Re-examining the Design Logic of Bitcoin's Lightning Network from Thunderbolt Thunder Network

TechFlow Selected TechFlow Selected

Re-examining the Design Logic of Bitcoin's Lightning Network from Thunderbolt Thunder Network

It seems that unifying all Bitcoin ecosystem protocols and accommodating various assets and BitMM implementations is no longer just talk, but Thunderbolt at this stage still resembles "writing a highly advanced math paper," and there remains a significant gap before it becomes practically usable for developers.

1. Why Can't You Buy Coffee with Bitcoin?

When it comes to Bitcoin, most people first think of its "decentralized" and "immutable" properties. But when you actually try to use it to buy a cup of coffee, you quickly run into an awkward problem: the transaction confirmation time is longer than the time it takes to brew the coffee, and sometimes the fees are even higher than the price of the drink. Assets on Bitcoin remain largely "frozen"—held via HODLing, unable to be loaned, combined, or made interoperable.

Bitcoin’s Script language has an extremely conservative structure, limiting most off-chain interactions. It was never designed to process tens of thousands of payments per second. Yet real-world demand exists—people want Bitcoin to be usable, whether for buying a game skin, watching a video, or sending a tip, without waiting ten minutes.

2. The Lightning Network: A Double-Edged Sword

Image source: Cointelegraph

The Bitcoin mainchain resembles a highway, while the Lightning Network functions like toll express lanes built alongside it. Its core idea stems from a compromise over mainchain efficiency: since on-chain transactions face speed bottlenecks, instead of recording every single transaction on-chain, users establish private "payment channels" where frequent transactions are tallied off-chain, with only the final balance settled on the blockchain when the channel closes. This model is akin to friends taking turns paying for meals—rather than transferring money after each meal, they settle accounts once after ten dinners. The Lightning Network is essentially a vast network woven from millions of such payment channels.

However, this seemingly elegant system faces multiple practical challenges. First is the high barrier to entry: users must pre-lock funds to open a channel, meaning a dedicated connection must be established in advance to transact with any counterparty. Second is the complex routing issue: if user A and B lack a direct channel, even if an indirect path A-C-B exists, the transaction fails if intermediate channels lack sufficient funds or nodes go offline. More critically, there are security risks—the system requires users to stay online continuously to prevent fraud attempts during channel closure, such as submitting outdated state updates. This imposes unrealistic operational demands on average users.

Despite being live for years, these structural flaws have kept the Lightning Network from breaking through usage barriers. Public data shows that total capital locked in the entire network remains around $100 million—negligible compared to Bitcoin's trillion-dollar market cap, rendering its ecosystem nearly marginal. This raises a pressing question: can we build a better off-chain payment protocol to overcome these limitations?

According to ChainCatchers on April 15, HSBC announced in an official press release that Bitcoin Thunderbolt represents the most significant technical upgrade to Bitcoin in a decade. While Thunderbolt appears at first glance like a “Lightning Network 2.0,” it’s not merely an upgrade—it’s more accurately described as a fundamental rethinking of how Bitcoin interacts off-chain.

3. What Is the Thunderbolt Protocol?

Image source: Nubit | Bitcoin Thunderbolt

Bitcoin Thunderbolt is a soft fork upgrade built directly on Bitcoin’s base layer. Unlike second-layer networks or cross-chain bridges, it modifies the Bitcoin protocol at the foundational level, significantly enhancing scalability, transaction performance, and programmability.

In terms of performance, Nubit leverages UTXO (Unspent Transaction Output) Bundling technology to dramatically optimize traditional Bitcoin transaction processing. The legacy Bitcoin network processes one UTXO at a time, severely limiting speed and throughput. UTXO Bundling allows multiple UTXOs to be grouped and processed together, effectively compressing transaction data and increasing transaction speed by approximately 10x—all without compromising security.

On programmability, Bitcoin Thunderbolt reintroduces and extends the OP_CAT opcode—an operation originally present in early Bitcoin versions but later disabled. OP_CAT enables data concatenation, allowing developers to construct more complex script logic and implement smart contracts natively on the Bitcoin mainchain. The immediate benefit? Developers can now deploy decentralized applications (dApps) directly on Bitcoin without relying on sidechains, Rollups, or bridged tokens.

