Arthur Hayes: The global economy is at an inflection point of the inflation cycle, and holding cryptocurrencies is the best way to preserve value

TechFlow Selected TechFlow Selected

Arthur Hayes: The global economy is at an inflection point of the inflation cycle, and holding cryptocurrencies is the best way to preserve value

The depreciation caused by the expansion of the banking system and centralized credit allocation is imminent.

Author: ARTHUR HAYES

Compiled by: TechFlow

Some people will say:

-

“The crypto bull market is over.”

-

“I need to exit my tokens now because we’re in the downtrend of the bull cycle.”

-

“Why isn’t Bitcoin rising along with large U.S. tech companies in the Nasdaq 100?”

This chart comparing the Nasdaq 100 (white) and Bitcoin (gold) shows both assets moving in tandem, but Bitcoin has stalled after reaching all-time highs earlier this year.

This chart of the Nasdaq 100 (white) versus Bitcoin (gold) shows their movements aligned, but Bitcoin has stagnated after hitting record highs earlier this year.

Yet the same people also say:

-

“The world is shifting from a unipolar, U.S.-dominated order to a multipolar one led by China, Brazil, Russia, and others.”

-

“To finance government deficits, savers must face financial repression, and central banks must print more money.”

-

“World War III has already begun, and war leads to inflation.”

These conflicting views on the current stage of the Bitcoin bull market, alongside opinions about geopolitics and global monetary conditions, confirm my belief that we are at an inflection point—transitioning from one geopolitical and monetary world order to another. While I don’t know which nation will ultimately dominate or what the new trade and financial architecture will look like, I do understand its general shape.

I want to step back from the noise of today’s volatile crypto capital markets and focus instead on the broader cyclical reversal underway.

I aim to analyze the three major cycles from the Great Depression of the 1930s to today. This analysis centers on Pax Americana because the entire global economy is effectively a derivative of the dominant empire’s financial policies. Unlike Russia in 1917 or China in 1949, Pax Americana did not undergo political revolution due to the two World Wars. Most importantly for this analysis, America has been relatively the best place to hold capital. It possesses the deepest equity and bond markets and the largest consumer base. Whatever America does, the rest of the world follows and reacts, leading to varying outcomes regardless of the flag on your passport. Therefore, understanding and anticipating the next major cycle is crucial.

Historically, there are two types of eras: local and global. During local eras, governments impose financial repression on savers to fund past and present wars. In global eras, financial controls ease and global trade flourishes. Local eras are inflationary; global eras are deflationary. Any macro thinker you follow likely uses a similar framework to describe the major cycles of the 20th century and beyond.

The purpose of this history lesson is to make informed investment decisions across cycles. Within a typical 80-year life expectancy—and given the stem cell treatments I’ve received—I may live even longer. You can expect to experience roughly two major cycles. I categorize our investment choices into three buckets:

If you believe in the system but not in those managing it, invest in real estate.

If you believe in both the system and its managers, invest in government bonds.

If you trust neither the system nor its managers, then invest in gold or other stateless assets like Bitcoin. Stocks are legal fictions, upheld by courts backed by armed enforcement. Thus, stocks require a strong state to exist and retain value over time.

In local, inflationary times, I should own gold and avoid stocks and bonds.

In global, deflationary times, I should hold stocks and avoid gold and bonds.

Government bonds rarely preserve value over the long term unless I can leverage them infinitely at low or zero cost, or regulators force me to hold them. This is mainly because politicians find it too tempting to print money to fund political goals without resorting to unpopular direct taxation.

Before describing the cycles of the last century, let me highlight several key dates.

-

April 5, 1933: On this day, U.S. President Franklin D. Roosevelt signed an executive order banning private ownership of gold. He then defaulted on the U.S. commitment under the gold standard by devaluing the dollar from $20 to $35 per ounce of gold.

-

December 31, 1974: On this day, U.S. President Gerald Ford restored Americans’ right to own gold privately.

-

October 1979: Federal Reserve Chair Paul Volcker changed U.S. monetary policy to target credit quantity rather than interest rates. He then tightened credit to curb inflation. By Q3 1981, the 10-year U.S. Treasury yield hit a record high of 15%, while bond prices reached historic lows.

