Who Owns the Most Bitcoin? (2025)

TechFlow Selected TechFlow Selected

Who Owns the Most Bitcoin? (2025)

Exploring individuals, companies, and wallets that have become major cryptocurrency holders, along with the amount of Bitcoin they hold.

Author: Arkham

Translation: Block unicorn

Introduction

Satoshi Nakamoto, the anonymous founder of Bitcoin, is the largest holder of Bitcoin, owning 1.096 million BTC (approximately $128 billion). Arkham's tag originates from a known mining pattern called the "Patoshi pattern," which includes Satoshi's unique (known) addresses used in early Bitcoin transactions. According to Arkham's research, he accumulated this wealth by mining over 22,000 blocks. The individual wallet holding the most Bitcoin belongs to the Binance exchange, with nearly 250,000 BTC.

Using Arkham, we can identify which specific wallets hold the most Bitcoin:

Bitcoin is a decentralized digital currency that operates on a blockchain—a peer-to-peer network. Due to these characteristics, no single entity owns the entire Bitcoin network, but individuals can access and own Bitcoin through their private keys.

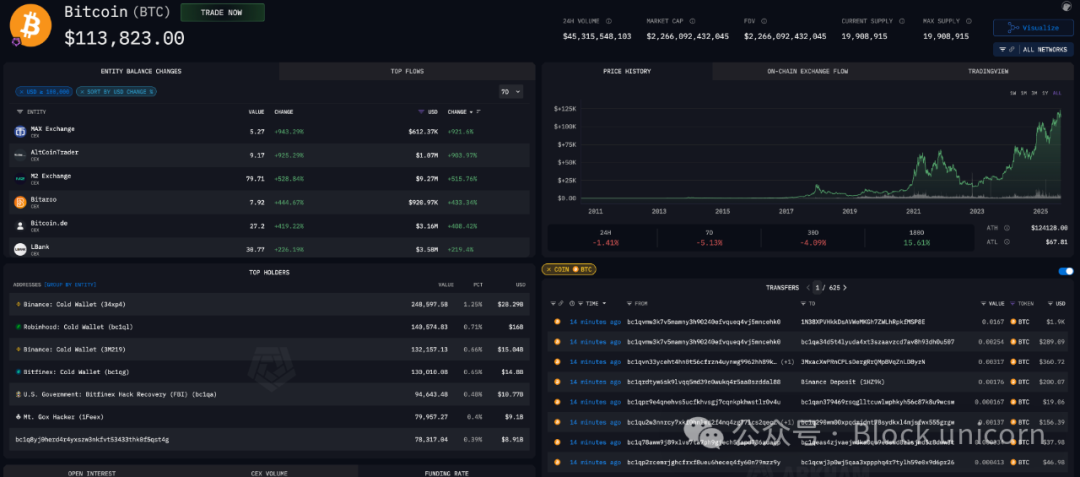

With Bitcoin’s price surging to around $124,000 in August 2025—reaching a market cap peak of $2.47 trillion—several Bitcoin billionaires and other wealthy holders have emerged. In this article, we will explore some of the individuals, companies, and wallets that have become major players in the cryptocurrency space based on on-chain data and public disclosures, along with the amount of Bitcoin they hold.

Note: Bitcoin prices fluctuate constantly, and the amount of Bitcoin held in specific wallets may change over time.

Summary

-

Satoshi Nakamoto is the largest Bitcoin holder, owning approximately 1.1 million BTC, valued at around $128 billion today.

-

Coinbase holds nearly 1 million BTC in total. BlackRock, Binance, and Strategy each hold over 600,000, 450,000, and 200,000 BTC respectively.

