Macro Black Swans and On-Chain Selling Pressure: A Risk-Aversion Handbook for the Crypto Market Next Week

TechFlow Selected TechFlow Selected

Macro Black Swans and On-Chain Selling Pressure: A Risk-Aversion Handbook for the Crypto Market Next Week

The cryptocurrency market is currently highly volatile, with short-term price movements extremely sensitive to news developments.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization stands at $3.1 trillion, with BTC accounting for 59.2% ($1.83 trillion). The stablecoin market cap is $30.81 billion, down 0.75% over the past seven days; USDT represents 60.57% of this total.

Among the top 200 projects listed on CoinMarketCap, most declined while a minority rose: BTC fell 6.87% over seven days; ETH fell 11.6%; SOL fell 11.2%; AXS surged 122.1%; and ZRO rose 34.8%.

This week, U.S. spot Bitcoin ETFs recorded net outflows of $1.32 billion; U.S. spot Ethereum ETFs saw net outflows of $600 million.

Market Outlook (Jan 26–Feb 1):

The current RSI stands at 44.24 (neutral zone); the Fear & Greed Index is at 25 (re-entering the fear zone); the Altcoin Season Index is at 39 (neutral, up from last week).

BTC key range: $88,000–$92,000; short-term trend leans toward consolidation near the upper end.

ETH key range: $2,900–$3,300; awaiting directional clarity.

SOL key range: $124–$137; technical indicators show mixed bullish/bearish signals, awaiting new catalysts. Solana’s “Alpenglow” network upgrade—scheduled for Q1 2026—is expected to become a major price catalyst.

Cryptocurrency markets are currently experiencing extremely high volatility, with short-term price action highly sensitive to news flow. Particular attention should be paid to Trump’s external tariff policies and Federal Reserve monetary policy signals, both of which significantly influence overall crypto risk sentiment.

Understanding the Present

Weekly Recap of Major Events

- On Jan 19, the cryptocurrency market experienced a flash crash early Monday morning: BTC plunged up to 3.79% within one hour, dropping from ~$95,500 to ~$91,900 before recovering to ~$92,800;

- On Jan 18, Sonic announced that, as planned, it had successfully burned 16,027,929.41 S tokens via fully permissionless smart contracts—these represented unclaimed allocations from the first-quarter airdrop;

- On Jan 18, according to Defillama data, Meteora generated $1.33 million in revenue over the past 24 hours—surpassing Pump.fun’s $1.16 million and ranking third behind Tether ($16.45 million) and Circle ($6.6 million);

- On Jan 19, Paradex’s official status page updated to confirm its blockchain resumed operations at 20:13;

- On Jan 20, Japan’s 40-year JGB yield rose 5.5 bps to 4%, reaching its highest level since issuance began in 2007—and marking the first time in over 30 years that Japanese government bond yields hit 4%. This also marks the first time since Dec 1995 (when the 20-year JGB yield reached 4%) that JGB yields have crossed the 4% threshold;

- On Jan 21, according to Bitget market data, spot gold surged 10% over 20 days, breaking above $4,800/oz for the first time and rising over $480 year-to-date;

- On Jan 21, Rainbow, a cryptocurrency wallet, announced it will take an RNBW token airdrop snapshot at 4:20 PM ET on Jan 26, with the official airdrop scheduled for Feb 5;

- On Jan 22, Trump stated he would not impose tariffs related to Greenland, prompting a short-term crypto rally;

- On Jan 22, North Korean hackers resurfaced, launching fake job interview attacks targeting over 3,100 IP addresses;

- On Jan 23, the Financial Times reported that SpaceX—the rocket manufacturer owned by Elon Musk—is scouting Wall Street investment banks for its upcoming “mega” IPO, expected to rank among the largest in history;

- On Jan 22, BitGo (BTGO.US), a cryptocurrency custody provider, officially rang the bell on the NYSE, becoming the first crypto IPO of the year.

Macroeconomic Indicators

- On Jan 22, initial U.S. jobless claims for the week ending Jan 17 totaled 200,000, below the forecast of 210,000; the prior week’s figure was revised from 198,000 to 199,000;

- At 23:00 on Jan 23, the U.S. University of Michigan Consumer Sentiment Index for Jan came in at 56.4, exceeding expectations of 54 and the prior reading of 54;

- On Jan 23, CME’s “FedWatch” tool showed a 5.7% probability of a 25-basis-point rate cut by the Fed in January, and a 94.3% chance of holding rates steady.

