Bankless: Five Crypto Narratives That Performed Strongly in 2023

TechFlow Selected TechFlow Selected

Bankless: Five Crypto Narratives That Performed Strongly in 2023

Which verticals today are flashing bullish signals and showing strong signs of entering the mainstream market?

Written by: Ben Giove

Compiled by: TechFlow

The year 2023 got off to a dramatic start. A banking crisis, crackdowns on centralized exchanges, and seemingly endless regulatory fears—each day brought a fresh wave of bad news.

Yet, the cryptocurrency market has shaken off these concerns. Bitcoin and Ethereum surged 69.1% and 57.8%, respectively, in the first few months of the year, outperforming all other major asset classes globally. Moreover, several sectors within crypto continue to show strong signs of growth.

Historically, sustained crypto bull markets have not only been driven by appreciation in Bitcoin and Ethereum, but also catalyzed by applications—such as the rise of smart contracts and ICOs in 2016–2017, or DeFi/NFT use cases in 2020–2021—that drive demand for block space.

Which verticals today are flashing bullish signals and showing strong indications of entering the mainstream? Let’s dive deeper:

Liquid Staking

Liquid staking derivatives (LSDs) have recently gained significant traction as we approach the highly anticipated “Shanghai” upgrade—an Ethereum upgrade scheduled for April 12 that will enable withdrawals of staked ETH. Despite the Shanghai upgrade not yet being implemented, LSD deposits have already surged 21.3% year-to-date, rising from 4.9 million to 6 million.

In the short term, the impact of the Shanghai upgrade on ETH prices remains uncertain. However, it is more certain that by eliminating technical implementation risks, the Shanghai upgrade is likely to trigger a “staking supercycle”—a period over the coming years where ETH staking rates could rise from the current 15% toward the PoS network average of around 60%.

Anticipation of this staking supercycle has already driven substantial gains in governance tokens of LSD issuers—such as Lido (LDO), Rocket Pool (RPL), StakeWise (SWISE), Frax (FXS), and Stader (SD)—as markets expect them to capture inflows from this trend.

Additionally, assets providing staking infrastructure are benefiting from LSD growth, such as SSV Network—a Distributed Validator Technology (DVT) protocol—and Redacted Cartel (BTRFLY), a liquidity bribe marketplace rumored to be entering the LSD space.

As deposit volumes grow, LSDs should see significant increases in revenue, since rising ETH prices will increase the ETH-denominated value of their income.

NFT-Fi

NFT-Fi (DeFi for NFTs) is another sector that has seen notable growth in 2023, reshaping competitive dynamics within the space.

The NFT marketplace landscape has shifted dramatically in 2023 with the rise of Blur. Leveraging innovative incentive programs and token distribution, Blur has overtaken OpenSea to become the leading marketplace and aggregator in the space. While questions remain about its long-term sustainability, Blur has injected substantial liquidity into the NFT ecosystem—popular collections like BAYC now have total bid value exceeding $61.9 million.

Other platforms, such as AMMs like SudoSwap and Caviar, offer innovative solutions for deepening category-wide liquidity, though they have yet to make a significant market impact.

