Jupiter Studio, a new launchpad platform, goes live, sparking on-chain market activity on its first day

TechFlow Selected TechFlow Selected

Jupiter Studio, a new launchpad platform, goes live, sparking on-chain market activity on its first day

The platform's 24-hour trading volume approaches $100 million, with multiple projects surpassing a market cap of $1 million.

By Asher, Odaily Planet Daily

Yesterday, Jupiter, a leading protocol in the Solana ecosystem, launched its own Launchpad platform—Jupiter Studio. This move represents not just an iteration and upgrade over the "Pump.fun-style token launch model," but more like Jupiter's attempt to leverage its built-in liquidity and protocol access to create an “on-chain project factory” of its own.

Below, Odaily Planet Daily walks you through the Jupiter Studio platform and examines the performance of tokens created on it.

Jupiter Studio Token Creation Features

For users planning to create tokens on Jupiter Studio, no upfront capital deposit is required—they only need to pay gas fees to initiate the creation process.

Creator Benefits

By using Jupiter Studio to launch a token, creators are entitled to the following incentives:

-

Trading fee revenue: Creators receive 50% of all swap trading fees, including those generated during both the bonding phase and after graduation;

-

Liquidity Pool (LP) lock share: One year after the project graduates, creators gain ownership of 50% of the liquidity pool, ensuring long-term incentives;

-

Token allocation: Creators can choose to allocate 0% to 80% of the total token supply (with a fixed total supply of 100 million tokens) to support team development and ongoing operations.

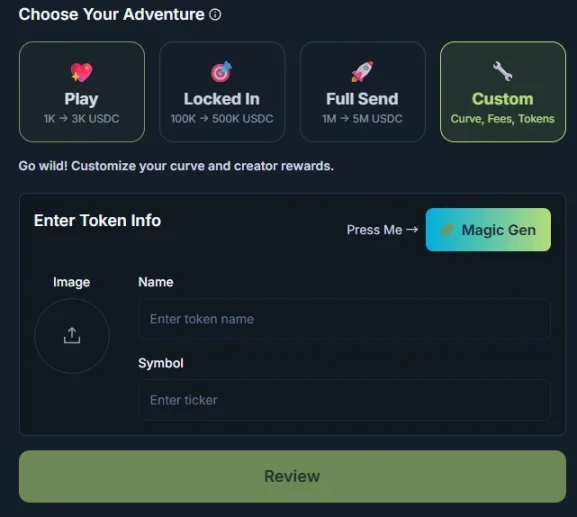

Preset Options and Customizable Parameters

As shown in the image below, Jupiter Studio offers three preset modes to simplify token creation: Play (initial market cap of 1,000 USDC, enters Meteora pool when reaching 3,000 USDC), Locked In (initial market cap of 100,000 USDC, enters Meteora pool at 500,000 USDC), and Full Send (initial market cap of 1 million USDC, enters Meteora pool at 3 million USDC).

In addition, Jupiter Studio supports custom configuration of key parameters for flexible tuning of a project’s tokenomics, including:

-

Starting Market Cap: Set the project’s initial valuation to determine the starting token price;

-

Graduation Market Cap: Once this threshold is reached, the system automatically migrates and locks liquidity into a Meteora liquidity pool (the lower the graduation threshold, the sooner liquidity can be secured and graduation achieved);

-

Vesting Schedule: Creators can choose immediate unlock upon graduation or linear monthly unlocking over 6 or 12 months;

-

Unlock Period: Optional 6-month or 12-month vesting periods.

