Hotcoin Research | Bitcoin Surpasses $120,000—Is the Altcoin Season Really Here This Time?

TechFlow Selected TechFlow Selected

Hotcoin Research | Bitcoin Surpasses $120,000—Is the Altcoin Season Really Here This Time?

The crypto market is currently in the early stage of transitioning from Bitcoin dominance to altcoins during a bull cycle.

1. Introduction

On July 14, Bitcoin's price surged past $120,000, reaching a new all-time high. At the same time, altcoins experienced a long-awaited broad rally. This market shift quickly sparked investor discussions about a potential "altcoin season." With rising expectations for Federal Reserve rate cuts, a macro policy shift toward easing, and continuous institutional capital inflows into Bitcoin and Ethereum, market risk appetite has clearly increased. However, Bitcoin's dominance remains high, the ETH/BTC ratio has not broken through key resistance levels, and capital flows show selective diffusion. Is the current altcoin rally a genuine signal of an emerging "altcoin season," or merely a short-term surge driven by capital flows?

This article provides a comprehensive in-depth analysis from multiple dimensions—macro environment and institutional investment trends, capital flows and index analysis, on-chain activity and ecosystem recovery, and shifts in market sentiment and热度—to help investors clarify the complex current market landscape through rigorous data interpretation. It also reviews and analyzes popular and promising sectors, aiming to help investors grasp opportunities and risks amid the chaotic market environment.

2. Macro-Level Analysis

1. Macro Environment Turning More Accommodative

Recently, the global macro environment continues tilting toward loosening, with favorable factors accumulating. First, the Fed’s monetary policy is turning more dovish: the minutes released in July showed increasing divergence between hawks and doves within the Fed, with Waller proposing a rate cut in July and Bowman supporting an earlier cut, though most officials still favor maintaining a wait-and-see stance. Federal funds futures indicate a roughly 65% probability of a rate cut in September, significantly higher than previous expectations. The Fed’s own economic projections have also shown an unusual split: 12 officials support a cumulative 50-basis-point rate cut by 2025, while seven back a 100-basis-point reduction. On one hand, the loose liquidity environment is lifting valuations of Bitcoin and crypto assets; on the other, persistently high rates make markets highly sensitive to the timing of rate cuts—once dovish signals are announced, Bitcoin’s upward momentum could intensify rapidly.

Recent easing of global trade tensions has also provided a friendlier macro backdrop for the crypto market. Additionally, geopolitical risks have somewhat subsided, reducing market sensitivity. Regulatory authorities in the U.S. have recently sent supportive signals: leadership changes at the SEC, progress on stablecoin legislation (GENIUS Act), proposals for a Bitcoin strategic reserve, and the White House releasing a digital asset policy blueprint—all reducing regulatory uncertainty and boosting investor confidence.

