Bankless: Points Expire, Unlocks Continue, Market Struggles to Hold Amid VC and Retail Investor Tug-of-War

TechFlow Selected TechFlow Selected

Bankless: Points Expire, Unlocks Continue, Market Struggles to Hold Amid VC and Retail Investor Tug-of-War

The "points" meta has become too obvious to sustain.

Author: David Hoffman

Translation: TechFlow

The EIGEN airdrop has sparked discussions about the growing divide between private and public markets. The large-scale private sales based on points systems and high-FDV airdrops are creating structural problems for the crypto industry.

Transforming points programs into multi-billion-dollar tokens with low liquidity is not a stable equilibrium. Yet we remain trapped in this model due to a confluence of factors: excessive venture capital, lack of new participants, and overregulation.

The meta around token distribution is always evolving. We’ve witnessed several major eras:

-

2013: Proof-of-Work (PoW) forks and fair launch meta

-

2017: Initial Coin Offering (ICO) meta

-

2020: Liquidity mining era (DeFi summer)

-

2021: NFT minting

-

2024: Points and airdrop meta

Each new token distribution mechanism has its strengths and weaknesses. Unfortunately, this particular meta begins with a structurally disadvantaged retail investor—a direct consequence of relentless regulatory pressure on the industry.

Excessive Venture Capital vs. Retail Investors

Currently, there is an oversupply of venture capital in the crypto space. Although 2023 was a poor year for fundraising, the massive funding rounds of 2021 still leave substantial capital available, and overall, venture investing in crypto remains a persistent and ongoing activity.

Many well-funded VC firms are still willing to lead investments at billion-dollar valuations, allowing crypto startups to remain private for increasingly long periods. This is rational—because if the current token issuance price is a multiple of the last private round, even later-stage VCs can still find favorable deals.

The problem arises when a startup launches its token publicly at a $10B to $100B valuation: most of the upside potential has already been captured by early insiders—that is, no one gets rich buying a $100 billion token.

This structural bias against public market capital worsens the overall sentiment in the crypto industry. People want to get rich alongside their internet friends and build strong online communities and friendships around such activities. This is the promise of crypto—and that promise is currently unfulfilled.

