The Second Act of Perp DEX: HYPE Crosses the Kill Zone, EVM's Ceiling Predestined

TechFlow Selected TechFlow Selected

The Second Act of Perp DEX: HYPE Crosses the Kill Zone, EVM's Ceiling Predestined

Hyperliquid's challenge lies not in technology but in governance philosophy: a laid-back operational approach struggles to survive in a fiercely competitive market. Only by building an ecosystem flywheel akin to BNB can HYPE evolve from a liquidity token into the core of a value network.

Organization Matters in a Downturn

There are no secrets in the crypto market—only differences in how fast information spreads.

A follow-up on Perp DEX is indeed overdue. Nearly 20 projects are set to reach TGE by Q1 2026. From Aster’s trading volume to StandX’s orderbook积分, the noise flooding the market keeps everyone on edge.

This shouldn’t cast doubt on Hyperliquid. While the synergistic flywheel between HyperEVM and HYPE has yet to materialize, Lighter hasn’t managed to dethrone the new king. We remain fixated on first-hand narratives of Binance and FTX’s rivalry, rendering the Perp DEX War a secondhand memory.

Falling Into the HYPE New Chapter

Lighter Isn’t Lighter, Hyper Is Even More Hyper

Lighter is undoubtedly a successful project. It seized the opportunity after Hyperliquid validated the Perp sector, cementing the perception that Hyperliquid is Binance’s challenger, while Lighter is Hyperliquid’s challenger.

Turtles can’t keep stacking forever. Looking at exchange competition: beyond Binance, OKX struggles to operate OKB effectively; Coinbase’s market cap is over five times Kraken’s valuation.

Trading has inherent monopolistic effects. Even second-place players cannot achieve self-sustainability. The Perp DEX space has already entered a red ocean phase, with no significant market expansion expected. What remains is merely存量博弈 driven by TGE preparation.

Let’s clarify BNB’s role: Binance Spot and BNB Chain need a connector—a function HYPE has yet to fulfill.

