Bitcoin after deleveraging: the next winner in global capital flows

TechFlow Selected TechFlow Selected

Bitcoin after deleveraging: the next winner in global capital flows

Once the deleveraging settles, it will be the fastest horse, accelerating forward.

Author: fejau

Translation: TechFlow

I want to write about a question I've been pondering for a long time: how Bitcoin might behave under a significant shift in capital flows—an environment it has never experienced since its inception.

I believe that once deleveraging ends, Bitcoin will present an incredible trading opportunity. In this article, I’ll lay out my reasoning in detail.

What have been the key historical drivers of Bitcoin’s price?

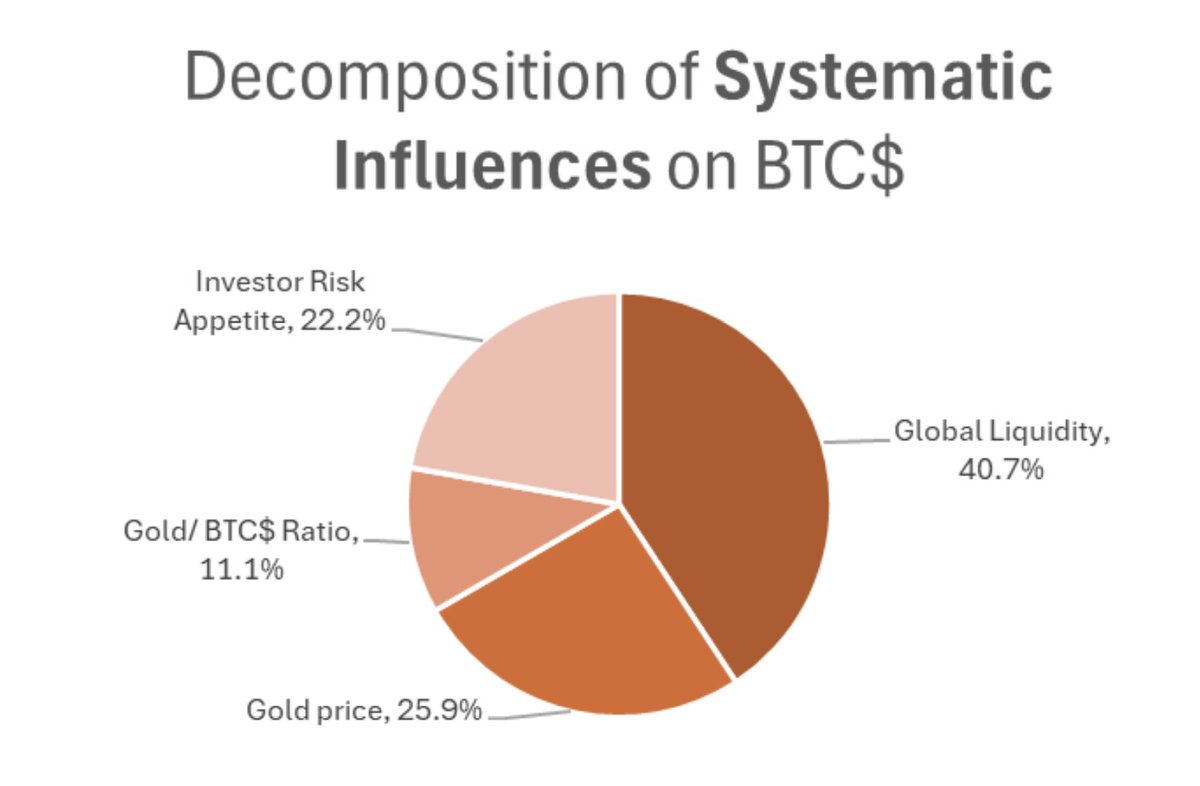

I’ll build upon Michael Howell’s research on the historical drivers of Bitcoin’s price and use these insights to better understand how these intersecting factors may evolve in the near future.

