Getting rich is a war of attrition: even geniuses can be brought down by greed

TechFlow Selected TechFlow Selected

Getting rich is a war of attrition: even geniuses can be brought down by greed

Life is a war of attrition; only those who laugh last truly win.

Author: BowTied Bull

Translation: Baihua Blockchain

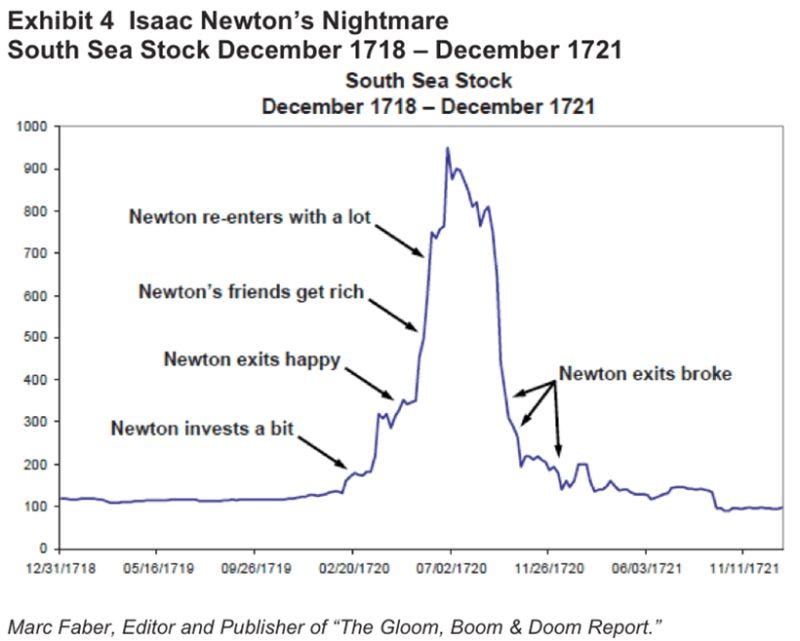

Throughout history, these dramatic booms and busts are nothing new. The only difference now is that we have the internet, where such events are discovered and amplified within seconds. Some people built over $30 million in wealth, only to end up with zero. Know who else failed? Isaac Newton—in the infamous South Sea Bubble.

The War of Attrition—Avoiding Zero

We can apply this principle to everything. People give up by age 25, drowning in cheap alcohol and bar spirits. They try entrepreneurship for no more than three months, then settle for annual raises that barely keep up with inflation. It applies to dating too. Most men either let themselves go or refuse to seek their ideal type abroad (usually attractive foreigners).

In short, life isn’t a sprint. While you’ll experience massive leaps, the foundation is laid during seemingly flat months or even years. This is a long, brutal war of attrition (think of those boring games on shows like Survivor where your only task is standing motionless on a pole). It's a test of who remains standing when others collapse, quit, or self-destruct.

How is this game different from those TV challenges? You never have to hit zero. You might endure a bad year, month, or quarter. That’s fine. As long as you never reach zero, there's no financial reset.

Every worthwhile game—business, investing, fitness, relationships—has an unwritten rule. Winners aren't the fastest or strongest in any single year, but those who survive across a decade of changing conditions.