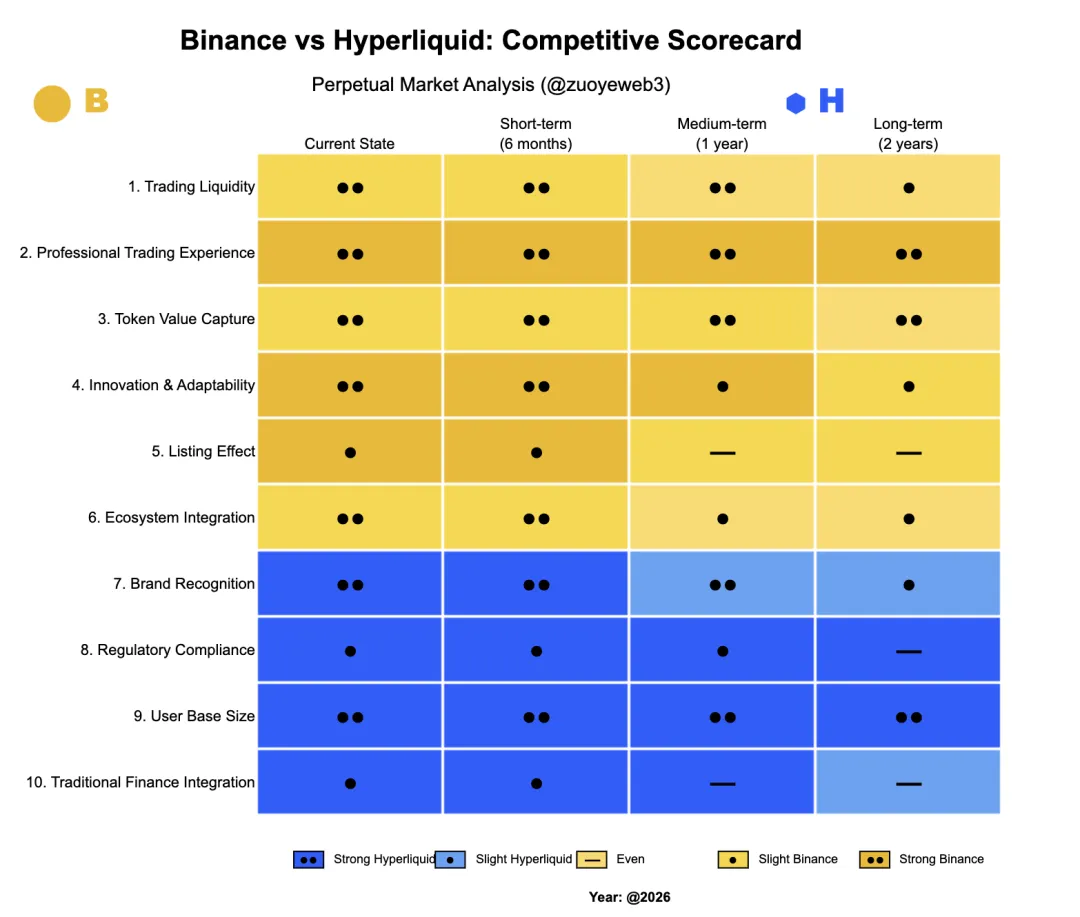

Image caption: Binance vs. Hyperliquid comparison

Source: @zuoyeweb3

Projects desire Binance’s “listing effect,” so they’re willing to pay premium channel fees—whether for spot listings, futures, pre-market trading, wallet alphas, or YZi Labs’ EASY Residency.

Binance needs projects to perform “traffic operations” off its main site to delay post-listing decay. Hence, BNB Chain’s native projects (like PancakeSwap and ListaDAO) must absorb project assets and sustain the next wave of listing momentum through active operations.

This is the real role of BNB and BNB Chain within Binance—but it hinges entirely on the continued existence of Binance’s listing effect, which ironically pushes Hyperliquid toward self-breakthrough.

If we were to correct this logic, Hyperliquid’s rise serves as proof. Perp historically follows the path of “spot first, then futures,” but Hyperliquid broke the mold by focusing directly on “Perp trading” itself. This reflects an industry-wide consensus: trading has gone mainstream, and exchanges can no longer rely on listing effects.

- Exchanges like OKX fail to sustain project prices post-listing due to lack of liquidity and on-chain DeFi ecosystems. They become secondary distributors. OKB lacks on-chain value capture and functions merely as an in-platform coupon, losing its core token purpose;

- Hyperliquid delivers professional-grade trading experiences. After FTX’s collapse, HyperCore became synonymous with on-chain trading—the larger the trade, the more reliant traders are on Hyperliquid’s liquidity.

One more note: Aster and CZ once pushed for “private/dark pool trading,” but failed to dent Hyperliquid’s market share. Beyond niche money laundering use cases, privacy isn’t a top priority for most traders. Even Binance’s KYC requirement doesn’t matter much.

