Crypto Market Weekly Insight (11.10-11.17): Market in extreme panic, privacy sector stands out

TechFlow Selected TechFlow Selected

Crypto Market Weekly Insight (11.10-11.17): Market in extreme panic, privacy sector stands out

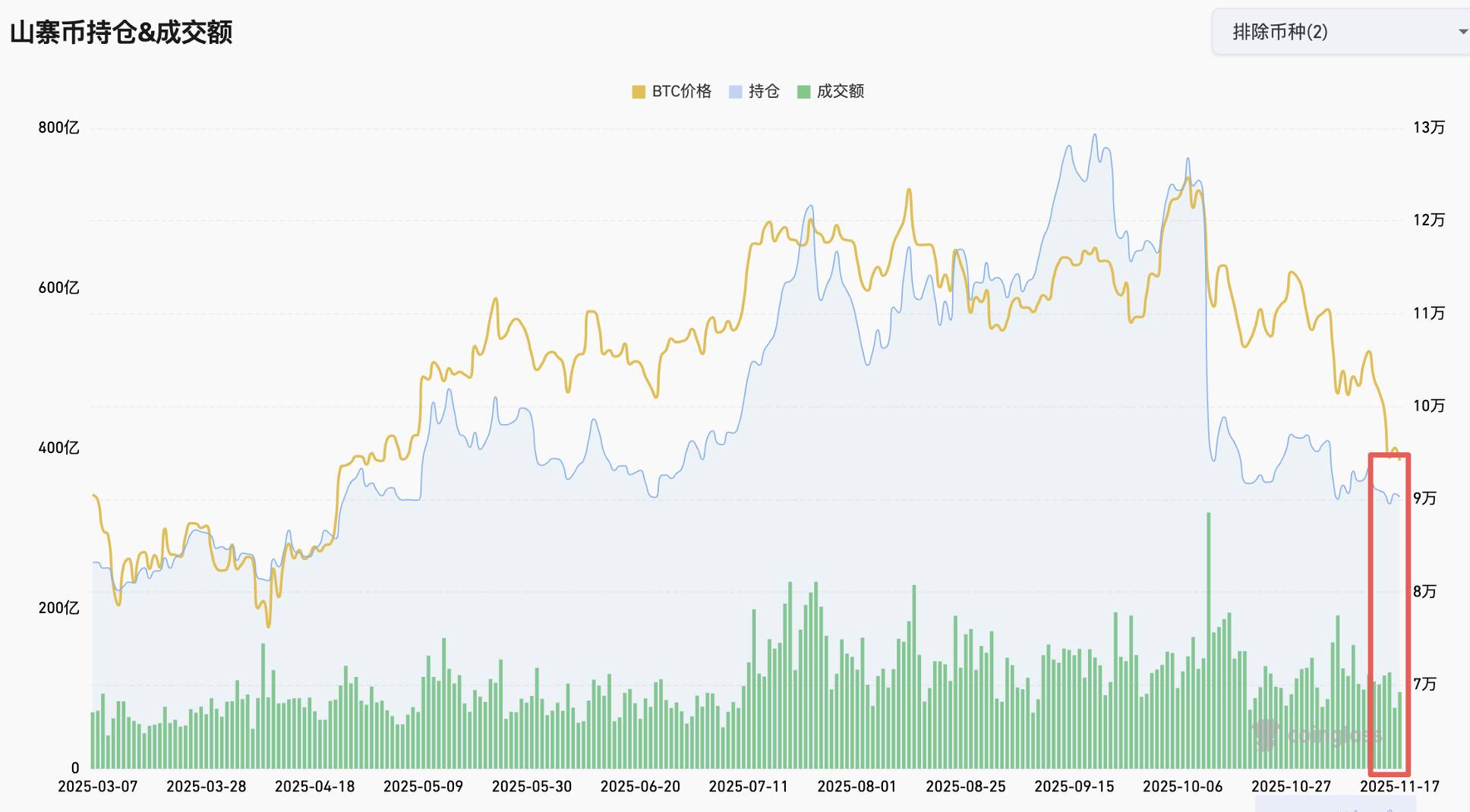

Last week, both the open interest and trading volume of altcoin contracts at exchanges declined, reflecting a continued lack of liquidity following the crash on October 11.