As shown in the chart above, Bitcoin’s drivers include:

-

Overall investor demand for high-risk, high-beta assets

-

Correlation with gold

-

Global liquidity

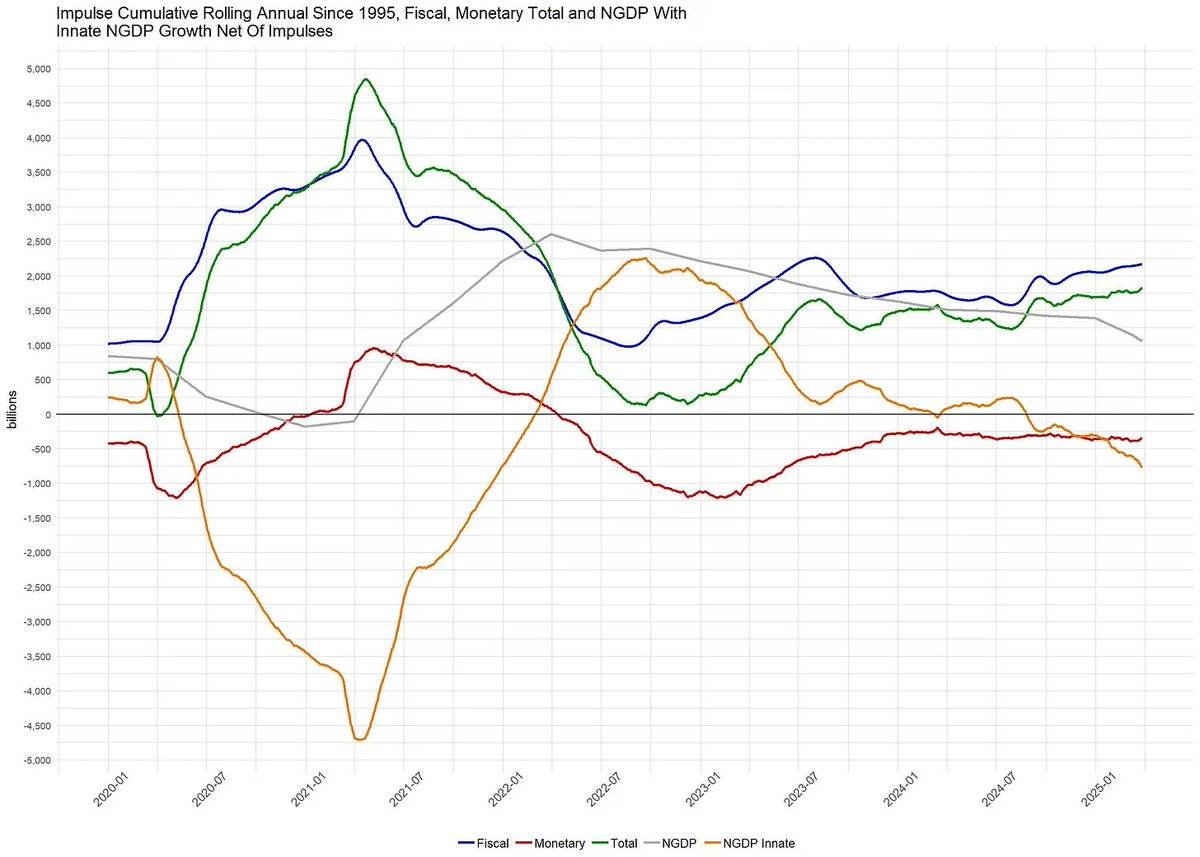

Since 2021, I’ve used a simple framework to understand risk appetite, gold performance, and global liquidity—focusing on fiscal deficits as a percentage of GDP, as a convenient proxy for understanding the fiscal stimulus that has dominated global markets since 2021.

A higher fiscal deficit-to-GDP ratio mechanically leads to higher inflation, higher nominal GDP, and thus higher aggregate corporate revenues, since revenue is a nominal metric. For companies benefiting from economies of scale, this becomes a tailwind for earnings growth.