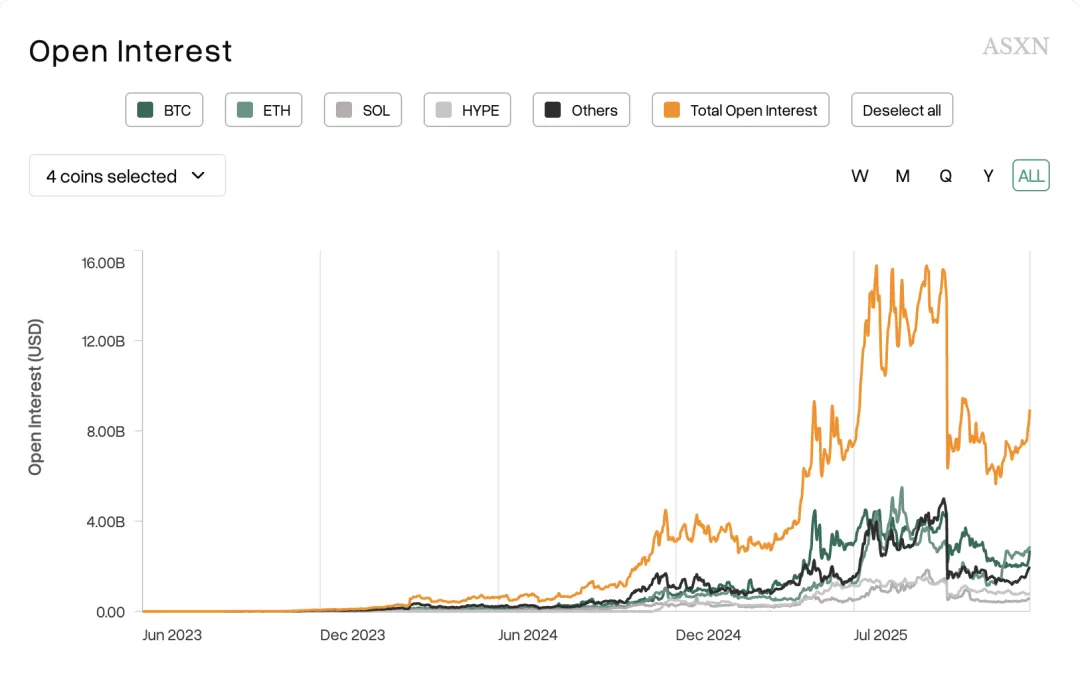

Image caption: Main traded currencies

Source: @asxn_r

The truly fundamental and irreversible trend is that people now only trade major coins like BTC/ETH. New tokens see brief volume spikes upon launch, but nothing more—true for BeraChain, Monad, Sonic, and other next-gen L1s alike.

The “listing effect” that powers top-tier exchanges and the fee-based models of mid-tier ones are fading into history. This may be why exchanges are launching their own Perp DEXs and expanding into trading everything—including traditional assets like stocks, forex, and precious metals.

Yet none of this harms Hyperliquid’s liquidity. As I noted in RFQ Architecture: Market-Making as a Service, An Alternative Path for Latecomers to Perp DEX, Variational’s strength lies in opening market-making architecture to retail users—an actual market demand. In contrast, most Perp DEXs’ volume farming积分 programs represent “early liabilities” waiting to be cashed out at TGE.

If you think Bitget can seize Binance’s derivatives market with golden marketing campaigns, then StandX’s orderbook积分 should challenge Hyperliquid’s dominance.

The better the liquidity, the more a market becomes a trader’s daily hangout. In the Perp DEX space—where listing effects are even weaker—the gap between yield farmers and real users widens further. Remember, most people still earn via CEX dual-token products—let alone actively trading Perp on-chain.

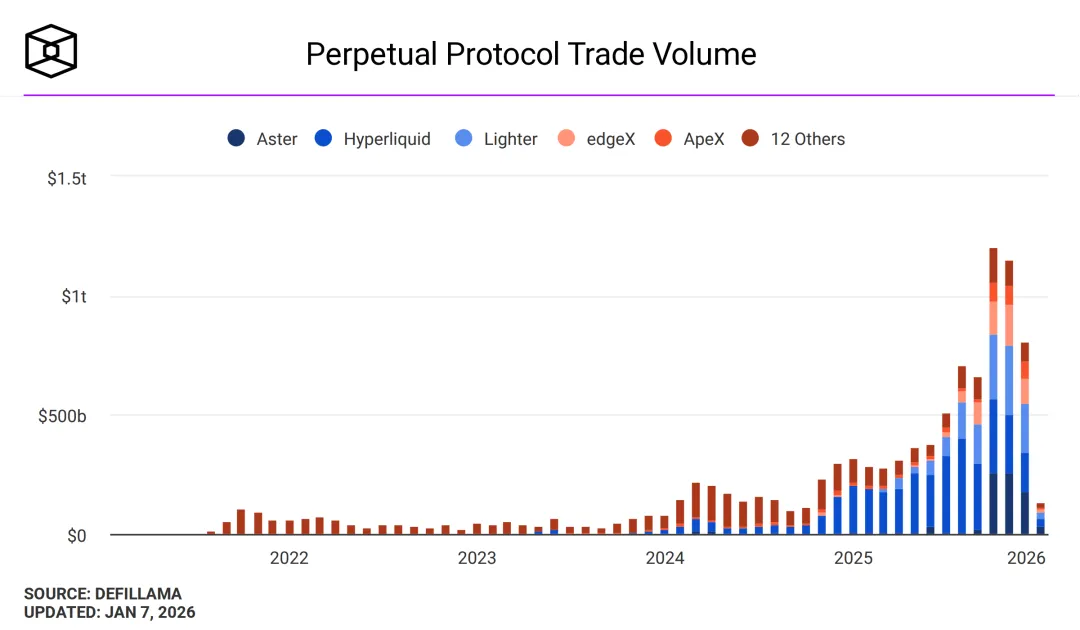

Image caption: Perp DEX trading volume

Source: @TheBlock__

Lighter embraces forex; Edge builds its own chain. Without surpassing HyperCore’s liquidity, they inevitably grow complex to sustain their narratives—this complexity undermines their token’s value capture, turning them into OKB-like “in-platform coupons.” Let’s seriously address regulatory expectations of a “discount” on Hyperliquid: since BitMEX, neither CEXs nor DEXs have lost market share due to U.S. regulatory actions—only hacks or crashes caused major shifts.

