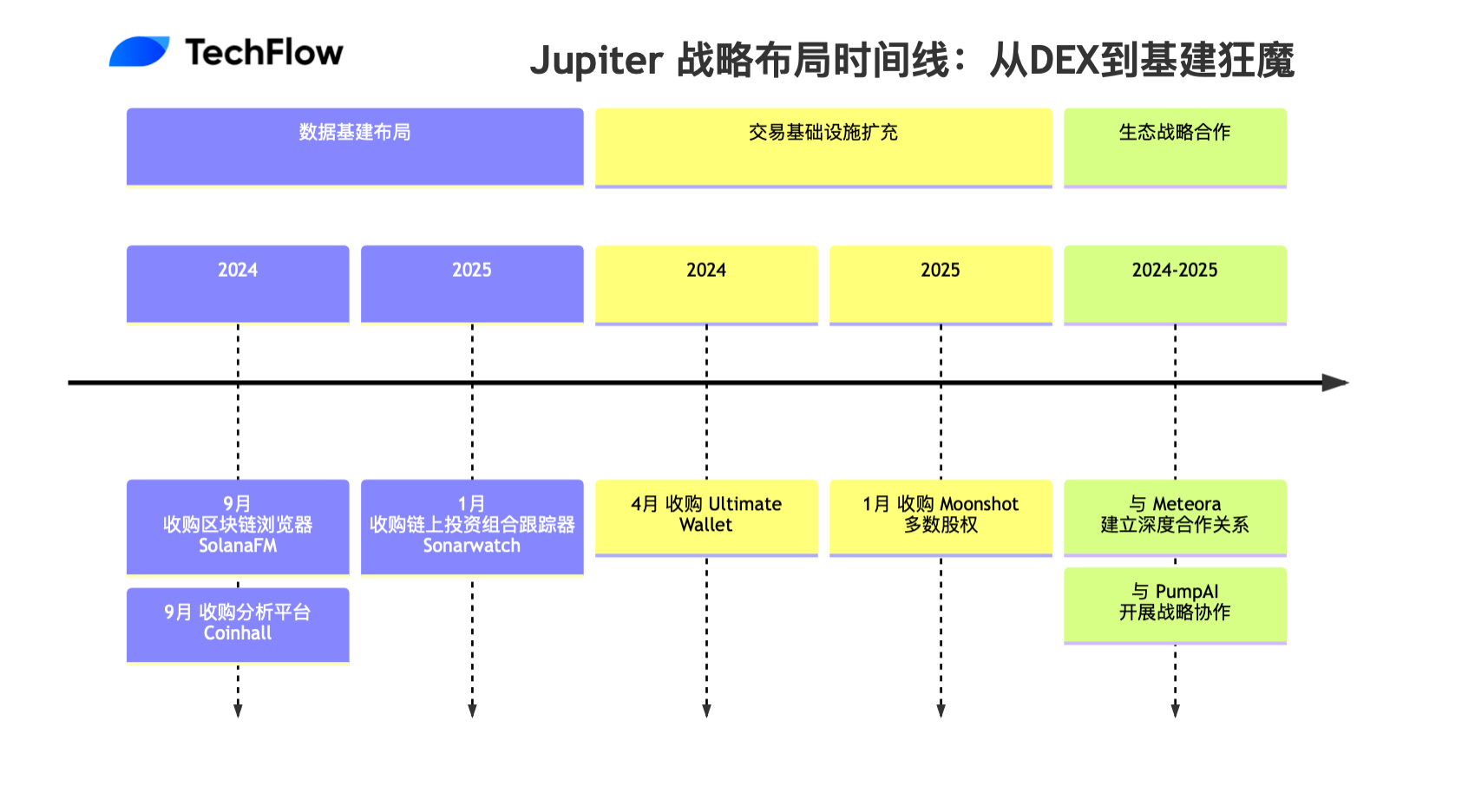

Recapping Jupiter's Acquisition Timeline: From DEX to Infrastructure Ambitions

TechFlow Selected TechFlow Selected

Recapping Jupiter's Acquisition Timeline: From DEX to Infrastructure Ambitions

Why has a DEX that once focused on providing optimal slippage suddenly transformed into an "infrastructure maniac"?

Text: TechFlow

Amid the turbulence of the crypto market, projects within the Solana ecosystem are shining brightly.

Take Jupiter, for example. When users happily claimed their recent airdrop and raved about how delicious the "Jupiter feast" was, did they also sense a whiff of Jupiter's deep pockets?

Sometimes, a project’s generosity stems from behind-the-scenes alliances and meticulous strategic planning.

