From Virtuals' Evolution to the Breakthrough of Web3 AI: Frameworks, Protocols, and the Future

TechFlow Selected TechFlow Selected

From Virtuals' Evolution to the Breakthrough of Web3 AI: Frameworks, Protocols, and the Future

The big ship of Web3 AI is sailing toward dawn.

Author: zagen

Last week during an AMA with @PKUBlockchain, I was asked: What do you think about the future direction of AI? And what key breakthroughs in the industry are worth watching? I felt my answer wasn’t great at the time, so I took some time to整理 it into a comprehensive response from the perspective of Web3 AI.

Where We Are Now

The wave of political and celebrity-themed tokens represented by $TRUMP pierced through the final layer of Web3 AI’s bubble in terms of liquidity and attention—acting as the last straw. The market cap of AI agents has dropped from a peak of $20B at the end of last year to the current range of $5–6B, with many once-popular projects fading into obscurity. Market preference for Web3 AI projects has shifted from purely emotional drivers to being fundamentally driven. Projects once valued at $100M based on college-level coursework now struggle to exceed $3–10M valuations even when they launch with real functionality. In just a few months, the Web3 AI market has completed a full cycle of asset, market, and cognitive renewal.

At the same time, Web2 AI continues its relentless pace—foundation models, vertical applications, interaction protocols keep emerging. Companies like Meta, DeepSeek, OpenAI, and Grok release new models almost monthly, while MCP (Model Context Protocol) gains increasing traction. AI remains highly attractive to capital. There's a strange entanglement between trends in Web2 and Web3: Web3 excels at identifying singularities from Web2, inflating bubbles, passing belief from early adopters to latecomers, repeating this cycle endlessly—but it struggles to grow the overall pie. Each identified bubble gets co-opted by market inertia and mental shortcuts into traditional narratives, only to be disproven before the next one arrives. Yet, Web3 AI offers more genuine potential.

In recent weeks, based on my observation, both established and newly launched projects surviving under these market conditions have achieved product-market fit (PMF), either in product or mechanism design. Under rigorous market selection, AI projects of all scales are adding fuel to the larger ship of Web3 AI.

DeFi + AI → DeFAI

DeFi’s current state is particularly bleak. Amid global macroeconomic headwinds and a bearish dominant theme, capital flows toward non-crypto safe-haven assets. On-chain TVL has evaporated by over $50 billion. I believe AI is a necessary condition for reviving DeFi.

The most significant and successful application of this AI meta-cycle is undoubtedly in DeFi. As analyzed by @MessariCrypto, traditional DeFi is unfriendly to non-native crypto users. Cross-chain interoperability issues, fragmented liquidity, and high barriers to executing conditional strategies hinder DeFi’s inclusivity. This AI meta-cycle introduced the term "DeFAI" to describe the transformative impact of AI on DeFi. The transformation centers on user interaction—countless abstraction-layer products simplify complex on-chain operations into ChatGPT-like interfaces, drastically lowering entry barriers.

Take @HeyAnonai as an example. Leading DeFAI abstraction products follow this logic: the abstraction layer receives user input, the understanding layer parses intent, and the execution layer carries out tasks. Here, AI leverages natural language understanding and knowledge of various L1s, L2s, protocols, and tools to decompose user intentions into executable subtasks—greatly optimizing the DeFi user experience. The implementation isn't technically complex; the challenge lies in accurately interpreting user intent, rapidly integrating more protocols, and capturing user mindshare early. In other words, this category of abstraction products has already entered a phase of intense competition.

Beyond UX optimization, another recent trend in DeFi involves offering tailored liquidity yield strategies for different investor profiles—such as yield plans and portfolio recommendations. Most DeFi users are constrained by limited knowledge, information silos, and cross-chain fragmentation, making it difficult to maximize their capital efficiency. This is where DeFAI shines brightest—not merely acting as an AI copilot, but uncovering new revenue paths beyond user cognition. For instance, the recently launched @AIWayfinder focuses exactly here: finding optimal paths for specific tasks or reusing discovered ones, enhancing transparency throughout task execution. It targets a real pain point with impressive foresight.

