Bitcoin ETF has been approved, and institutions won't tell you they're already FOMOing

TechFlow Selected TechFlow Selected

Bitcoin ETF has been approved, and institutions won't tell you they're already FOMOing

From an investor's perspective, altcoins appear undervalued, and the Ethereum ecosystem is poised for significant gains.

Author: Duo Nine

Translation: TechFlow

With the approval of Bitcoin ETFs and institutional involvement, the nature of cryptocurrency cycles is about to change. Large capital now has unprecedented control over Bitcoin and its price.

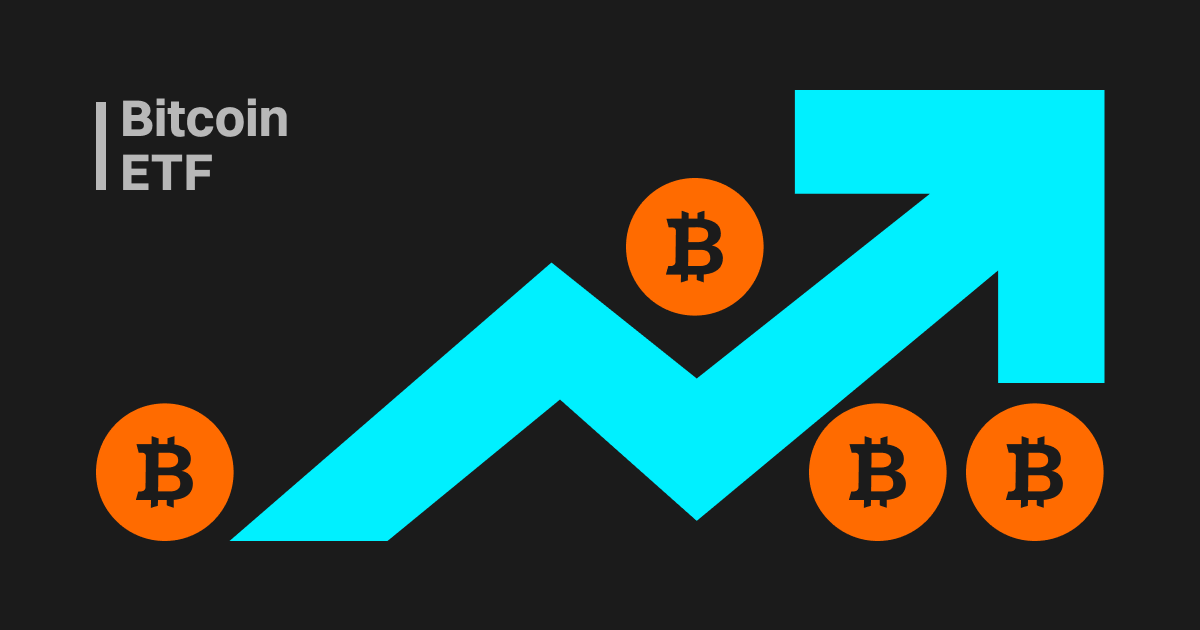

A total of 11 ETFs began trading last Thursday, reaching a first-day trading volume of $4.6 billion—twice the record of gold ETFs! It turns out that early Bitcoin adopters were right.

This is a pivotal moment for Bitcoin—we are entering a new chapter in cryptocurrency. Throughout this process, Bitcoin has solidified its position as the market leader, remaining the undisputed king. However, not all news is good.

Bitcoin ETFs achieved tremendous success with nearly $10 billion in trading volume within three days, benefiting everyone involved. Grayscale can finally sell—and they did. GBTC sold over $500 million worth of Bitcoin in total. Before this, Grayscale could only buy and hold.

Fortunately, other ETFs were net buyers, collectively purchasing $800 million in new Bitcoin. That averages nearly $300 million per day! This equates to removing approximately 7,000 BTC from the market daily!

Only 900 new BTC are mined each day. This buying pressure could soon reflect in Bitcoin's price. Not to mention that within 90 days, the halving event will cut mining rewards in half to 450 BTC per day (expected on April 22, 2024).

If these ETFs continue at this pace, there won't be much Bitcoin left. Even if trading volumes decline, ETFs represent additional demand that didn't exist before. Moreover, they will now compete with retail investors, whales, and figures like MicroStrategy’s Saylor.

What will be the outcome?

Bitcoin will grow unprecedentedly during this cycle. We will witness institutional FOMO driving Bitcoin to unprecedented levels, setting new all-time highs.