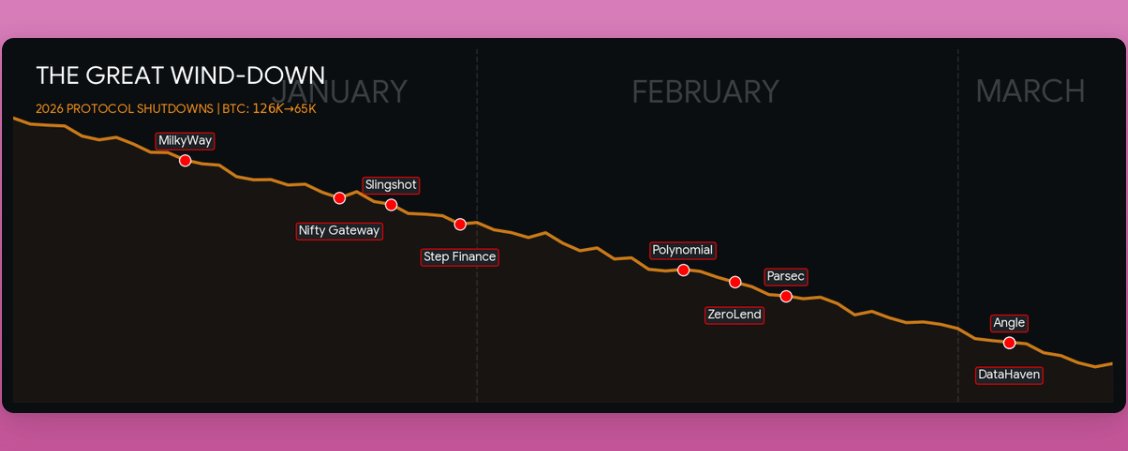

Recent Collapse Events

There are many such stories. How many of you have already forgotten: 1) Sam Bankman-Fried—a thirty-year-old billionaire running one of the most profitable trading platforms at the time. He greedily misused customer funds, leading to bankruptcy and prison. 2) Do Kwon—who absurdly declared "Stay strong, guys, pouring more money in," actually doubling down on his Ponzi scheme before collapsing to zero. 3) Long-Term Capital Management—a fund literally founded by Nobel laureates. One over-leveraged bet at the wrong time? Game over.

Even Isaac Newton lost his mind during the South Sea Bubble. After cashing out early for a profit, he re-entered out of envy (at the peak), lamenting: "I can calculate the motion of heavenly bodies... but not the madness of people."

This is a lesson repeated for centuries. Same plot, evolving technology, identical outcome: greed, leverage, and inability to stay in the game.

Even the world’s smartest minds have gotten trapped in their complex models, forgetting that markets are driven by emotional humans, not numbers.

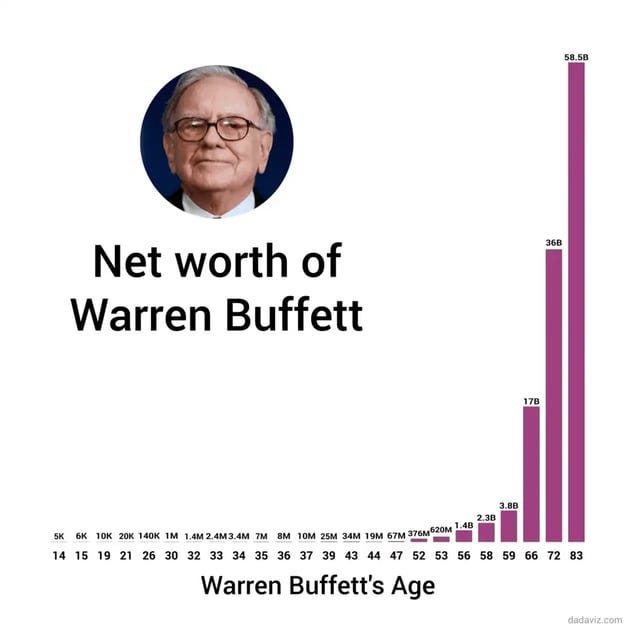

The war of attrition is the core strategy: this game rewards those who conquer their psychological weaknesses. Buffett was mocked for decades as "boring." He underperformed during frenzies, always buying what nobody wanted. Yet he still stands today. His empire compounds because he follows just one rule: don’t lose money. While we’d never consult him on tech matters, conceptually, his approach is sound. You must stay in the game and refuse to sell at a loss (this demands deep research, diamond-handed resolve, and zero leverage—since interest alone could wipe you out).

Jeff Bezos did the same. He raised $1 million by selling less than 20% of his company. He could’ve sold more, but he wanted control—staying in the game. This proved his wisest decision. Through the dot-com crash, through years of fierce boardroom battles, he held firm. By trading greed for endurance, he built a trillion-dollar empire (Amazon).

Elon Musk has lived through it all. He’s not the best example—he nearly went bankrupt. Yet he remains a prime survival case. After PayPal, he poured nearly all his wealth into Tesla and SpaceX, teetering on ruin. He borrowed money from friends for rent, but never gave up. He fought to survive, not to appear successful.

Apple is another (surprising) example. In the 1990s, it nearly went bankrupt. Most companies would have collapsed, but Apple didn’t. They cut costs, rebuilt, and waited patiently. Years later came the iPod, then the iPhone—the compounding phase began. Another trillion-dollar lesson in resilience.

