Hong Kong's spot virtual asset ETFs struggle in trading—due to "lack of innovation" or "bad timing"?

TechFlow Selected TechFlow Selected

Hong Kong's spot virtual asset ETFs struggle in trading—due to "lack of innovation" or "bad timing"?

The significance of Hong Kong launching spot virtual asset ETFs does not lie in bringing immediate transformative changes to the market, but rather in signaling that Hong Kong's financial institutions will accelerate their adoption of virtual assets.

Author: Jason Jiang, Researcher at OKLink Research Institute

Since April 30, Hong Kong's six spot virtual asset ETFs have been trading for half a month. How has the market performed? Have physically-backed creations and redemptions, along with Hong Kong’s earlier launch of a spot Ether ETF compared to the U.S., brought new inflows? What developments can we expect in the future? To answer these questions, OKLink Research Institute reviews the development of Hong Kong's virtual asset ETF market over the past two weeks based on data.

1. Market Performance of Hong Kong Virtual Asset ETFs Over the Past Two Weeks

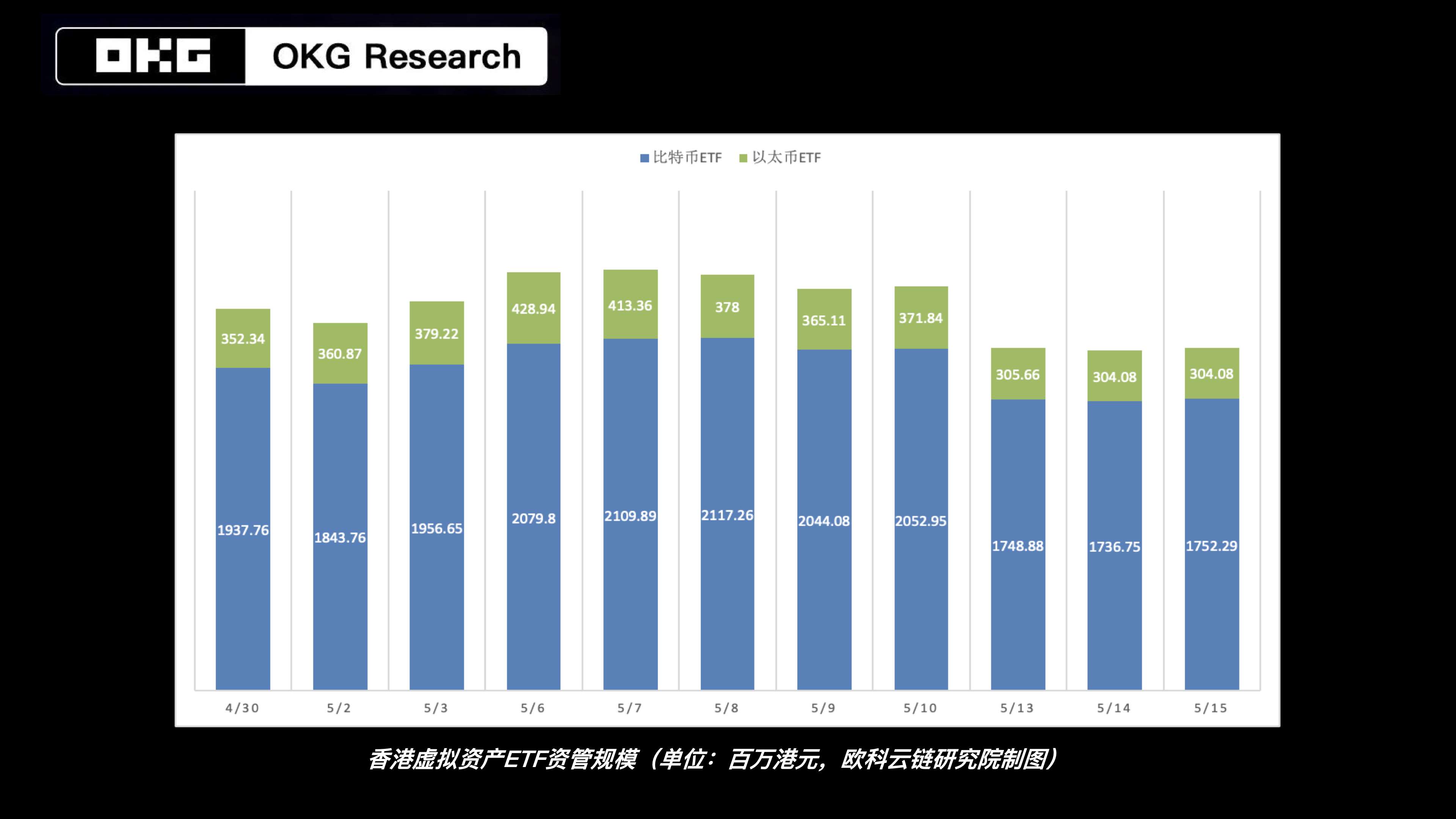

On their debut day, April 30, Hong Kong’s three spot Bitcoin ETFs raised $248 million—far exceeding the ~$125 million initial capitalization of U.S. spot Bitcoin ETFs on January 10 (excluding Grayscale). However, subsequent performance has fallen short of expectations. According to incomplete statistics from OKLink Research Institute, as of May 15, 2024, the total AUM of Hong Kong’s six spot virtual asset ETFs exceeded HK$2 billion (~US$264 million), with CSOP’s Bitcoin ETF accounting for HK$816 million—nearly 40% of the total. The remaining spot ETFs each hold less than HK$500 million in assets. While this pales in comparison to the ~$51.4 billion AUM of U.S. spot Bitcoin ETFs, given the scale difference between Hong Kong’s ETF market (~$50 billion) and the U.S. (~$8.5 trillion), a $264 million virtual asset spot ETF still represents a significant impact on Hong Kong’s local financial ecosystem.

