After losing my entire position in three months, here are a few reflections

TechFlow Selected TechFlow Selected

After losing my entire position in three months, here are a few reflections

Money is just a way to measure your progress, but that doesn't mean you can "save your progress" upon reaching your goal.

Author: Res

Translation: TechFlow

Over the past three months, after losing most of my portfolio assets, I've been reflecting on one key idea:

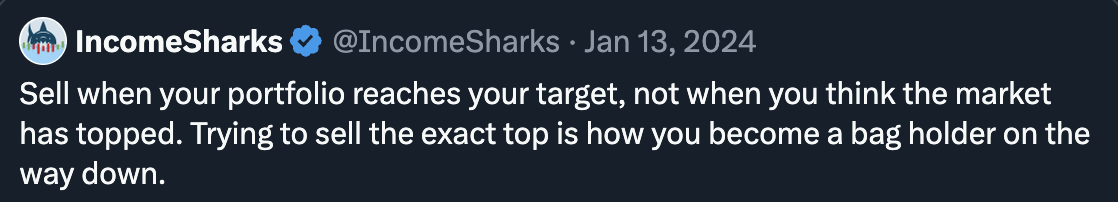

"Sell when your portfolio reaches your goal—don't wait until you think the market has peaked."

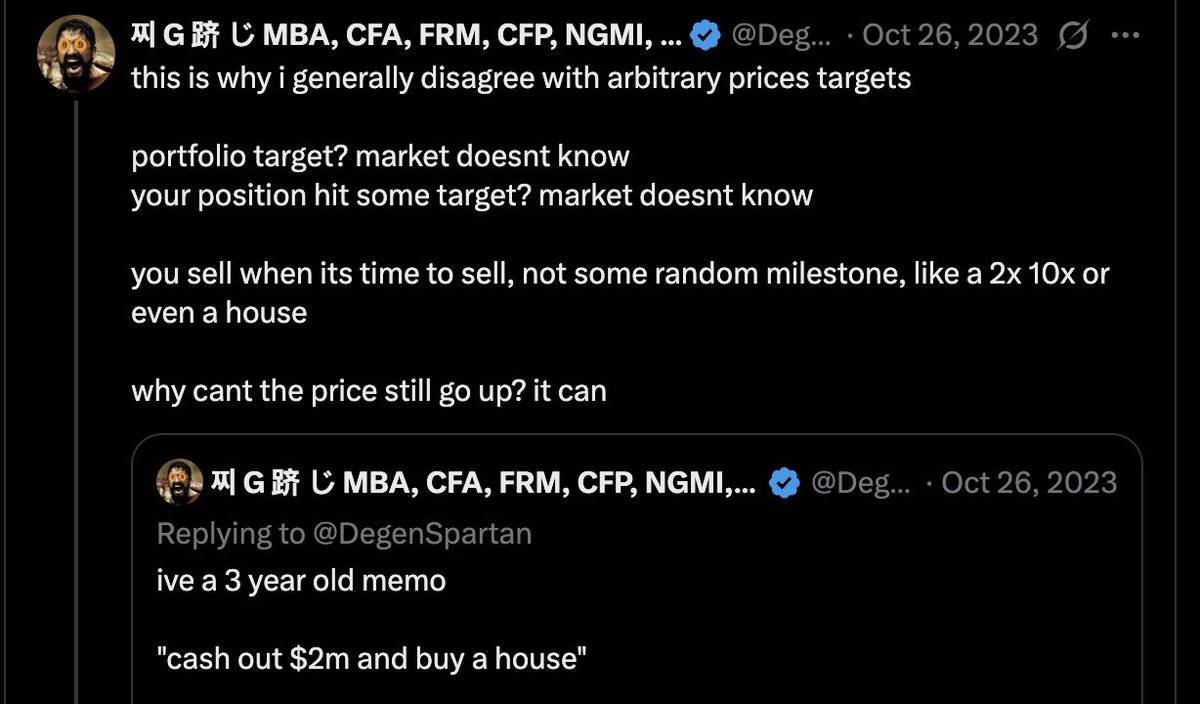

I used to believe that selling based on personal goals was counterproductive because your trading risks and decisions should be dictated by the market. By the way, you can check out @DegenSpartan's posts where he defends this viewpoint.