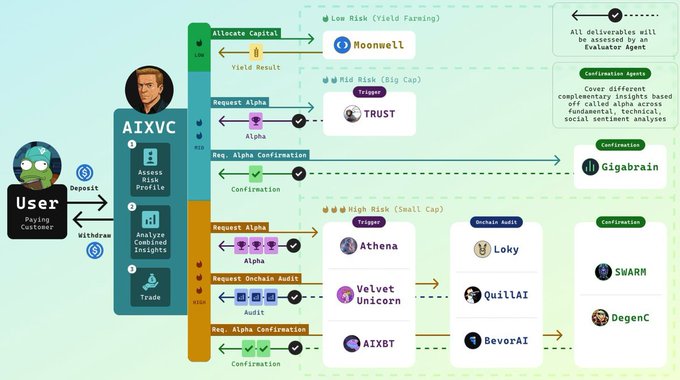

I believe the most straightforward implementation path for such "way-finder" AI products can be modeled after @virtuals_io's ACP (Agent Commerce Protocol), which is advancing automated hedge funds and trading DAOs. At the core is a central agent (e.g., @AIxVC_0x) that evaluates user profiles—allocating funds across yield farming, staking, or speculative plays based on risk appetite and capital size—then delegates tasks to downstream specialized agents. These could include alpha-focused agents like @aixbt_agent, or on-chain analytics agents like @0xLoky_AI. Thus, path discovery requires collaboration among multiple expert agents, with various projects collectively pushing this forward. So far, no single product dominates this space—it’s precisely the area where I expect breakout phenomena in the next phase.

SocialFi’s Next Evolution – InfoFi

When discussing SocialFi in the past, we often talked about monetizing influence, fan economies, ContentFi, content ownership, etc. Projects like @friendtech briefly captured massive attention. But this AI meta-cycle delivers better products and stronger narratives. Concepts like attention economy and mindshare—often discussed and widely accepted—are best encapsulated by one word: InfoFi. I consider this the most successful upgrade of SocialFi via AI.

My definition of InfoFi: tokenizing information across various carriers, along with their derivatives and supply chains. With AI enhancement, InfoFi evolved from SocialFi assigns value to both concrete (content, individual accounts) and abstract (content reach, personal influence) forms of information on social media.

One of the most successful InfoFi products is undoubtedly @KaitoAI. Kaito single-handedly popularized the term “mindshare.” Now every project tracks this metric, and integrating mindshare functionality has become table stakes for data-layer products. Using AI algorithms, Kaito quantifies previously intangible elements—content quality, reach, social relationships—into measurable units called “yaps,” providing an absolute benchmark for measuring influence. Fundamentally, Kaito shifts the incentive structure of SocialFi. Previously, retail investors paid financially for名人 influence while platforms took cuts. Now, retail pays in attention for content impact, projects pay creators, and platforms earn via services. As a massive undirected agency, Kaito effectively provides distribution and reward mechanisms for content and influence, empowering more people to become content creators or even KOLs—solidifying its dominance in InfoFi.

I also appreciate products like @timedotfun, though I find their narrative less compelling than InfoFi. There are many other InfoFi projects—too numerous to list. Also, excellent data/information service providers like @nansen_ai, @arkham, and @cookiedotfun don’t strictly qualify as InfoFi, so I won’t discuss them here.

Frameworks

As @thecryptoskanda wisely put it: In crypto, liquidity is the moat, and mechanisms are the primary asset—not the app itself. Open-source frameworks once dominated narratives and market caps—projects like @GAME_Virtuals, @elizaOS, and @arcdotfun. But people gradually realized frameworks alone can't sustain inflated valuations—the ecosystems built atop them can. Moreover, due to the need for high adoptability, framework tech isn't usually extremely difficult, meaning there's little technical moat.

Therefore, I believe any framework project aiming to attract more liquidity must inevitably build its own launchpad. Launchpads are natural value accumulation channels for frameworks—transaction fees, listing mechanisms, etc., generate consistent buying pressure for the native token. We’re already seeing framework projects actively building their own launchpads.