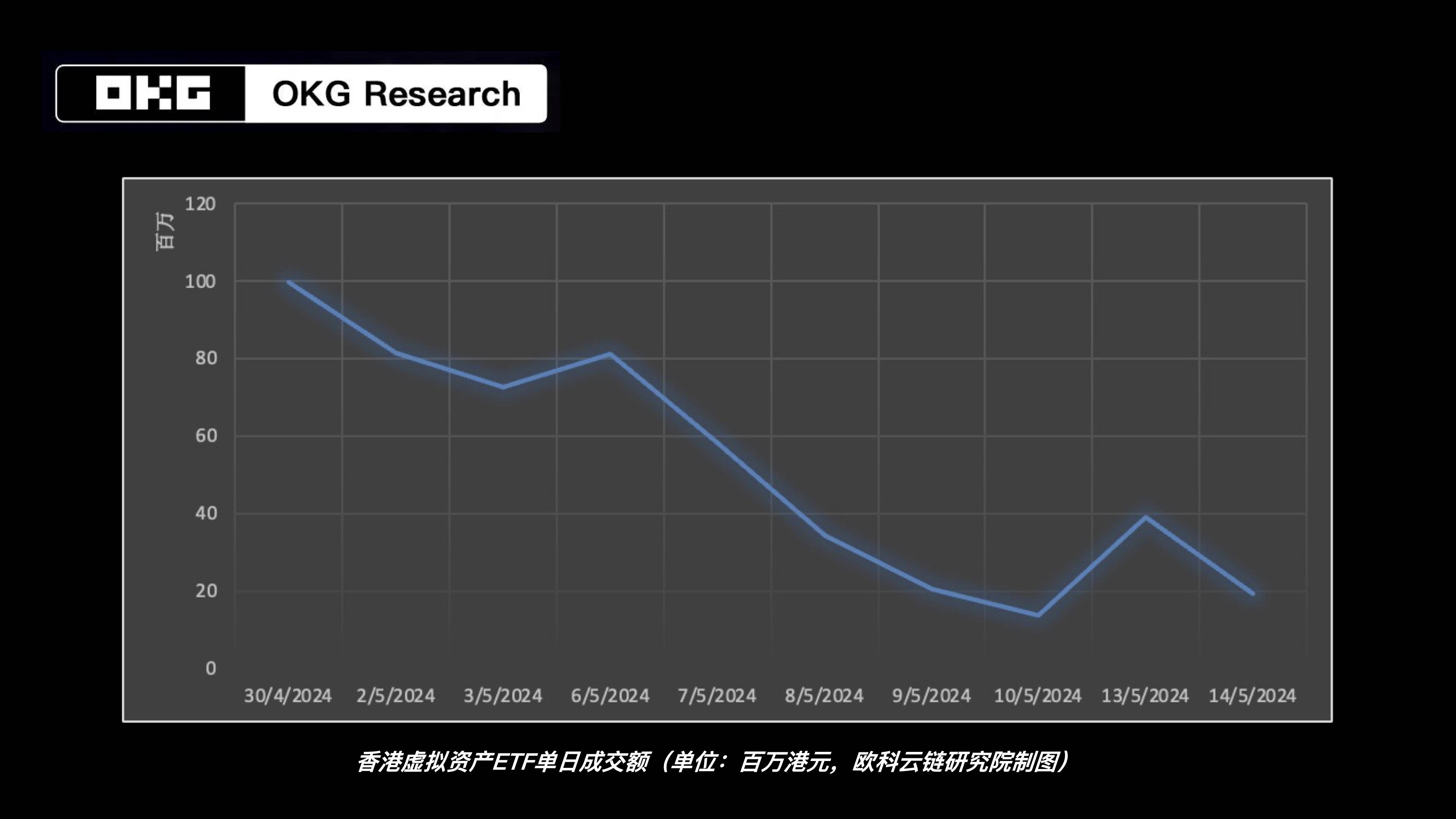

In terms of trading activity, total turnover of Hong Kong’s spot virtual asset ETFs surpassed HK$520 million over the past two weeks. However, daily trading volumes have recently shown a fluctuating downward trend, falling below HK$40 million for several consecutive trading days (as of May 14).

Nevertheless, trading volume alone does not reflect the direct impact of spot ETFs on the crypto market; only actual capital inflows can influence market dynamics. Unfortunately, fund flows into Hong Kong ETF products have also been lackluster: the three Bitcoin spot ETFs have seen four consecutive days of net outflows, while the Ether spot ETFs have experienced multiple days of net outflows. In fact, global demand for spot virtual asset ETFs appears to be weakening overall. Since the halving, U.S. Bitcoin ETFs have generally faced capital outflows—over the past month, they recorded net outflows on 14 trading days, totaling $783 million.

2. Why Has the Ether ETF Failed to Deliver a "Surprise"?

Compared to the U.S., the main advantage of Hong Kong’s spot Bitcoin ETFs lies in physical creation and redemption. Although issuers have not yet disclosed exact proportions of physical versus cash subscriptions, early reports suggest that physically-backed shares may have accounted for over 50% of initial issuance. Yet this feature has not led to sustained growth in Hong Kong’s spot ETF market.