2. Institutional Capital Continues Inflowing

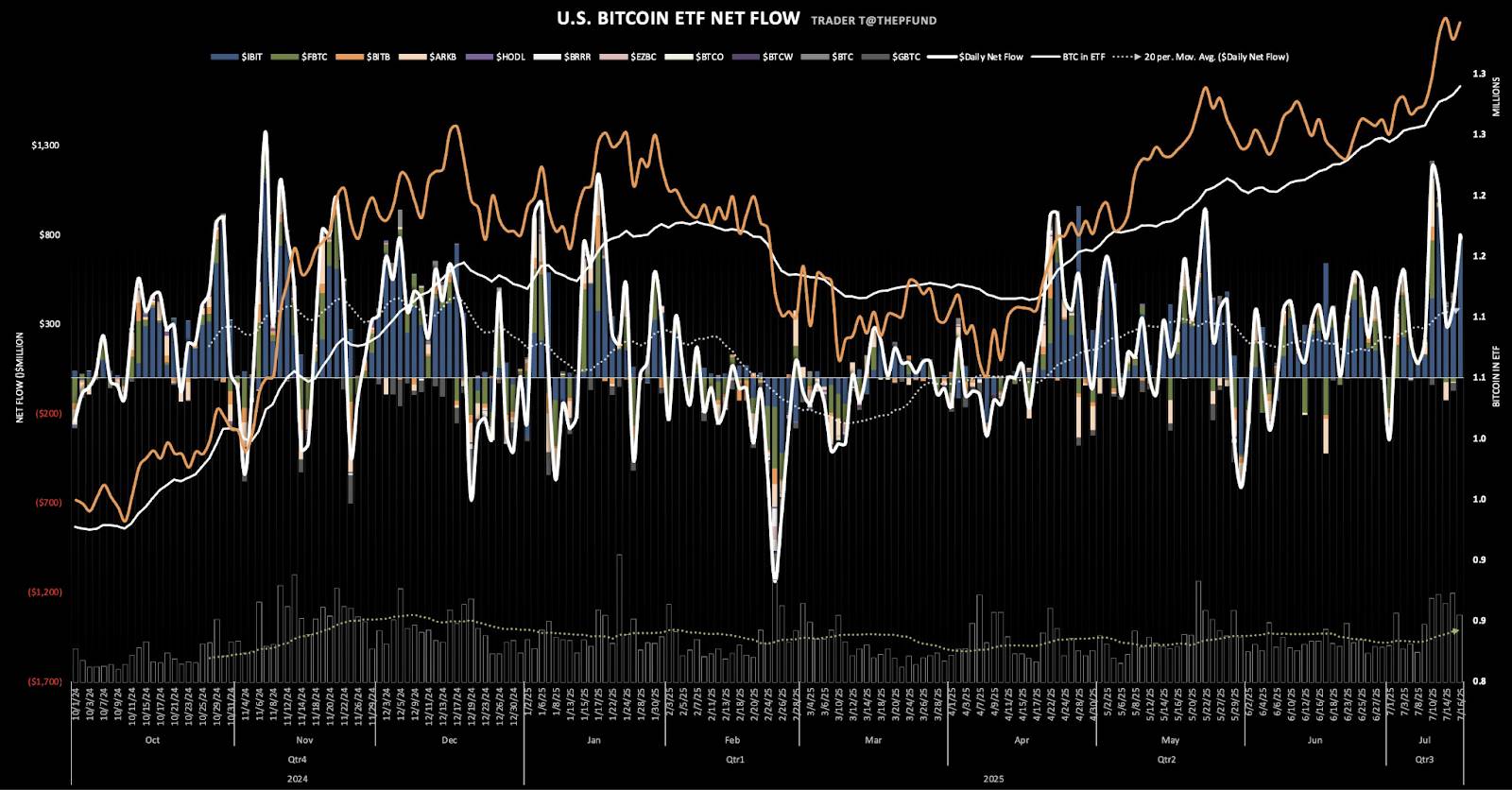

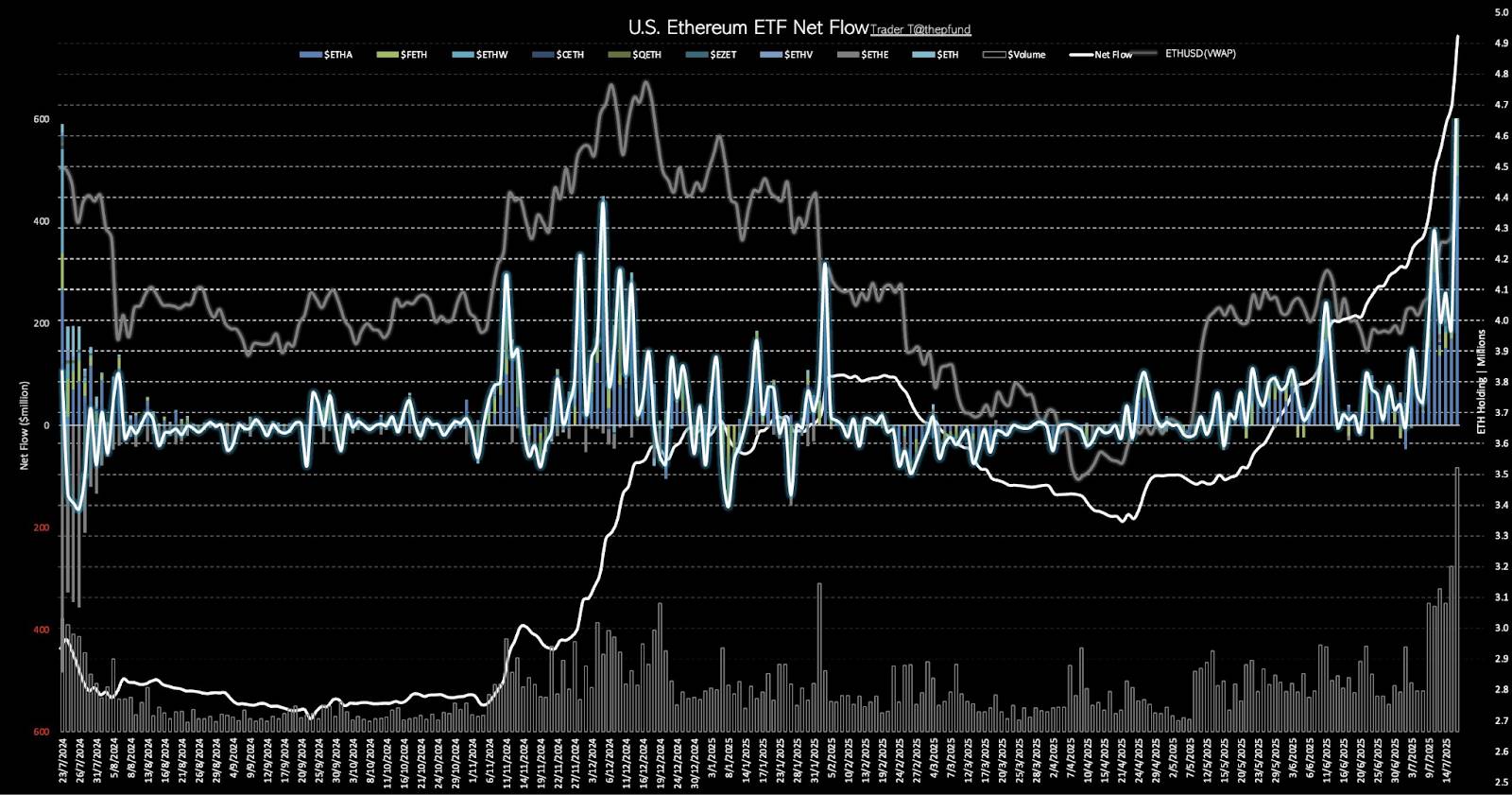

Sustained large-scale inflow of institutional capital is a major driver of market prosperity. Overall, institutional investment is gradually expanding beyond Bitcoin and Ethereum into other public chain assets. On July 16, spot Bitcoin ETFs recorded net inflows of $799.5 million, bringing total assets under management to $148.84 billion—the tenth consecutive day of net inflows. Spot Ethereum ETFs saw net inflows of $716.63 million, with assets reaching $13.25 billion—the ninth straight day of net inflows. Despite Ethereum’s spot price lagging behind Bitcoin since 2025, institutional capital is accelerating its entry via ETFs. As ETH reclaims the $3,000 level, the ETF accumulation effect becomes more evident, further fueling market sentiment around Ethereum and altcoins.

Source:https://x.com/thepfund

Beyond BTC and ETH, institutional capital is increasingly targeting other public chains. VanEck, Bitwise, and others have already submitted applications to the SEC for Solana spot ETFs. Grayscale, the largest crypto asset manager, has launched a trust product holding a basket of altcoins. On July 15, U.S.-based asset manager ProShares launched a 2x long Solana futures ETF (ticker: SLON) and a 2x long XRP futures ETF (UXRP), officially listed on NYSE Arca. This reflects growing mainstream investor attention and allocation toward major alt assets.