-

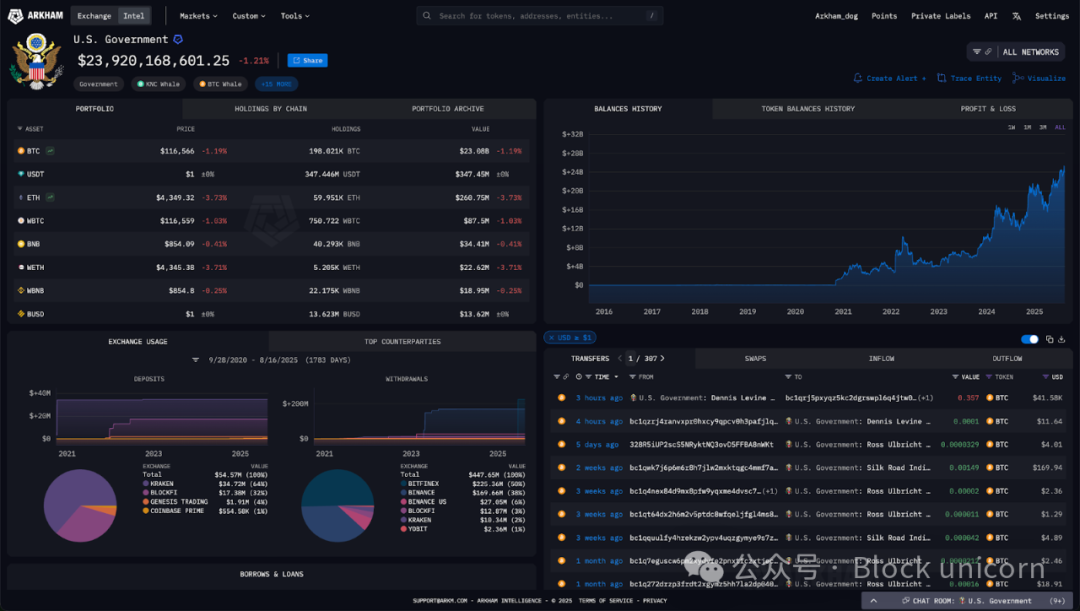

The U.S. government holds 198,000 BTC, seized from the Silk Road marketplace, James Zhong, and the Bitfinex hack.

-

There are multiple unknown Bitcoin billionaire wallets, most of which have remained inactive since Bitcoin was first deposited into them.

Largest Known Individual Holders

While many large Bitcoin holders remain unidentified, several have been revealed through public disclosures or research.

Satoshi Nakamoto, the anonymous creator of Bitcoin, is the largest individual holder, owning 1.1 million BTC distributed across 22,000 addresses. As the network’s first miner, he mined over 22,000 blocks between 2009 and 2010, earning 1.1 million BTC in block rewards. However, although it is speculated that these rewards were collected by a single entity, we cannot fully confirm Satoshi’s true identity.

Below is a known Satoshi address you can view on Arkham: 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.

The second-largest known individual Bitcoin holder is the LuBian hacker, who stole 127,426 BTC from LuBian in December 2020. At the time, this stash was worth $3.5 billion, but now exceeds $14.8 billion in value.

Gemini founders Tyler and Cameron Winklevoss disclosed in 2013 that they had purchased 1% of Bitcoin’s total supply at the time. This is estimated to be around 70,000 BTC. Currently, the Winklevoss twins hold 17,688 BTC, valued slightly above $2 billion.

Prominent venture capitalist Tim Draper bought 29,656 BTC for $18.7 million from the U.S. Marshals Service in 2014. Draper later purchased an additional 2,000 BTC during a second Bitcoin auction in December 2014. Arkham currently estimates Draper holds 33,806 BTC, worth $3.95 billion. Some of the largest addresses attributed to Draper include:

-

bc1qul68d3qeqhxa2kq8yrs0l85awu8v7hp2l3pdag

-

bc1qzmx9spvnkx3s78v03kswv4xtzp88tem5e5m08j

-

bc1q80h3q90uq0297wxv4rnx67mzcwanwp9pd489uf

(Full disclosure: Draper is one of Arkham’s investors through his firm Draper Associates)

Michael Saylor, co-founder of MicroStrategy, revealed in November 2021 that he personally owns 17,732 BTC. Known for his extremely bullish stance, Saylor has become a prominent figure in crypto culture. He maintains an active media presence on Twitter and other platforms, publicly advocating for Bitcoin’s philosophy.

Publicly Traded Companies Holding Bitcoin

As Bitcoin’s value as a digital asset gains recognition, public companies have begun incorporating Bitcoin into their investment strategies or corporate treasury diversification.

MicroStrategy, led by Michael Saylor, is the publicly traded company holding the most Bitcoin. The firm has been accumulating Bitcoin since August 2020, with its latest purchase in August 2025—430 BTC for $51.4 million—bringing its total holdings to 629,376 BTC (valued at $72.4 billion).