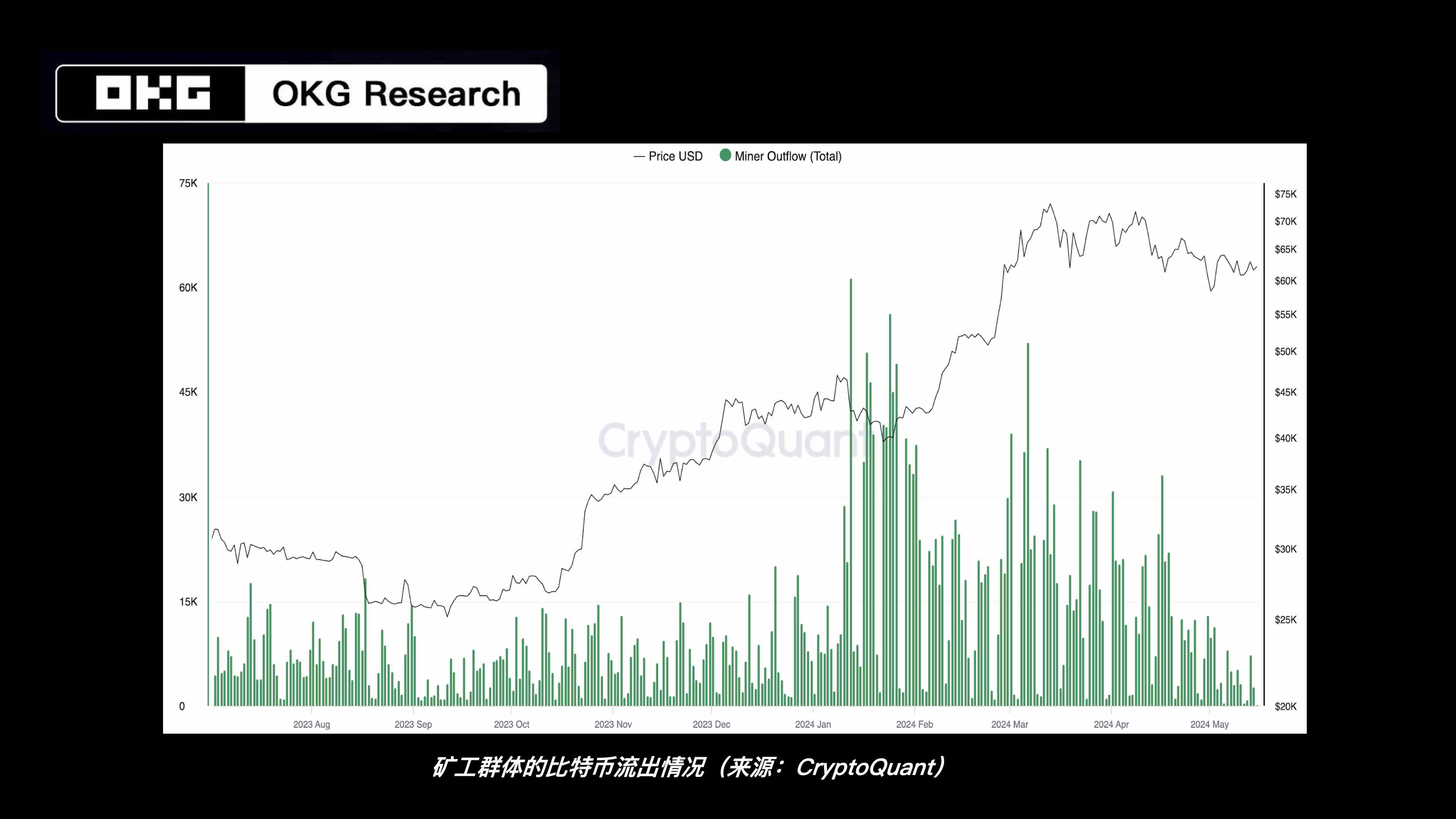

In theory, physical creation is more attractive to native crypto investors, particularly Bitcoin miners—who were expected to be key participants in Hong Kong’s spot Bitcoin ETFs. However, on-chain data indicates that miners are currently choosing to “wait and see” rather than depositing their Bitcoin into ETFs through physical subscription. Miner wallet balances show that selling pressure has dropped to its lowest level in six months. Combined with Hong Kong’s lack of fee advantages, it seems unlikely that miners will shift their stance soon enough to provide meaningful incremental capital to the ETF market.