- Hacked: KuCoin (2020), ByBit (2025, $1.4B+ stolen)

- Crashed: BitMEX during 2020·3·12 blackout

- Reputation-damaged: Huobi—Sun’s pGala incident

Only SBF’s FTX was killed by CoinDesk’s FUD, losing due to less江湖savvy than CZ. In this light, 1011 is just another annual routine for legacy exchanges like Binance.

Now is a rare moment of regulatory relaxation from the SEC. Binance has officially landed in Abu Dhabi; Hashkey completed its Hong Kong IPO. Hyperliquid isn’t unregulatable—even if the team insists on maintaining a “decentralized” facade, it could adopt Binance’s multi-entity regulatory model, bringing core clearing functions under compliance frameworks.

Law is a barrier to entry for the weak; compliance is the price of landing for the strong.

Chains Need Strong Operations

Reversing the Clock, Nostalgia Becomes the Mainstream

The listing effect on CEXs and volume farming on DEXs are both fading. Hyperliquid’s liquidity remains solid. HYPE has passed the kill switch threshold and won’t become another FTT.

But this isn’t the whole story. HYPE still fails to align with the HyperEVM ecosystem, unable to generate BNB-like “artificial prosperity,” unlike Ethereum’s genuine DeFi structure. This misalignment was detailed in Misalignment: Ethereum Bleeds, Hyperliquid Stalls; no need to repeat here.

This article focuses on the root causes and potential solutions.

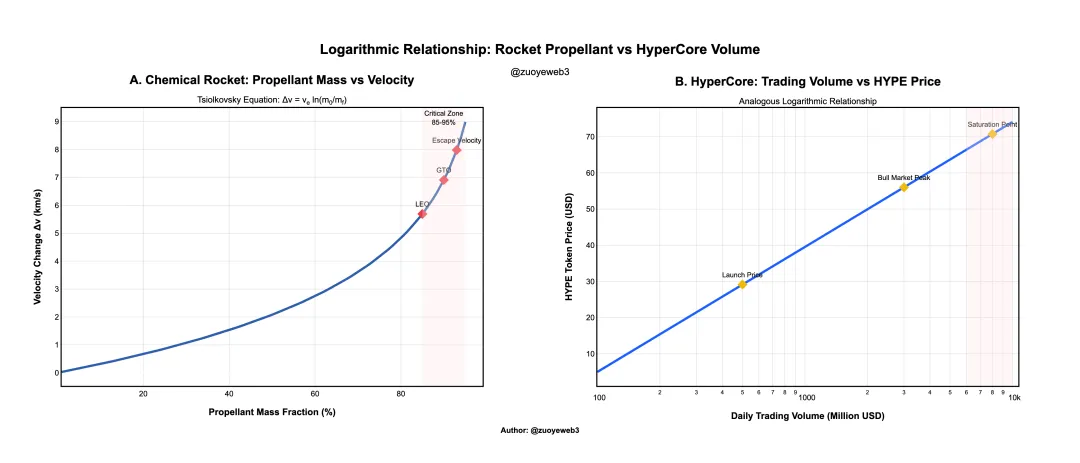

Rocket fuel and thrust have a logarithmic relationship—the same applies between HyperCore’s volume and HYPE’s price.

Within chemical rocket architecture, exponential increases in fuel mass are needed for linear speed gains. Currently, HyperCore’s fees support HYPE’s price, but HyperCore’s volume cannot grow indefinitely—especially with Binance and other Perp DEXs aggressively diverting traffic.

Image caption: Token price vs. trading volume

Source: @zuoyeweb3

Note: This diagram illustrates dynamic changes only. HYPE’s initial price was single-digit, but only stabilized around $30 in the public eye as its “fair starting valuation.” Trading volume data has been adjusted for illustrative clarity regarding HYPE price and HyperCore volume correlation.

Note also: this does not contradict the idea that Perp DEXs cannot outcompete Hyperliquid. Crypto assets are now limited to BTC/ETH, and the overall Perp market has hit a temporary ceiling.