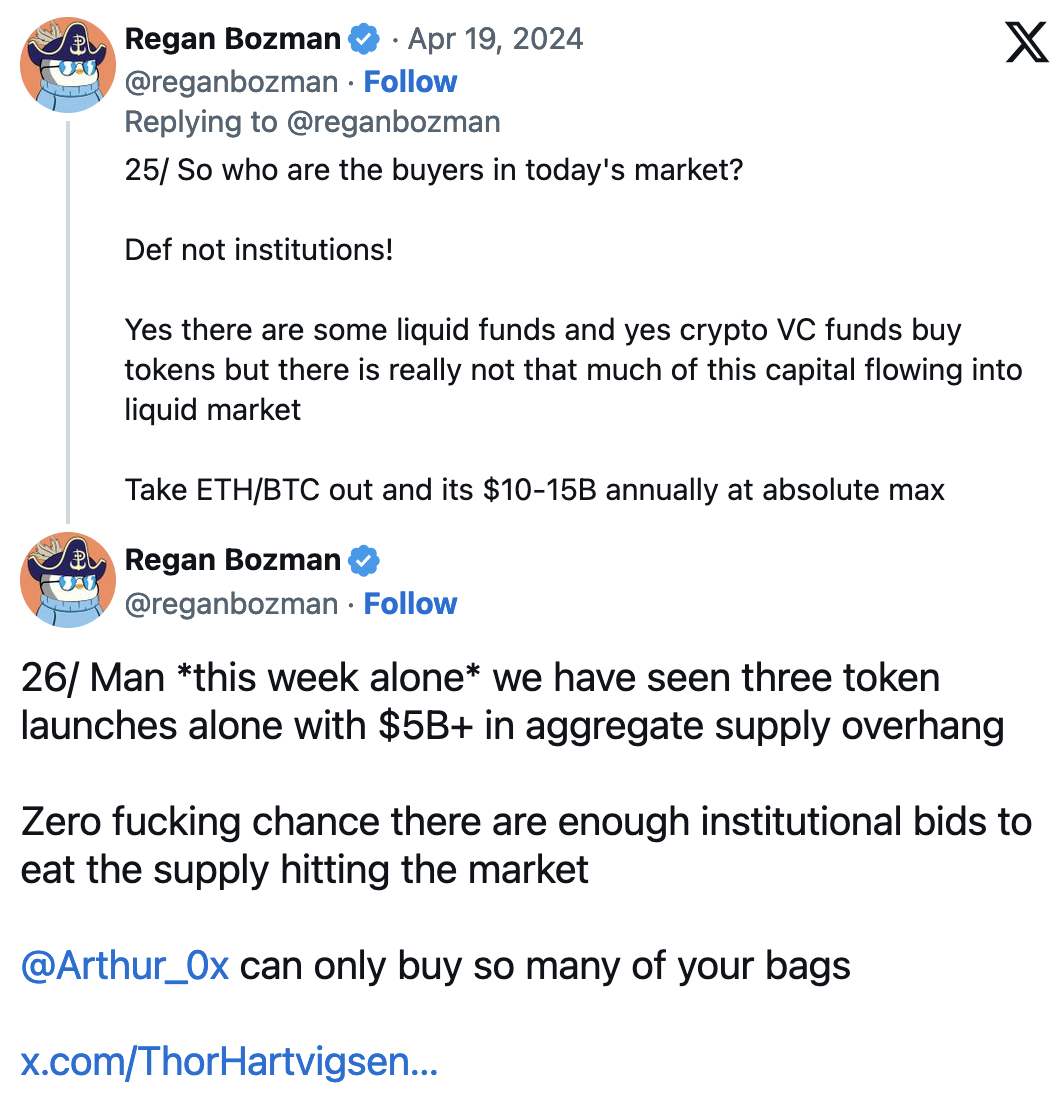

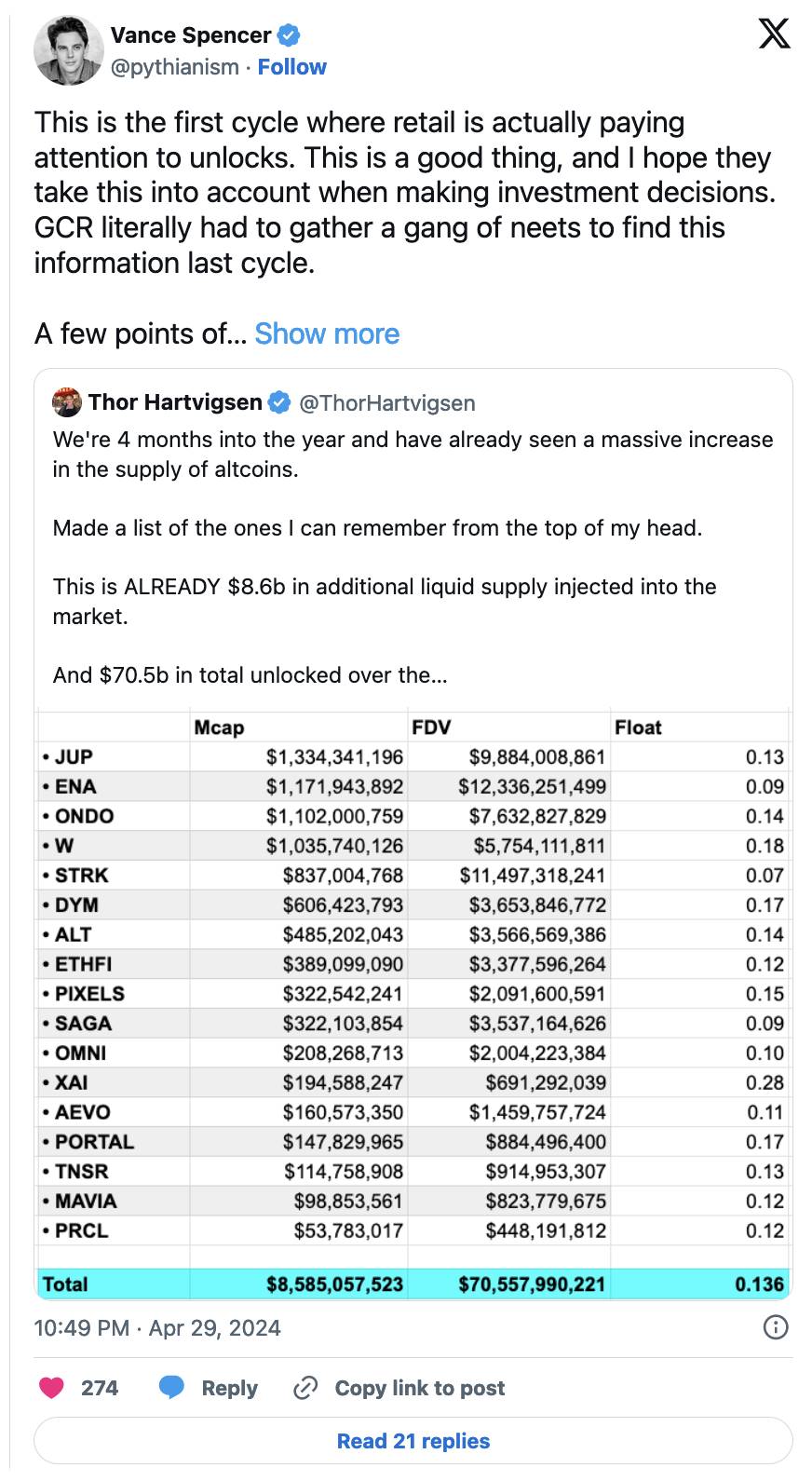

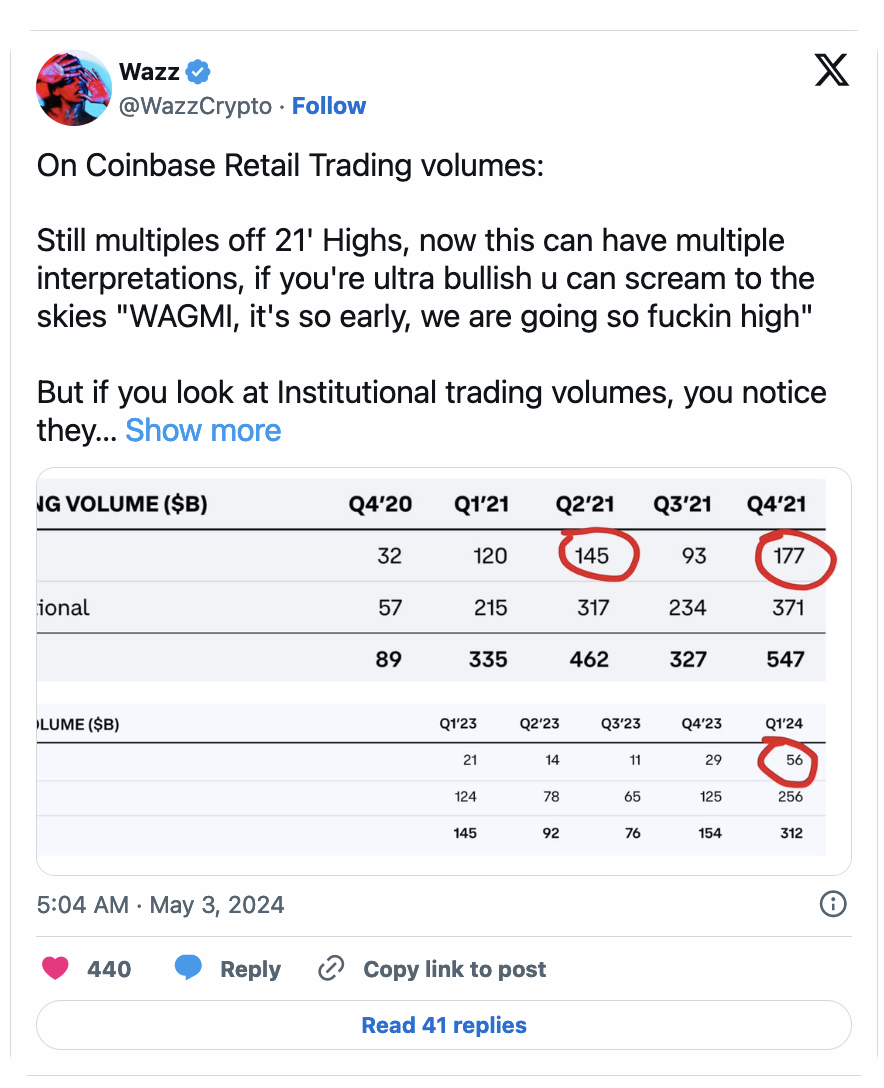

Facing Billions in Unlock Without New Participants

Several data points should give you pause:

Since retail primarily holds the long tail of crypto assets, institutional liquidity entering via Bitcoin ETFs does not impact these markets. Capital recycling from crypto-native players selling BTC they bought at $14K to Larry Fink can temporarily prop up these assets—but this is all internal capital from PVP-capable players who understand unlock mechanics and how to avoid them.

Impact of the SEC

By restricting startups’ ability to freely raise capital and distribute tokens, the SEC is pushing capital toward less-regulated private markets.

The SEC’s corrupt and excessive stance on token classification is devaluing public market capital. Startups cannot exchange tokens for public market funding without triggering massive legal overhead.

The Compliance Trajectory of Crypto

Over time, crypto has become increasingly compliant. When I entered the space during the 2017 ICO frenzy, ICOs were promoted as a democratized way to access investment and capital. Of course, ICOs eventually devolved into rampant scams, but the narrative nonetheless drew me and many others to recognize the transformative potential of crypto. However, once regulators deemed these transactions clear unregistered securities offerings, the ICO meta ended.

Then, the industry pivoted to liquidity mining, undergoing a similar lifecycle.

In each cycle, crypto finds ways to obscure its methods of distributing tokens to the public—and in each cycle, obscuring this process becomes harder. Yet this process is vital for project decentralization and the nature of our industry.

This cycle faces the most intense regulatory scrutiny we’ve ever seen. As a result, lawyers for venture-backed startups face the toughest compliance challenge in industry history: distributing tokens to the public without being sued by regulators.