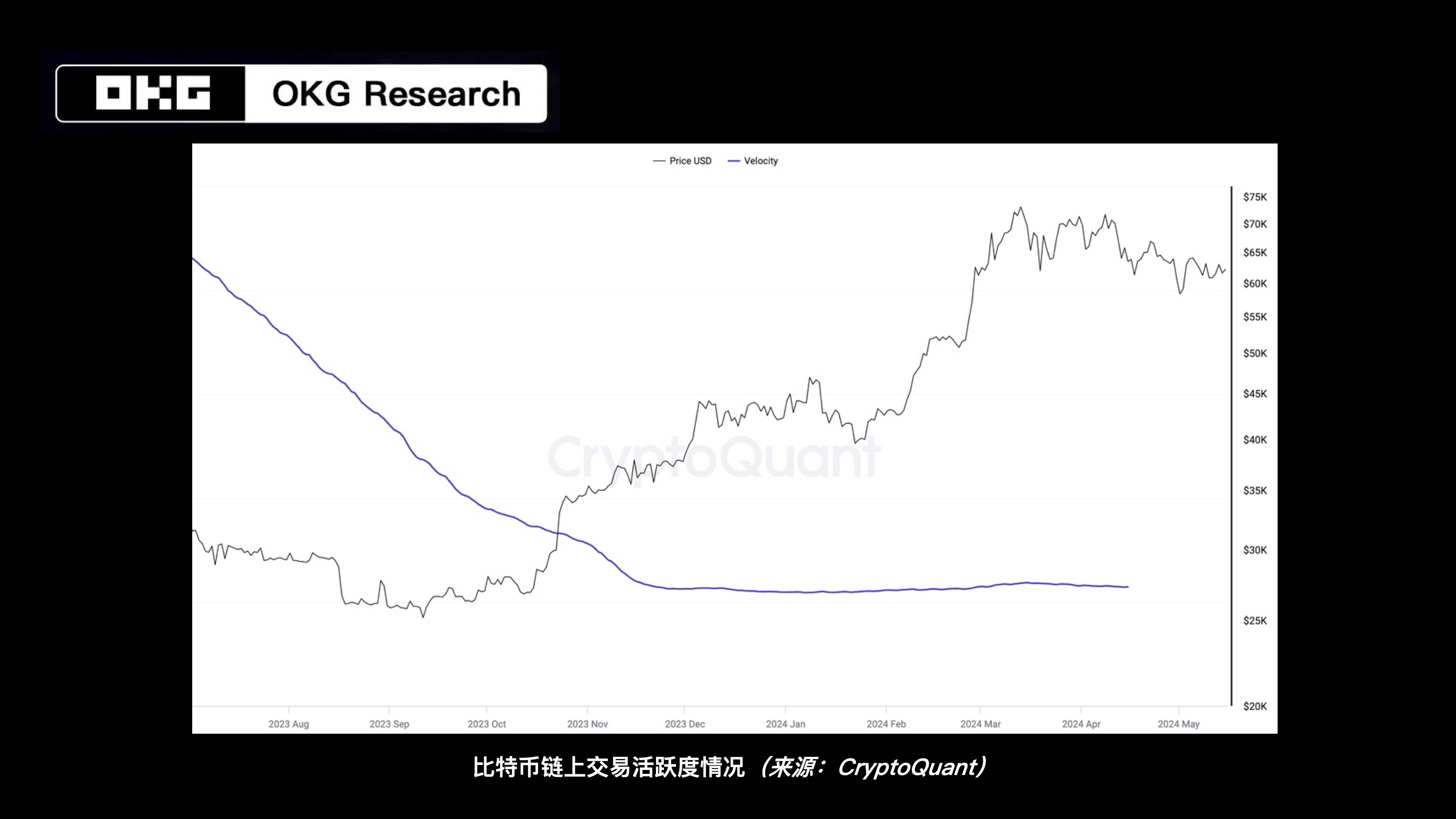

Additionally, examining recent changes in overall on-chain data for Bitcoin reveals declining transaction volume and market liquidity. Part of this stems from macroeconomic uncertainty in the U.S., causing Wall Street-led institutional investors to remain cautious about deploying liquidity. Another factor is the weak performance of the Bitcoin ecosystem lately, which has dampened holder enthusiasm for trading within the current price range, thereby reducing demand for ETF products.

