Reviewing the History of Cryptocurrency Market Crashes: Every Panic Was Said to Be the Last

TechFlow Selected TechFlow Selected

Reviewing the History of Cryptocurrency Market Crashes: Every Panic Was Said to Be the Last

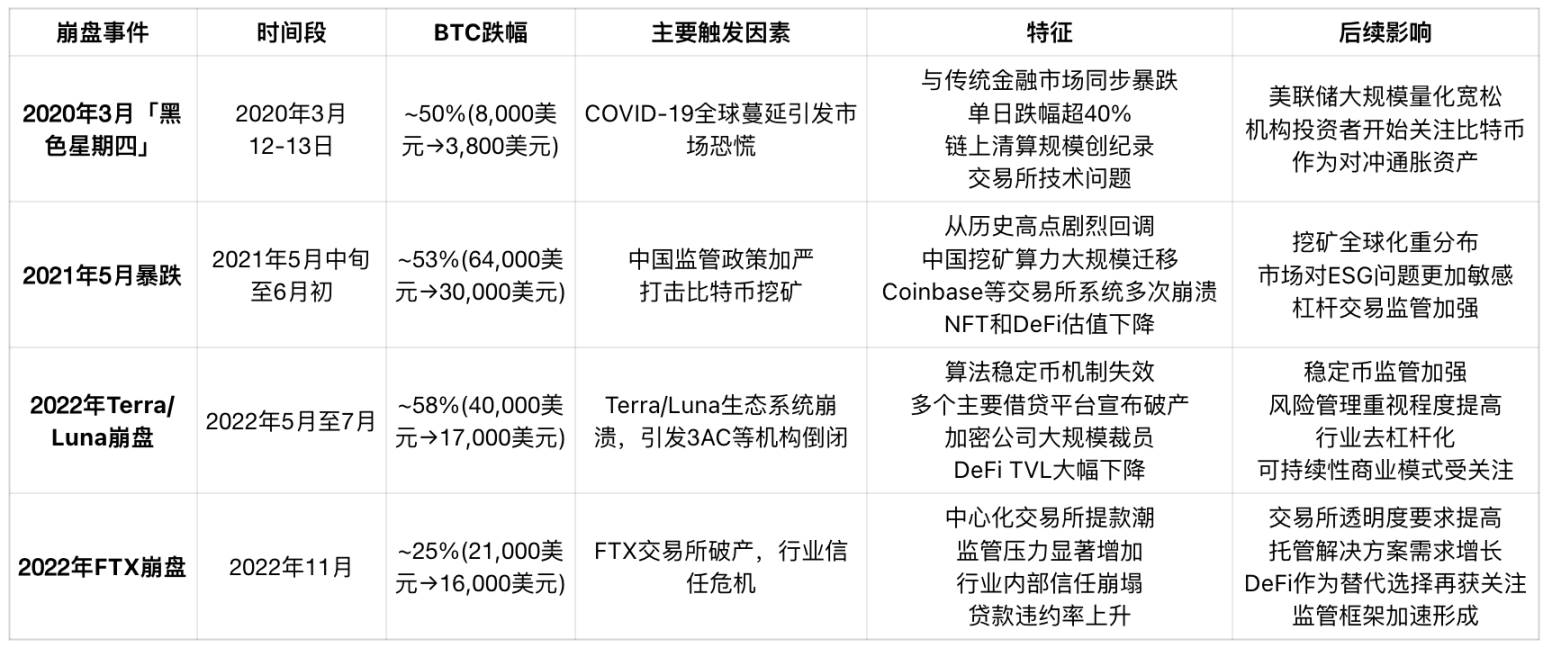

Historical Market Crashes Compared in Full.

By ChandlerZ, Foresight News

In April 2025, the crypto market plunged into turmoil once again. The Trump administration revived its tariff threats, abruptly shifting global financial sentiment. Bitcoin dropped over 10% in two days, while Ethereum at one point crashed nearly 20%, with $1.6 billion in liquidations within 24 hours. As in previous historic crashes, this scene reignited collective anxiety: "Is this the end, or just the beginning of another collapse?"

Yet if we look back at the history of crypto markets, this isn't the first time everyone thought “it’s over.” In fact, every extreme panic has merely been a unique ripple along this asset's price curve. From “Black Thursday (312)” to “519,” from the 2020 global financial panic, to the “crypto Lehman moment” triggered by FTX’s credit collapse, and now the tariff crisis—each time, the script repeats.