Some public companies are beginning to include crypto assets beyond Bitcoin on their balance sheets. On July 15, SharpLink Gaming (Nasdaq: SBET) held 296,508 ETH worth approximately $997 million, surpassing the Ethereum Foundation to become the world’s largest corporate holder of ETH, earning it the nickname “the MicroStrategy of Ethereum.” The number of institutions holding over 100,000 ETH has risen to seven: SharpLink Gaming (280,600 ETH), Ethereum Foundation (241,500 ETH), PulseChain Sac (166,300 ETH), Bitmine Immersion (163,100 ETH), Coinbase (137,300 ETH), Golem Foundation (101,200 ETH), and Bit Digital (100,600 ETH).

In addition, “SOL’s version of MicroStrategy,” DeFi Development Corp, now holds 640,585 SOL and equivalent assets valued at $98.1 million. Starting July 17, SRM Entertainment officially changed its name to Tron Inc., switching its stock ticker from “SRM” to “TRON.” Tron previously announced it would go public via reverse merger and launch a TRX strategic reserve, with SRM staking all its TRX holdings to earn staking rewards.

3. Capital Flows and Index Analysis

1. Bitcoin Dominance

Bitcoin dominance (BTC Dominance) measures Bitcoin’s market cap as a percentage of the total crypto market cap. A peak and subsequent decline in Bitcoin’s share is one of the classic signs of an impending "altcoin season." On July 14, Bitcoin hit a new high above $120,000, yet Bitcoin dominance showed a downward trend, currently at 62.88%, still historically high. Sustained high dominance indicates Bitcoin has absorbed substantial new capital, meaning altcoins have not yet gained broad popularity. Only when this ratio declines significantly—signaling capital rotation from Bitcoin to smaller-cap assets—will clear signs of an altcoin season emerge.

