TechFlow News: On January 28, Bitcoin has completed its 2023–2025 market cycle and entered the post-cycle consolidation phase. According to Benjamin Cowen’s latest “Q1 2026 Crypto Macro Risk Memo,” current market conditions resemble those of mid-2019, with Bitcoin expected to reach its cyclical peak in Q4 2025—though unlike previous cycles, this peak is being driven by market apathy rather than euphoria.

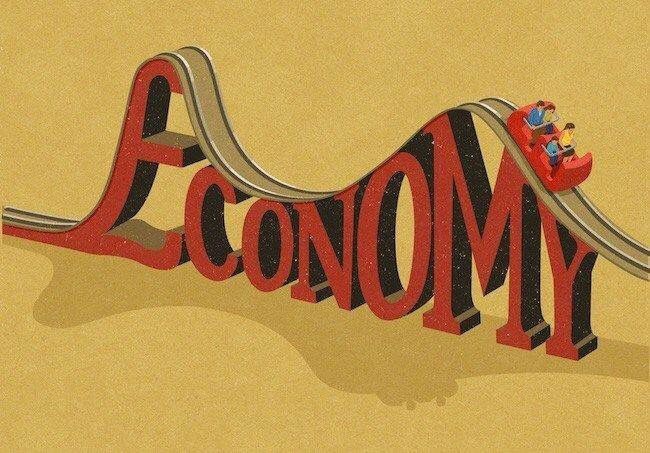

The report notes that while macroeconomic conditions are cooling, they remain resilient—constraining large-scale liquidity expansion and shifting crypto market risk-return dynamics toward capital preservation. Although markets may experience rebounds and certain assets may perform well, structural upside remains constrained until liquidity, participation, and on-chain conditions reset.

Apathy-driven market corrections tend to be more volatile than euphoria-fueled crashes, manifesting as multiple countertrend rallies rather than a single sharp decline; investors should prepare accordingly.