Breaking the Balance

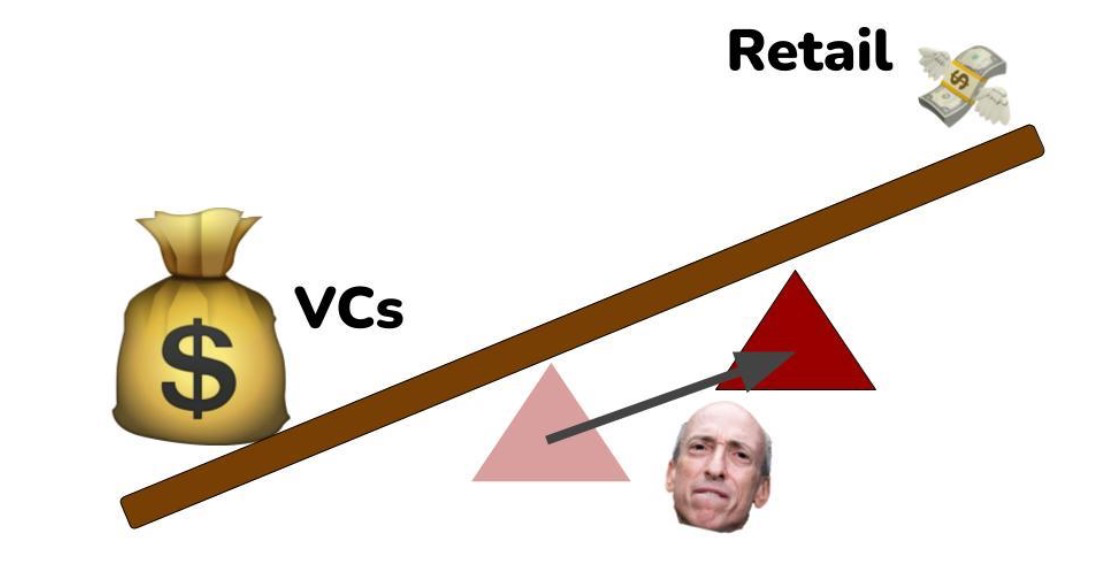

Regulatory compliance heavily tilts the balance between public and private markets toward the private side, as startups can simply opt to take venture capital instead of risking violations of securities laws.

The position of the fulcrum balancing private and public capital is determined by the regulator’s control over crypto markets.

-

If there were no investor accreditation laws, the fulcrum would be more balanced.

-

If there were a clear regulatory path to issue tokens compliantly, the gap between public and private markets would shrink.

-

If the SEC weren't waging war on crypto, we’d have fairer, more orderly markets.

Because the SEC provides no clear rules, we end up with a complex and confusing “points” meta that satisfies no one.

Points Are Unfair, Markets Are Disordered

“Points” leave retail investors completely in the dark about what they’re actually receiving—because if teams clearly stated that points represent bonds on future tokens, they’d expose themselves to potential securities law violations (from the perspective of a corrupt and overreaching SEC).