Source:https://www.tradingview.com/symbols/BTC.D

2. ETH/BTC Ratio

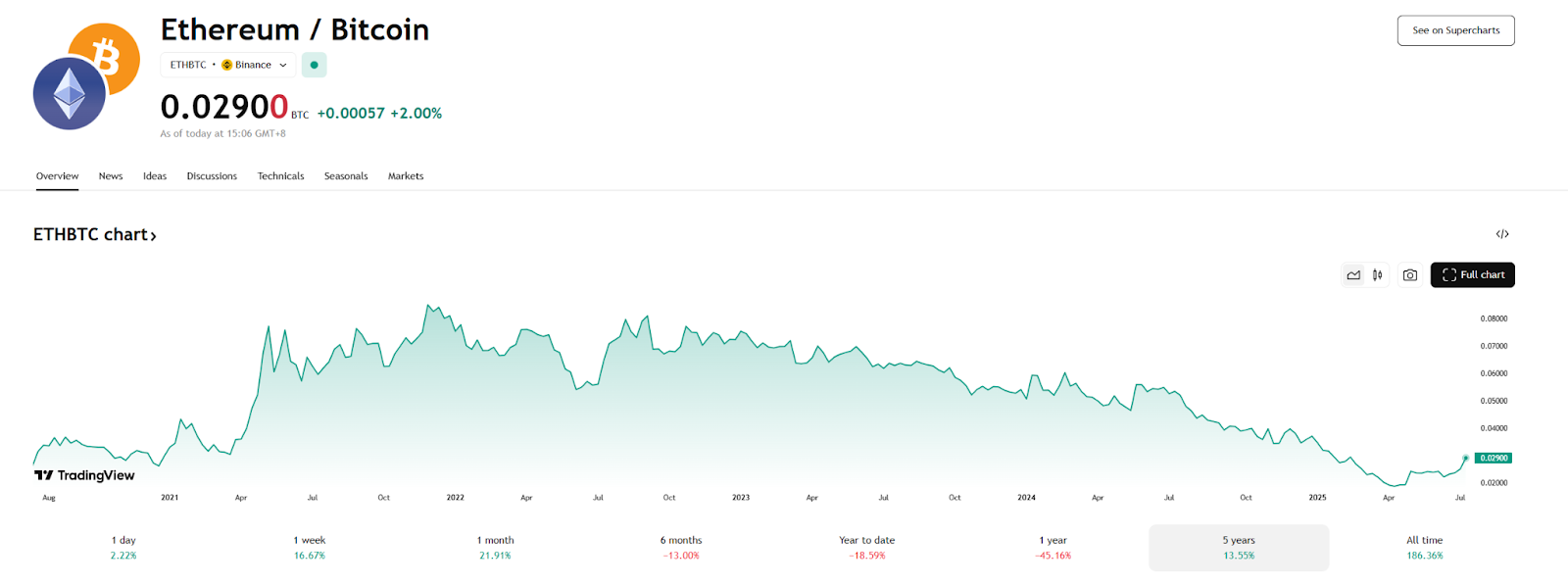

The ETH/BTC ratio reflects Ethereum’s relative performance against Bitcoin and is seen as a leading indicator of altcoin capital flows. An uptick in this ratio often signals the beginning of capital inflows into altcoins. If the ratio sustains upward movement, it suggests more capital is shifting from Bitcoin to Ethereum and other altcoins, providing strong support for an altcoin bull run. Currently, the ETH/BTC ratio is trending upward, indicating accelerating capital inflows into Ethereum. The ratio has rebounded from a Q1 low of 0.017 to 0.029. Technically, some analysts note that if the ETH/BTC ratio can decisively break above 0.03, it may signal a shift in market risk appetite from Bitcoin to Ethereum and altcoins, potentially triggering a new wave of altcoin rallies and reigniting broader altcoin market activity.

