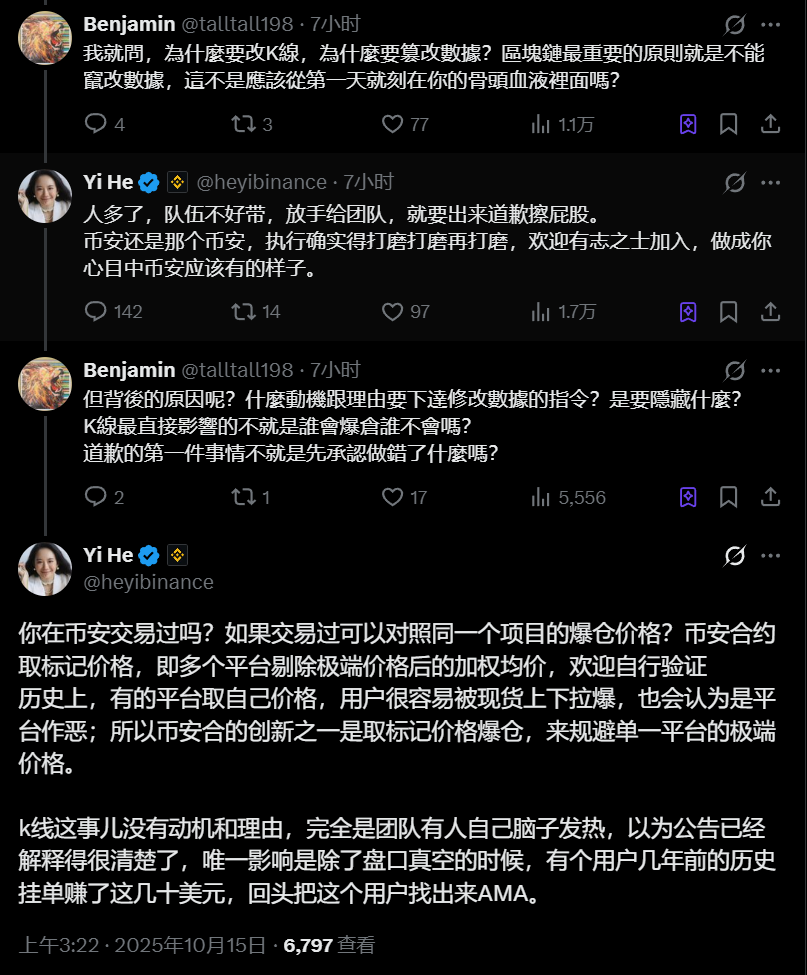

TechFlow news, on October 15, He Yi responded on X platform regarding the "data modification" incident. She stated: "If you've traded on Binance, you can compare the liquidation price of the same project. Binance Futures uses the mark price, which is the weighted average price across multiple platforms after excluding extreme values. Feel free to verify this yourself. Historically, some platforms used their own prices, making users vulnerable to being liquidated by spot market manipulation, leading people to believe the platform was acting maliciously. That's why one of Binance Futures' innovations is using the mark price for liquidations, avoiding extreme prices from a single platform. As for the K-line issue, there was no motive or reason—it was simply someone on the team acting impulsively, thinking the announcement had already made things clear. The only impact was that, apart from during order book vacuum periods, a user's historical limit order from several years ago profited几十 dollars."

In addition, He Yi also said: "With more people involved, it's harder to manage the team. Delegating to the team means I have to step in and apologize when things go wrong. Binance is still Binance, but execution definitely needs refinement—again and again."