U.S. Signs Massive Reciprocal Tariff, Triggering Global Stock Market Plunge | Hotcoin Research Market Insights

TechFlow Selected TechFlow Selected

U.S. Signs Massive Reciprocal Tariff, Triggering Global Stock Market Plunge | Hotcoin Research Market Insights

Market Outlook: The market showed range-bound volatility this week, sentiment remains fearful, on-chain stablecoins saw slight issuance growth, and both U.S. spot Bitcoin and Ethereum ETFs experienced net outflows.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total cryptocurrency market capitalization stands at $2.68 trillion, with BTC accounting for 61.9% ($1.66 trillion). The stablecoin market cap is $235 billion, up 0.49% over the past 7 days, of which USDT accounts for 61.57%.

This week, BTC has traded in a range, currently priced at $82,687; ETH has also been range-bound, now at $1,769.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: EOS gained 24.27% over 7 days, PENDLE rose 17.96%, and COMP increased 12.12%.

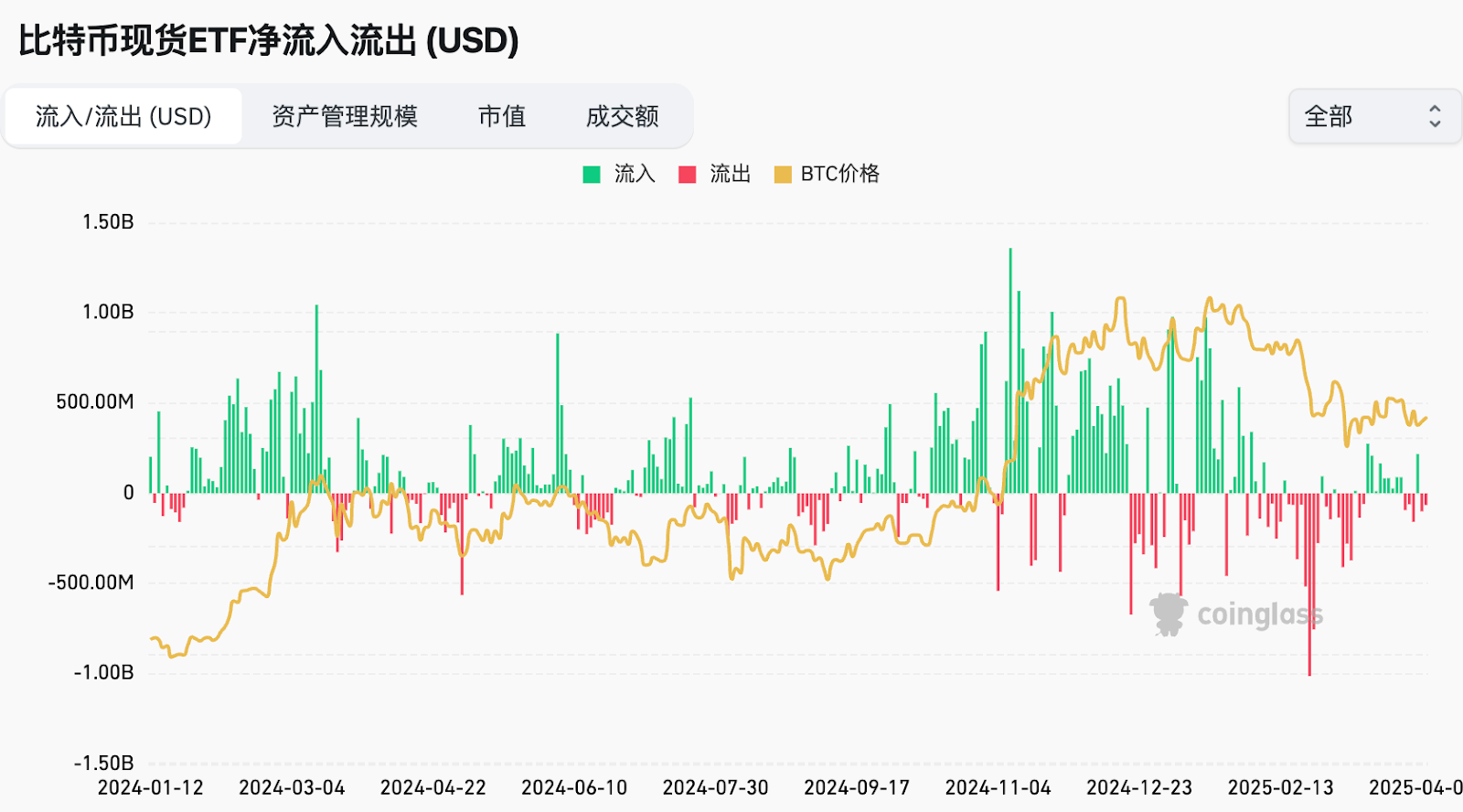

This week, U.S. spot Bitcoin ETFs saw net outflows of $165.3 million; U.S. spot Ethereum ETFs recorded net outflows of $50 million.

The "Fear & Greed Index" on April 4 stood at 34 (higher than last week), with market sentiment reflecting fear for 6 days and neutrality for 1 day this week.