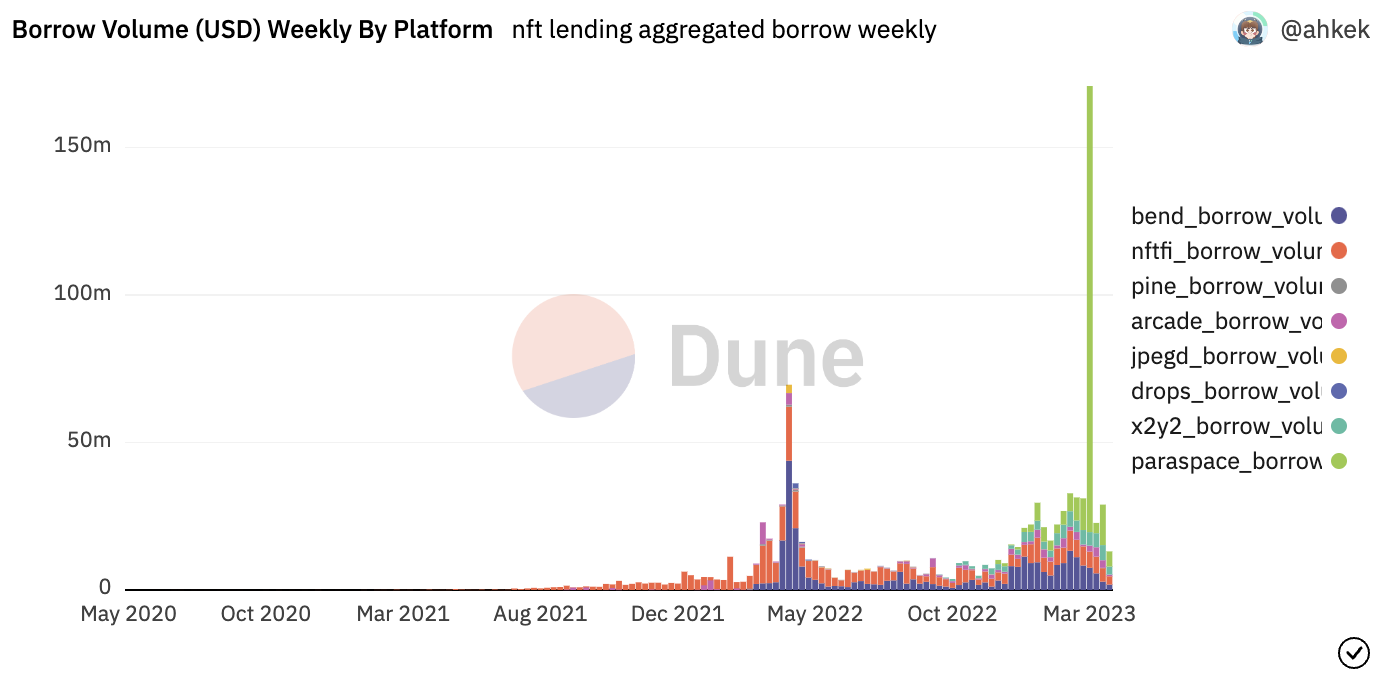

Lending is another subsector within NFT-Fi that has experienced remarkable growth.

Loan originations in Q1 2023 surged from $95.4 million to $436.5 million (up 357.5% quarter-over-quarter), largely driven by platforms like NFTfi, Arcade, and BendDAO, which provide NFT traders with access to liquidity or high leverage.

Although NFT prices measured in ETH have only slightly increased at the start of the year—the Nansen Blue Chip 10 Index is up just 8.5%—this NFT-Fi-driven surge in liquidity and leverage should yield long-term benefits by maturing the asset class’s market structure. As interest grows in alternative use cases beyond JPEGs—such as gaming—NFT-Fi is expected to keep expanding.