Source:https://www.tradingview.com/symbols/ETHBTC/

3. Altcoin Season Index

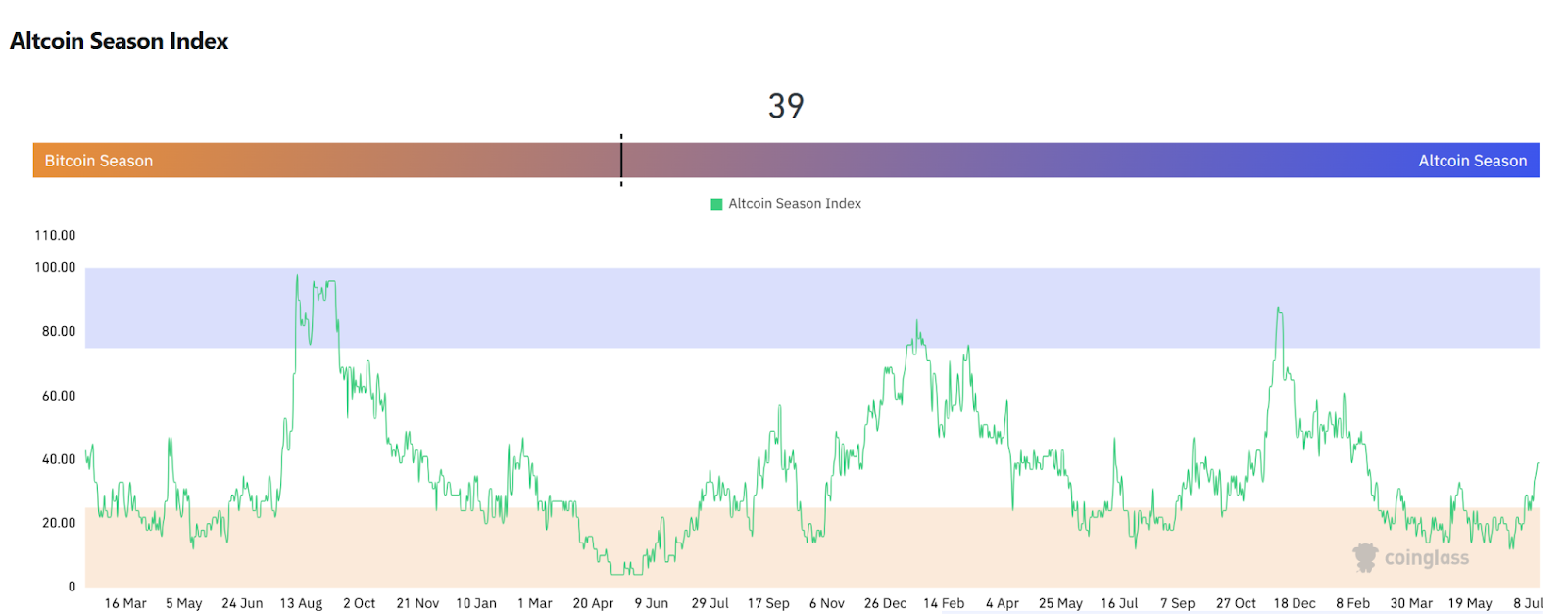

The Altcoin Season Index measures whether non-Bitcoin assets (altcoins) have collectively outperformed Bitcoin over the past 90 days. According to CoinMarketCap’s methodology, an "altcoin season" is recognized when at least 75% of the top 100 cryptocurrencies (excluding stablecoins) outperform Bitcoin; if 25% or fewer beat Bitcoin, it's considered a "Bitcoin season." The Altcoin Season Index has recently warmed up again: after dropping to around 15 in mid-June, it began rebounding rapidly in July and has now reached 39. Calculated based on the proportion of altcoins outperforming Bitcoin over the past 90 days, the current figure indicates nearly 40% of major coins are performing better than BTC, suggesting growing altcoin market activity.

Source:https://www.coinglass.com/pro/i/alt-coin-season

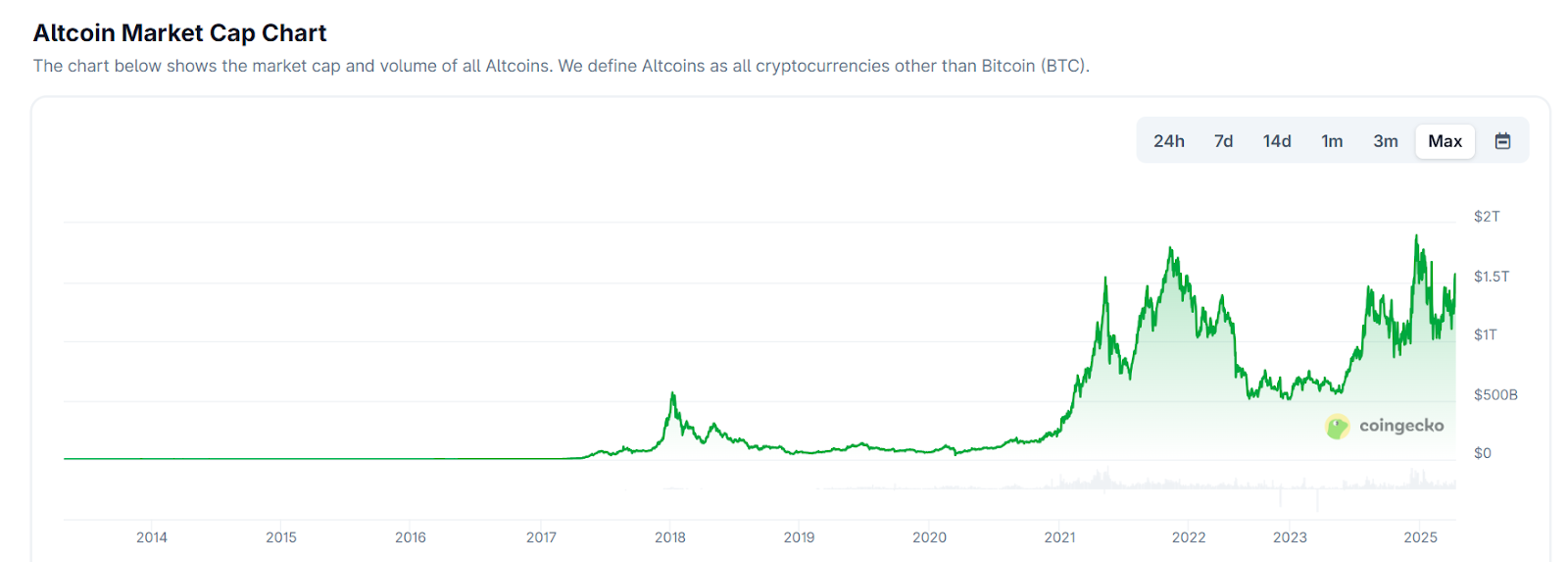

4. Altcoin Market Share and Trading Volume

According to CoinGecko data, the overall crypto market’s 24-hour trading volume is approximately $243.7 billion, with Bitcoin accounting for about 21%, Ethereum 17.5%, and other tokens around 61.5%, marking a significant increase in volume share. This is mainly due to Ethereum’s strong rebound and major altcoins being at relatively low levels after prolonged declines, coupled with renewed narratives sparking “bottom-fishing” behavior. Notably, while altcoin relative trading volume has risen, the rally is not universal but rather shows selective rotation among hot themes. Current capital flows reflect a pattern of “actively seeking the next narrative and blue-chip projects” rather than “embracing all altcoins broadly.”

Source:https://www.coingecko.com/en/global-charts

4. On-Chain Activity and Ecosystem Recovery

1. On-Chain Activity

On-chain activity metrics (such as daily active addresses and transaction counts) reflect network usage and user engagement. Data shows recent notable recovery in on-chain activity. Ethereum reclaimed the top spot in June for gas fee revenue, while Solana continues leading in activity rankings, recording over 29.7 billion transactions in June (about 4.8 million daily active addresses on average), far exceeding Ethereum and Bitcoin.