Market Outlook: The market remains range-bound amid ongoing fear. On-chain stablecoins saw slight issuance increases, while both U.S. spot Bitcoin and Ethereum ETFs experienced net outflows. Trading volume of gold-pegged assets on-chain remains active. On April 2, reciprocal tariffs were imposed far exceeding market expectations, triggering severe risk-off sentiment across global equity markets leading to broad declines. The probability of a 25-basis-point rate cut by the Fed in May is now 33.3%, higher than last week. The broader market is expected to remain volatile over the next period (April–May). For potential opportunities, focus on trending projects on the SOL chain and closely monitor Hotcoin New Listings to unlock further wealth opportunities.

Understanding the Present

Weekly Major Events Recap

1. The Trump family holds at least 60% of WLFI through a new holding company;

2. On March 31, according to Bitcoin Magazine, BlackRock CEO Larry Fink stated that the U.S. dollar faces risks of losing its global reserve currency status, potentially being replaced by "digital assets such as Bitcoin";

3. On April 1, Tether added another 8,888 BTC ($735 million) in Q1;

4. On April 2, market reports indicated that stablecoin issuer Circle filed an S-1 document with the U.S. Securities and Exchange Commission (SEC), officially launching its initial public offering (IPO) process. The company plans to list on the New York Stock Exchange under the ticker symbol "CRCL";

5. On April 2, Coinglass data showed that funding rates on major CEXs and DEXs indicate continued bearish sentiment in the crypto market;