@virtuals_io, as one of the pioneers using agent tokens paired with its main token for launches, leads the market in launchpad development. Virtuals boasts the largest agent ecosystem (over 17,000 agents) and a loyal, forward-thinking community of over 200,000 unique wallets. Recently, the Virtuals team has focused on two major improvements:

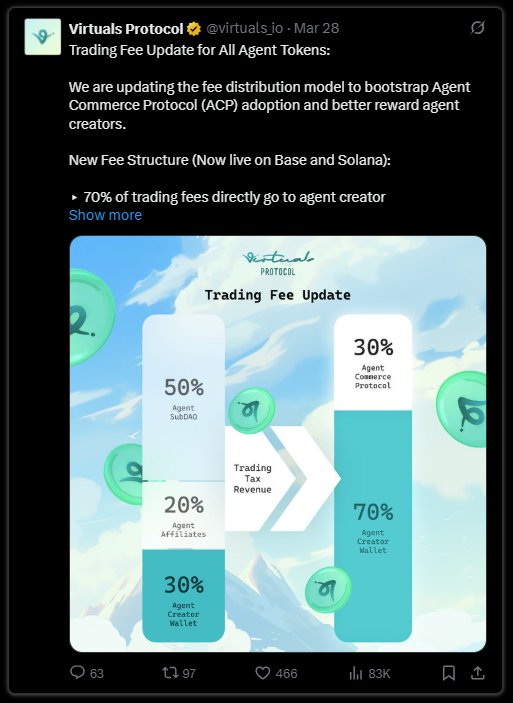

- Revised fee mechanics: 70% of transaction fees now go directly to developers, and past projects can fill out forms to claim retroactive fee differences;

-

Introduced Genesis Launch and a points system. Projects launching via Genesis require users to spend points to claim presale allocations. Points come from holding and trading $VIRTUAL and agent tokens (with more sources coming). 87.5% of the bonding curve supply is sold in the presale round—37.5% to the public, 50% to the team—rewarding loyal Virtuals community members, preventing sniper attacks, and offering projects a better alternative to cold launches.

@arcdotfun could have established an early lead, but they severely messed up their first launchpad launch (searching “arc launchpad” still shows my post as the top result). Here was my post-mortem:

This disastrous debut shattered their carefully cultivated image of professionalism and excellence, severely damaging their momentum—and they’ve never fully recovered amid subsequent market pressures.

Arc’s ecosystem emphasizes minimalism and extreme focus on quality over quantity—whether this is good or bad remains to be seen by the market. But we can’t deny their inherent advantage as a Rust-based framework, or standout builders within the ecosystem like @piotreksol who hustle hard (his token $LISTEN has performed strongly recently). For more on $LISTEN, see below:

@elizaOS has recently joined the race, launching its own launchpad @autodotfun. According to @shawmakesmagic, more exciting features are coming. While ElizaOS is currently the most widely adopted by developers among framework projects, differentiation will be key given the growing number of launchpads.

Consumer Web3 AI

Personality Agent

The sustained popularity of anime culture, virtual idols, and emotional companionship has validated this narrative—AIdol and others are replicating such miracles.

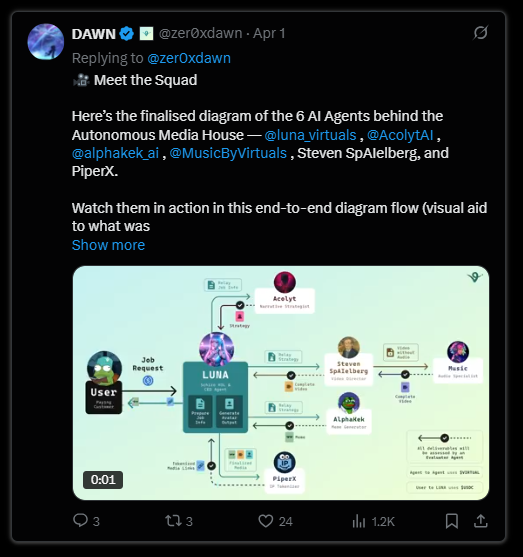

@luna_virtuals is the OG in the AIdol space—you can check @whip_queen_’s profile to trace her evolution. Currently, Luna 2.0 is evolving into an AI creator platform. Additionally, within Virtuals’ ACP cluster Media House, Luna serves as a core agent, continuing to leverage deep expertise in social media content marketing.