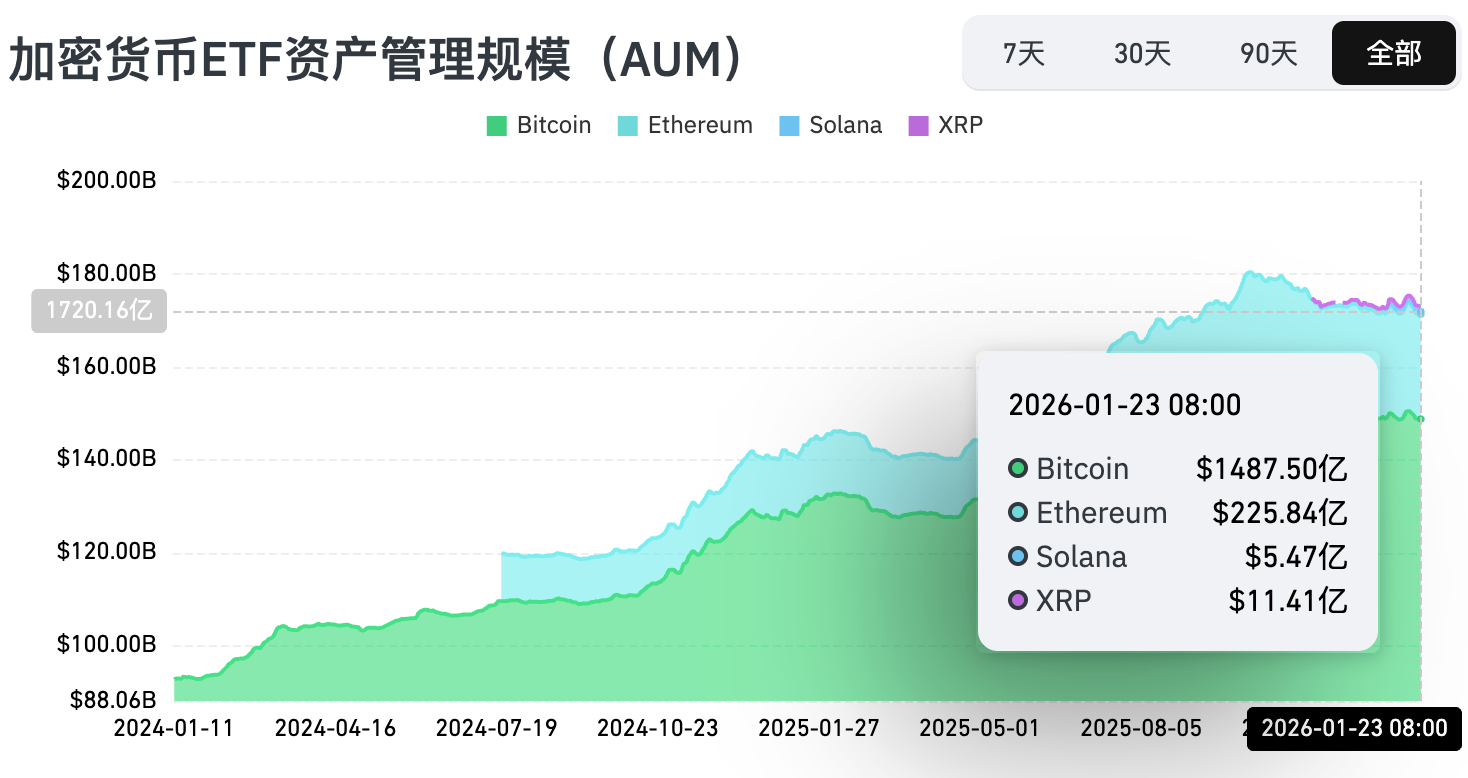

ETFs

From Jan 19 to Jan 24, U.S. spot Bitcoin ETFs recorded net outflows of $1.32 billion. As of Jan 24, GBTC (Grayscale) had cumulative outflows of $25.539 billion and currently holds $14.414 billion; IBIT (BlackRock) holds $69.721 billion. Total market cap of U.S. spot Bitcoin ETFs stands at $120.315 billion.