If I had already hit my target when Bitcoin (BTC) reached $50,000, why would I sell if I believed it could go to $100,000? That never made sense to me.

Likewise, if your portfolio is at $870,000 and your goal is $1 million, you can’t force the market to keep rising just because you haven’t hit your number—especially if the market may have already topped.

You must accept reality and let go.

However, this mindset is overly idealistic—or achievable only by that 0.01%. Yes, in theory this approach is perfect, but the reality is you can't precisely time market tops.

How many people have experienced their wealth pulling back from peak levels? I’d bet many here once achieved their dream of financial freedom months or even years ago, only to watch it vanish within weeks.

Poorly liquidated junk tokens, revenge trading, leveraged bets… some have gone from eight-figure portfolios to zero.

You never truly know if the market has peaked—you simply don’t have that ability.

The very traits that make you rich are often what cause you to lose everything. Most of the time you're a "perma-bull"; your high risk tolerance brings massive returns during bull runs, but this same behavioral pattern—reinforced by continuous wins and positive feedback—can cloud your judgment during downturns, leaving you vulnerable to being "rekt".

Not to mention timing: bottoms usually take months to form, while tops often collapse within days—especially after exponential rallies.

Except for a rare few elite traders, most people remain bullish when they should be exiting, simply because that’s how their trading psychology is wired.

And when they do make mistakes—especially big ones—some can’t emotionally handle it. If you’ve already reached your goal, why not “save your progress” and restart from a calm, abundant, and objective state? It's like playing a video game—you wouldn’t run through an entire playthrough without saving.

Only after losing a lot do you realize that what you once had was far more real and meaningful than numbers on a screen.

On the other hand, I don’t believe those who adopt a “I’ll stop once I reach X” mindset ever actually succeed. This mentality will never get you close to your goal, because you must love the game: learn → improve → win. Money is merely a metric of your progress—but that doesn’t mean you can simply “save progress” upon reaching a milestone.

Sometimes, additional gains won’t meaningfully change your life, yet the risks you’re taking are extremely high. You’ll always feel tempted that now is the time to go all-in; you’ll always find reasons to stay bullish.

The vast majority of people trading in these markets should adopt a systematic approach to profit-taking and risk management:

1. Avoid "all-in" moves. Accept reality—you're not that top-tier trader. Maybe one day you will be, but not today.

2. While making profits, withdraw funds gradually regardless of your market outlook.

3. Set larger goals based on lifestyle needs, and clearly define your risk-to-reward ratio (R:R). Once your net worth hits a certain level, begin reducing risk exposure—because further gains may not significantly improve your life, while losses could have devastating consequences.

For example, going from $500K to $900K might not change your life much, but dropping from $500K to $100K would be catastrophic—even though both represent a $400K difference.

Withdraw more capital and reduce risk at predetermined levels. Your aim should be to operate from a place of abundance, not fear or scarcity. You’ll be surprised how objective you can become—suddenly, emotions no longer control you.

4. Manage risk dynamically according to market conditions. There are times when you can take on more aggressive risk—such as when ETFs are approved, the Fed begins cutting rates, Trump wins re-election, or whenever Trump, Powell, or other key figures clearly signal a buy opportunity.

Your risk management and portfolio allocation should combine 1) market context and 2) personal life considerations—not rely solely on one factor.

Most people focus only on market signals and ultimately fail to reach their goals because, for most, that approach isn’t realistic.

5. Love the game and focus on growth—the money will follow. To succeed, you can never stop moving forward. If you want to quit, then you'll never truly succeed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News