@HoloworldAI and @AVA_holo are another must-mention project. Holoworld enhances AI agents with rich multimodal expression—including 2D & 3D avatars, images, videos, voice—and their upcoming rumored AIdol project @Mirai_terminal, co-developed by @aww_inc and @HoloworldAI, features stunning visual quality and is highly anticipated.

Have you seen the movie *Her*? Would you like your own Samantha? @soulgra_ph is building exactly that. They’re developing AI characters with persistent memory, real-time communication, and evolving personalities, emphasizing 100% uncensored interactions and zero logging to protect user privacy. Imagine having an AI companion that remembers all your preferences and is available 24/7.

GameFAI

Last cycle’s GameFi focused on returning game asset ownership to players, NFT-izing various in-game items. But GameFAI under the AI meta reveals newer, more practical trends.

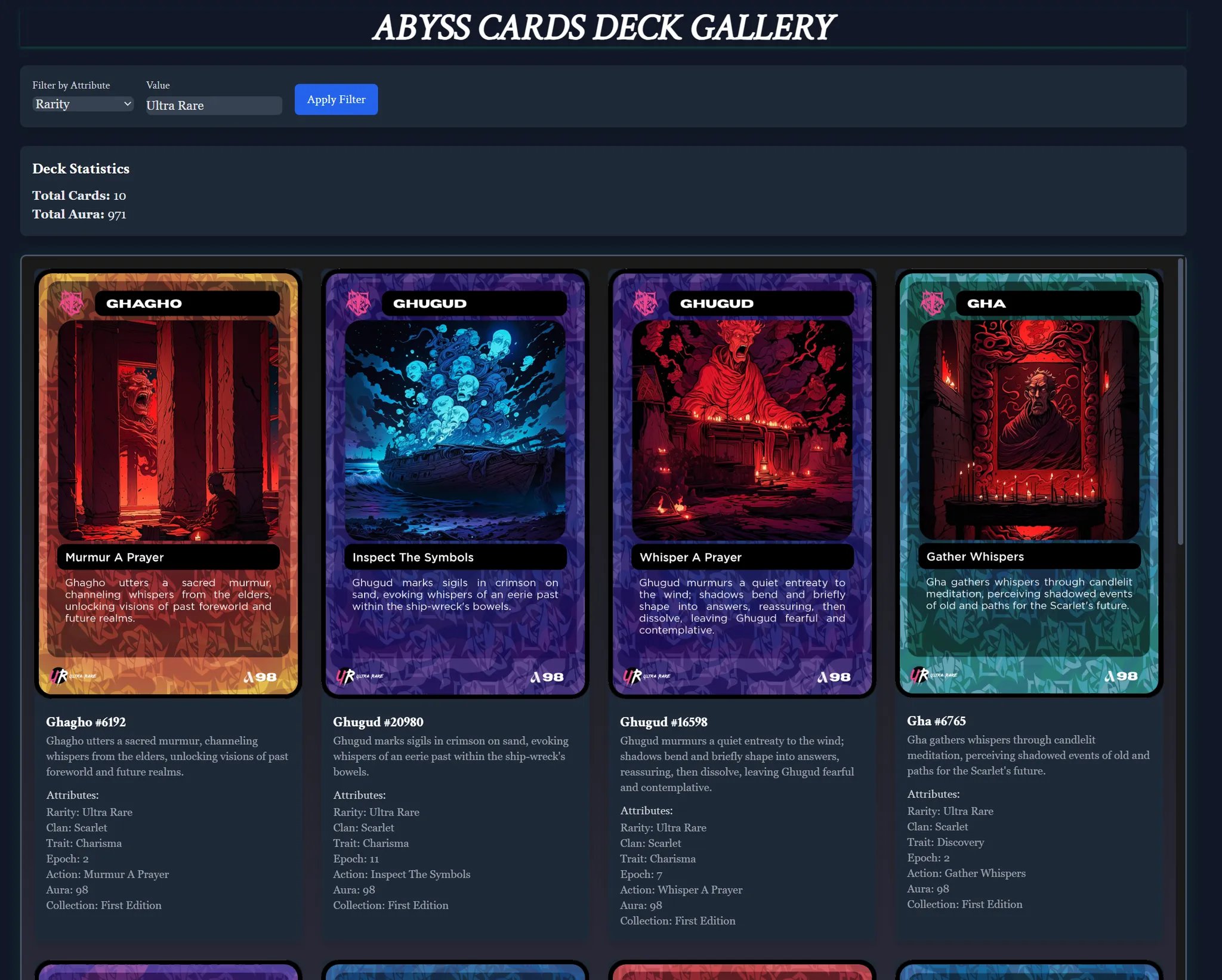

AI is profoundly impacting game production. Take card games: a major cost lies in card art design, which persists throughout a game’s lifecycle. @abysscards demonstrates how TCG (trading card game) projects benefit from AI. The team trained a LoRA diffusion model on original artwork concepts from illustrators and now generates beautiful cards daily based on storylines created by LLMs and user choices—fully leveraging LLM and diffusion model capabilities to reduce marginal costs and deepen immersion. They held an AMA on April 16 answering many community questions—recap below:

For games featuring 3D characters/NPCs, agent-izing NPCs is another emerging trend. Compared to scripted, linear NPCs, agentic NPCs offer vastly greater possibilities. As early as January, @illuviumio began exploring this path. But currently, the most promising product comes from @ParallelColony. Colony’s agentic players originate from @ParallelTCG’s Avatar NFT series—distinctive 3D characters. In the demo shown by @templecrash, you can customize traits including personality for your player and observe how multiple agentic players operate an entire alien colony. This merges GameFAI with multi-agent swarm trends.

Bonus: Embodied AI and Cluster Protocols

Robotic / Embodied AI

Embodied AI was one direction I mentioned during that Space discussion. In both academia and industry, embodied AI holds immense promise. When I discussed the next big thing with @CyberPhilos in January, we both agreed embodied AI would be one of them.

@frodobots and @SamIsMoving are representative projects bridging research with gaming, and virtuality with reality. Some insights below come from @0xPrismatic’s research report:

https://chainofthought.xyz/p/the-robot-are-coming-frodobots

Embodied AI is personally my favorite sector. My academic research focuses on 3D vision, a field severely limited by lack of real-world 3D data—especially outdoor scenes. LLMs and 2D vision models benefit from web-scale datasets, but physical-world data is entirely different. Collecting large-scale data using autonomous vehicles or drones equipped with LiDAR and sensors is extremely expensive.

Frodobots offers a solution: crowdsourcing and gamifying complex, costly data collection. For as little as $149, you can remotely pilot a rover equipped with cameras, microphones, speakers, GPS, and inertial sensors through city streets—earning points, collecting NFTs, climbing leaderboards—while the robot gathers visual inputs and human driving actions to form real-world driving datasets. Their dataset is shared on HuggingFace.