-

January 20, 1980: Ronald Reagan was sworn in as U.S. President. He subsequently deregulated the financial services industry. Other notable changes included favorable tax treatment for stock options and the repeal of the Glass-Steagall Act.

-

November 25, 2008: The Federal Reserve began printing money under its Quantitative Easing (QE) program, responding to the global financial crisis triggered by subprime mortgage losses on financial institutions’ balance sheets.

-

January 3, 2009: Satoshi Nakamoto launched the Bitcoin blockchain with the genesis block. I believe our Lord and Savior arrived here, liberating humanity from state control by creating a digital cryptocurrency capable of competing with digital fiat.

1933–1980: The Ascendant Cycle of Pax Americana

Compared to the rest of the world, the United States emerged from the wars unscathed. In terms of American lives and property lost, WWII was less deadly and materially destructive than the 19th-century Civil War. While Europe and Asia lay in ruins, American industry rebuilt the world and reaped enormous rewards.

Although the war went well for the U.S., it still required financial repression to pay the costs. Starting in 1933, the U.S. banned gold ownership. In the late 1940s, the Fed merged with the U.S. Treasury, enabling yield curve control so the government could borrow below market rates as the Fed printed money to buy bonds. To ensure savers couldn't escape, interest rate caps were imposed on bank deposits. The marginal dollars saved funded WWII and the Cold War against the Soviet Union.

With gold and inflation-linked fixed-income securities banned, what could savers do to beat inflation? The stock market was the only option.

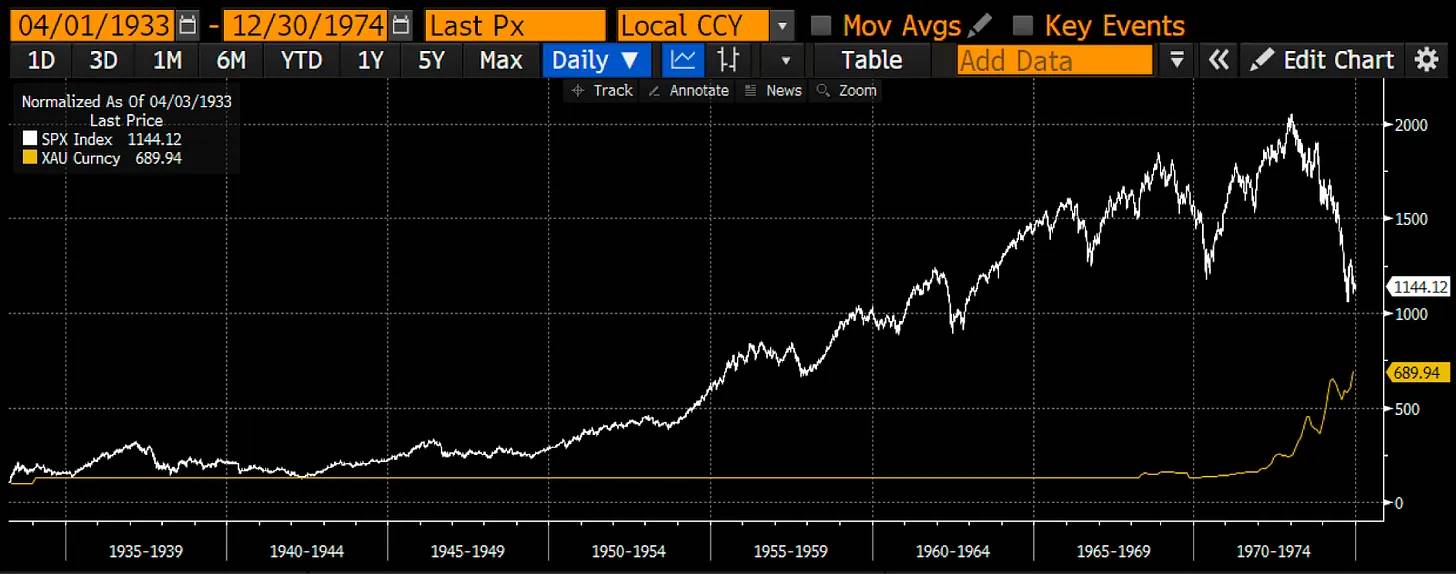

S&P 500 Index (white) vs. Gold (gold), indexed to 100, from April 1, 1933 to December 30, 1974

Even after gold rose following President Nixon’s 1971 abandonment of the gold standard, stocks outperformed gold.