In most cases, monetary policy has played a secondary role in risk asset movements, while fiscal stimulus has remained the primary driver. As regularly updated by @BickerinBrattle, U.S. monetary stimulus has been so weak relative to fiscal stimulus that I set it aside entirely in this discussion.

As the chart below shows, among major developed Western economies, the U.S. runs a fiscal deficit-to-GDP ratio far exceeding that of any other nation.

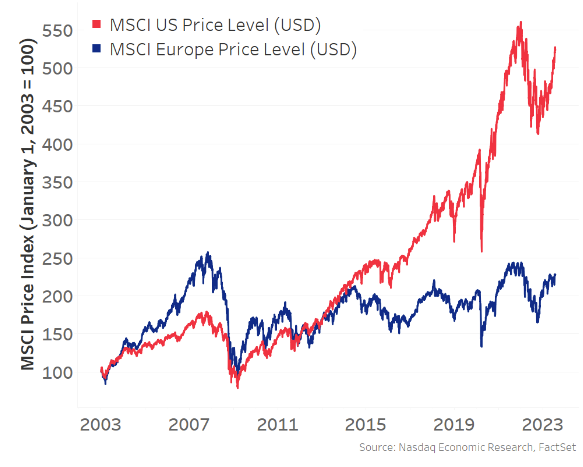

Due to the U.S.’s massive deficit spending, income growth has dominated, leading U.S. equities to outperform other modern economies:

Because of this dynamic, U.S. equities became the marginal driver of risk appetite, wealth effects, and global liquidity—making the United States the gravitational center of global capital. This capital inflow into the U.S., combined with a large trade deficit, meant America exchanged goods for foreign-held dollars, which were then reinvested into dollar-denominated assets (such as Treasuries and MAG7 stocks). Thus, the U.S. became the dominant force shaping global risk sentiment.

Now, returning to Michael Howell’s analysis mentioned earlier: risk appetite and global liquidity have primarily been driven by the U.S. over the past decade, a trend accelerated post-pandemic due to America’s significantly larger fiscal deficits compared to other nations.

Consequently, Bitcoin—though a globally liquid asset (not just U.S.)—has increasingly correlated with U.S. equities since 2021.

However, I believe this correlation with U.S. equities is spurious. When I use the term "spurious correlation" here, I mean it statistically—that there exists a third, unobserved variable not captured in correlation analysis that is the true underlying driver. I believe this factor is global liquidity, which, as we’ve discussed, has been predominantly shaped by the U.S. over the last decade.