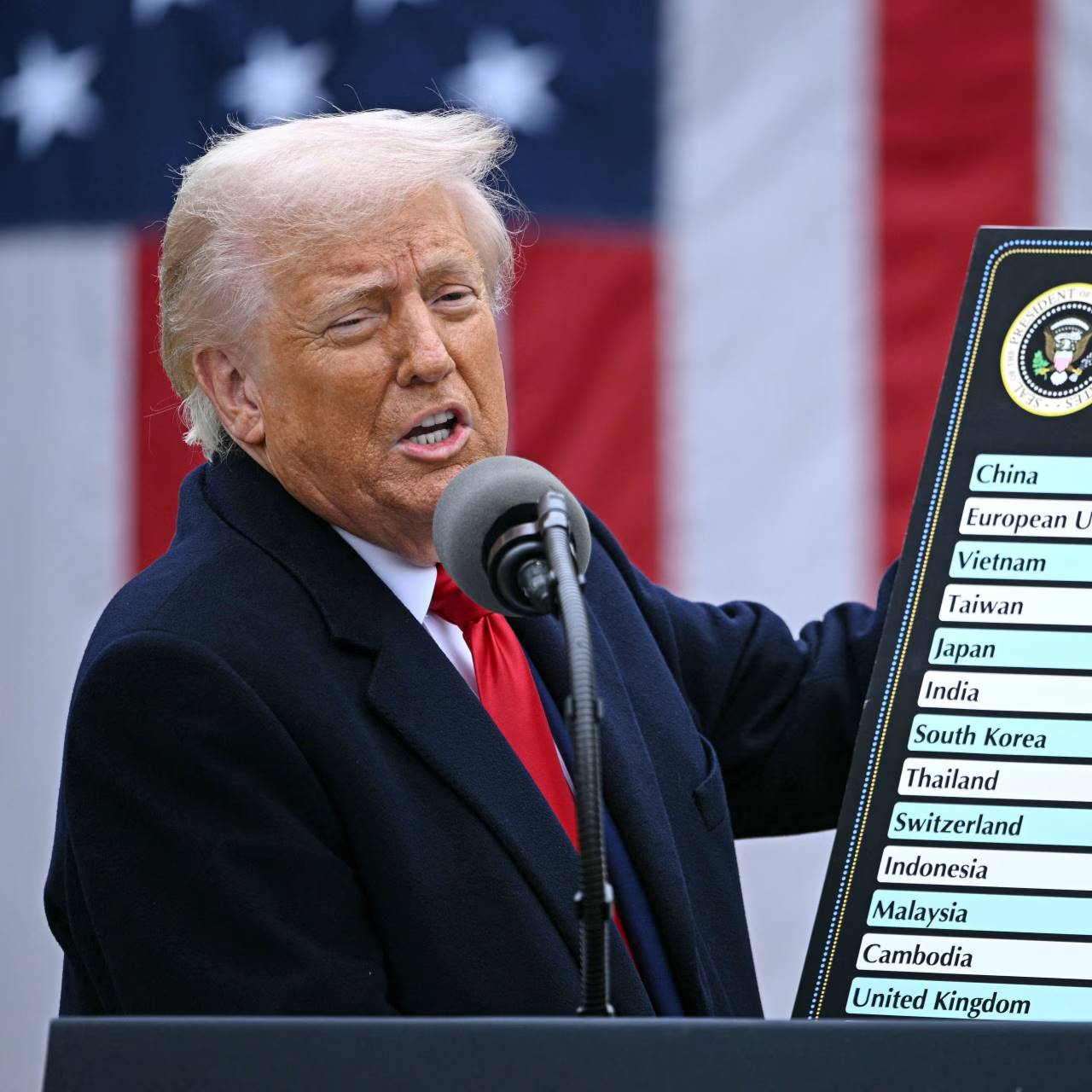

p>6. On April 3, after President Trump signed an executive order imposing "reciprocal tariffs" on trading partners, U.S. stock index futures plunged in after-hours trading;7. On April 2, Justin Sun posted on social media stating that FDUSD issuer First Digital Trust (FDT) had effectively gone bankrupt and could not meet customer redemption obligations;

8. On April 3, China International Capital Corporation (CICC) published an analysis indicating that Trump's announcement of "reciprocal tariffs" on April 2 exceeded market expectations.

CICC believes these reciprocal tariffs may heighten uncertainty and market concerns, increasing the risk of stagflation in the U.S. economy. Estimates suggest the tariffs could raise U.S. PCE inflation by 1.9 percentage points and reduce real GDP growth by 1.3 percentage points, although they might generate over $700 billion in fiscal revenue. Facing stagflation risks, the Federal Reserve can only adopt a wait-and-see approach, making near-term rate cuts unlikely. This will further increase downside economic risks and downward pressure on financial markets;

9. On April 4, major U.S. indices opened and closed lower, with the Dow dropping approximately 1,700 points, the S&P 500 falling 4.8%, and the Nasdaq plunging nearly 6%.

Macroeconomic Overview

1. On April 4, Federal Reserve Chair Powell said in a keynote speech on the economic outlook that weak growth and rising inflation offset each other, keeping the Fed’s expectation of two rate cuts in 2025 unchanged;

2. On April 6, according to CME's "Fed Watch" tool, the probability of a 25-basis-point rate cut by the Fed in May is 33.3%, with a 66.7% chance of rates being held steady;

3. On April 4, U.S. non-farm payroll employment for March came in at 228,000, above the expected 135,000 and revised upward from the previous 151,000 (adjusted to 117,000). Job growth significantly exceeded market forecasts.