Let’s deconstruct where Hyperliquid’s “laissez-faire” attitude comes from. The reason might be simple but brutal: the Hyper team still treats BTC as the standard for chains and FTX as the benchmark for derivative exchanges. Learn from the good, avoid the bad.

The USDH auction ticker is telling. Hyperliquid’s official nodes don’t vote, designate teams, or provide official liquidity support. As a result, USDH lacks development potential and holds no clear advantage over USDC or USDe.

Hyperliquid’s current “non-intervention” is HyperEVM’s biggest flaw. It’s not that Hyperliquid lacks operational will or capability. Recall that Hyperliquid first gained attention through memes; Unit launched with a de facto “official” cross-chain bridge; USDC long relied on Arbitrum to access HyperCore.

But all these efforts were limited to HyperCore. Perhaps in Hyperliquid’s view, HyperCore is a product requiring strong ops, while HyperEVM is an open ecosystem.

Unfortunately, times have changed. Today’s chains resemble Super Apps. Like internet giants, there hasn’t been a new mass-market hit in years—true for TON, Monad, Berachain, Sonic. Even Plasma doesn’t look like a stablecoin chain but more like a vault brought to life.

On-chain infrastructure is too mature. Chains/L2s no longer enjoy direct network effects. Options now are: compete for存量 like ETH L1/Solana; introduce RWA like Canton offering SaaS-like services; or artificially sustain like BNB Chain.

Jeff likely wants to avoid the disaster of FTX-style aggressive operations, hence adopting a conservative stance on HyperEVM—leaving projects to community self-governance, unable to build meaningful interaction with HYPE, leading to quick death after HYPE distribution.

Even HyperCore’s operations follow minimalism. Observe the accounts of Hyperliquid, Jeff, and Hyper Foundation—almost zero interaction with projects.

This approach worked in 2017 or DeFi Summer 2020, when on-chain lacked key products. Building something meant instant traffic and profit, plus wild token speculation. Those conditions are gone.

In fact, Hyperliquid doesn’t need a full transformation—just learning BNB’s playbook could help build its own growth flywheel.

HYPE’s path forward is to emulate BNB.