Author: Yuuki, TechFlow

1. Overall Performance

1. Market Sentiment:

Last week's market was extremely fearful. The short-lived positive impact of the end of the U.S. government shutdown was quickly overshadowed by declining odds of a Fed rate cut in December. Meanwhile, Japanese long-term bond yields continued to rise, with 10-year JGB yields reaching 1.73%, a 17-year high.

BTC fell 9.99% over the week, ETH dropped 13.62%, MSTR’s mNAV declined to 1.2, and BMNR’s ETH holdings incurred a paper loss of 3 billion yuan. Currently, crypto assets are falling in tandem with U.S. equities but not recovering with them. Investors are watching NVIDIA’s quarterly earnings report this Thursday, along with real liquidity injections from events such as the reopening of the government and the Fed’s balance sheet reduction. According to the Coinglass Fear & Greed Index, market sentiment remained in the "fear" zone for all seven days last week, with five days classified as "extreme fear." The last time a similar situation occurred was on February 27, 2025, with market recovery taking about two months afterward.

Chart: Last week's market sentiment was in extreme fear

Source: Coinglass

2. Macro Events:

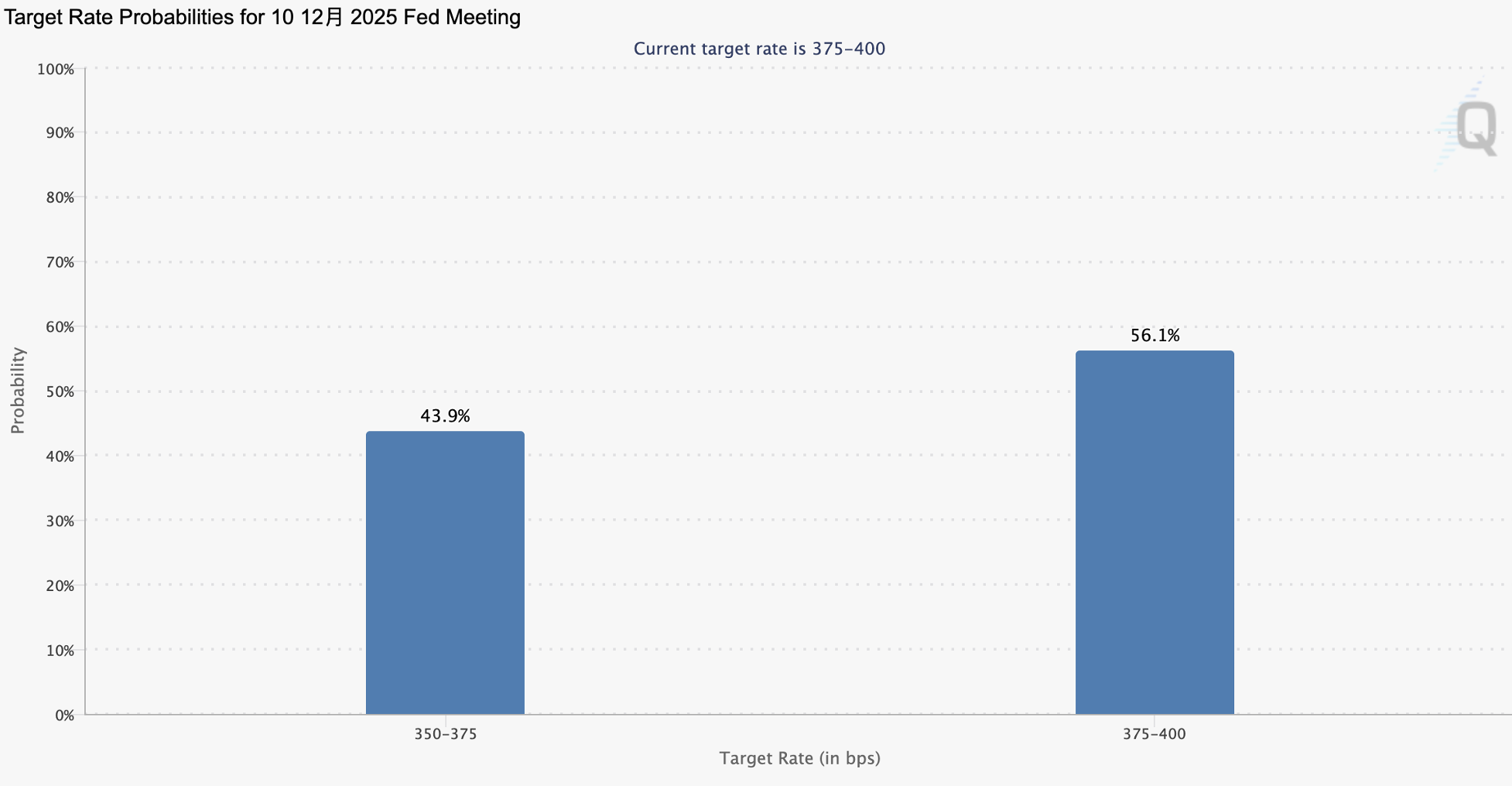

Due to persistent inflation and insufficient cooling in the labor market, coupled with missing core data during the government shutdown, multiple Fed officials including Kashkari, Hammack, and Musalem adopted hawkish tones last week. Markets now price in only a 43.9% chance of a Fed rate cut in December, suppressing risk asset prices. U.S. major indices pulled back notably mid-week, while the crypto market continued to decline.

Chart: Probability of a 25 bps Fed rate cut in December drops to 43.9%

Source: CME Group

10-year Japanese government bond yields rose to 1.73%, the highest level in 17 years since June 2008. Unwinding of the yen carry trade could also tighten global liquidity.