But what happened when capital could once again freely bet against the system and its government?

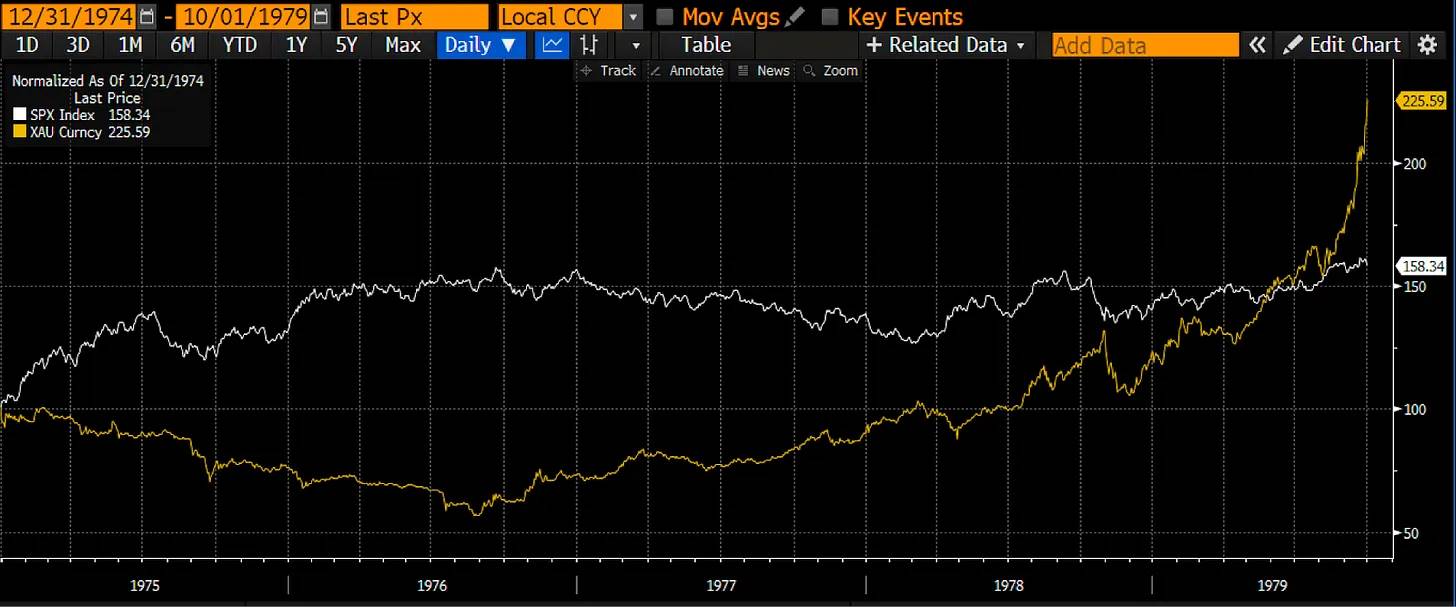

S&P 500 Index (white) vs. Gold (gold), indexed to 100, from December 31, 1974 to October 1, 1979

During this period, gold outperformed stocks. I stop the comparison in October 1979 because that’s when Volcker announced the Fed would drastically tighten credit, restoring confidence in the dollar.

1980–2008: The Zenith Global Cycle of Pax Americana

As confidence grew that the U.S. could and would defeat the Soviet Union, the political winds shifted. It was time to transition from a wartime economy, lift financial and other regulations, and let markets flourish.

Under the new petrodollar monetary architecture, the dollar was backed by oil sale surpluses from Middle Eastern producers like Saudi Arabia. To maintain the dollar’s purchasing power, interest rates needed to rise to suppress economic activity and inflation. That’s exactly what Volcker did—pushing rates higher and triggering a recession.

