Circle CEO: How Wild is the Prophet Who Put the Dollar "On-Chain"?

TechFlow Selected TechFlow Selected

Circle CEO: How Wild is the Prophet Who Put the Dollar "On-Chain"?

The person who built a business empire around cryptocurrency.

By: Thejaswini M A

Translation: Saoirse, Foresight News

"We are in the early stages of a disruptive technology that has the potential to transform the world as profoundly as the internet."

Jeremy Allaire has accurately predicted the future three times. The first was in 1990, when most people had never heard the word "internet," yet he already saw the transformative potential of the World Wide Web. That insight led to the creation of ColdFusion software, earning him millions.

The second time was in 2002, when he foresaw that anyone would be able to broadcast video content globally without relying on television networks. This vision gave rise to Brightcove, bringing him hundreds of millions of dollars.

The third time was in 2013, when he realized cryptocurrency could become the foundation of an entirely new financial system. That bet may permanently change how money works.

Now 54, Allaire has spent three decades building the invisible infrastructure underpinning the digital world. The USDC stablecoin he created processes trillions of dollars in transactions annually and has become a bridge between traditional finance and the crypto economy.

Yet for someone whose career is built on seeing what others miss, Allaire's work in shaping the future never stops.

A Decade of Network Awakening

In 1990, in a dorm room at Macalester College in Minnesota.

Allaire’s roommate did something nearly unthinkable. As a staff member of the school’s computer services department, he managed to connect their dorm to the internet. While most people thought “web” referred only to spider webs, Allaire was about to glimpse the future.

The moment he logged on for the first time, everything changed.

He said immediately, "This will change the world"—not a casual remark from a college student. By the time he graduated in 1993, the web had become his "primary passion."

Consider the context: when Allaire first encountered the internet, Netscape didn’t exist, Yahoo hadn’t been founded, and the term "cyberspace" was barely known. He had glimpsed the next chapter of human civilization.

But the foundation for this moment had been laid years earlier.

In 1984, in the Allaire family living room in Winona, Minnesota.

Thirteen-year-old Jeremy made a small request of his parents: lend him $5,000 to start a baseball card trading business. His father Jim, a psychologist, and mother Barb, a newspaper editor, understood people and information—but they were baffled by their son wanting to use a large sum to trade cardboard.

While other kids collected cards for fun, Jeremy took a different approach: he spotted market inefficiencies, pricing trends, and arbitrage opportunities.

In the end, he doubled his initial capital.

In 1993, fresh out of college, Jeremy was obsessed with the internet.

He faced a problem: almost no one understood what he was talking about. The internet? Most businesses had never heard of it. So he did the logical thing—he started his own company.

"Global Internet Vision" was born, offering consulting services to media publishers eager to understand this mysterious "web." But consulting wouldn't change the world.

In 1995, a conversation between Jeremy and his brother J.J. would either make them rich or bankrupt them.

They used J.J.'s $18,000 in savings to found Allaire Corporation—almost all the money they had.

The brothers complemented each other perfectly: J.J. handled programming and technology, while Jeremy focused on market needs. It was 1995—Netscape hadn’t yet monopolized browsers, and businesses hadn’t grasped the commercial potential of the web.

The launch of ColdFusion changed everything almost overnight. The software turned static web pages into interactive applications capable of connecting to databases, managing user accounts, and processing transactions.

Suddenly, companies like MySpace, Target, Toys "R" Us, Lockheed Martin, Boeing, and Intel could build dynamic websites without hiring armies of programmers. The software became the foundation of e-commerce, the backbone of content management, and an engine powering the dot-com boom.

Starting as a 12-person team in Minnesota, they quickly became profitable.

Realizing the web was growing faster than expected, they partnered with Boston-based Polaris Ventures, securing their first real funding round: $2.5 million.

When they tried to move to Silicon Valley, landlords rejected them for being "too small," so they moved to Boston instead. That rejection might have saved them. Boston's tech ecosystem offered resources and talent without Silicon Valley's self-centered culture.

Annual revenue soared from over $1 million in 1996 to around $120 million in 2000. The company grew to over 700 employees, with offices across North America, Europe, Asia, and Australia. In January 1999, they went public on Nasdaq—one of the early success stories proving internet software wasn't just hype.