At the asset protocol integration level, Nubit promotes Goldinals—a unified standard based on zero-knowledge proofs and state commitments. In simple terms, Goldinals is a "Bitcoin-native" token standard that enables on-chain verification of each token’s existence and status without external trusted entities or complex cross-chain bridges. BitMM, an on-chain automated market maker running on Bitcoin, integrates fragmented protocols such as BRC-20, Runes, and Ordinals. Nubit also achieves key breakthroughs in trustless trading through its BitMM (Bitcoin Message Market) system, enabling users to conduct trustless trade matching and information validation directly on the Bitcoin chain.

Unlike conventional scaling approaches (e.g., sidechains, Plasma, Rollups, or wrapped token bridges), Nubit follows a “mainchain-native scaling” approach. Whether it's transaction compression, smart contract support, asset standard unification, or on-chain trade matching—all operate directly on the Bitcoin mainchain using native BTC, not bridged or mapped tokens.

3.1 Core Mechanism Explained

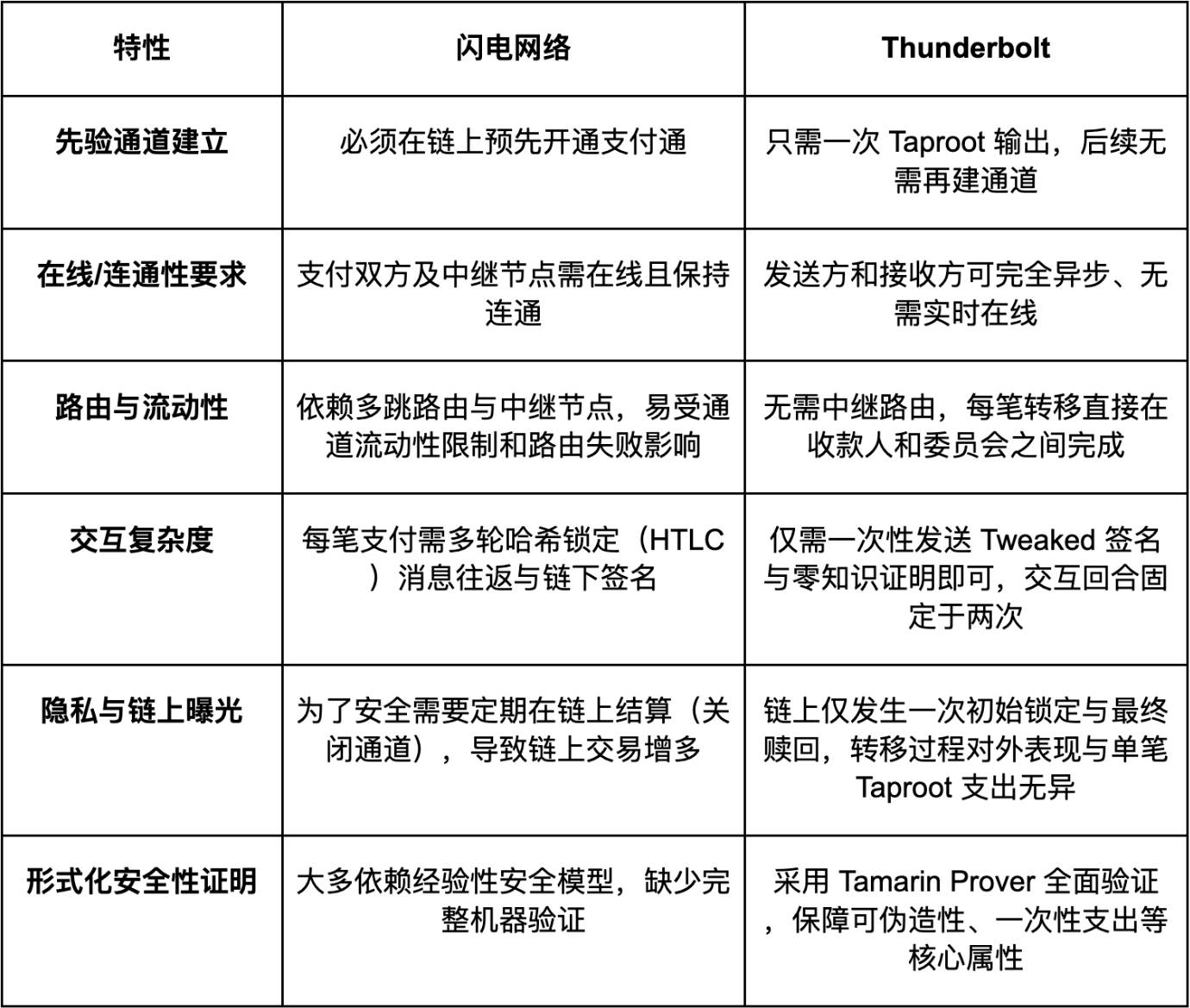

This section draws from the paper “Stateless and Verifiable Execution Layer for Meta-Protocols on Bitcoin” (see reference link 1). In personal understanding, Bitcoin Thunderbolt (Thunderbolt Network) and Bitcoin Lightning (Lightning Network) are both proposed solutions aimed at addressing the slow confirmation times on the Bitcoin mainchain. Their shared goal is to improve efficiency and reduce costs. The key differences lie in their design:

- The Lightning Network focuses on “payment channels”—limited to simple transfers, lacking support for smart contracts or complex logic. Additionally, its high setup and maintenance barriers hinder mass adoption.

- Thunderbolt, developed by Nubit, aims to provide a programmable off-chain protocol supporting Turing-complete operations, enabling sophisticated state assets, liquidity protocols, and financial applications.

Flexible Multi-Party Signatures

Imagine splitting a Bitcoin "signature" into two parts: one held by Alice, the other by a committee. Each time the asset is transferred, Alice and the committee each add a "secret tweak" to their respective signature halves—known only to the new recipient. The recipient uses this secret to reconstruct the full signature, without requiring Alice or the committee to be online during the transfer.