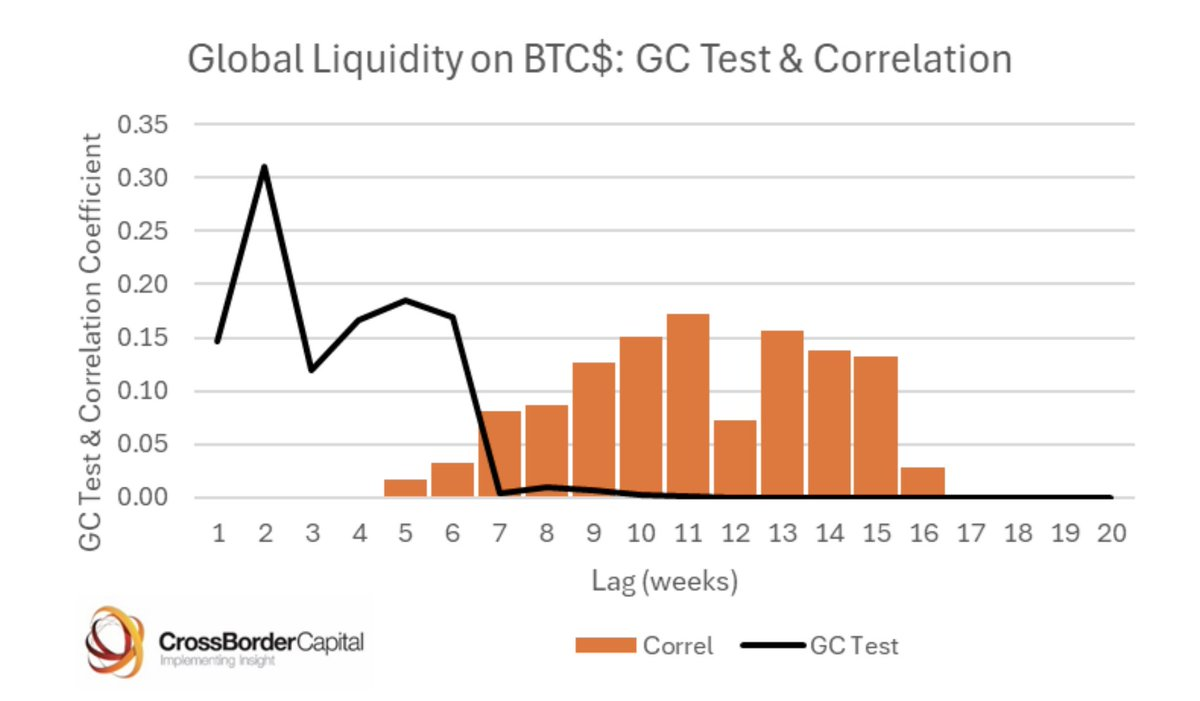

As we delve deeper into statistical significance, we must also establish causality, not just positive correlation. Fortunately, Michael Howell has done excellent work in this area, using Granger causality tests to demonstrate a causal relationship between global liquidity and Bitcoin.

So where does this leave us as a baseline?

Bitcoin is primarily driven by global liquidity, and because the U.S. has been the main source of increased global liquidity, a spurious correlation with U.S. equities emerges.

Over the past month, amid speculation about Trump’s trade policy goals and the potential reconfiguration of global capital and commodity flows, several key narratives have emerged. I summarize them as follows:

-

The Trump administration aims to reduce trade deficits with other countries, which mechanically means fewer dollars flowing abroad—dollars that would otherwise be reinvested into U.S. assets. A reduction in the trade deficit cannot occur without this dynamic.

-

The Trump administration believes foreign currencies are artificially suppressed, making the dollar artificially strong, and seeks to rebalance this. Put simply, a weaker dollar and stronger foreign currencies would lead to higher interest rates abroad, incentivizing capital repatriation to capture better-yielding instruments and domestic equities under adjusted FX conditions.

-

Trump’s “shoot first, ask questions later” approach to trade negotiations is pushing the rest of the world—previously running relatively meager fiscal deficits compared to the U.S. (as noted above)—to invest heavily in defense, infrastructure, and broadly protectionist government spending to become more self-sufficient. Regardless of whether tariff tensions de-escalate (e.g., with China), I believe this shift is now irreversible, and countries will continue down this path.

-

Trump wants other nations to increase their defense spending as a share of GDP and contribute more to NATO, given the disproportionate burden currently borne by the U.S. This too will expand fiscal deficits.

I’ll temporarily set aside my personal views on these points and instead focus on their logical implications if carried to their conclusion:

-

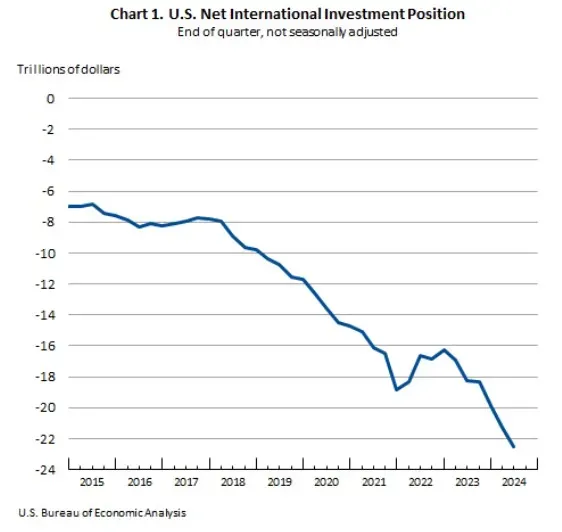

Capital will exit dollar-denominated assets and flow back home. This implies underperformance of U.S. equities relative to the rest of the world, rising bond yields, and a weaker dollar.