March 2001, the call that tested everything.

Macromedia wanted to acquire Allaire Corporation—for $360 million.

At 29, Jeremy was about to become very wealthy.

He agreed. Jeremy and J.J. sold Allaire Corporation to Macromedia. Jeremy became Chief Technology Officer of the multimedia giant, while J.J. left the tech industry to pursue other interests.

The Video Revolution

In 2002, as CTO of Macromedia, Jeremy walked into a meeting with an idea that might unsettle his bosses.

He understood the data: Macromedia's Flash technology—the animation, video, and gaming engine driving early internet multimedia—was installed on 98% of computers worldwide, and broadband was spreading fast. Everything was falling into place.

He proposed Project Vista: a browser-based system for capturing, uploading, and publishing video, enabling anyone to become a broadcaster and reach a global audience.

Imagine YouTube—but years before Google even considered the idea of a video platform.

Macromedia executives listened politely, then rejected the project.

Jeremy watched his own company miss the future of media. The company that brought Flash—the core technology of early internet multimedia—to the world had just refused to enter online video, missing a key piece of the internet's evolution.

In February 2003, Jeremy resigned from Macromedia.

Colleagues thought he was crazy. Why leave everything behind—a high-paying job as CTO of a major tech company, overseeing important products?

Because he saw the future, and Macromedia wasn't going to build it.

Jeremy joined General Catalyst as an entrepreneur-in-residence. For a year, he studied markets, watched pieces fall into place, preparing to challenge the entire television industry. He was just waiting for the perfect moment.

In 2004, he co-founded Brightcove, with a vision to "create an environment where independent video creators could deliver content directly to consumers, bypassing traditional TV networks and channels."

Compared to his first company, Jeremy's strategy shifted: instead of bootstrapping with borrowed money, he decided to "raise venture capital immediately and scale fast." Challenging television required deep pockets and partnerships with major content producers.

The company's mission reflected Jeremy's deepening understanding of the democratizing power of internet technology. It proved he was right: content creators who couldn't afford TV networks suddenly had global distribution; independent filmmakers could reach audiences without begging media tycoons.

In 2012, Brightcove went public at a $290 million valuation, with Jeremy holding a 7.1% stake.

He successfully built a marketplace allowing thousands of creators to reach global audiences without pleading with TV networks, film studios, or media executives. But as Brightcove conquered online video, Jeremy stepped down from CEO in 2013, becoming chairman.

Why leave when things were going well? This was the second time. But Jeremy's eyes were already fixed on the next horizon.

The Currency Revolution

In 2013, Jeremy Allaire once again stared at a computer screen, just as he had 23 years earlier in a Minnesota dorm.

This time, he was studying something called Bitcoin.

The 2008 financial crisis had made him question everything about traditional banking. Lehman Brothers collapsed, Bear Stearns vanished, and the global financial system nearly failed. Jeremy wondered: was there a better way?

When he first encountered Bitcoin, the feeling was familiar—almost déjà vu. "I had exactly the same feeling about digital currency, particularly Bitcoin," he told Fortune magazine. "We are in the early stages of a disruptive technology that has the potential to transform the world as profoundly as the internet."

He saw what he described as a "universal system for moving money, akin to how HTTP is the foundation for moving information on the internet."

In October 2013, Jeremy co-founded Circle with Sean Neville.

Their vision: help create the world’s first global internet-native currency, built on open platforms and standards like Bitcoin.

Accel Partners and other top-tier VCs jumped in immediately. Everyone sensed this wasn’t just incremental improvement to existing financial services.

Jeremy wanted to create programmable money that could settle payments nearly instantly, at a fraction of the cost of traditional wire transfers. They weren’t trying to improve existing financial services—they aimed to create an entirely new category, operating globally without relying on the correspondent banking relationships that make international transfers slow and expensive.

But Circle’s early attempts at consumer-facing Bitcoin apps and exchanges weren’t very successful. The breakthrough came when Jeremy realized the problem wasn’t the technology—it was volatility.