As of July 17, 2025, Ethereum’s daily active ERC-20 addresses were around 510,000, up approximately 50.8% year-on-year. This significant growth reflects increased user and application adoption of the Ethereum network. Meanwhile, the DApp ecosystem remains vibrant, with daily unique active wallets (dUAW) rising to 25 million, up 8% month-on-month. DeFi TVL and NFT trading volume surged 25% and 40% respectively, further confirming an overall rise in on-chain user activity. These data suggest that both capital and user participation are heating up across the on-chain ecosystem, laying the foundation for altcoin rotation.

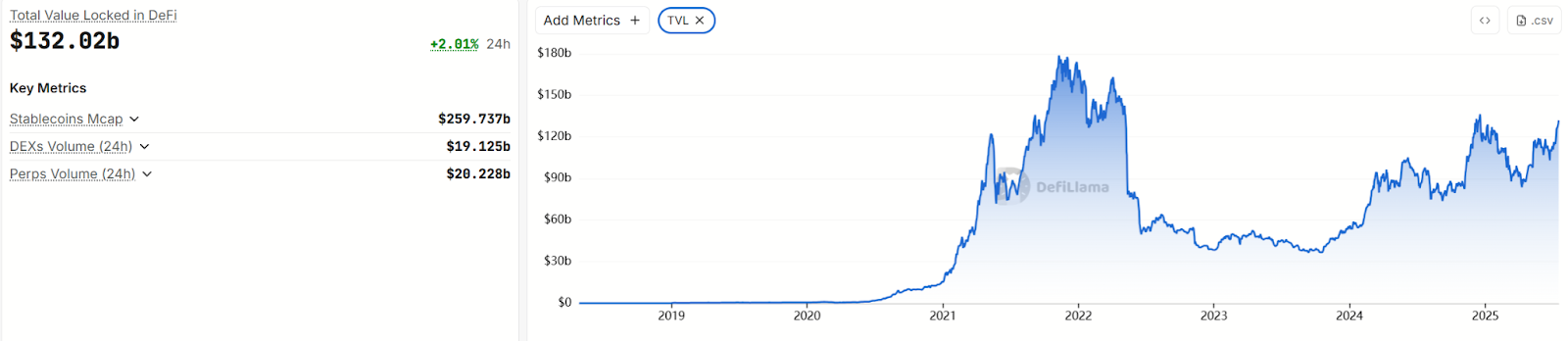

2. DeFi TVL (Total Value Locked)

DeFi TVL is rebounding, with Ethereum’s 40% price surge driving TVL spikes across many protocols—top-tier protocols like Aave seeing around 20% month-on-month growth. Lido and EigenLayer remain volatile but maintain substantial locked value. On the Layer-2 front, Base is rapidly rising, recording 292 million cumulative transactions in June and averaging about 1.71 million daily active addresses. Arbitrum (ARB) and Optimism (OP), leaders in Ethereum’s Layer-2 space, continue benefiting from ongoing narrative momentum. Although ARB hasn’t approached last year’s highs, it’s receiving funding support for revitalizing DeFi applications. Chainlink (LINK) benefits from recovering oracle demand, strengthening its position in data markets. Aptos (APT) sees significant community growth, with its price rising to about $5.90, indicating a revival of DeFi ecosystem vitality and renewed capital inflows.

As of July 17, the total value locked (TVL) in the DeFi market has grown from $89 billion at the start of the year to around $132 billion in June, particularly with innovative projects and new financial protocols attracting capital.