The market keeps replaying the same story, but investor memory remains short.

This article reconstructs the “market scenes” of four prior historic crashes using real data, comparing dimensions such as drawdowns, sentiment indicators, and macroeconomic contexts, aiming to extract a traceable and predictive pattern: how does the crypto market bear pressure when risks emerge? And how does it repeatedly reshape its narrative amid systemic shocks?

Historical Crash Overview: A Familiar Script, Different Triggers

Over the past five years, the crypto market has experienced at least four systemic crashes. Though their triggers varied, each led to sharp price corrections and cascading on-chain and off-chain reactions.

Data shows that “312” remains the most brutal crash in history, with both BTC and ETH plunging over 50% in a single day. Total liquidations reached $2.93 billion, affecting over 100,000 traders, including one massive position worth $58.32 million. This scale of liquidation indicates widespread high leverage (e.g., 10x or higher) among market participants. As prices rapidly fell, margin calls were triggered, fueling further sell-offs and creating a vicious cycle.

Meanwhile, BitMEX’s dramatic decision to “pull the plug” and halt trading exposed the fragility of market liquidity. Other exchanges also descended into chaos, with bitcoin price spreads across platforms briefly exceeding $1,000. Arbitrage bots failed due to trading delays and API overloads. This liquidity crisis caused market depth to evaporate almost instantly—buy orders vanished, and selling pressure completely dominated.

BitMEX, then the largest platform for short positions, effectively became a “lifeline” preventing bitcoin’s price from collapsing to zero. Had trading continued uninterrupted, its order book depletion could have driven prices toward zero, triggering chain-reaction failures across other platforms.

The Domino Effect of Black Swans

“312” was not an isolated crypto event—it mirrored the broader systemic financial crisis of early 2020.

Panic-Driven Stock Market Collapse

After the Nasdaq hit a record high of 9,838 points on February 19, 2020, global market sentiment turned sharply as the COVID-19 pandemic spread. In March, U.S. stocks experienced rare consecutive circuit breakers, with market-wide halts triggered on March 9, 12, and 16. On March 12 alone, the S&P 500 plunged 9.5%, its worst single-day drop since the 1987 “Black Monday.” The VIX fear index spiked to a record 75.47. European indices (Germany, UK, France) and Asian markets (Nikkei, Hang Seng) simultaneously entered technical bear markets, with at least ten national indexes dropping over 20%.

Systematic global sell-offs quickly spilled into all risk assets. Bitcoin and Ethereum faced indiscriminate dumping, marking the emergence of a “financialized resonance”—a high degree of synchronization between crypto and traditional assets driven by collapsing risk appetite.

Commodity Market Bloodbath

Traditional commodity markets also collapsed during this crisis. On March 6, 2020, OPEC and Russia failed to agree on production cuts. Saudi Arabia immediately launched a price war—boosting output and slashing oil prices—triggering a plunge in global energy markets. On March 9, WTI crude oil crashed 26%, the biggest drop since the 1991 Gulf War. By March 18, WTI fell below $20. The collapse of oil—the “lifeblood of the global economy”—intensified fears of a deep global recession.

Gold, copper, and silver also plummeted, showing that even “traditional safe-haven” assets failed to hedge against downside risk in the initial phase of the crisis, as liquidity fears escalated.

Dollar Liquidity Crisis and the Paradox of Safe-Haven Assets

As global asset prices tumbled together, a dollar liquidity crisis emerged. Investors rushed to sell all kinds of assets for U.S. cash, driving the DXY dollar index from 94.5 to 103.0 in mid-March—a three-year high. This “cash is king” mentality led to indiscriminate selloffs across all risk assets, leaving Bitcoin unable to escape.

This was a perfect storm of liquidity contraction, credit unraveling, and emotional stampede—where the boundaries between traditional and crypto markets were completely erased.

Policy Hammer: China’s Regulatory Crackdown in May 2021

In May 2021, the crypto market suffered another blow. After hitting a record high of $64,000 in early May, Bitcoin lost half its value within three weeks, bottoming out near $30,000—a peak decline of over 53%. This crash wasn’t due to on-chain system failures or direct macroeconomic shocks. Instead, it was primarily triggered by a series of stringent regulatory policies issued by the Chinese government.

