanley ($270 Million)

Morgan Stanley is a globally renowned investment bank and wealth management firm headquartered in New York. Founded in 1935 from the legacy of the Morgan financial dynasty, it is one of the world’s leading financial service providers, offering corporate finance, M&A advisory, securities underwriting, asset management, wealth management, and investment banking services. Morgan Stanley possesses deep expertise across investment banking, asset management, trading, and wealth management.

Morgan Stanley holds $269.9 million in Bitcoin ETFs—all invested in Grayscale’s GBTC—making it the third-largest holder of GBTC.

3) Pine Ridge Advisers ($210 Million)

Pine Ridge Advisers, founded in 2018 and based in New York, is a prominent financial advisory firm known for its expertise in wealth management, investment strategy, and financial planning. Its mission is to deliver personalized and comprehensive financial solutions to clients ranging from individual investors to corporations and institutions.

Pine Ridge holds a total of $205.8 million in spot Bitcoin ETFs: $83.2 million in IBIT, $93.4 million in FBTC, and $29.3 million in BITB.

4) ARK Investment Management ($206 Million)

ARK Investment Management is the firm founded and led by “Cathie Wood,” established in 2014 in New York. It focuses on thematic investing in disruptive innovation, including AI, energy transformation, fintech, and genomics, with multiple funds targeting these themes.

ARK holds $206 million in ARK 21Shares Bitcoin ETF—one of the first 11 spot Bitcoin ETFs launched. Since approval, ARK Investment Management has consistently bought shares of its own ETF, possibly engaging in self-promotion to grow AUM and attract more investors.

5) Ovata Capital Management Ltd ($74 Million)

Ovata Capital, founded in 2017 and headquartered in Hong Kong, specializes in Asian equities with core strategies in arbitrage, relative value, event-driven, and long/short equity. Its portfolio manager, Jon Lowry, previously worked at Millennium Management and Elliott Management Corp. Reports indicate Ovata’s fund rose 10% last year and gained 5.6% in the first four months of this year.

Ovata Capital holds over $74 million in Bitcoin ETFs, including FBTC, GBTC, BITB, and IBIT (exact allocations undisclosed).

6) Hightower Advisors ($68.34 Million)

Hightower, headquartered in Chicago, is a well-known investment management firm offering wealth management and investment solutions to high-net-worth individuals, family offices, RIAs, and institutional investors.

Hightower holds over $68.34 million in U.S. spot Bitcoin ETFs. With $12.2 billion in total AUM, it holds positions in six spot Bitcoin ETFs:

$44.84 million in Grayscale GBTC;

$12.41 million in Fidelity FBTC;

$7.62 million in BlackRock IBIT;

$1.7 million in ARKB;

$990,000 in Bitwise BITB;

$790,000 in Franklin EZBC.

7) Rubric Capital Management ($60 Million)

Rubric Capital Management is a U.S.-based investment management firm founded in 2008. It focuses on long-term global equity investments, known for deep research and specialized methodologies using fundamental, quantitative, and market analysis. The team seeks companies with strong potential and long-term growth prospects to meet clients’ financial goals.

Rubric Capital Management currently holds over $60 million in BlackRock’s spot Bitcoin ETF.

Holding Companies – $1.35 Billion

Susquehanna International Group ($1.1 Billion)

Within the holding company category, only one investor stands out: SIG Holdings, LLC—the parent of Susquehanna International Group (SIG), also known as SeaGate International Group.

Susquehanna International Group (SIG) is a U.S. financial services firm headquartered in Bala Cynwyd, Pennsylvania, renowned for its technological and analytical prowess in financial markets and considered one of the world’s largest quant trading firms. Founded in 1987 by Jeff Yass, Arthur Dantchik, and Joel Greenberg, SIG operates globally in securities, options, futures, derivatives, asset management, and private equity, with total investments of approximately $575.9 billion—Bitcoin ETFs representing just a small fraction.

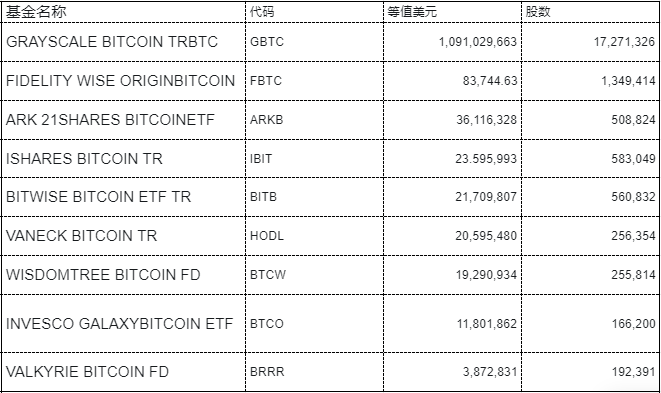

SIG holds nine spot Bitcoin ETFs totaling $1.31 billion, with the largest position in Grayscale’s GBTC—17.27 million shares worth $1.09 billion—making it the largest holder of GBTC.

Summary

On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) approved the listing of 11 spot Bitcoin ETFs, a landmark moment for the digital asset market. The approval of Bitcoin ETFs and other crypto-related ETFs has undoubtedly opened the door for traditional investors to enter this emerging market.

Since ETFs listed on exchanges are regulated by the SEC, investing in Bitcoin via ETFs carries lower risk compared to direct ownership. Amid global geopolitical instability and expectations of Fed rate cuts, spot Bitcoin ETFs have become attractive investment vehicles for traditional financial institutions.

However, if only 20% of institutional holdings are publicly disclosed—as suggested by 13F filings—who owns the remaining 80%? Moreover, as massive capital flows into these dominant financial products, could this drain liquidity from primary and secondary markets, potentially starving new projects of attention and funding? Share your thoughts in the comments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News