Source:https://www.coingecko.com/en/global-charts

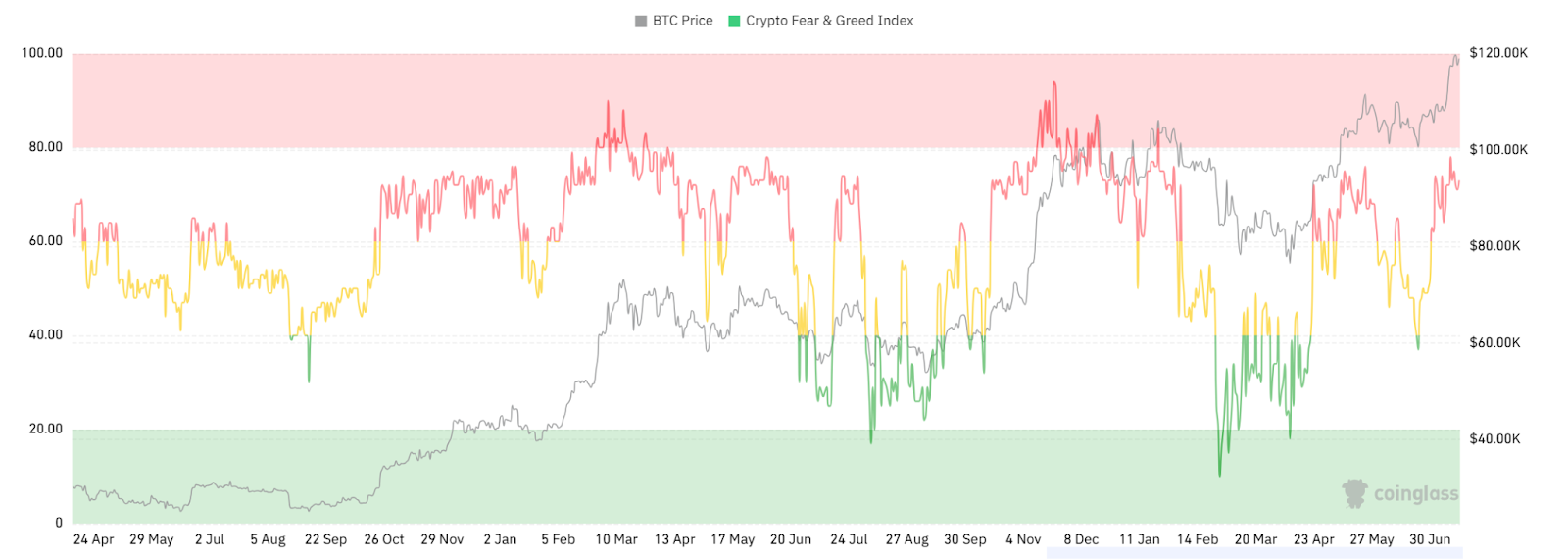

5. Market Sentiment and Heat Indicators

Market sentiment often foreshadows capital rotation. The Fear & Greed Index is a common gauge of overall market mood. By mid-July, market sentiment turned clearly optimistic, with FOMO building among investors. Since July, the Crypto Fear & Greed Index has remained elevated, climbing steadily into the “greedy” zone above 70.

Source:https://www.coinglass.com/pro/i/FearGreedIndex

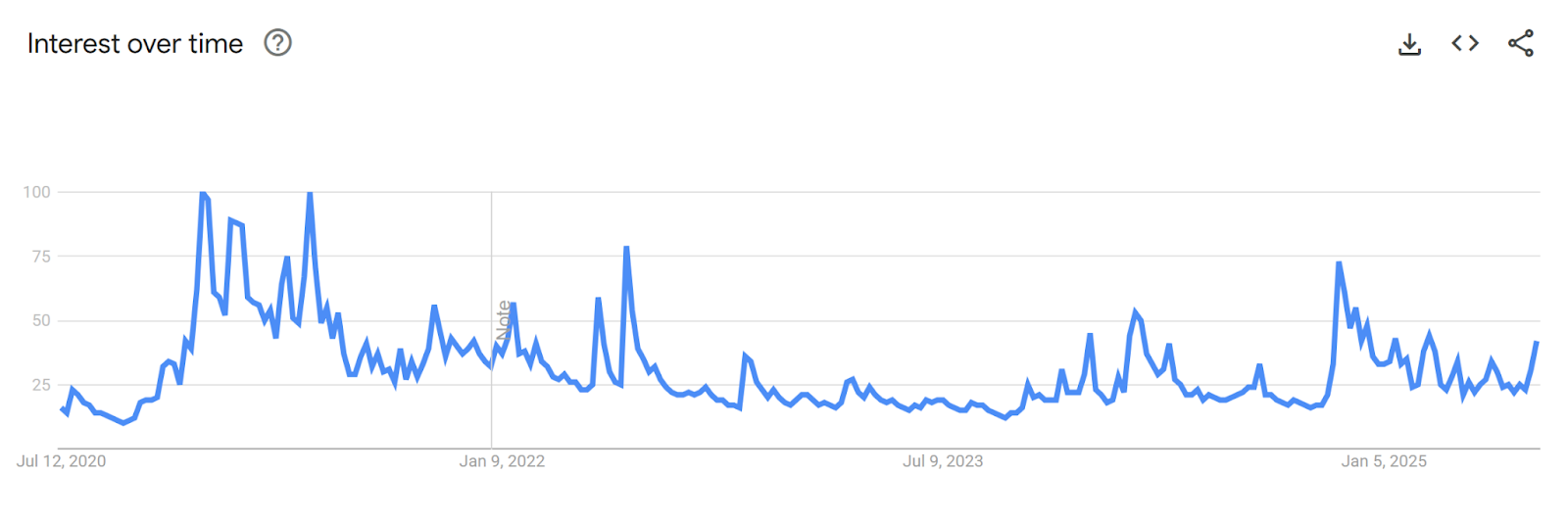

Compared to price gains, public attention remains relatively modest. Google Trends shows that despite Bitcoin hitting new highs, search interest is far below the peaks of the 2017 and 2021 bull markets. This implies that while capital is flooding in, retail and general public enthusiasm is still developing. Discussion热度 for altcoins on social platforms like X remains subdued, lacking explosive topics. Overall, while there’s clear FOMO sentiment, caution persists. Although Google Trends show Bitcoin-related searches haven’t reached prior highs, altcoin-related queries have increased, suggesting retail attention is gradually shifting from Bitcoin to a broader range of altcoins.

Source:https://trends.google.com/trends/

6. Review of Popular and Promising Altcoin Sectors

- Meme: CoinGecko data shows the total market cap of meme coins is about $78.9 billion, with an average 7-day gain of 25%. Leading projects include DOGE, SHIB, PEPE, BONK, TRUMP, PUMP, and PENGU. Narratively, cat-and-dog themed and frog-themed meme coins have broad community bases, while newer memes like TRUMP, PENGU, and USELESS leverage celebrity associations, NFT/IP links, and hype around Launchpad ecosystems. Overall, the meme sector remains cyclical and highly volatile.