On May 18, China’s Financial Stability and Development Committee announced it would “crack down on Bitcoin mining and trading activities.” The next day, provinces including Inner Mongolia, Qinghai, and Sichuan—home to major mining hubs—rolled out targeted rectification measures. Numerous mining farms were forced to shut down, causing Bitcoin’s global network hash rate to drop nearly 50% within two months.

At the same time, bank interfaces for domestic exchanges came under scrutiny, tightening OTC channels and creating capital repatriation pressure. Although major exchanges had already exited mainland China after 2017, the “policy hammer” still sparked global investor risk aversion.

On-chain, block intervals surged dramatically—confirmation times jumped from 10 minutes to over 20—causing network congestion and soaring transaction fees. Market sentiment indicators collapsed, with the Crypto Fear & Greed Index plunging into “extreme fear.” Investor concerns about escalating regulation became the dominant short-term force.

This crash marked the first time the crypto market directly faced confidence reconstruction under “national-level suppression.” Long-term, however, the exodus of mining power unexpectedly boosted North America’s share of global hash rate, becoming a pivotal turning point in the geographic transformation of Bitcoin mining.

Systemic Chain Reaction: Terra/Luna and the DeFi Trust Crisis

In May 2022, the algorithmic stablecoin UST from the Terra ecosystem lost its peg, sparking a “Lehman moment” in decentralized finance. Bitcoin had already drifted down from $40,000 at the start of the year to around $30,000. But as UST’s mechanism failed, Luna’s price collapsed to zero within days, destabilizing the DeFi ecosystem. BTC subsequently plunged to $17,000, with the entire correction lasting until July and a maximum drawdown of 58%.

UST was once the largest algorithmic stablecoin by market cap, relying on Luna as collateral for minting. When doubts arose about UST’s stability, panic spread rapidly. Between May 9 and 12, UST consistently depegged, and Luna’s price plummeted from $80 to less than $0.0001—an entire ecosystem collapsed in five days.

The Luna Foundation Guard had previously allocated over $1 billion in Bitcoin reserves to defend UST’s peg, but ultimately failed. These BTC sales further intensified downward pressure. Meanwhile, numerous DeFi projects in the Terra ecosystem—such as Anchor and Mirror—saw their TVL drop to zero, resulting in massive user losses.

The collapse triggered a domino effect: hedge fund Three Arrows Capital (3AC), heavily exposed to UST and Luna, collapsed due to insolvency; soon after, CeFi lending platforms like Celsius, Voyager, and BlockFi faced runs and eventually filed for bankruptcy.

On-chain, ETH and BTC transfer volumes spiked as investors fled risky DeFi protocols, causing liquidity pools across multiple chains to dry up and DEX slippage to soar. The entire market entered a state of extreme panic, with the Fear & Greed Index hitting its lowest level in years.

This was a “global recalibration” of trust models within the crypto ecosystem. It undermined confidence in algorithmic stablecoins as viable financial infrastructure and prompted regulators to re-evaluate the risk scope of “stablecoins.” Afterwards, USDC and DAI increasingly emphasized collateral transparency and audit mechanisms, and market preference visibly shifted from “yield incentives” to “collateral security.”

Trust Collapse: The Off-Chain Credit Crisis Ignited by FTX’s Implosion

In November 2022, FTX—the so-called “institutional trust anchor”—collapsed overnight, becoming one of the most impactful “black swan” events in crypto history since Mt. Gox. This was a collapse of internal trust, severely damaging the foundational credibility of the entire crypto financial ecosystem.

The incident began with a leaked balance sheet of Alameda Research, revealing that it held large amounts of its own exchange token, FTT, as collateral—sparking widespread skepticism about asset quality and solvency. On November 6, Binance CEO Changpeng Zhao announced he would sell his FTT holdings, causing FTT’s price to nosedive and triggering a wave of off-chain panic withdrawals. Within 48 hours, FTX faced a full-scale bank run, unable to meet customer redemptions, and ultimately filed for bankruptcy protection.

FTX’s implosion dragged Bitcoin down from $21,000 to $16,000, a drop of over 23% in seven days; Ethereum fell from around $1,600 to below $1,100. Over $700 million in liquidations occurred within 24 hours—not as severe as “312,” but given that this crisis originated off-chain and impacted multiple major platforms, the loss of trust far exceeded what a simple price drop could reflect.