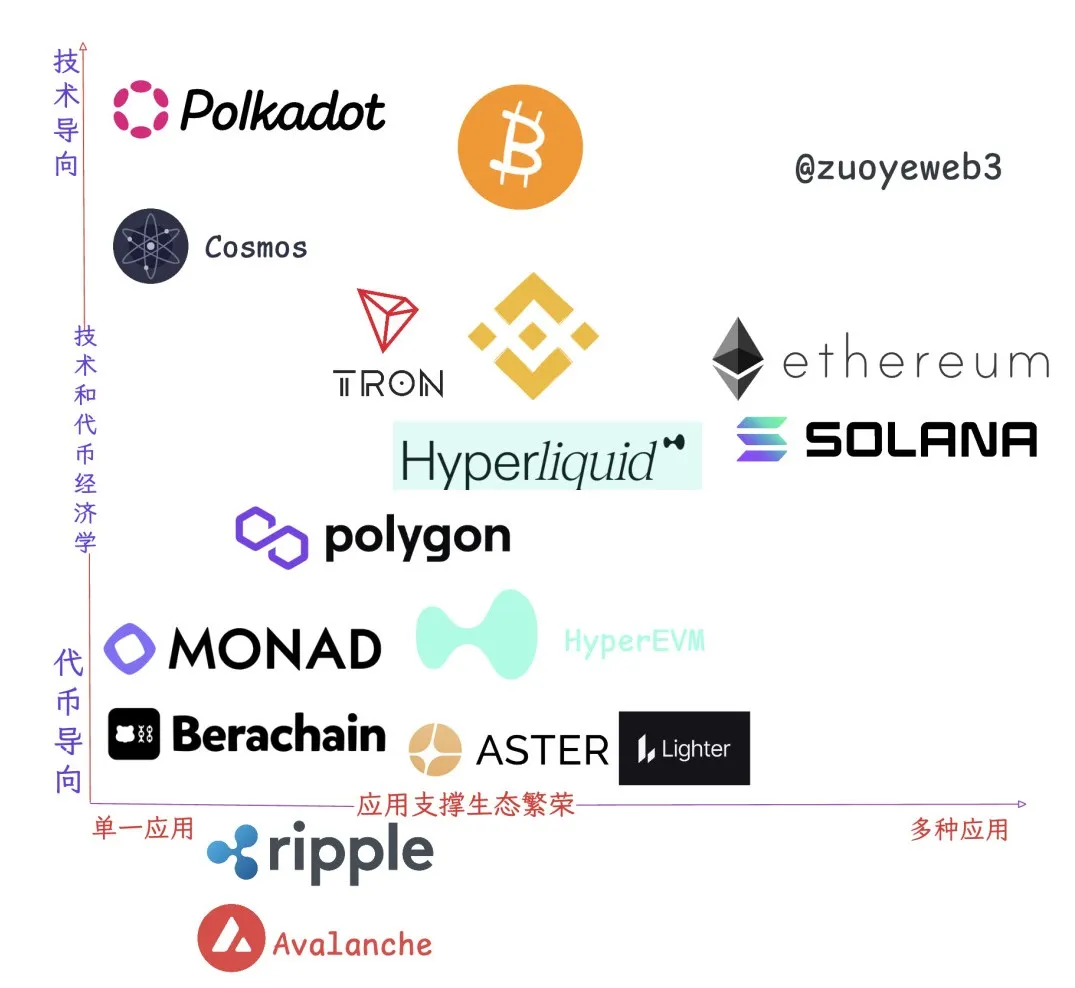

Image caption: Relationship between ecosystem and applications

Source: @zuoyeweb3

Look at surviving chains/L2s today—it’s not a simple equation of ecosystem vitality and strong token value capture. Reality is far messier. Only Ethereum fits the textbook ideal; others defy easy categorization.

In short, ideals rarely manifest in reality.

- Single-app chains: TRON survives on USDT, Polygon on Polymarket;

- Technologically advanced (but economically broken): Polkadot and ATOM, innovative in design but failing to capture economic value;

- Purely token-driven: Monad/Berachain—mission accomplished after token launch;

- Ecosystem-rich: Solana and Ethereum;

- Existential: Ripple, Avalanche—existence is the mission.

Further breakdown: both Binance Spot and HyperCore belong to the “bucket group.” Their tokens strongly capture value; their platforms offer multi-category utility—spot/futures trading, wealth management, staking, even transfers. Not quite chains, yet functionally equivalent.

BNB Chain’s value lies in being part of Binance Spot’s “chain-shaped” distribution arm. After Dragon Mom left, Rong Mom arrived—Binance never abandons BNB Chain because many things are easier done via a chain than an exchange. Traffic has long-term value.

Yet HIP-3 is essentially HyperCore’s liquidity spillover, competing with HyperEVM for traffic. This internal traffic war now plays out not just among HIP-3 projects, but also between Builder Code and HyperEVM builders.

Hyperliquid aims to be the AWS of liquidity, but its internal structure remains unclear.

BNB Chain isn’t Binance’s ideal form—but it’s good enough for Hyperliquid to learn from.

BNB Chain acts as Binance Spot’s distribution channel. It can’t self-sustain without strong operations, let alone feed back into Binance. But for HyperEVM at this stage, that’s sufficient.

Between preserving minimal operations and keeping HyperEVM open, there’s room to move forward: officially endorse category leaders in lending, Swap, LST, etc. The failed HIP-5 proposal was too blunt; using HYPE buybacks to repurchase project tokens isn’t viable.

Ecosystem collaboration violates no principles. Hyperliquid barely interacts with any project—perhaps preferring off-chain MM alliance-style cooperation. But on-chain visibility still matters.

If even minimal HyperEVM operations aren’t performed, HYPE will likely stall around $50, lacking imagination around HyperEVM’s network effects—and thus losing exponential upside potential.

Without HyperEVM’s support, HyperCore would need liquidity rivaling OKX’s level—but even then, the HYPE flywheel couldn’t form.

In short, for on-chain ecosystems, “decentralized” HyperEVM has no way back.

Conclusion

Hyperliquid is lighter than Binance, with higher capital efficiency. Lighter isn’t lighter than Hyperliquid; Aster is eager to get complicated.

TGE-bound or near-TGE Perp DEXs like Aster and Edge will all launch their own L2s/chains—as part of valuation inflation plans, just like PumpChain is part of a token launch strategy.

Now is the critical moment for Hyperliquid to embrace complexity—to leverage scale for future gains.

As previously noted, Hyperliquid isn’t great at inventing new products (Jeff did try prediction markets). Its strength lies in engineering-level composability. If FTX isn’t a good model, BNB Chain certainly is.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News