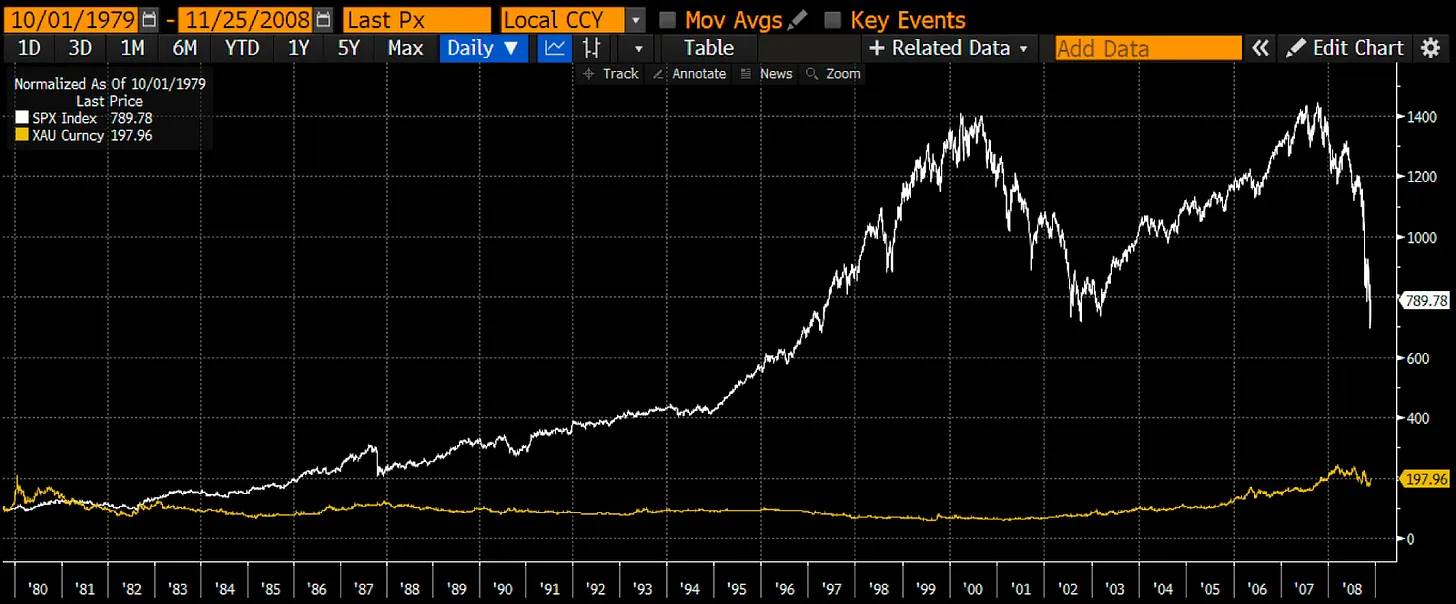

The early 1980s marked the beginning of the next cycle, during which the U.S., as the sole superpower, expanded global trade while the dollar strengthened due to monetary conservatism. Unsurprisingly, gold underperformed relative to stocks.

S&P 500 Index (white) vs. Gold (gold), indexed to 100, from October 1, 1979 to November 25, 2008

Apart from reducing some Middle Eastern nations to the Stone Age, the U.S. faced no peer or near-peer military conflict. Even after wasting over $10 trillion fighting cave dwellers in Afghanistan, cave dwellers in Syria, and guerrilla insurgents in Iraq—and losing—confidence in the system and government remained unshaken. After Jesus seized glory dramatically a millennium ago, Allah now prepares to deliver serious damage to America.

2008–Present: Pax Americana Versus the Medieval Local Cycle

Facing another deflationary economic collapse, Pax Americana defaulted and devalued once again. This time, instead of banning private gold ownership and devaluing the dollar against gold, the Fed chose to print money and buy government bonds—what they call Quantitative Easing (QE). In both cases, dollar-based credit expanded rapidly to “save” the economy.

Proxy wars between major political blocs erupted once again. A key turning point was Russia’s 2008 invasion of Georgia, a response to NATO’s intention to admit Georgia. For Russia’s elite under President Putin, halting the nuclear-armed NATO’s advance and encirclement of Russian territory remains paramount—then and now.

Currently, the West (Pax Americana and its vassals) fights intense proxy wars against Eurasia (Russia, China, Iran) in Ukraine and the Levant (Israel, Jordan, Syria, Lebanon). Any of these conflicts could escalate into nuclear war between the sides. In response to seemingly unstoppable war momentum, nations are turning inward, ensuring every aspect of their national economies is prepared to support war efforts.