Jupiter, the hottest DEX protocol in the Solana ecosystem, has quietly embarked on an acquisition spree over the past 1–2 years, integrating multiple projects into its growing empire.

A recent notable piece of news is that Jupiter has acquired a majority stake in Moonshot.

But its moves go far beyond that. Through a series of precise acquisitions, Jupiter is weaving an ecosystem network spanning trading, data, wallets, and more.

From its origins as a token-swapping DEX aggregator, Jupiter has evolved into a comprehensive builder of ecosystem infrastructure—its ambitions now extending well beyond simple decentralized trading.

Why has this once-slippage-obsessed DEX suddenly transformed into a "infrastructure powerhouse"?

TechFlow has mapped out Jupiter’s development and acquisition timeline, along with its recent partnership dynamics, to reconstruct the strategic logic behind these seemingly fragmented moves.

Starting with a DEX: Jupiter’s Origins

In 2021, amid the booming growth of the Solana ecosystem, a project named Jupiter quietly emerged. Initially just another newcomer among DEX aggregators, its inherent technical strengths quickly set it apart in the fiercely competitive DeFi landscape.

Jupiter’s first breakthrough addressed a common pain point in DeFi: slippage. Using innovative routing algorithms, Jupiter could identify optimal trading paths across complex liquidity pools, significantly reducing transaction costs for users.

The project grew at an impressive pace. By 2023, public data showed it had become the largest DEX aggregator in the Solana ecosystem, capturing over 50% of on-chain token swaps.

Clean interface design, seamless cross-chain support, and precise catering to institutional-grade trading needs made Jupiter the platform of choice for professional traders.

Yet what truly distinguished Jupiter from competitors may have been its forward-thinking approach to ecosystem building.

In today’s hyper-competitive, homogenized crypto environment, one thing is clear:

A successful DEX must do more than offer quality trading services—it must become a central hub connecting the entire ecosystem.

And so, Jupiter’s acquisition campaign began.

The Acquisition Wave: Expanding the Infrastructure Map

Meow, Jupiter’s founder, stated in a podcast interview: "Our vision isn’t just to build a great DEX, but to create a complete DeFi infrastructure ecosystem."

So, what does a complete ecosystem need?

If you’re a user, the answer is obvious: ideally, all your DeFi activities—from data analysis and trade execution to asset management—should be supported in one place, forming a closed loop.

Of course, no single DEX can achieve this alone. Thus, acquisition and collaboration became viable pathways.

When viewed together, Jupiter’s recent acquisitions all revolve around building this very loop.

Data Infrastructure: Acquiring SolanaFM, Sonarwatch, and Coinhall

Before trading, users need accurate market data, on-chain activity analysis, and real-time price monitoring to inform decisions. Perhaps driven by this strategic insight, Jupiter began building out its data capabilities over the past two years.

-

September 2024: Acquired blockchain explorer SolanaFM

SolanaFM was one of the more distinctive blockchain explorers in the Solana ecosystem, offering users fast, simple, and intuitive access to on-chain data—most importantly, simplifying transaction details and reducing the complexity of visualizing fund flows.

As early as 2022, SolanaFM secured a $4.5 million seed round led by investors including Spartan Group. Public records show Jupiter itself was one of the project’s early investors, laying the groundwork for the eventual acquisition.

This acquisition not only strengthened Jupiter’s data analytics capabilities but also provided users with more transparent on-chain tracking. Beyond the mature data analysis engine, perhaps even more valuable was gaining a technical team experienced in on-chain data processing.

-

September 2024: Acquired analytics platform Coinhall

At the 2024 Solana Breakpoint conference, Jupiter announced the acquisition of the well-known trading analytics platform Coinhall. Known for its powerful market data analysis and user-friendly interface, Coinhall provides traders with real-time insights into market trends, price movements, and trading volume.

This acquisition holds significant strategic value: first, by integrating Coinhall’s tools, Jupiter substantially enhanced its market data analysis capabilities. Additionally, Coinhall’s one-click trading feature and intuitive data visualization will be fully embedded into Jupiter’s trading platform, further optimizing the user experience.

-

January 2025: Acquired on-chain portfolio tracker Sonarwatch

Just yesterday (the 25th), the Jupiter DAO officially announced this acquisition via its X account.

From a business standpoint, integrating Sonarwatch clearly strengthens Jupiter’s portfolio tracking functionality. Sonarwatch’s portfolio tools will be fully integrated into both Jupiter’s web and mobile platforms, offering users comprehensive asset monitoring.

The significance lies in filling Jupiter’s gap in real-time market surveillance.