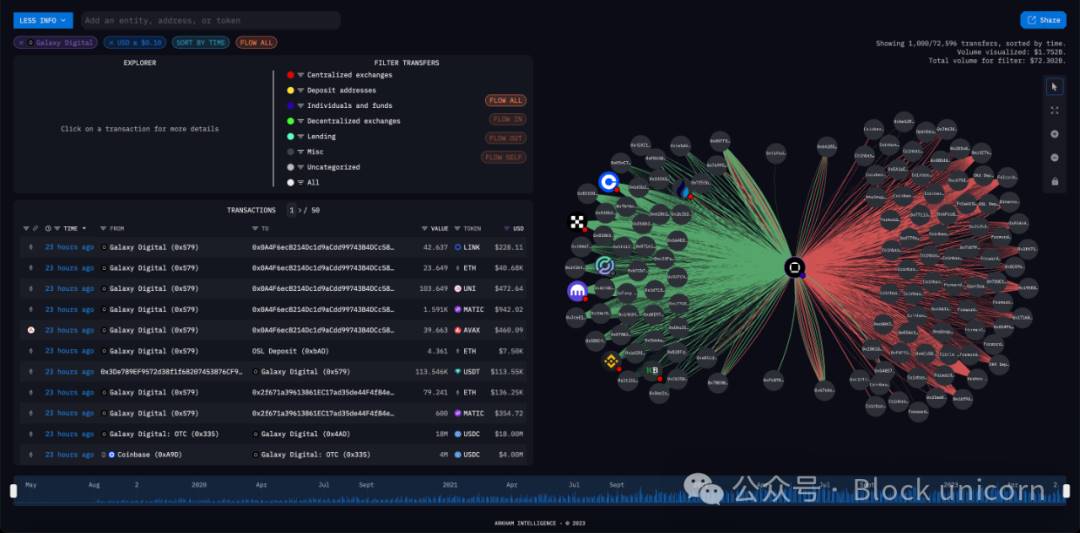

Galaxy Digital provides asset management, trading, and other institutional services. Founded by Mike Novogratz, Galaxy Digital reported holding $1.58 billion worth of Bitcoin according to its 2023–24 public filings. However, this figure does not account for any digital asset loan payables or collateral obligations.

Galaxy Digital's transactions in Arkham Visualizer

MARA is a North American publicly listed Bitcoin mining company and another major Bitcoin holder. It operates nine mining facilities, averaging 24.4 BTC mined per day. According to Arkham data, MARA’s on-chain wallets hold 16,975 BTC (worth $1.98 billion).

Tesla is reported to hold 10,700 BTC. This was initially disclosed in Tesla’s 10-K filing in February 2021, stating the company used 7.5% of its cash reserves to buy $1.5 billion worth of Bitcoin. The company initially said it would begin accepting Bitcoin as payment for its products but soon reversed the plan citing climate concerns. During the 2022 crypto market crash, Tesla sold 75% of its Bitcoin holdings in Q2 2022, incurring a $140 million loss. Since then, Tesla’s Bitcoin holdings have remained unchanged. Tesla currently holds 11,509 BTC, valued at $1.34 billion.

Finally, BlackRock and other ETF providers hold significant amounts of Bitcoin in their spot Bitcoin ETFs. BlackRock is the largest institutional asset manager holding Bitcoin, with 735,840 BTC, valued at $85.59 billion.

Private Companies Holding Bitcoin

Mt. Gox, a Japan-based Bitcoin exchange, shut down and filed for bankruptcy in 2014 after suffering a massive Bitcoin hack. Over the years, the appointed trustee has recovered some of the lost Bitcoin, most of which was returned to creditors in 2024. The Mt. Gox wallet currently holds 34,689 BTC, valued at $4.04 billion.

Tether, the issuer of the stablecoin USDT with a circulating supply of $83.4 billion, reported $1.48 billion in net profit in Q1 2021 and stated it would allocate 15% of its net realized operating profits to regular Bitcoin purchases starting in May. Tether currently holds 78,601 BTC, valued at $9.14 billion.

Exchange-Traded Funds and Trusts

Since the launch of spot Bitcoin ETFs in the U.S. in January 2024, on-chain holdings of ETFs include: BlackRock (735,840 BTC), Fidelity (14,000 BTC), Bitwise (40,780 BTC), Franklin Templeton (5,360 BTC), ARK Invest (43,990 BTC), Invesco (5,490 BTC), VanEck (17,090 BTC), Valkyrie (5,730 BTC), WisdomTree (13,420 BTC).

Grayscale, a subsidiary of Digital Currency Group, offers multiple products on public markets and custodies all its digital assets through Coinbase. While Grayscale publicly reports its Bitcoin balance, it refuses to disclose the on-chain addresses of its trusts—Arkham was able to identify these addresses, totaling 627,000 BTC spread across over 1,750 different addresses, each holding no more than 1,000 BTC. Grayscale currently holds 232,178 BTC, valued at $27.01 billion.

Which Government Holds the Most Bitcoin?

Unlike most nations that only seize Bitcoin through criminal arrests, El Salvador and the Central African Republic have boldly adopted Bitcoin as legal tender. El Salvador purchased 2,546 BTC for $108 million. Additionally, in November 2022, President Nayib Bukele announced the country would buy 1 BTC every day. El Salvador currently holds 6,272 BTC, valued at $729.62 million.