(Note: Velocity measures how quickly units circulate across the network. A higher value indicates faster on-chain circulation and greater transactional activity.)

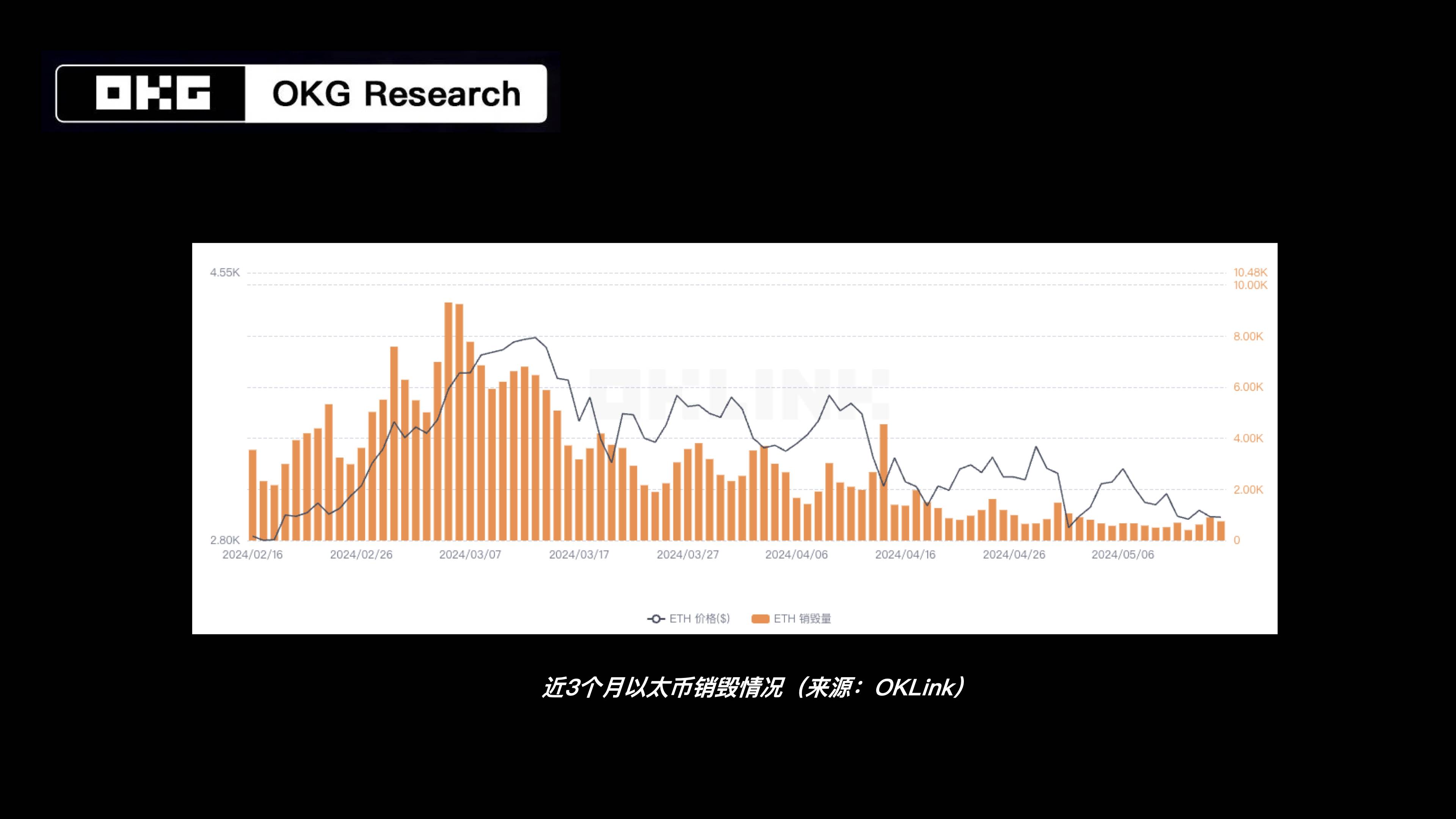

The much-anticipated spot Ether ETF has also failed to deliver a short-term boost. Currently, Ether spot ETFs account for just 15.11% of Hong Kong’s spot virtual asset ETF market, with AUM at approximately HK$327 million—down from initial levels. This underperformance reflects Ethereum’s recent weakness: despite the post-Cancun upgrade period seeing gas fees hit record lows, there was no broad-based surge in Layer 2 projects or improvement in on-chain activity. On the contrary, adjustments to the transaction fee structure following the Cancun upgrade have kept Ethereum in an inflationary state for over a month, negatively affecting market sentiment toward Ether.