-

This capital will return to regions where fiscal deficits are no longer constrained—other advanced economies will begin aggressive spending and money printing to finance these expanding deficits.

-

As the U.S. shifts from being a global capital partner to a more protectionist stance, holders of dollar assets will have to increase the risk premium on what were once considered pristine assets, applying wider safety margins. Over time, this will push up bond yields, prompt foreign central banks to diversify their balance sheets beyond just U.S. Treasuries toward neutral commodities like gold, and similarly drive foreign sovereign wealth funds and pension funds to pursue such diversification.

-

The counterpoint is that the U.S. remains the epicenter of innovation and technology-driven growth—a reality no country can easily replicate. Europe is too bureaucratic and socialist to emulate American-style capitalism. I sympathize with this view, which suggests this may not be a multi-year structural shift but rather a medium-term cyclical one, as valuations of tech giants could cap upside momentum for some time.

Returning to the title of this piece, the first trade is to sell overconcentrated dollar-denominated assets worldwide, avoiding the ongoing deleveraging process. Because global investors are overweight these assets, deleveraging could turn chaotic when risk limits are hit by large fund managers and speculative players like multi-strategy hedge funds with strict stop-loss rules. When that happens, we’ll see margin-call-like days where all assets are sold indiscriminately to raise cash. Right now, the strategy is survival and preserving dry powder.

Yet, once deleveraging subsides, the next trade begins—shifting toward a more diversified portfolio: foreign equities, foreign bonds, gold, commodities, and even Bitcoin.

We’re already seeing signs of this dynamic on rotation days and non-margin-call days: the DXY index is falling, U.S. equities are underperforming international markets, gold is surging, and Bitcoin is holding up surprisingly well relative to traditional U.S. tech stocks.

I believe that as this unfolds, the marginal increase in global liquidity will reverse our accustomed dynamic. Other regions—not the U.S.—will take the lead in driving global liquidity and risk appetite.

While considering the risks of this diversification within a backdrop of global trade wars, I remain cautious about diving too deeply into the tail risks of foreign risk assets, given potential landmines around adverse tariff news. This makes gold and Bitcoin particularly attractive vehicles for global portfolio diversification during this transition.

Gold has been rising steadily in absolute terms, hitting new all-time highs daily, reflecting this regime shift. Yet, despite Bitcoin holding up surprisingly well throughout this transformation, its beta exposure to risk appetite has so far capped its performance, preventing it from matching gold’s rally.

Therefore, as we move toward a rebalancing of global capital, I believe the next major trade will be Bitcoin.

When I compare this framework with Howell’s correlation study, I see them converge:

-

U.S. equities depend on global liquidity only indirectly—through fiscal-stimulus-driven liquidity plus some capital inflows (but we’ve just established that this inflow component may stall or even reverse). Bitcoin, however, is a truly global asset, reflecting a broader, more inclusive view of global liquidity.

-

As this narrative solidifies and risk allocators continue rebalancing, I believe risk appetite will increasingly be driven by regions outside the U.S.

-

Gold is performing exceptionally well, so for the portion of Bitcoin linked to gold, we can check that box as well.

Given all this, I’m seeing—for the first time in financial markets—the possibility of Bitcoin decoupling from U.S. tech stocks. I know this idea often coincides with local tops in Bitcoin. But what’s different this time is the potential for a fundamental shift in capital flows—one that could make this divergence persistent.

Thus, for a macro trader like me who trades risk appetite, Bitcoin now feels like the purest expression of that trade. You can’t impose tariffs on Bitcoin. It doesn’t care which border it’s on. It offers high beta to portfolios without the current tail risks associated with U.S. tech. I don’t need to take a view on whether the EU can get its act together. It provides pure exposure to global liquidity—not just U.S. liquidity.

This market regime is precisely why Bitcoin was created. Once the dust of deleveraging settles, it will be the fastest horse—ready to accelerate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News