2018: The Birth of USDC

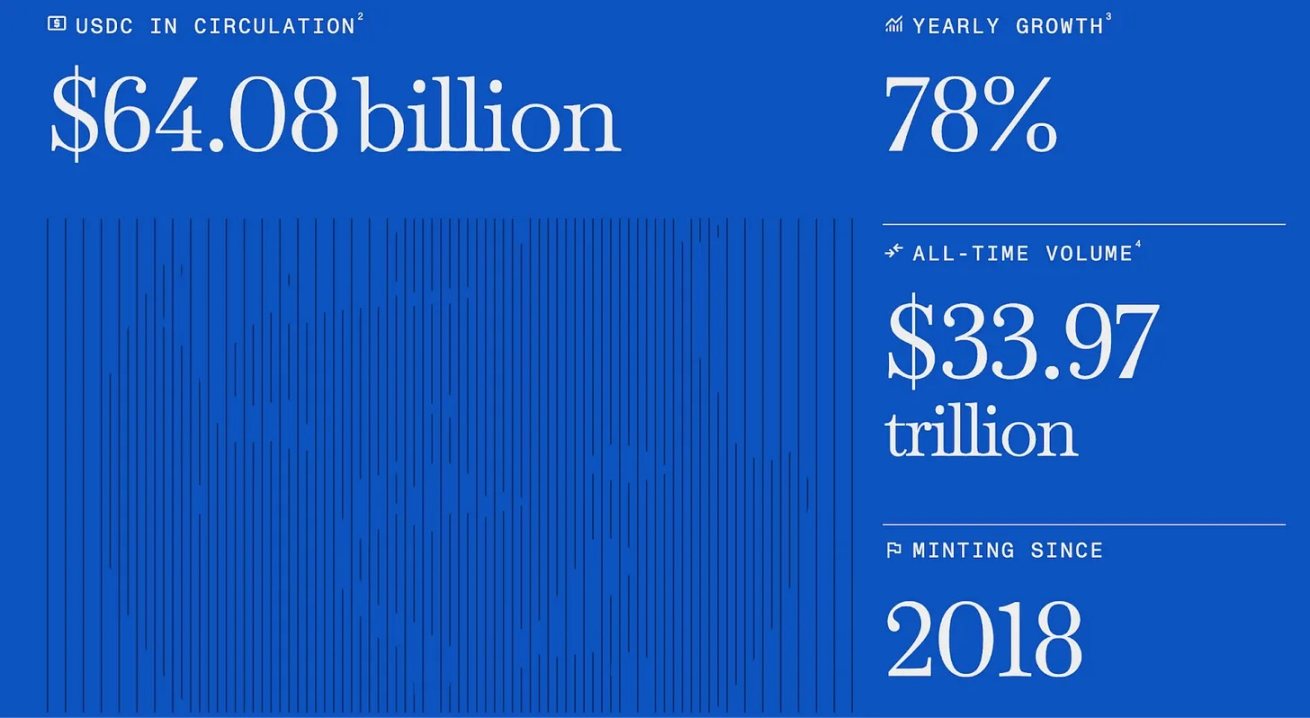

Through the Centre Consortium, partnering with Coinbase, Circle launched USD Coin (USDC)—a stablecoin backed by actual U.S. dollar reserves, with each USDC token pegged exactly to one dollar.

Now, businesses could enjoy the benefits of cryptocurrency—instant global transfers, 24/7 availability, programmable smart contracts—without enduring Bitcoin’s wild price swings.

Jeremy chose a risky regulatory path. Unlike many crypto firms operating in gray areas, Circle worked directly with financial regulators to ensure USDC met the highest standards of transparency and compliance.

This decision sometimes put Circle at a competitive disadvantage: other stablecoin issuers, less concerned with compliance, could move faster. But Jeremy was playing a longer game.

By 2025, USDC had become the second-largest stablecoin by market cap, with over $64 billion in circulation. Businesses used it for international payments, developers built financial applications on it, and individuals sent cross-border remittances instantly.

Jeremy’s success came after overcoming what industry observers called an "almost impossible distribution challenge." Unlike Tether, which gained widespread adoption through early partnerships with Asian crypto exchanges, Circle had to build its distribution network from scratch.