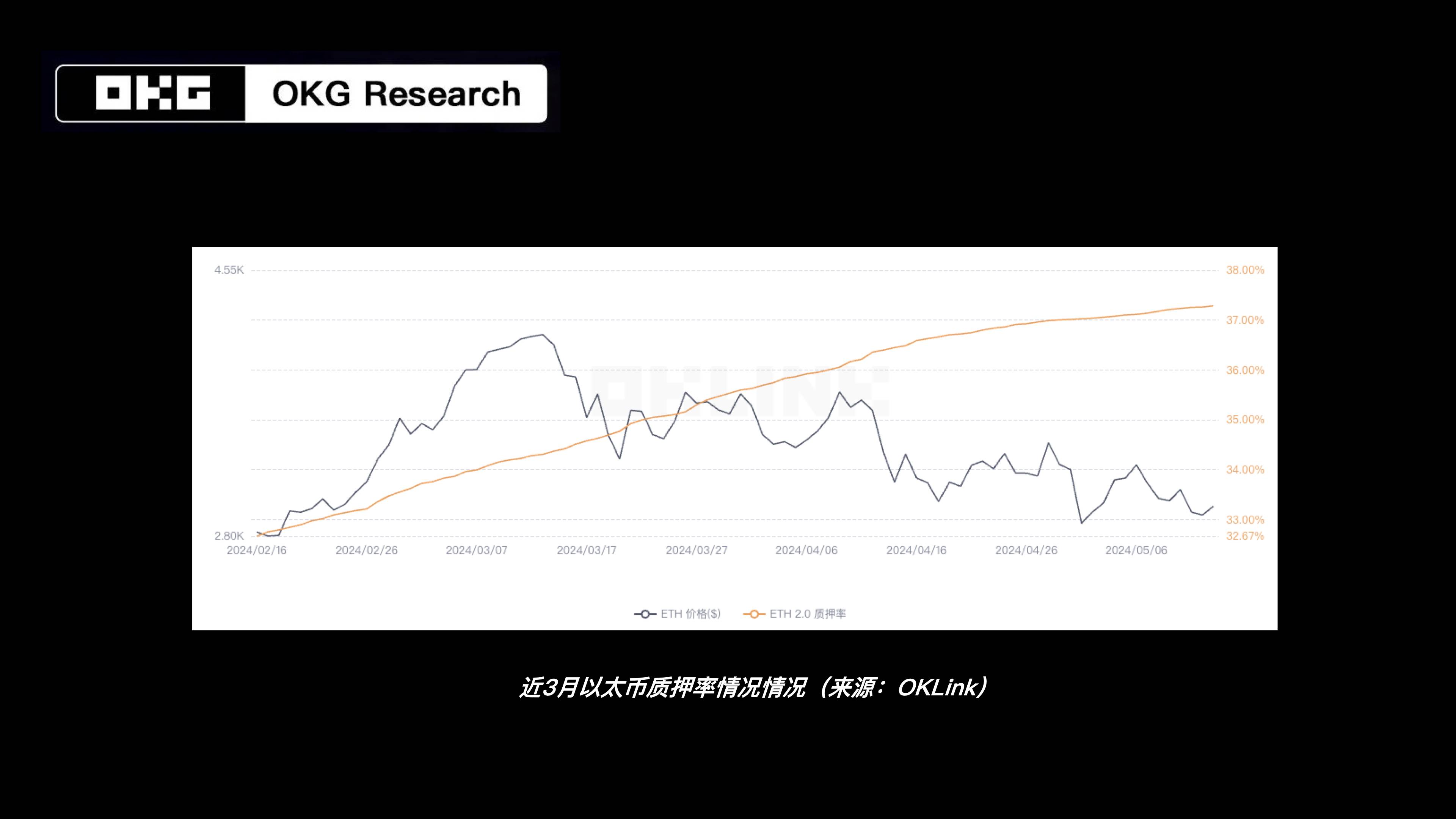

Moreover, one potential reason for the limited appeal of Hong Kong’s spot Ether ETFs is the lack of staking support. We believe whether staking is supported could be the decisive factor in determining the scale of Ether ETF adoption. Currently, the yield from staking Ether stands at around 3.7%. From both narrative and economic perspectives, this additional income could be a major draw—especially for traditional finance investors—and represents a key differentiator between Bitcoin and Ether. Existing Ether holders may hesitate to participate in ETFs if doing so means giving up staking rewards. New investors, unless strongly bullish on the Ethereum ecosystem, are likely to prefer Bitcoin ETFs over Ether ones.

3. What Should We Expect from Hong Kong’s Virtual Asset ETF Market Going Forward?

Given the widespread belief that the U.S. SEC will not approve spot Ether ETF applications this month, Hong Kong retains a first-mover advantage in this space for the foreseeable future. If the Ethereum ecosystem regains momentum, we believe Hong Kong still has the opportunity to attract new capital flows into its ETF market from investors interested in Ether.

Beyond this, there are several other promising developments ahead for Hong Kong’s spot virtual asset ETF market:

First, since Hong Kong has already approved spot ETFs for PoS-based assets like Ether, it may become feasible in the future to include other mainstream public chain tokens—such as Solana, which also uses PoS—via ETF listings in traditional financial markets. This would greatly enhance Hong Kong’s appeal to various Web3 projects and expand the long-term potential of its virtual asset ETF offerings.

