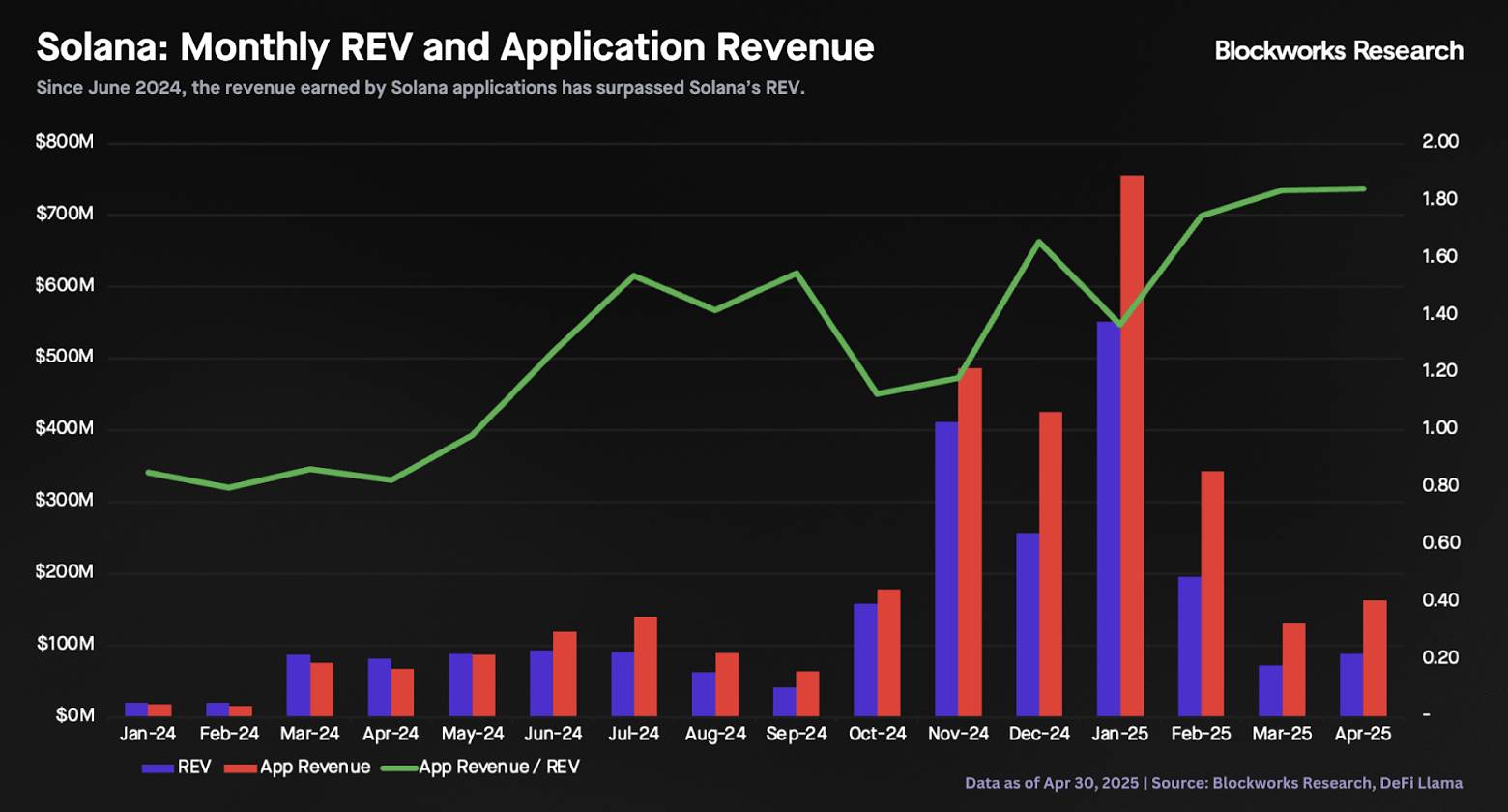

TechFlow reports on May 8 that according to Blockworks Research data, the revenue of all Solana applications is only 1.8 times that of Solana itself. This commission rate is significantly higher than Apple's App Store's current 30% cut, which the U.S. government currently considers monopolistic. Analysts suggest this could indicate two possibilities: either Solana's revenue is too high, meaning its token should trade at a lower price-to-earnings ratio; or it demonstrates that Solana possesses a strong "business moat," warranting a higher price-to-earnings ratio.