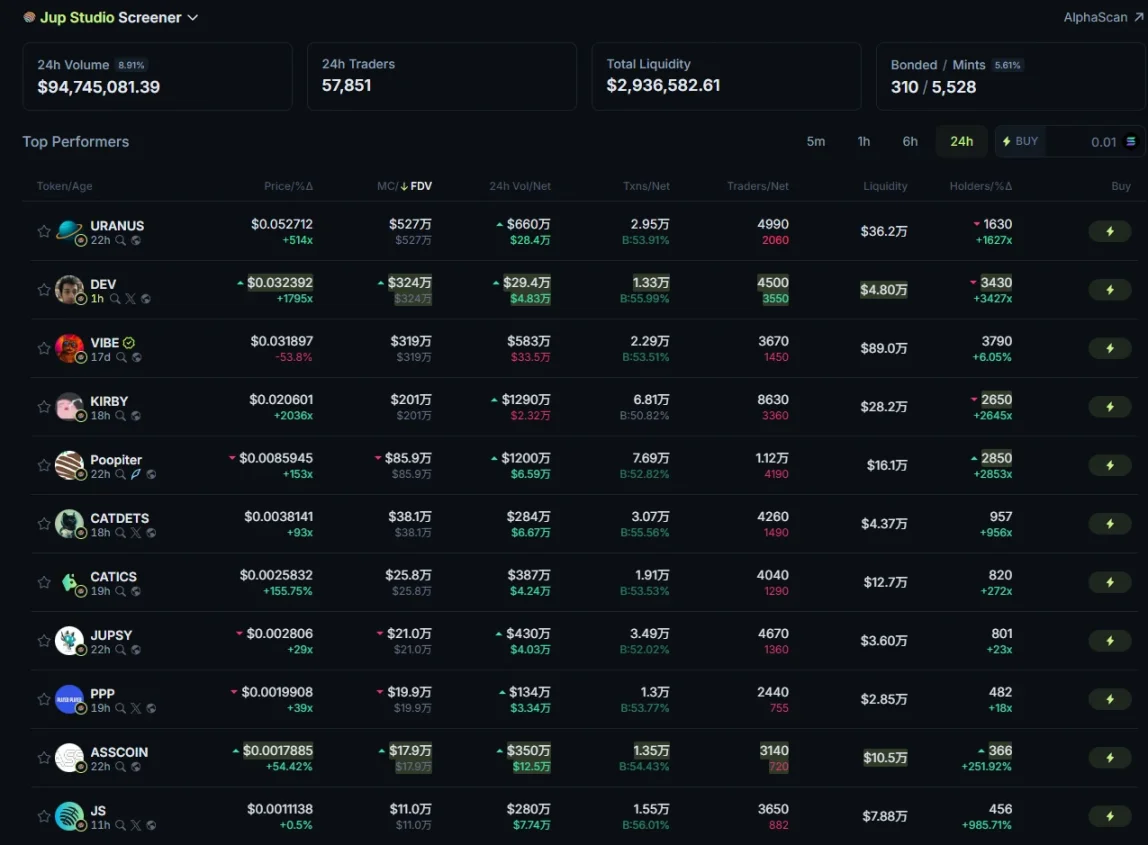

Platform Hits Nearly $100M in 24-Hour Volume; Multiple Tokens Surpass $1M Market Cap

Despite the current overall slowdown in on-chain trading activity, Jupiter Studio delivered results far exceeding market expectations on its first day—significantly outperforming other recent popular Launchpad platforms. Compared to Genesis, launched by AI agent leader Virtuals, and auto.fun backed by a16z, Jupiter Studio has taken a clear lead in both user engagement and token performance.

According to Jupiter Studio Screener data, at the time of writing, the total trading volume across all tokens created on the platform exceeded $94.7 million, demonstrating strong liquidity and market interest. Additionally, the total liquidity locked in these token pools approaches $3 million and continues to grow.

Meanwhile, several projects surpassed a $1 million market cap within less than 24 hours of launch. So far, four projects have crossed the $1 million mark. Among them, URANUS—driven by a strong community, high engagement, and meme culture—has surpassed $5 million in market cap, making it the top-performing new token on the platform. DEV and VIBE have each surpassed $3 million, while KIRBY has exceeded $2 million.

Data from Jupiter Studio Screener

Overall, Jupiter Studio has made a solid debut. However, whether it can truly ignite a new wave of on-chain momentum depends on whether any project can rapidly scale into tens of millions—or even surpass $100 million—in market cap in the near term. Such milestones will be key indicators of the platform’s ability to drive broader market rallies. While overall market liquidity remains insufficient to support a full-blown “alt season,” there is hope that Jupiter can leverage its traffic to deliver more sustained profit opportunities for on-chain participants.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News