Chart: Japan's 10-year government bond yield rises to 1.73%

Source: TradingView

3. Specific Data:

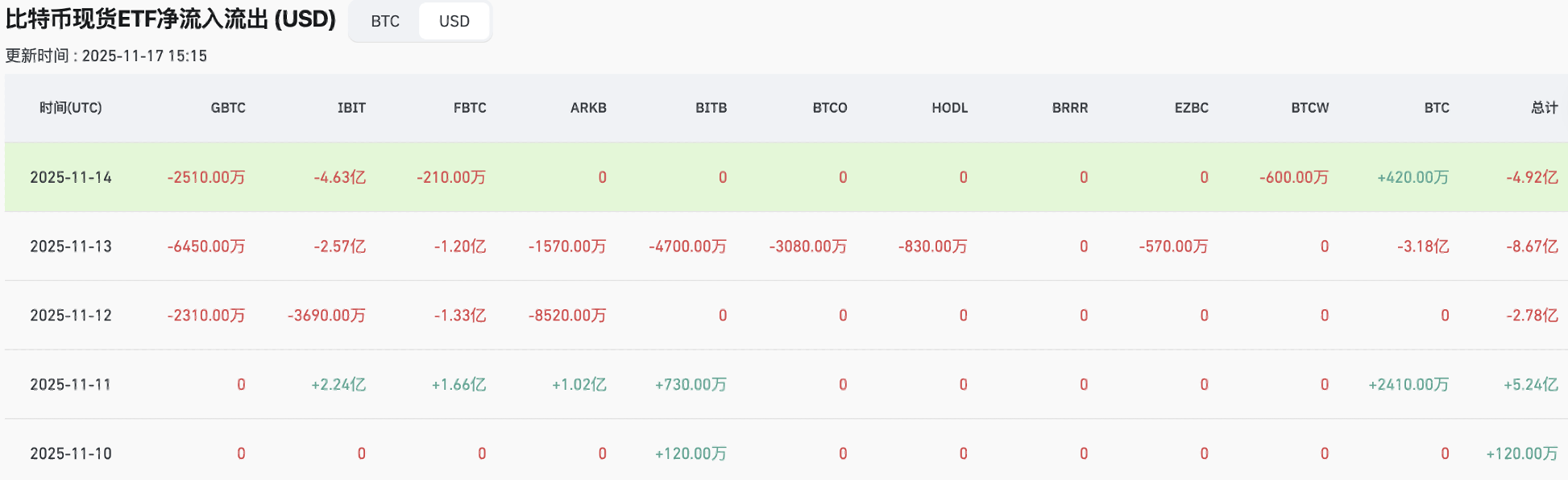

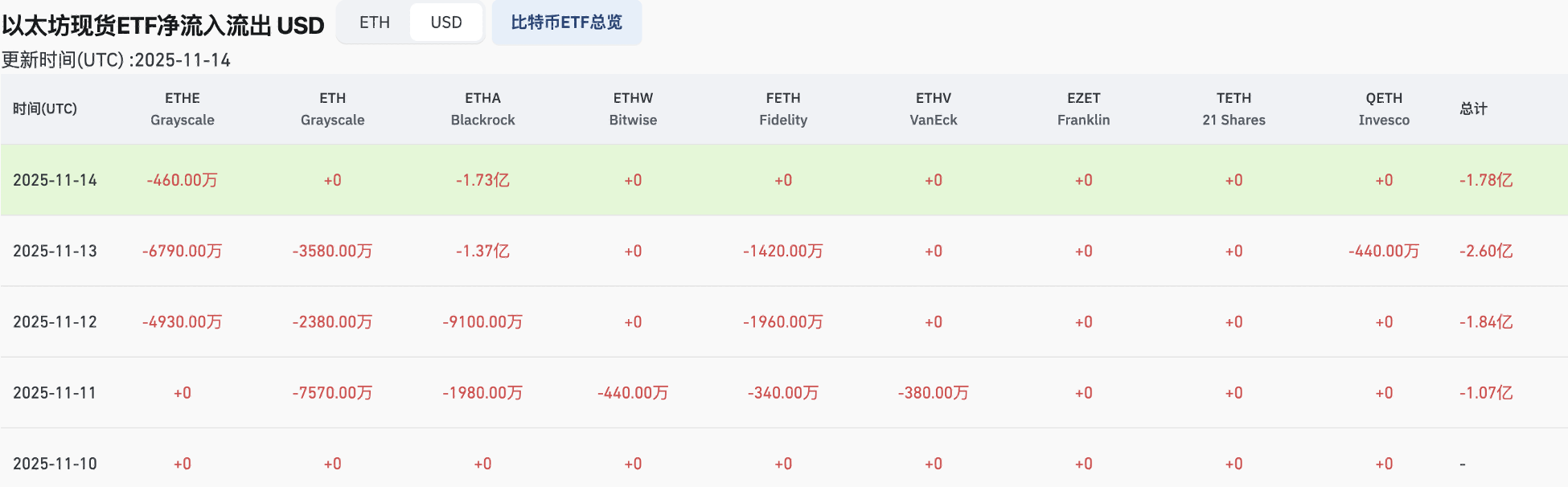

Last week, BTC ETFs saw outflows of $1.112 billion, down 7.9% week-on-week; ETH ETFs recorded outflows of $729 million, up 43.5% compared to the previous week. Current BTC exchange reserves stand at 2.1374 million BTC, unchanged from the prior week; ETH exchange reserves are at 12.01 million ETH, down 1.75%. As of November 16, stablecoin market cap remains flat at $265.095 billion week-on-week.