- Emerging Layer1: Layer1 focus is on scalability upgrades such as Solana, BNB, and Hyperliquid expansion plans, as well as ecosystem incentives from public chains like Sui, Berachain, and Sonic driving capital inflows. Progress in performance, security, and app ecosystems across major chains is also critical. Overall, Layer1 maintains a solid position, leaning toward long-term ecosystem development.

- Layer2 Ecosystem: Layer2 focuses on Ethereum scaling, with leading projects including Mantle, Arbitrum, Polygon, Stacks, Optimism, Immutable X, Starknet, and zkSync. Layer2 benefits from scalability narratives, with high热度 around ecosystem testnets and airdrop expectations. Projects are advancing functionality and cross-chain interoperability—for example, Arbitrum expanding its ecosystem apps, Optimism launching new network initiatives. Overall, if the “cross-chain interoperability + airdrops” theme continues, this sector will remain relevant in H2, though risks of market saturation in Layer2 demand should be monitored.

- LSD/Restaking: With ETH price recovery, staking and restaking sectors continue heating up. Tokens like LDO, EIGEN, BABY, and ETHFI have started rebounding recently. LSD protocols are launching new products—Pendle advancing V2 scaling and entering traditional finance. Overall, LSD/restaking relies on PoS Ethereum, with a solid ecosystem base, retaining strong capital-attracting potential in H2.

- RWA: RWA has recently drawn institutional attention. Key projects include Ondo, Centrifuge (CFG), Goldfinch (GFI), TrueFi (TRU), Maker (MKR), and Reserve Rights (RSR). For example, Ondo focuses on tokenizing government bonds and credit assets, with its U.S. Treasury tokenization pool (OUSG/USDY) currently holding around $1.4 billion in TVL. It recently partnered with Pantera to launch a $250 million fund targeting RWA projects. Centrifuge is also expanding into off-chain collateralized assets. RWA discussions are gaining traction on social media, with growing collaboration between institutions and project teams. Fundamentally, regulatory compliance and yields from off-chain assets are driving this sector, with MakerDAO actively adding RWA-backed collateral. Overall, RWA is backed by real-world assets, offering stable returns and institutional appeal. As compliance advances and asset tokenization progresses, this sector is poised to attract more capital in H2.

- AI: The AI sector thrives on hot narratives like generative AI and smart contracts. Leading projects include ICP, FET, and VIRTUAL, which have recently seen technical rebounds. Google search interest in “AI Agents” has surged 320% year-on-year, boosting market话题for AI tokens. The global AI wave is elevating interest in AI-linked cryptos, especially when major tech firms enter crypto-AI projects, often triggering capital inflows. Overall, the AI sector is strongly driven by macro themes and remains a popular investment area. If AI applications continue to explode in H2, representative projects could see significant upside potential.

7. Conclusion and Recommendations

Based on the above indicators, the crypto market is currently in the early phase of transitioning from Bitcoin-led to altcoin-driven within the bull cycle. Loose liquidity, favorable regulation, and institutional buying provide solid external support. The Fear & Greed Index has reached “extreme greed,” reflecting strong market optimism. The ETH/BTC ratio and ETH’s price gains are clearly outpacing Bitcoin. Most major altcoins have outperformed BTC in the short term. DeFi TVL, stablecoin supply, and on-chain activity are all trending upward. All these suggest that as market sentiment improves and macro conditions turn favorable, demand for altcoin allocation is gathering momentum.

However, Bitcoin’s market share remains high, and the ETH/BTC ratio has yet to achieve a clear technical breakout. Capital rotation shows a selective, “point-to-point” pattern, lacking the broad-based euphoria seen in full altcoin seasons. This implies the current rally is more likely a “partial altcoin rise” led by large-cap and hot-theme assets, rather than a widespread speculative frenzy. Therefore, from a trend perspective, the current altcoin market appears to be in the early stages of a substantive upswing.

Looking ahead, if the accommodative cycle and institutional inflows persist and the macro environment stabilizes further, the overall crypto market should remain in an upward trajectory, with the H2 bull wave likely not over. Current signals across various market dimensions are numerous and positive, showing early signs of an emerging “alt season.” Investors may moderately focus on competitive alt assets while closely monitoring market movements and key indicators, staying alert to pullback risks amid extreme sentiment. During this transitional period before trends fully clarify, maintaining flexibility, cautious diversification, and dynamic portfolio adjustments will help capture opportunities and manage risks.

About Us

Hotcoin Research, as the core research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We offer a three-pillar service system of "trend analysis + value discovery + real-time tracking," delivering precise market interpretations and practical strategies through deep dives into industry trends, multi-dimensional evaluation of promising projects, and round-the-clock market volatility monitoring. Supported by weekly dual broadcasts of our strategy livestream "Top Coins Selection" and daily news briefings "Blockchain Headlines," we serve investors at all levels. Leveraging advanced data analytics models and an extensive industry network, we empower novice investors to build cognitive frameworks and help professional institutions capture alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing inherently carries risks. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News