In short, before deciding to use leverage, reflect deeply on all these cases. Can you survive a real downturn? -50% to -60% drawdowns? Losing your job simultaneously? Plus an emergency expense? Modeling with rose-tinted glasses is far easier.

Never Make an Investment You’ll Regret

Any investment you’ve deeply researched and truly believe in should be held forever—say, 20–30 years. This doesn’t mean holding 100%, but you should always retain some portion. If you bought Bitcoin at $100 and sold everything at $200, you'll never look yourself in the eye again. We know many such people. Someone bought Ethereum at $80, sold all at $200, then watched it climb past $4,000 while their S&P 500 returns lagged by over 1000% during the same period.

In short, for any well-researched investment, you can sell part. But always keep some, in case you sold too early.

Choosing zero deliberately makes no sense

Most people aren’t wiped out by leverage—they do it to themselves.

They sell stocks or tokens after a 10x rise, proud of "locking in profits." They trade peace of mind for a few million dollars by selling their startup, only to watch it go public later at hundreds of millions or even billions (Victoria’s Secret being a famous case). They abandon careers, relationships, or ideas before exponential curves turn upward. All the gains lie at the inflection point! (Reminder: progress is nonlinear—true for stocks, tokens, and any small business).

To avoid this, design your life to absorb losses and preserve some high-risk positions that have already appreciated. Keep expenses low, maintain sufficient liquidity to make big bets without desperation. Hold onto your skills and equity. These assets compound until the curve turns.

Endure the boredom before breakout; accept appearing wrong for years. Successful people aren’t those with the best strategies… but those who persist long enough for their strategies to work.

Every major success story is a case study in painful endurance and belief. Compounding only works for the few who remain solvent long enough to experience it. This is the ticket into the top 1%.

Most can’t tolerate being undervalued or delayed gratification. They need recognition and attention, so they cash out to feed their ego.

They crave comfort, so they surrender future possibilities. They mistake busyness for progress, others’ approval for security. They voluntarily exit before the game turns in their favor. Ironically, focusing solely on survival and adaptability itself creates inevitable success.

If you stay in the arena long enough, odds eventually tilt your way. The longer you endure pain, boredom, and obscurity, the greater your exposure to favorable tail events. Life cannot stop someone who refuses to leave.

If you’re in that seemingly stagnant "grind" phase, remember—it’s entirely psychological. If you’re making correct choices, momentum is silently building. Don’t expect immediate returns; focus on survival.

Each month you remain solvent, each year you hold your ground, increases your probability of breakthrough. This is the math of attrition.