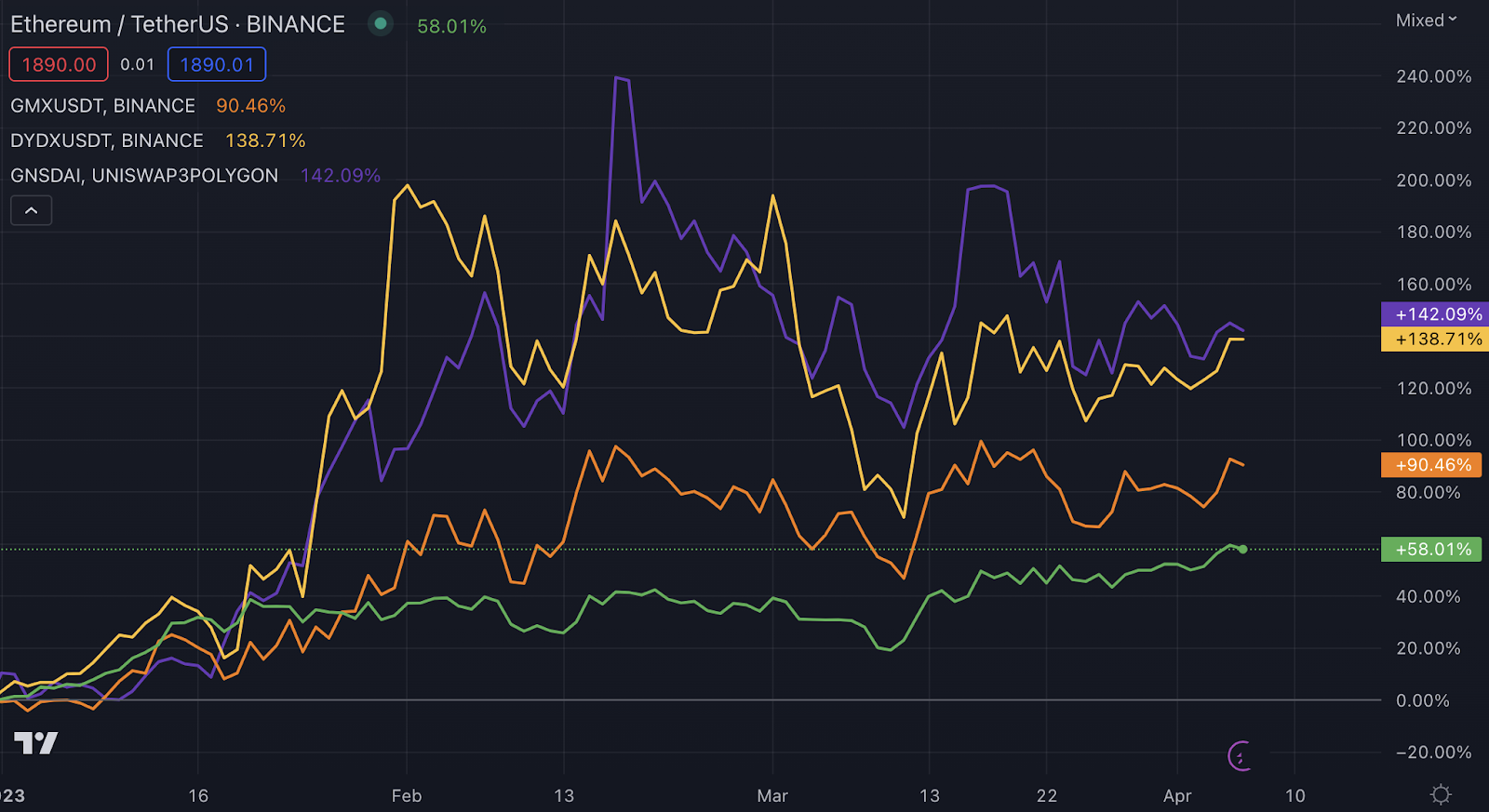

Perpetual DEXs

Perpetual DEXs—platforms where users can trade perpetual futures contracts (futures without expiry dates)—are widely seen as major beneficiaries following the collapse of FTX, with many hoping that trading activity for crypto’s most popular derivatives product will migrate on-chain.

While centralized exchanges still dominate, perpetual DEXs have achieved significant growth amid the market rebound. According to Token Terminal, volume for pure-perpetual DEXs rose 77.3% quarter-over-quarter in Q1 2023—from $926 billion in Q4 2022 to $1.643 trillion.

This growth has led many top perpetual DEX governance tokens to outperform ETH, including dYdX (DYDX), GMX (GMX), Gains Network (GNS), and Kwenta (KWENTA).

If prices stabilize further and liquidity returns to the market, these DEXs appear well-positioned for continued growth in the coming months. Additionally, platforms like GMX, GNS, and KWENTA stand to benefit from rising Layer 2 adoption and the widespread rollout of ARB and OP incentives. When used effectively, these tokens can deepen liquidity and stimulate trading activity across their platforms.