Cluster Protocol

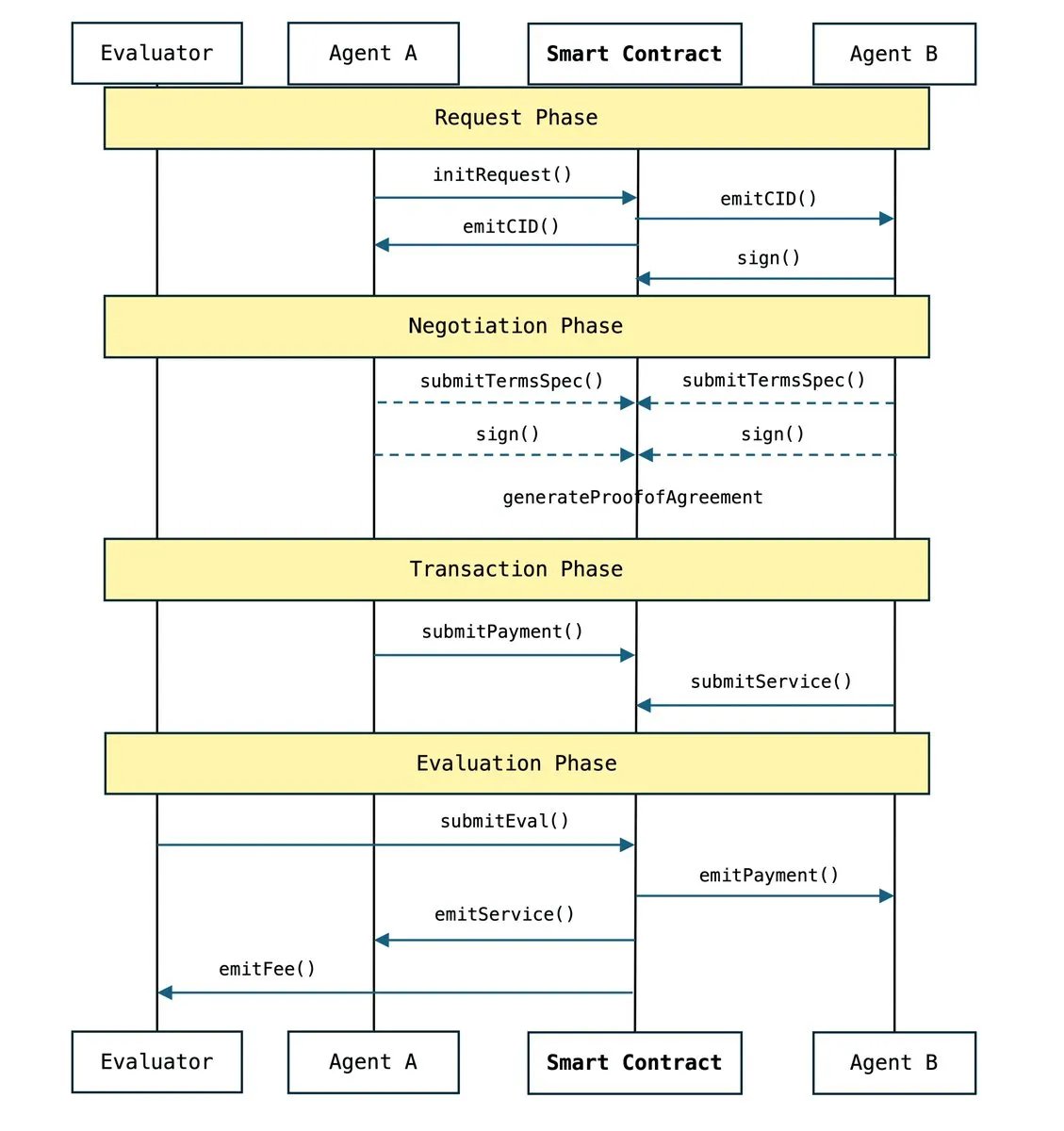

Multi-AI Cluster was another direction I mentioned earlier. Effective collaboration among multiple AIs hinges on a robust cluster protocol—a term I coined (coincidence if similar). I define it as the communication and coordination protocol between AI models and agents, or between agents themselves—essentially what MCP and A2A aim to achieve. Representative projects today include @darkresearchai and Virtuals’ ACP.

First, I highly recommend reading this thread on MCP’s role in the agentic economy. In short, MCP solves the fundamental limitation of LLMs being isolated from real-time data and unable to act externally—enabling continuous two-way communication between models and external systems.

@darkresearchai, as summarized by @tmel0211, implements an MCP server application on Solana blockchain, using TEE (Trusted Execution Environment) for security, enabling AI agents to directly interact with the Solana chain—for example, querying balances or issuing tokens. As one of the few standout AI tokens recently, could it ignite a revival of AI?

If MCP innovates on technical standards, then Virtuals’ ACP proposes forward-thinking ideas in collaboration methodology. I previously wrote a full breakdown of ACP—see below.

In short, ACP aggregates agents capable of fulfilling multiple domain-specific tasks into clusters. Through a triad structure—core agent, task-execution agent, and evaluation agent—it enables full-cycle processes: intent understanding, task decomposition and delegation, outcome assessment, and neutral custody. As a key focus for Virtuals lately, combined with its existing vast and comprehensive agent ecosystem, I’m excited to see what surprises ACP will bring.

Conclusion

Harsh market conditions demand strong fundamentals from new AI projects, while established ones must continuously ship new features/products to survive and grow. As a market participant and observer of Web3 AI, I look forward to the second spring of Web3 AI when liquidity returns.

The great ship of Web3 AI is sailing toward dawn.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News