U.S. spot Ethereum ETFs recorded net outflows of $600 million.

Anticipating the Future

Industry Conferences

- Consensus Hong Kong 2026 will be held in Hong Kong, China, on Feb 11–12;

- ETHDenver 2026 will take place in Denver, USA, on Feb 17–21;

- EthCC 9 will be hosted in Cannes, France, from Mar 30 to Apr 2, 2026. The Ethereum Community Conference (EthCC) is one of Europe’s largest and longest-running annual Ethereum events, focusing on technology and community development.

Project Updates

- Defiance will delist its Nasdaq-listed Ethereum ETF—Defiance Leveraged Long & Income Ethereum ETF (ETHI)—on Jan 26;

- RollX, the Perp DEX protocol on Base Network, begins its first unlock claim period on Jan 26. Genesis airdrop supply totals 180 million tokens; eligible addresses include Trade & LP points holders, and contributors who participated in campaigns via Binance Wallet, Bitlayer, Galxe, etc.;

- Aster’s Phase 4 airdrop claim window opens on Jan 28, 2026;

- Catizen’s Pixel Ninja game on the TON ecosystem will shut down on Jan 29, 2026;

- Infinex, a cross-chain DeFi aggregator platform, will conduct its Token Generation Event (TGE) on Jan 30. Its public sale attracted 868 participants, raising $7.214 million in USDC. Approximately $5 million (5% of INX’s total supply) was allocated, with ~$2.21 million refunded;

- Coinbase will suspend services in Argentina effective Jan 31, 2026: Argentine peso (ARS) deposits and withdrawals for USDC will no longer be supported, though ARS deposits and withdrawals remain unaffected;

- Ready Player Me, a metaverse avatar platform, has been acquired by Netflix and will cease operations on Jan 31, 2026; all team members will join Netflix.

Key Events

- Starting Jan 28, Korea’s Financial Intelligence Unit (FIU) will restrict unregistered overseas cryptocurrency exchanges and wallets from listing on Google Play in Korea. Registration requires implementation of an Anti-Money Laundering (AML) system and certification under the Korea Internet & Security Agency’s (KISA) Information Security Management System (ISMS). Non-compliant apps will be blocked in Korea from Jan 28 onward—new users won’t be able to install them, and existing users may lose functionality due to inability to update;

- At 22:45 on Jan 28, Canada will announce its central bank interest rate decision;

- At 03:00 on Jan 29, the U.S. Federal Reserve will announce its interest rate decision (upper bound);

- At 21:30 on Jan 29, the U.S. will release initial jobless claims (in thousands) for the week ending Jan 24.

Token Unlocks

- Jupiter (JUP) unlocks 53.45 million tokens on Jan 28, valued at ~$10.53 million (~1.7% of circulating supply);

- TreeHouse (TREE) unlocks 85.85 million tokens on Jan 29, valued at ~$8.5 million (~39.41% of circulating supply);

- Zora (ZORA) unlocks 168 million tokens on Jan 30, valued at ~$5.23 million (~4% of circulating supply);

- Kamino (KMNO) unlocks 228 million tokens on Jan 30, valued at ~$11.22 million (~3.68% of circulating supply);

- Optimism (OP) unlocks 31.34 million tokens on Jan 31, valued at ~$9.88 million (~1.62% of circulating supply);

- Sui (SUI) unlocks 43.52 million tokens on Feb 1, valued at ~$65.29 million (~1.15% of circulating supply);

- EigenCloud (EIGEN) unlocks 36.82 million tokens on Feb 1, valued at ~$12.53 million (~8.88% of circulating supply).

About Us

Hotcoin Research, the core research and analysis arm of Hotcoin Exchange, transforms professional insights into actionable trading tools. Through our weekly “Insight Reports” and in-depth “Research Briefs,” we decode market dynamics. Our exclusive “Hotcoin Select” program—powered by AI and expert curation—identifies high-potential assets to reduce trial-and-error costs. Every week, our analysts host live sessions on Hotcoin Live to unpack trending topics and forecast market trends. We believe that empathetic support combined with expert guidance empowers more investors to navigate market cycles and seize value opportunities across Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News