ETFs

Data shows that between March 31 and April 4, U.S. spot Bitcoin ETFs saw net outflows of $165.3 million. As of April 4, GBTC (Grayscale) has cumulatively lost $22.575 billion, currently holding $16.162 billion, while IBIT (BlackRock) holds $48.241 billion. The total market value of U.S. spot Bitcoin ETFs is $96.288 billion.

U.S. spot Ethereum ETFs recorded net outflows of $50 million.

Looking Ahead

Upcoming Events

1. TOKEN2049 Dubai 2025 will be held in Dubai from April 30 to May 1, 2025;

2. Canada Crypto Week will take place in Toronto, Canada, from May 11 to 17, 2025;

3. Paris Blockchain Week 2025 will be held in Paris, France, from April 8 to 10, 2025;

4. YZi Labs will collaborate with Silicon Valley's AGI House to host an offline hackathon on April 12, focusing on fintech solutions powered by artificial intelligence and blockchain.

Project Updates

1. INERTIA, the lending protocol on Initia, continues its incentivized testnet until April 8, during which users can mint testnet LSTs (nINIT and sINIT) and participate in borrowing and lending;

2. Bybit Web3 will streamline its product lineup to enhance user experience. Bybit Web3 will shut down its NFT marketplace, inscription marketplace, and IDO product page at 00:00 on April 9, 2025;

3. Binance’s second round of voting for new listings ends at 7:59 on April 10, 2025. Participating projects include VIRTUAL, BIGTIME, UXLINK, MORPHO, GRASS, ATH, WAL, SAFE, ZETA, IP, ONDO, and PLUME;

4. Sonic SVM, Solana-based Layer 2 scaling network, continues its Mainnet Reward Program Season 1 until April 10;

5. Web3 social platform and infrastructure provider UXLINK will conduct its Season 3 airdrop snapshot on April 10, with claim availability starting April 18. This airdrop will distribute no more than 3.077% of the total supply, targeting community users of the OAOG protocol, developers and partners of the testnet and AI growth agent, participants in the S3 staking campaign, and other active users.

Key Events

1. Senior White House officials confirmed that the baseline tariff rate (10%) took effect early April 5, while reciprocal tariffs will take effect early April 9;

2. The U.S. SEC has postponed its decision on options trading for BlackRock's Ethereum ETF to April 9;

3. Terra founder Do Kwon’s case status conference, originally scheduled for March 10, has been rescheduled by the New York District Court to April 10, with the final trial still set for January 26, 2026.

Token Unlocks

1. Movement (MOVE) will unlock 50 million tokens at 20:00 on April 9, valued at approximately $15.77 million, representing 2.04% of circulating supply;

2. Aptos (APT) will unlock 11.31 million tokens at 16:00 on April 12, worth about $48.97 million, or 1.87% of circulating supply;

3. Axie Infinity (AXS) will unlock 9.09 million tokens at 21:10 on April 12, valued at around $22.36 million, accounting for 5.67% of circulating supply.

About Us

Hotcoin Research, as the core investment research hub within the Hotcoin ecosystem, is dedicated to providing global digital asset investors with professional, in-depth analysis and forward-looking insights. We have built a three-pillar service framework of "trend analysis + value discovery + real-time tracking," delivering precise market interpretations and practical strategies through deep industry trend analysis, multi-dimensional project evaluation, and round-the-clock market volatility monitoring. Combined with our twice-weekly "Top Coins Selection" strategy livestreams and daily "Blockchain Today" news briefings, we serve investors at all levels. Leveraging cutting-edge data analytics models and extensive industry networks, we continuously empower novice investors to build foundational knowledge frameworks while helping institutional clients capture alpha returns, jointly seizing value-growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly recommend that investors fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News