Chart: BTC ETF outflows of $1.112 billion, down 7.9% week-on-week

Source: Coinglass

Chart: ETH ETF outflows of $729 million, up 43.5% week-on-week

Source: Coinglass

Chart: BTC exchange reserves unchanged week-on-week

Source: Coinglass

Chart: ETH exchange reserves down 1.75% week-on-week

Source: Coinglass

Chart: Stablecoin market cap unchanged week-on-week

Source: Coinglass

2. Local Highlights

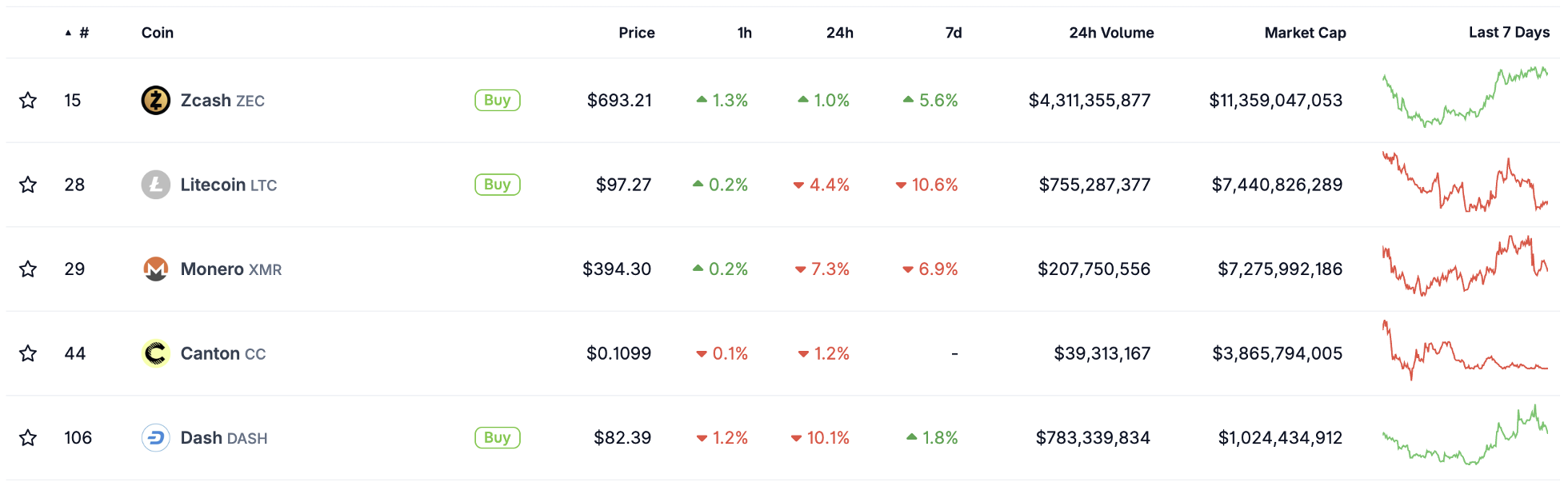

1. ZEC rose 6% over the week, hitting a new all-time high, while STRK surged 47%. Amid an overall weak market, privacy coins continued leading gains—ZEC gained 6%, surpassing a $15 billion market cap and becoming the 10th largest crypto asset. On Hyperliquid, the top ZEC short position incurred over $22 million in unrealized losses, with liquidation triggered at $1,112. Market speculation around ZEC on-chain inscriptions has begun. STRK jumped 47%, boosted by its founder (also co-founder of ZEC) and endorsement from Vitalik.

Chart: Privacy sector continues to lead market gains

Source: Coingecko

2. ASTER rose 16% over the week, with approximately $1.7 million in daily revenue used for buybacks, representing a 30% increase from CZ’s initial purchase price of $0.90. The whale who heavily shorted ASTER after CZ announced his investment has now fully closed their position at break-even (previously holding up to $44 million), contributing to a sharp short-term rally in ASTER.