Since the Russia-Ukraine conflict began, Ukraine has received $22.8 million in Bitcoin donations. According to data reported by the Ukrainian government in April 2021, over 700,000 public officials declared ownership of Bitcoin, with some individuals holding up to 18,000 BTC. It is claimed that Ukrainian officials collectively hold 46,351 BTC. While these holdings technically do not belong to the government, the widespread and open declaration of Bitcoin ownership among civil servants remains highly significant and unusual.

Bhutan has been mining Bitcoin since 2019. In May 2023, Bhutan’s sovereign wealth fund, Druk Holding and Investments, announced a $500 million partnership with Bitdeer to expand its Bitcoin mining operations. Leveraging Bhutan’s geographical advantage, the country has built multiple hydroelectric power stations along its glacial rivers. It now uses its cheap and abundant hydropower to mine Bitcoin, reinvesting the profits into national development. Bhutan currently holds 9,969 BTC, valued at $1.16 billion.

Confiscations

However, in terms of confiscated Bitcoin, the United States leads with a wallet containing 198,022 BTC, valued at $23.04 billion. These Bitcoins were recovered by the FBI from the Bitfinex hack and seized from the Silk Road marketplace and Silk Road hacker James Zhong. Between 2014 and 2015, the U.S. government liquidated 173,998 BTC seized from Silk Road and 41,706 BTC seized from James Zhong via auctions conducted by the U.S. Marshals Service (USMS), earning $65.84 million and approximately $2.21 billion respectively.

The UK holds 61,245 BTC, valued at $7.13 billion. The Metropolitan Police seized 61,000 BTC from Jian Wen and Zhimin Qian in 2018 and gained access to these funds in July 2021.

In 2017, the Bulgarian government seized 213,519 BTC following a criminal crackdown. At the time, this represented 1% of the circulating supply and was worth $3.3 billion. Rumors circulated afterward that the government auctioned off all the seized Bitcoin in the following months, though it remains unclear whether this actually happened.

In November 2020, Chinese authorities confiscated 194,775 BTC from the operators of the PlusToken Ponzi scheme. These tokens were seized by local governments, but it is currently unknown whether China still holds these Bitcoins or has already sold them.

In July 2022, Finland liquidated 1,889 BTC that had been seized from criminal activities prior to 2018. The Finnish Customs still holds 90 BTC and an undisclosed amount of other tokens, which are currently awaiting court rulings.

Additionally, in January 2024, the German government seized 50,000 BTC from the pirated movie website Movie2k. However, these Bitcoins were fully sold off by July 2024.

Cryptocurrency Exchanges

Coinbase leads in exchange-held Bitcoin, with 974,400 BTC identified on-chain, valued at $113.4 billion (representing both its own holdings and customer funds under custody on Coinbase). Coinbase also invests part of its net income into crypto assets and holds a reserve of Bitcoin to meet customer withdrawal demands.

Binance and Upbit are also major exchange holders of Bitcoin, with 622,280 BTC and 170,800 BTC respectively. Exchange cold wallets hold customer deposits and typically do not represent ownership by the exchange itself. Together, Binance and Upbit hold over 4% of the Bitcoin circulating supply.

Largest Unidentified Whale Wallets

Besides cryptocurrency exchanges, there are numerous anonymous Bitcoin whale wallets holding large amounts of Bitcoin. These wallets vary in activity levels—some actively trade, while others have remained dormant for long periods, raising speculation about whether their owners still have access.

Among the top 10 wallets analyzed, 6 are inactive, while the remaining 4 have seen outflows since creation. Interestingly, 7 of the top 10 Bitcoin whale wallets were created after January 2018.

Below is a table of the largest unidentified Bitcoin holders, showing the amount of BTC held, percentage of circulating supply, wallet status, and observations.

Top Unidentified Whale Wallets Holding Over $1 Billion in Bitcoin

Conclusion

Bitcoin has evolved from a niche project among cryptography enthusiasts into a globally significant financial asset, held by numerous companies, individuals, and governments. Its strong appeal lies in its decentralized nature, ensuring no single party fully owns the Bitcoin network and making it nearly impossible for even the most determined attacker to take control.

Bitcoin’s maximum supply is capped at 21 million—a core design principle intended to ensure it remains a scarce asset, immune to inflationary issuance that could dilute its value. With an estimated 3.7 million BTC believed permanently lost in inaccessible wallets, the actual circulating supply is even lower.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News