Second, spot virtual asset ETFs essentially represent token securitization—transforming relatively niche digital assets into securities accepted by mainstream markets through compliant processes. Once assets like Bitcoin complete this “identity transformation,” financial institutions can leverage ETFs to launch leveraged products, lending services, asset management solutions, and other derivatives. This enables financial innovations that were previously difficult to implement directly with physical Bitcoin holdings, meeting diverse investor needs for exposure to virtual assets.

For example, CITIC Securities International has already launched structured products in Hong Kong based on spot virtual asset ETFs, while Harvest Fund Management and CSOP are advancing efforts to enable ETF collateralization. We believe spot virtual asset ETFs, as frictionless trading instruments, will catalyze further financial innovation. A growing array of structured products and derivatives tied to spot ETFs will open new possibilities for Hong Kong’s market, accelerating integration between its financial system and the virtual asset sector.

More importantly, as emphasized by OKLink Research Institute in interviews with media outlets such as the South China Morning Post, the significance of Hong Kong launching spot virtual asset ETFs does not lie in immediate market transformation. Rather, it signals that Hong Kong’s financial institutions are accelerating their embrace of virtual assets. In the near future, we may see more financial firms in Hong Kong participating in spot Bitcoin and Ether ETF markets—or expanding their virtual asset strategies through other channels—to offer broader access to virtual asset products and services for a wider range of users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News