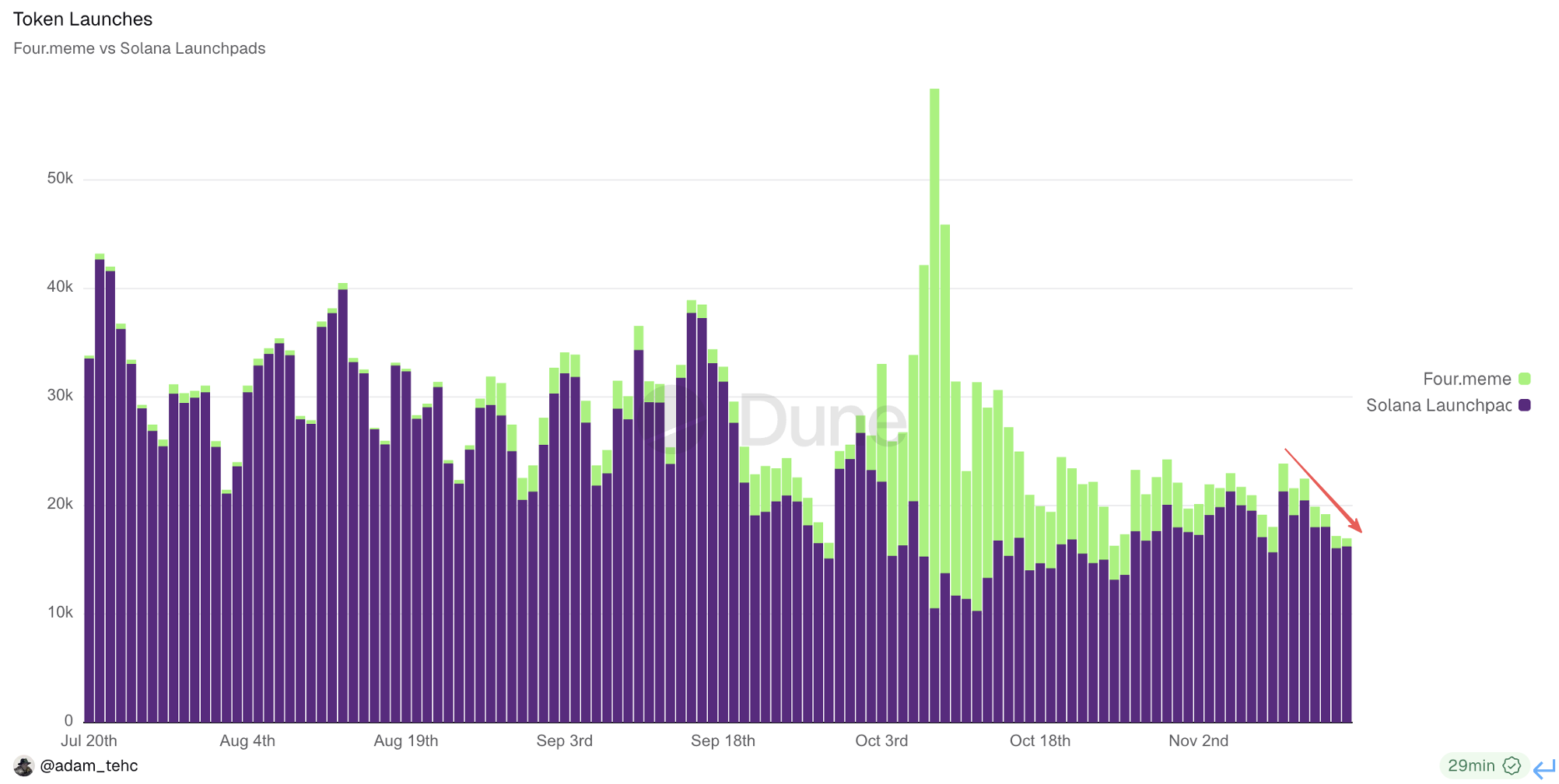

3. Last week, both holdings and trading volume of altcoin futures on exchanges declined, reflecting ongoing liquidity shortages following the October 11 crash. Token minting activity on Solana and BSC chains also continued to fall, indicating a lack of market momentum.

Chart: Altcoin futures holdings and trading volume both decline

Source: Coinglass

Chart: Declining token issuance on Solana and BSC chains

Source: Dune

4. Key News Last Week:

Fed officials Kashkari, Hammack, and Musalem made cautious comments regarding rate cuts;

Tom Lee: Suspected major "gap" in the balance sheets of one or two market makers;

Bitmine accumulated a total of 67,021 ETH worth approximately $234 million over the past week;

Czech National Bank becomes the first central bank globally to purchase Bitcoin;

Ripple invests $4 billion to build financial infrastructure connecting crypto and Wall Street;

Tether: Has deployed $1.5 billion so far into commodity trade financing, exploring new models combining stablecoins with physical assets;

Grayscale plans to file for IPO listing;

Stable: Mainnet launch upcoming;

dYdX community votes to increase protocol fee buyback ratio from 25% to 75%;

3. Focus This Week

1. Macro Events:

November 17: Federal Reserve Vice Chair Jefferson delivers remarks on economic outlook and monetary policy;

November 19: 2027 FOMC voter and Richmond Fed President Barkin speaks on economic outlook; NVIDIA earnings release;

November 20: U.S. September unemployment rate; Fed releases minutes from monetary policy meeting;

November 21: Final reading of U.S. 1-year inflation expectations for November; multiple Fed officials speak.

2. Token Unlocks:

See "This Week, Tokens Including ZRO, ZK, and KAITO Face Large-Scale Unlocks."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News