Asynchronous Fault-Tolerant Committee Ledger

A group of nodes (e.g., 4n+1) forms a "service committee" responsible for bookkeeping and confirming ownership. Even if some nodes fail, the ledger continues functioning as long as a majority remain online. These nodes only assist with signing and record-keeping—they cannot access or control funds—ensuring both security and decentralization.

Atomic Swap-Based Finalization

When spending the funds on-chain, a three-step "atomic swap" process occurs: 1) Alice and the committee spend the original locked output, temporarily transferring funds to the committee; 2) the committee locks an equivalent amount into a vault accessible only by "Zenni and the committee"; 3) Zenni then uses two signature fragments to withdraw the funds. This ensures neither Zenni nor the committee can cheat, guaranteeing seamless off-chain state transitions and on-chain redemption.

3.2 Thunderbolt’s Protocol Design and Key Innovations

- Non-Interactive, Recursive Signature Delegation

A tweakable threshold Schnorr signature scheme is designed. Traditional payment channels require multiple message exchanges, whereas Thunderbolt completes transfers with just one signed message containing a secret tweak, drastically reducing interaction requirements and online dependency. - Changing the "Lock" with Every Transfer

During each transfer, Alice and the committee update the signature with a new secret, invalidating the previous "lock." This prevents old signatures from being reused, eliminating replay attacks. - Minimal On-Chain Footprint

Only one initial on-chain "lock" transaction is required. All subsequent changes occur off-chain, with a final on-chain spend. Compared to Lightning, which frequently opens and closes channels, Thunderbolt reduces on-chain activity and enhances privacy. - No Risk of Loss During Downtime

Even if Alice or Zenni goes offline, as long as the majority of the committee remains active, transfers or redemptions can proceed anytime—no risk of timeout expiration or malicious channel closures. - Machine-Verifiable Security Guarantees

All critical components of the protocol undergo formal verification using Tamarin Prover. These security assurances aren’t theoretical—they’re rigorously tested and validated by automated tools.