On-chain, USDT and USDC swap volumes surged as users fled exchanges and moved assets into self-custody wallets. Cold wallet active addresses hit record highs, and “Not your keys, not your coins” became the dominant refrain on social media. Meanwhile, the DeFi ecosystem remained relatively stable—on-chain protocols like Aave, Compound, and MakerDAO avoided systemic risk thanks to transparent liquidation mechanisms and sufficient collateral, demonstrating early validation of decentralized architecture’s resilience under stress.

More profoundly, FTX’s collapse prompted global regulators to reassess systemic risks in crypto markets. The U.S. SEC, CFTC, and financial regulators in multiple countries launched investigations and hearings, pushing issues like “exchange transparency,” “proof of reserves,” and “off-chain asset audits” to the top of the regulatory agenda.

This crisis was no longer just “price volatility”—it was a complete handover of the “trust baton.” It forced the crypto industry to shift from superficial price optimism back to fundamentals: risk control and transparent governance.

2025 Tariff Crisis: Systemic External Pressure Reignited

Unlike internal industry crises such as the FTX collapse, the recent market crash triggered by Trump’s proposed “minimum baseline tariffs” echoes the global characteristics seen during “312.” It wasn’t caused by a single platform failure or asset失控, but rather by a convergence of geopolitical tensions, drastic shifts in global trade structures, and monetary policy uncertainty—a systemic financial panic rooted in macro forces.