Why will Bitcoin's price reach new highs?

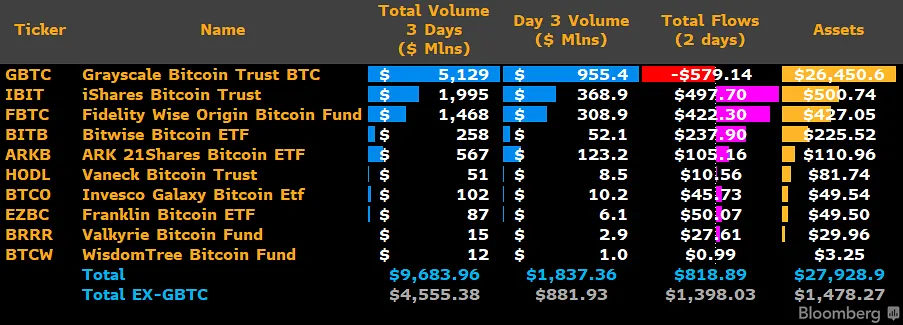

1.Bitcoin is the first ETF with a fixed supply! This is historic—traditional finance has never seen anything like it

Looking ahead, the traditional four-year bull-and-bear cycle driven by Bitcoin halvings is about to undergo significant changes. First, Bitcoin will surge strongly. No one knows how high it will go, but values between $100,000 and $200,000 are realistic.

Second, once prices reach the top, a correction will come. But it won’t be the kind of crash you might expect. After this cycle ends, Bitcoin’s volatility may significantly decrease, and its downturns may not be as severe as in the past (-77% in 2022).

If you missed buying Bitcoin below $50,000, you may never see such prices again. If Bitcoin maintains six-figure prices even during the next bear market, most retail investors will be effectively priced out and unable to afford entry.

Bitcoin could eventually surpass gold’s market cap of over $13 trillion. That would mean 1 BTC being worth around $500,000—a price almost unaffordable for retail investors. Yet they will surely be able to afford a $50 Bitcoin ETF share.

By pushing the price high enough, institutional players can control the Bitcoin market and drive you to buy their ETF shares, as those will then appear more attractive and accessible.

Thus, most people will never own or custody actual BTC, even though Bitcoin can be divided into 100 million units and you can buy a fraction (called satoshis). The majority of Bitcoin will end up in institutional hands.

2. Bitcoin will no longer be controlled by us, but by institutions

As Bitcoin matures as an asset class and the AUM of its ETFs grows into tens or even hundreds of billions, its volatility will naturally decline. This means future bear markets will feature less dramatic declines.

Moreover, these institutional participants have strong incentives to prevent excessive price drops, as their fees would suffer otherwise. This is the real motivation behind controlling Bitcoin’s price. How do they achieve this control?

Bitcoin is now fully integrated into the U.S. financial system. This means anyone with access to dollars can short or long Bitcoin indefinitely until the desired price level is reached. With spot ETFs, they now possess all the tools they need.

We know that U.S. banks can borrow unlimited dollars from the Federal Reserve based on demand, and they can use these dollars to manipulate any market. The housing bubble is a prime example. Could Bitcoin be the next target?

If your goal is to make money, this might not concern you too much, as numbers will rise rapidly regardless. However, in the long run, it does pose a threat to Bitcoin’s original ethos—the idea of an alternative to the current fiat-based financial system.

In this way, Bitcoin may become controlled by Wall Street. Yet Bitcoin is more than just sound money or digital gold. It is a movement capable of changing how we perceive money, and through its own success, transform the very fiat-based system that has just adopted it.

3.The approval of Bitcoin ETF suggests altcoins are undervalued, especially Ethereum

The approval of Bitcoin ETFs is extremely positive for altcoins. Ethereum surged immediately after the news broke. Perhaps this is also because Ethereum is the next cryptocurrency likely to be considered for an ETF.

However, Ethereum’s path may differ, as the SEC remains uncertain whether ETH qualifies as a security. The vote to approve Bitcoin ETFs was 3 in favor and 2 opposed out of 5 commissioners—a decision hanging on a single vote!

Given how fundamentally different Ethereum is from Bitcoin, it would be surprising to see ETH win a similar vote. The SEC has declared Bitcoin to be an asset, but has not done so for Ethereum or most altcoins.

Nonetheless, these developments suggest that, from an investor perspective, altcoins appear undervalued, and the Ethereum ecosystem stands to gain significantly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News