For this analysis, this means savers will be called upon to fund the nation’s wartime expenditures. They will face financial repression. The banking system will allocate most credit according to state directives toward specific political goals.

Pax Americana defaulted on the dollar again to prevent a deflationary depression akin to the 1930s. Subsequently, the U.S. erected protectionist trade barriers just as it did from 1930 to 1940. All nation-states now act in self-interest, meaning severe inflation alongside financial repression is inevitable.

S&P 500 Index (white), Gold (gold), and Bitcoin (green), indexed to 100, from November 25, 2008 to present

This time, as the Fed devalues the dollar, capital can freely exit the system. The difference is that at the start of this local cycle, Bitcoin offers an alternative stateless currency. The main distinction between Bitcoin and gold, as Lynn Alden puts it, is that Bitcoin’s ledger is maintained via cryptographic blockchain and moves at the speed of light. Gold’s ledger is maintained by nature and moves only as fast as humans physically transport it. Compared to digital fiat—which also moves at light speed but can be printed limitlessly by governments—Bitcoin excels, while gold falls short. This explains why Bitcoin has largely overshadowed gold since 2009.

Bitcoin has outperformed gold so dramatically that you cannot distinguish the returns of gold and stocks on this chart. Gold underperformed stocks by nearly 300%.

The End of Quantitative Easing

While I believe my background and description of the past 100 years of financial history are compelling, it doesn’t eliminate concerns that the current bull market has ended. We know we are in an inflationary era, and Bitcoin has done what it was supposed to: outperform stocks and fiat depreciation. Yet timing is everything. If you bought Bitcoin at recent all-time highs, you might feel like a beta male projecting past results into an uncertain future. That said, if we believe inflation will persist and war—whether cold, hot, or proxy—is imminent, what does the past tell us about the future?

Governments have consistently repressed domestic savers to fund wars and past cycle winners, maintaining system stability. In today’s nation-state and large integrated commercial banking system, the primary method governments fund themselves and key industries is by directing how banks allocate credit.

The problem with quantitative easing is that markets channel free money and credit into enterprises that don’t produce real goods needed for a wartime economy. Pax Americana exemplifies this phenomenon. Volcker ushered in the era of omnipotent central banks. Central bankers create bank reserves by buying bonds, lowering costs and increasing credit availability.