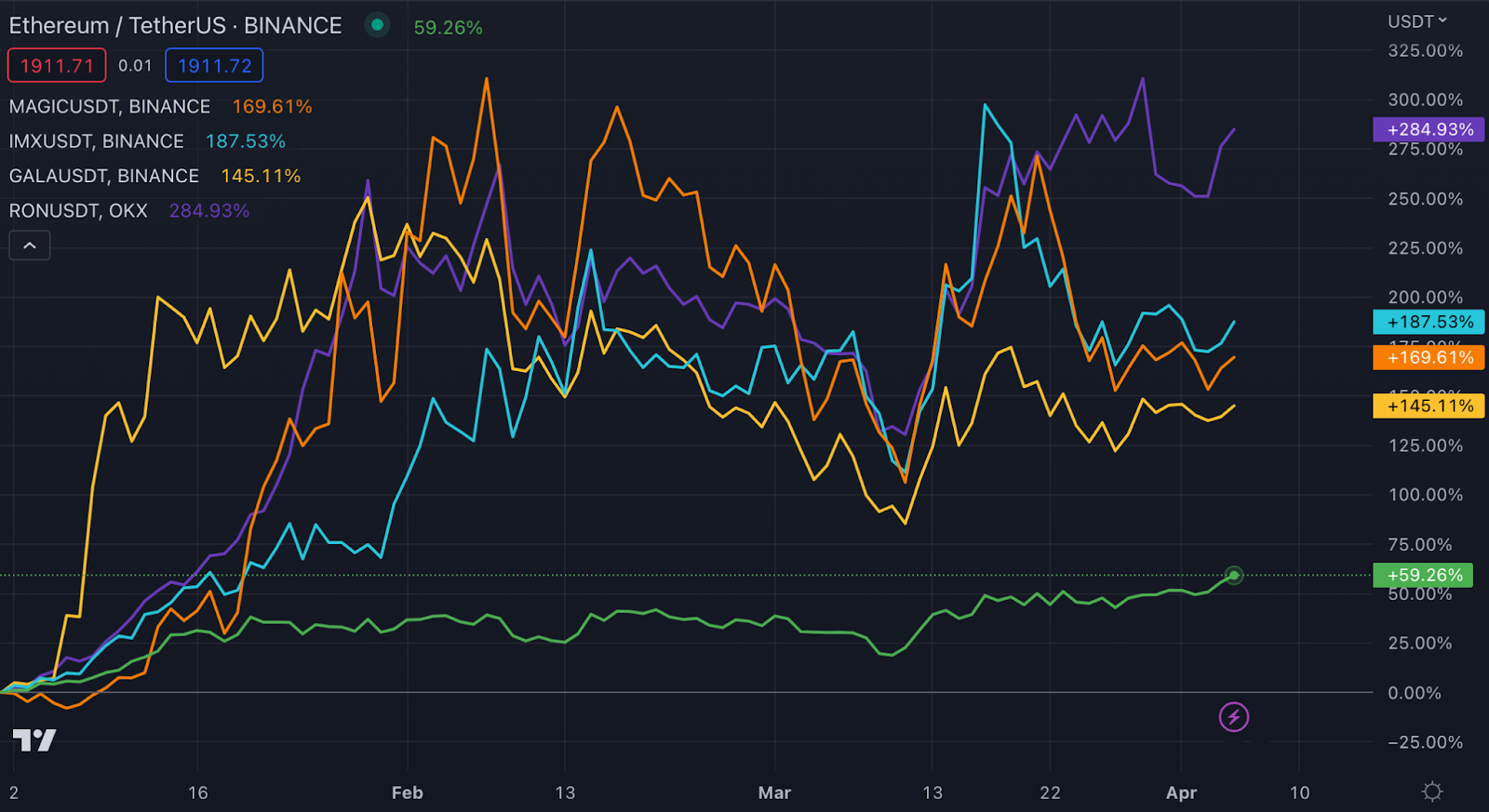

Gaming

Gaming is one of crypto’s most promising use cases for attracting new users and capital.

Though it hasn’t received as much attention as other verticals on this list, the sector has shown strong potential so far in 2023, with gaming tokens such as MAGIC, IMX, RON, and GALA outperforming ETH year-to-date.

Several positive catalysts within the gaming industry may have contributed to this performance, such as Arbitrum token emissions in Treasure’s case, Immutable’s announcement of zkEVM, and the launch of RON staking.

Other events—like the Game Developers Conference (GDC) and Epic Games’ announcement supporting 20 games with crypto elements—may also have fueled momentum in the sector.

With highly anticipated game launches on the horizon—including the card game Parallel, auto-battler RPG Illuvium, FPS titles Deaddrop and Shrapnel, and fully on-chain MMOs Realm and Influence—the industry is poised for steady, gradual growth throughout 2023. Upcoming improvements in gameplay and user experience—such as account abstraction—are also expected to support continued progress in the months ahead.

On-Chain Treasuries

On-chain treasuries represent another emerging area in DeFi, echoing the conditions that sparked the previous "DeFi Summer"—namely, a zero-interest-rate environment. Back then, double-, triple-, quadruple-, or even quintuple-digit yields became oases in a capital-starved world. Though those returns were illusory and ultimately unsustainable, they attracted massive capital flows into DeFi chasing those gains.

Today, DeFi faces the opposite challenge: U.S. Treasury yields in meatspace now exceed farming yields from even the safest protocols (on a risk-adjusted basis). Furthermore, major stablecoins like USDT, USDC, and DAI pay no interest to holders, increasing the opportunity cost of holding cash on-chain.

Several solutions have emerged to address this issue. Ondo Finance (and more recently OpenEden) now offer ways to access tokenized U.S. Treasuries directly from within DeFi.

Despite requiring KYC/AML hurdles and being limited to accredited investors, these products have found strong product-market fit. Ondo’s OUSG has already attracted $65.2 million in TVL.

If interest rates remain above 0% and stablecoins continue offering no yield, the tokenized treasury market could maintain its rapid growth trajectory and penetrate one of the world’s largest financial markets.

Conclusion

There are numerous crypto sectors worth watching closely. Liquid staking, blockchain gaming, NFT-Fi, perpetual DEXs, and on-chain treasuries are just a few promising subsectors showing early signs of growth in 2023.

The year has only just begun, and market trajectories remain uncertain—much could change. But now is the time to start paying attention. Crypto is about to get interesting again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News