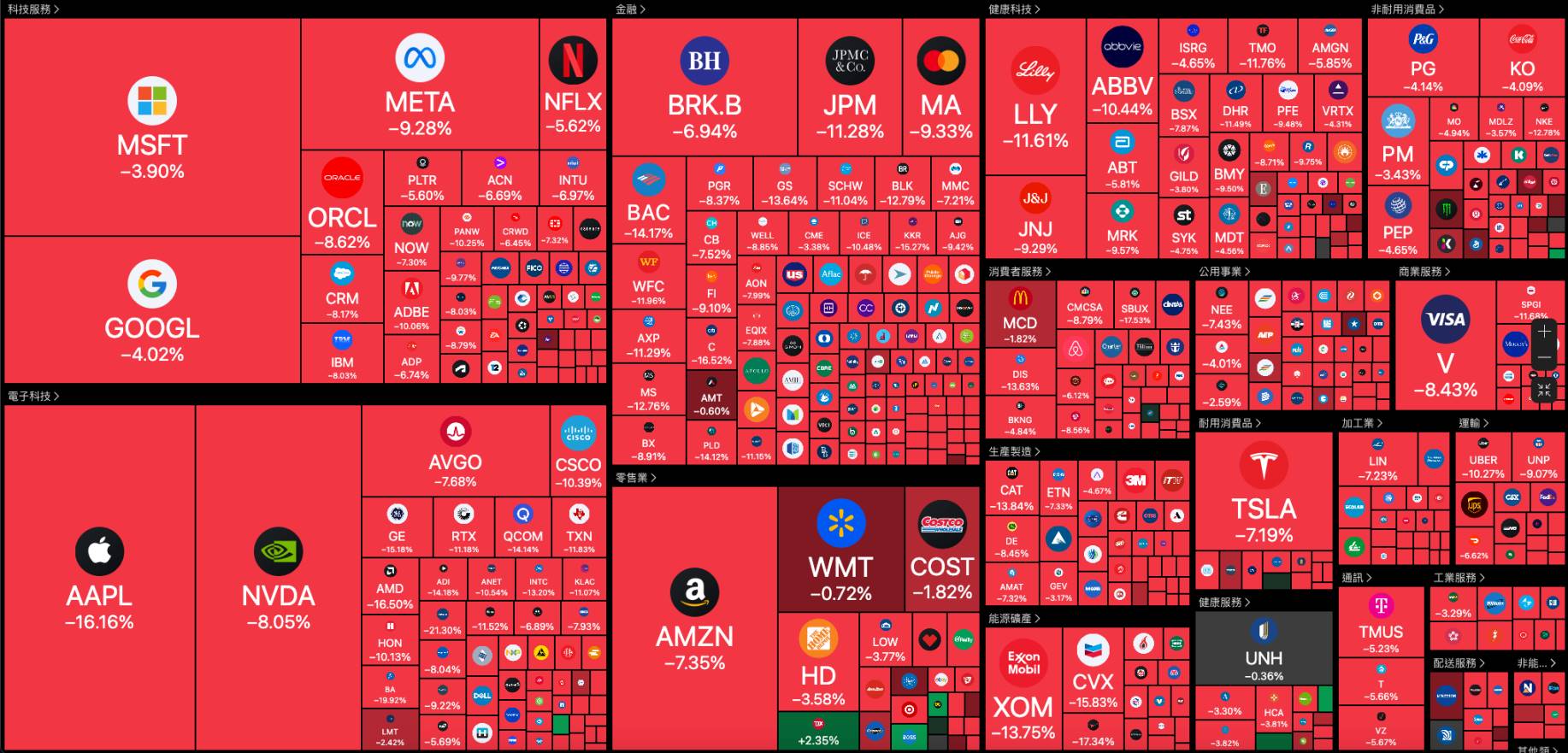

On April 7, U.S. equities opened lower, with tech and semiconductor stocks hit hard—NVIDIA down over 7%, Tesla nearly 7%, Apple over 6%, Amazon and AMD more than 5%, Intel and ASML over 3%. Blockchain-related stocks also declined broadly, with Coinbase and Canaan each falling about 9%.

Interestingly, when rumors surfaced that Trump was considering a 90-day suspension of tariffs, the S&P 500 reversed from an initial drop of over 4.7% to gain nearly 3.9%; the Dow rebounded from a 4.4% fall to rise over 2.3%; the Nasdaq flipped from down nearly 5.2% to up over 4.5%; and BTC surged above $81,000.

However, the White House later told CNBC that any talk of a 90-day tariff suspension was “fake news,” sending global markets back into decline—proving just how much pressure Trump’s tariff policies exert on global finance.

Surviving Multiple Crashes: Risk Origins, Transmission Paths, and Market Memory

From “312” to the “tariff war,” each major crypto crash reveals different types of systemic pressures facing this emerging asset class. These crashes aren’t just about differing magnitudes of price drops—they reflect the evolution of crypto across liquidity structure, credit models, macro coupling, and policy sensitivity.

The key difference lies in the “level” of the risk source.

The 2020 “312” crash and the 2025 tariff crisis are both examples of “external systemic risks” driving market collapses—characterized by a “cash is king” mentality leading to broad-based sell-offs of on- and off-chain assets, showcasing the ultimate interconnectivity of global financial markets.

In contrast, the FTX and Terra/Luna episodes represent “internal credit/mechanism collapses,” exposing structural vulnerabilities in centralized and algorithmic systems. China’s regulatory crackdown exemplifies concentrated geopolitical pressure, revealing how crypto networks react passively to sovereign power.

Beyond these differences, several common patterns stand out:

First, the “sentiment leverage” in crypto markets is extremely high. Every price correction is rapidly amplified through social media, leveraged instruments, and on-chain panic behavior, often resulting in stampedes.

Second, risk transmission between on-chain and off-chain is increasingly tight. From the FTX collapse to whale liquidations on-chain in 2025, off-chain credit events no longer remain confined to “exchange problems”—they propagate onto the blockchain, and vice versa.

Third, market adaptability is improving, but structural anxieties are deepening. DeFi showed resilience during the FTX crisis but revealed logical flaws during the Terra/Luna collapse. On-chain data is more transparent than ever, yet large-scale liquidations and whale manipulation still frequently cause sharp volatility.

Finally, each crash pushes crypto toward “maturation”—not greater stability, but greater complexity. More sophisticated leverage tools, smarter liquidation models, and more complex player dynamics mean future crashes won’t be fewer—but understanding them requires deeper analysis.

Notably, none of these crashes ended the crypto market. Instead, each pushed structural and institutional reconstruction to deeper levels. This doesn’t mean the market will become more stable—on the contrary, increasing complexity often means future crashes may not decrease in frequency. But our approach to understanding volatile asset prices must become deeper, more systematic, and capable of integrating both “cross-system shocks” and “internal mechanism imbalances.”

These crises don’t tell us “crypto will ultimately fail.” Rather, they show that crypto must continuously redefine its place amid global financial order, decentralization ideals, and risk博弈mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News