4. How Does Thunderbolt Differ from Existing Lightning Network Solutions?

Let’s compare Thunderbolt with existing solutions like the BOLT protocol, Breez SDK, and Phoenix to understand its improvements.

Differences between Thunderbolt and existing Lightning Network solutions:

Thunderbolt’s primary advantages lie in “security” and “theoretical completeness.” It is one of the few protocols that can achieve:

- Provably secure protocol design

- Prevention of unilateral profit by malicious actors under any circumstances

Yet its drawbacks are equally apparent:

- High deployment complexity: Currently requires running the full protocol stack, making it inaccessible to average wallet users

- Mainchain compatibility limitations: Bitcoin’s minimal scripting language forces Thunderbolt to take circuitous implementation paths, increasing engineering difficulty

- Lack of ecosystem support: Unlike BOLT, which enjoys widespread wallet and node adoption, Thunderbolt remains in the “early research phase”

5. Thunderbolt’s Potential Impact: A Catalyst for BTCFi?

Image source: Self-made

Is Thunderbolt the optimal solution for BTCFi? Let’s propose a bold view:

Thunderbolt is theoretically the best current solution for BTCFi, but practically it remains in the “Alpha stage.” In other words, it’s like Bitcoin’s version of the “Ethereum 2.0 whitepaper”—visionary, yet not yet at the level of engineered, system-ready deployment. Based on current observations, Thunderbolt may evolve along three potential paths:

1. Integration into Rollup-like Systems: Serving as a DeFi Engine for Bitcoin

Given Bitcoin’s limited scalability, Thunderbolt might eventually become an off-chain module within a Bitcoin L2 (such as BitVM, Nomic, or BOB). This would resemble “integrating Thunderbolt as a universal contract execution layer within a Rollup.”

For example:

- BOB could integrate Thunderbolt’s channel layer for native BTC transactions

- The RGB ecosystem might adopt Thunderbolt’s state management logic

- BitVM, supporting more complex logic, could make Thunderbolt one of its standard contract frameworks

- Serving systems like Babylon and Bitlayer

2. Formation of an Independent Standard Ecosystem Running Parallel to the Mainchain

The most likely scenario is that Thunderbolt evolves similarly to the Lightning Network, developing its own ecosystem of nodes, operators, aggregators, and potentially Thunderbolt-LSP service providers. Meanwhile, Nubit, collaborating with Satoshi-era miners, is pushing for a soft fork upgrade introducing UTXO Bundling and OP_CAT—features that could directly support BTC-based assets (BRC-20, Runes, Ordinals), opening vast possibilities. Future developments might include:

- Thunderbolt Wallet (similar to Phoenix)

- Thunderbolt Node (lightweight nodes running channels)

- Thunderbolt DEX (off-chain order matching)

- Thunderbolt AMM (liquidity pools)

3. Replacement by Simpler Alternatives

Alternatively, if a future system emerges that achieves similar functionality without state channels, formal languages, or off-chain coordination, Thunderbolt may prove to be just a transitional phase. Examples include:

- BitVM achieving a more efficient contract execution environment

- Cross-chain ZK technologies enabling fully trustworthy BTC asset deployment on other chains

- A native Bitcoin protocol unifying payments, lending, and contracts into a single model

Finally, from an ecosystem perspective, Thunderbolt’s greatest significance isn’t just enabling payments—it’s granting Bitcoin assets their first true “off-chain contract composability.” This may sound abstract, but Ethereum’s DeFi explosion demonstrates how crucial composability truly is. Ethereum thrived thanks to a full-stack ecosystem: Solidity + Hardhat + Ethers.js + Metamask.

Thunderbolt’s most exciting aspect is the introduction of UTXO Bundling and OP_CAT. OP_CAT brings native programmability to Bitcoin, while UTXO Bundling groups small transactions to reduce data size and increase throughput—functionally similar to Ethereum Rollups. Suddenly, unifying all Bitcoin protocols and integrating diverse assets via BitMM no longer seems far-fetched. However, Thunderbolt today still resembles “a powerful mathematical paper”—while brilliant, it remains distant from being practically usable by developers.

References:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News