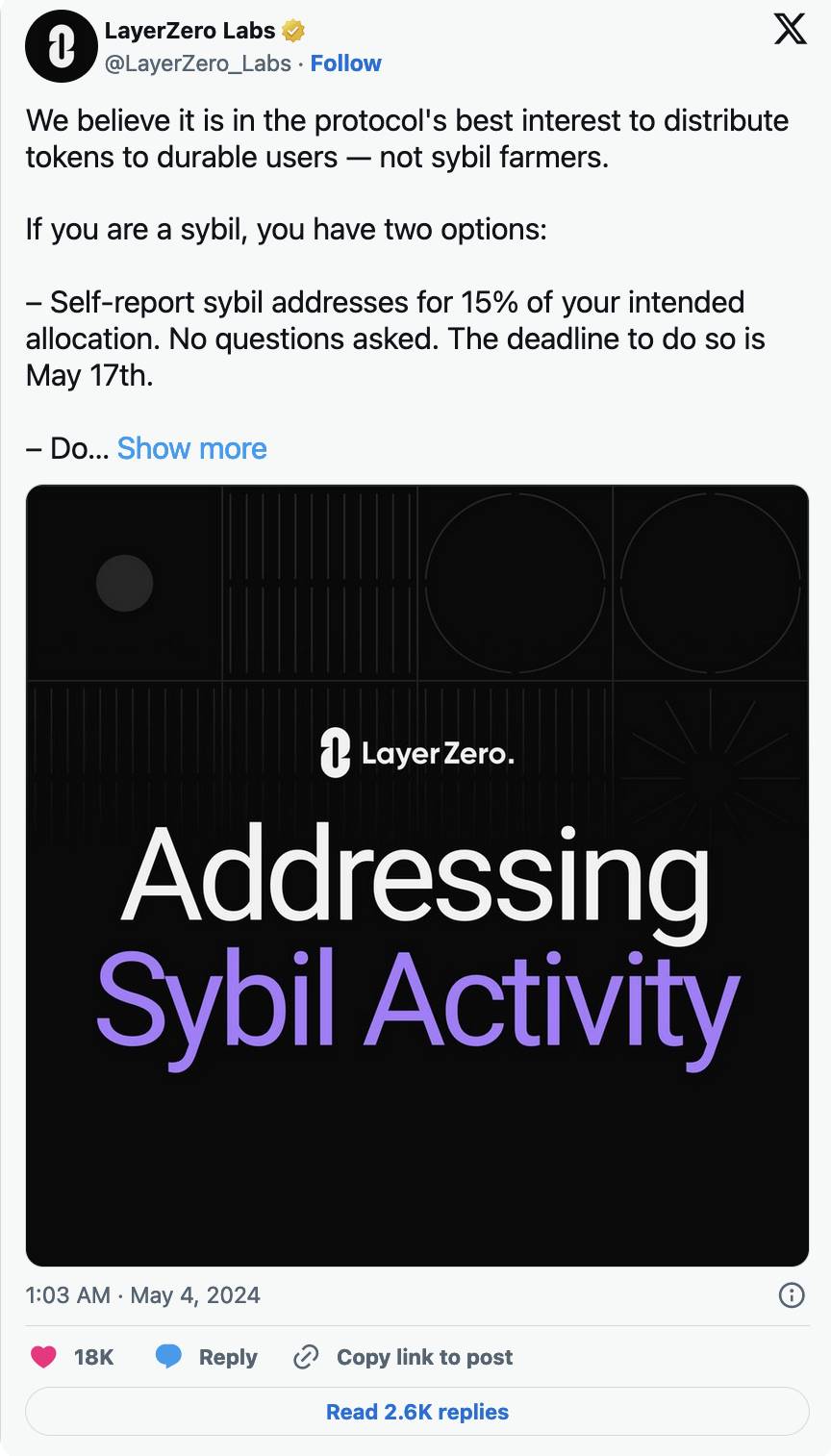

Points offer no investor protections because providing such protections first requires granting regulatory legitimacy to the process. Trapped in this terrible situation, we now see the sybil vs. community debate, where LayerZero finds itself stuck in a dilemma.

LayerZero recently announced a plan allowing users to self-report sybil behavior in its airdrop, prompting Kain Warwick to write a post defending sybils—arguing that, in a way, sybils significantly supported LayerZero and boosted its market presence.

In reality, there is no clear boundary between community members and sybils. Since ordinary crypto participants cannot access private markets, the only way to gain exposure is to commit and engage meaningfully on platforms where they hope to receive tokens.

Because small investors cannot simply write small checks to invest in early rounds of crypto projects, current token issuance mechanisms force users to engage in sybil-like behavior for projects they believe in. As a result, no "community" will unite to get rich together in this cycle like LINK did in 2020 or SOL in 2023. Current token distributions do not allow communities to gain early exposure at low valuations.

Thus, attacks on airdrop-based startups on Twitter are becoming increasingly common—an inevitable outcome of communities being unable to effectively express their stakeholder interests in projects. It echoes the sentiment: “No taxation without representation!”

Not to mention another looming issue: mercenary capital opportunistically farming and dumping tokens. Without the ability for small investors to participate in early-stage startups, these highly coordinated actors must compete with toxic mercenary farms for airdrops—with no discernible difference between the two.

An Unsustainable Equilibrium

The “points” meta has become too obvious to sustain. Both the SEC and scammers are exploiting it, each trying to benefit from the ambiguity.

We will inevitably need to shift toward different strategies—one hopes, strategies that enrich many early community stakeholders without provoking the SEC. Unfortunately, without clear regulations governing token issuance, such hopes remain mere fantasy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News