Circle’s solution: a strategic partnership with Coinbase. Circle agreed to pay Coinbase 50% of net interest income in exchange for distribution across its network.

Costly? Yes. Effective? Undoubtedly.

USDC became the primary Western alternative to Tether.

The Crisis Test

March 10, 2023, Dubai. This was supposed to be the weekend of Jeremy’s son’s 13th birthday.

At 2 a.m. local time, the phone calls began.

Silicon Valley Bank was collapsing—and Circle had $3.3 billion in USDC reserves held at the bank.

Within hours, USDC depegged, dropping to $0.87. Traders panicked. The stablecoin Jeremy had spent five years building seemed poised to become nearly worthless overnight.

Jeremy set up a virtual war room on Google Meet, working across an eight-hour time difference with teams on the East Coast. His son’s birthday party was forgotten—this was about protecting the funds of millions of users who trusted Circle.

Plan A: Immediately transfer funds to another bank.

Plan B: Rely on FDIC deposit insurance to cover any losses.

Plan C: Negotiate with firms willing to buy Circle’s SVB assets at a discount.

Under the watchful eyes of the entire crypto world, Jeremy made a personal commitment: if deposits at Silicon Valley Bank couldn’t be recovered, Circle would "make whole any shortfall."

The crisis tested every cornerstone of the reputation Jeremy had built: transparency, accountability, and the determination to do the right thing in hard times.

Circle published detailed blog posts explaining exactly what happened and what steps they were taking to protect customer assets.

Three days later, federal regulators guaranteed deposits at Silicon Valley Bank.

USDC regained its dollar peg. The crisis was over.

Jeremy proved Circle could withstand severe external shocks while maintaining customer trust. His choice to work with regulators—not against them—paid off at the most critical moment.

Throughout Circle’s journey, Jeremy positioned himself as the most prominent advocate in crypto for "clear regulatory frameworks." Many crypto entrepreneurs disagreed, favoring minimal oversight. But Jeremy testified before Congress, participated in regulatory working groups, and collaborated with global policymakers to shape crypto regulation.

In 2024, Circle became the first major global stablecoin issuer to comply with the EU’s Markets in Crypto-Assets Regulation (MiCA).

The strategy worked.

Then, Jeremy decided to take Circle public.

The road to IPO wasn’t smooth. An initial SPAC merger attempt in 2021 was not approved by the SEC. But Jeremy persisted.

In July 2025, Circle successfully listed on the New York Stock Exchange.

The IPO filing revealed a company with strong revenue, clear compliance, and massive scale. Circle’s public debut was valued at over $4.6 billion. Jeremy’s decade-long bet on stablecoins had delivered extraordinary returns.

Today, Circle trades under the ticker CRCL, with a market cap exceeding $40 billion. Since its July IPO, shares have risen over 430%, making it one of the most successful public market debuts in crypto history.

Jeremy believes stablecoins are approaching their "iPhone moment"—when technology becomes practical and easy enough to enable mass adoption.

The Genius Moment

On July 18, 2025, President Donald Trump signed a bill that validated Jeremy Allaire’s efforts over the past decade. The GENIUS Act became the first comprehensive U.S. stablecoin regulation. Jeremy’s push for compliance had positioned USDC perfectly.

The GENIUS Act did three things Jeremy had advocated for years: first, it confirmed stablecoins are not securities, eliminating long-standing regulatory uncertainty; second, it required stablecoins to be fully backed by safe assets like Treasury bonds, addressing reserve transparency; third, it placed stablecoin issuers under the same compliance framework as traditional banks.

Jeremy spent years building the infrastructure. Now, governments worldwide are scrambling to adapt to an inevitable world of programmable money.

The visionary who saw the web’s potential in 1990, foresaw video democratization in 2002, and recognized the crypto revolution in 2013 has just seen his third prediction redefine money itself.

In an industry obsessed with "move fast and break things," he has proven the most transformative changes often come from patience, persistence, and the wisdom to see what others overlook.

Three predictions. Three industries transformed. If his track record holds, even greater changes lie ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News