Notably, Sonarwatch positions itself as a “multi-chain” open-source tracking tool, designed to facilitate DeFi adoption across different blockchains—a positioning that aligns perfectly with Jupiter’s recently announced Omnichain Network—Jupnet.

Expanding Trading Infrastructure: Acquiring Ultimate Wallet and Equity in Moonshot

In the DeFi ecosystem, trading infrastructure serves as the critical link between users and trading platforms.

As a DEX aggregator, Jupiter must bridge the full journey from user entry to trade execution—prompting a series of strategic moves at the infrastructure level.

-

April 2024: Acquired Ultimate Wallet, launching the Jupiter Mobile initiative

When Jupiter acquired the wallet last year, it announced on X that its “mobile plan to attract tens of millions of users is launching,” and that it would “begin testing in May.”

The ambition to launch a dedicated mobile app became evident.

Jupiter stated that acquiring Ultimate Wallet aligned with its mobile strategy, allowing it to leverage the team’s technology and expertise to enhance Jupiter Mobile’s performance.

While Phantom Wallet and other dApps remain widely used, a DEX can also vertically integrate downstream by building its own front-end trading interface—gaining control over user access points to capture more traffic and trading revenue.

-

January 2025: Acquired majority equity in Moonshot

In recent days, Jupiter further expanded its ecosystem by acquiring a majority stake in Moonshot—a platform dubbed the “curated Meme coin marketplace” that surged in popularity alongside the Meme coin craze.

Moonshot needs little introduction. Launched in July 2024, this Meme trading platform recorded nearly $400 million in trading volume during the surge of Trump’s TRUMP token and topped regional app download charts.

More importantly, Moonshot offers fiat on-ramps enabling direct purchases of Meme coins—an irresistible advantage for any project in the trading space.

Gaining majority ownership means stronger control over Moonshot. Through this acquisition, Jupiter is no longer just an aggregator—it now controls part of the underlying liquidity source.

Other Strategic Collaborations

Beyond the above acquisitions, Jupiter is also connected to projects like Meteora and PumpAI.

-

Yield Optimization: Synergistic Development with Meteora

Meteora, a key infrastructure player in the Solana ecosystem, maintains a close yet independent relationship with Jupiter. Emerging from the former Mercurial team, Meteora has seen remarkable growth within the ecosystem.

Its TVL hit a record high of $1.3 billion in January 2024, briefly making it the highest daily-volume DEX in the ecosystem. This rapid growth was fueled by its innovative liquidity management mechanisms and tight integration with Jupiter.

Originally developed by the Jupiter team, Meteora focuses on building a sustainable yield layer for the Solana ecosystem. Through integration with Jupiter, users can earn additional yields while trading—greatly improving capital efficiency. Notably, this cooperation model was validated during recent market frenzies—for instance, during trading of the official TRUMP token, the Jupiter-Meteora combination delivered the best trading experience for users.

-

Innovation Ecosystem: Strategic Collaboration with PumpAI

Pump AI is an AI-powered launchpad built on Meteora that helps users create tokens. Everything—from descriptions and images to token generation and liquidity pools—is handled by artificial intelligence.

The project has established liquidity pool partnerships with other protocols such as Raydium and Jupiter.

Where Is the End Point?

Jupiter’s recent acquisition spree paints a grand vision that extends far beyond a single DEX platform.

By analyzing its acquisition strategy, we can clearly see that this star project in the Solana ecosystem is playing a much larger game: a shift from isolated services to a holistic, ecosystem-wide presence.

Jupiter’s acquisition map spans multiple strategic domains. From Ultimate Wallet at the user entry point, to analytics tools like Coinhall, to the blockchain browser SolanaFM—each acquisition fills a crucial gap in the ecosystem puzzle.

Especially through acquiring a majority stake in Moonshot, Jupiter has not only reinforced its dominance in liquidity aggregation but also constructed a complete DeFi service loop.

By integrating core infrastructure such as wallets, data, and trading, Jupiter is building a self-contained suite of DeFi services. Users can complete the entire process—from fiat onboarding and trading to yield optimization—within this ecosystem. Convenience may ultimately be the key to winning the competition.

Notably, Jupiter’s ongoing development of Jupnet—an omnichain network—demonstrates its sustained investment in technological innovation. This is not merely a complement to existing services, but a forward-looking move toward the future of cross-chain DeFi.

Looking ahead, Jupiter’s ambitions likely extend even further.

Its moves into fiat gateways and token launch platforms signal its intent to build an ecosystem covering the full lifecycle of projects. From project incubation and liquidity provision to end-user services, Jupiter is steadily establishing itself as the “infrastructure powerhouse” of the Solana ecosystem through this series of strategic moves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News