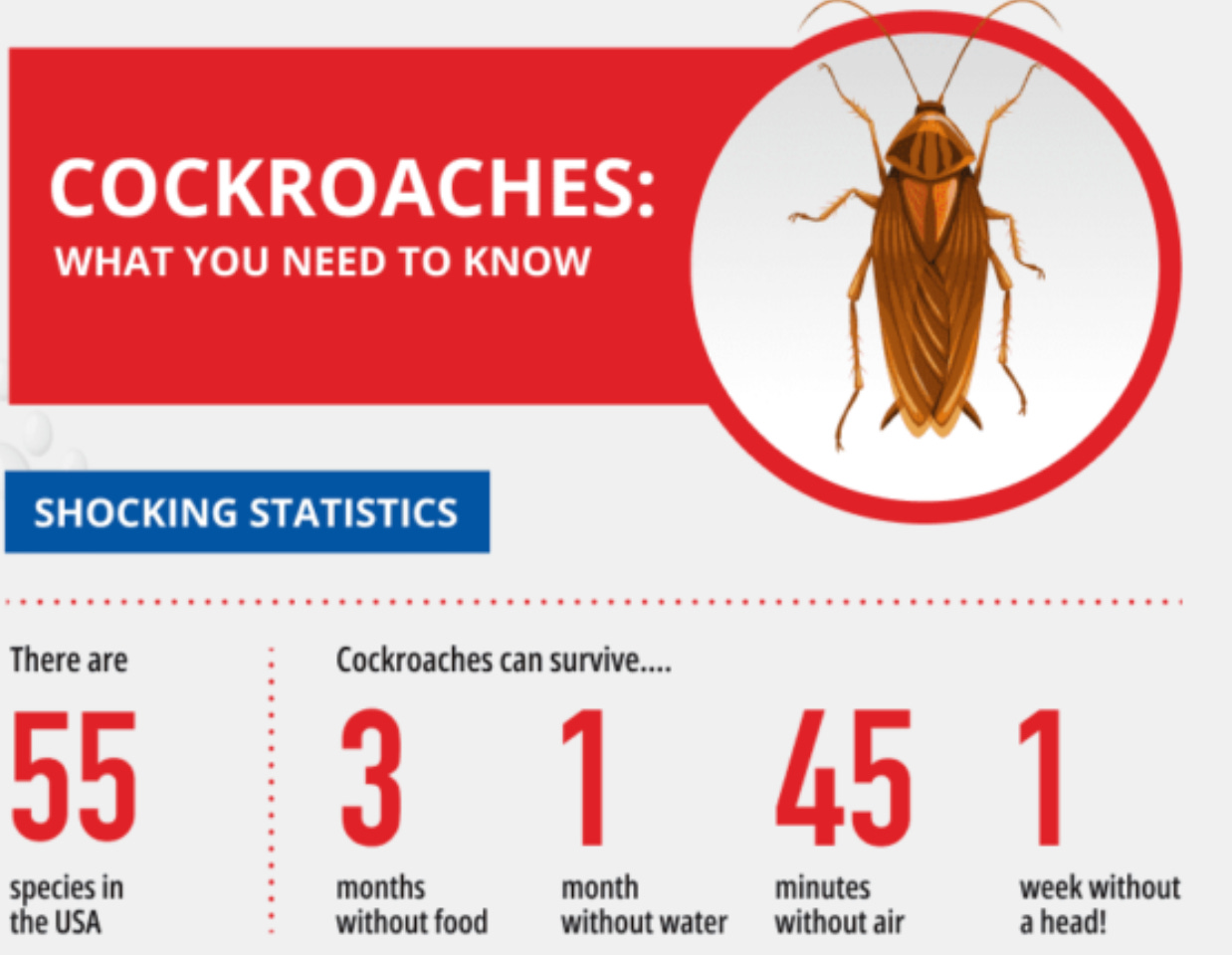

People hate cockroaches, but they teach us a vital lesson: find a way to survive

The more you crave results today, the less you’ll get. This is how Lady Luck operates. The skill you truly want is "endurance." Stay at the table long enough, and Lady Luck eventually thinks: "Hmm, this guy really doesn’t care—might as well give him that pot of gold."

Don’t blow up. Don’t cash out too early from investments with asymmetric return potential. Don’t trade your future for comfort. Keep expenses low, ego smaller, runway longer. Because life doesn’t reward the smartest player—it rewards the one who survives to the final table.

Think of it like poker. Your goal is to reach the final table, not become the spotlight on day one.

Live long enough, and the rest is statistics.

One final note on survival—even if you mess up

If you need real-world comeback examples, here are a few names you’d recognize today:

Disney: In 1923, Disney’s Laugh-O-Gram Films went bankrupt due to unpaid distributors. He moved to Hollywood, created Mickey Mouse and Snow White, and built an empire.

Ford: Before founding Ford Motor Company, he went bankrupt twice. His first company (Detroit Automobile Company) failed due to expensive, inefficient products. Later, he pioneered mass production, revolutionizing manufacturing.

Jobs: Fired from Apple in 1985, he threw himself into NeXT and Pixar, nearing financial collapse. Apple eventually acquired NeXT in 1997, allowing Jobs to return… bringing the iMac, iPod, and iPhone.

George Foreman: The famed boxer went bankrupt in the late 1970s, but returned to boxing at age 38. After earning enough, he launched the George Foreman Grill, netting hundreds of millions.

Milton Hershey: Before founding Hershey Chocolate, he failed twice in candy ventures. Even the most iconic brands had founders who failed repeatedly—they simply kept trying.

There are thousands of stories we know, and millions we don’t. The lesson is always the same. Learn from others’ mistakes. Don’t hit zero. Don’t sell 100% of an investment you truly believe in. Don’t use leverage.

In rare cases, if you do mess up… well, others have recovered from far worse. But given the outsized returns offered in 2025 by tech, crypto, and niche internet businesses, placing yourself in that position is utterly pointless.

Still, this is just one cartoonish perspective.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News