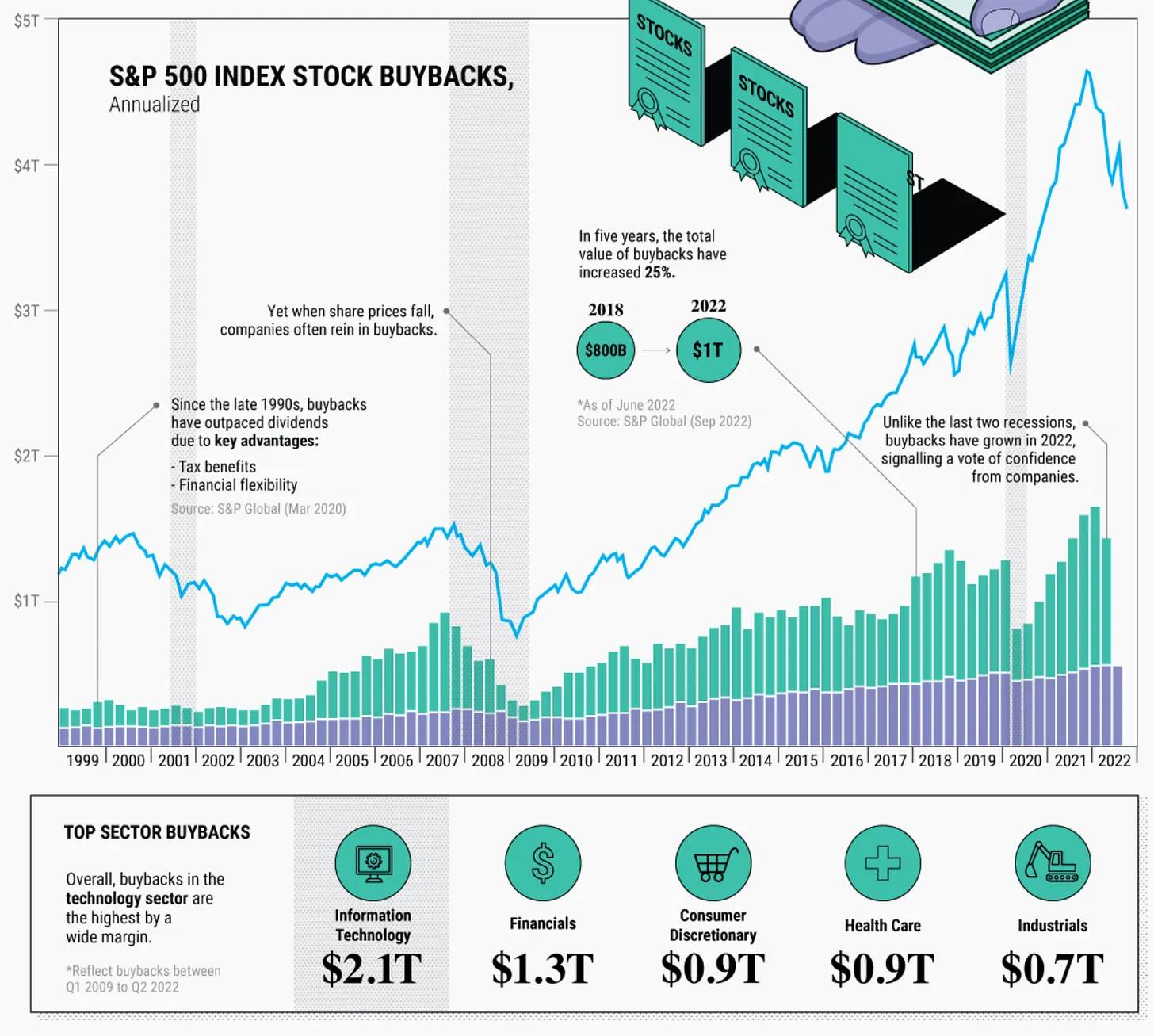

In private capital markets, credit allocation aims to maximize shareholder returns. The easiest way to boost stock prices is to reduce float through buybacks. Companies with access to cheap credit borrow to repurchase shares. They don’t borrow to expand capacity or improve technology. Growing the business to generate more revenue is challenging and doesn’t guarantee a stock price bump. But mathematically, reducing float increases share price—an approach adopted by large-cap firms with abundant cheap credit since 2008.

(See source)

Another low-hanging fruit is boosting profit margins. Instead of using stock gains to build new capacity or invest in better technology, corporations cut labor costs by offshoring jobs to China and other low-cost countries. U.S. manufacturing has become so fragile that it cannot produce enough ammunition for Russia’s fight in Ukraine. Moreover, China holds such a dominant position in manufacturing that critical components in the U.S. Department of Defense supply chain are produced by Chinese firms, many of which are state-owned. QE combined with shareholder-centric capitalism has made U.S. military “giants” dependent on the nation’s “strategic competitor” (their words, not mine)—China. How ironic! The credit allocation model of Pax Americana and the Western collective will converge with those of China, Japan, and South Korea. Either the state directly instructs banks to lend to certain industries/companies, or banks are forced to buy government bonds below market yields so the state can subsidize and offer tax breaks to “favored” firms. In either case, returns on capital or savings will lag nominal growth and inflation. Assuming no capital controls, the only escape is to buy extraterritorial stores of value like Bitcoin.

For those obsessed with tracking changes in major central bank balance sheets and believing credit growth is insufficient to push crypto prices higher again, you must now obsess over commercial bank-created credit. Banks do this by lending to non-financial businesses. Fiscal deficits also generate credit, as deficits must be funded by borrowing in sovereign debt markets—debt that banks dutifully purchase.

In short, in past cycles, we monitored the size of central bank balance sheets. In this cycle, we must track fiscal deficits and total non-financial bank credit.

Trading Strategy

Why am I confident Bitcoin will regain its magic? Why am I confident we are in a new localized, nation-state-first inflationary cycle?

Consider this data:

A federal agency now forecasts the U.S. budget deficit will surge to $1.915 trillion in fiscal year 2024, up from $1.695 trillion last year, marking the highest level outside the COVID-19 era. The 27% upward revision is attributed to increased spending.

For those worried that “slow” Biden won’t spend enough to keep the economy running ahead of elections, this is the answer.

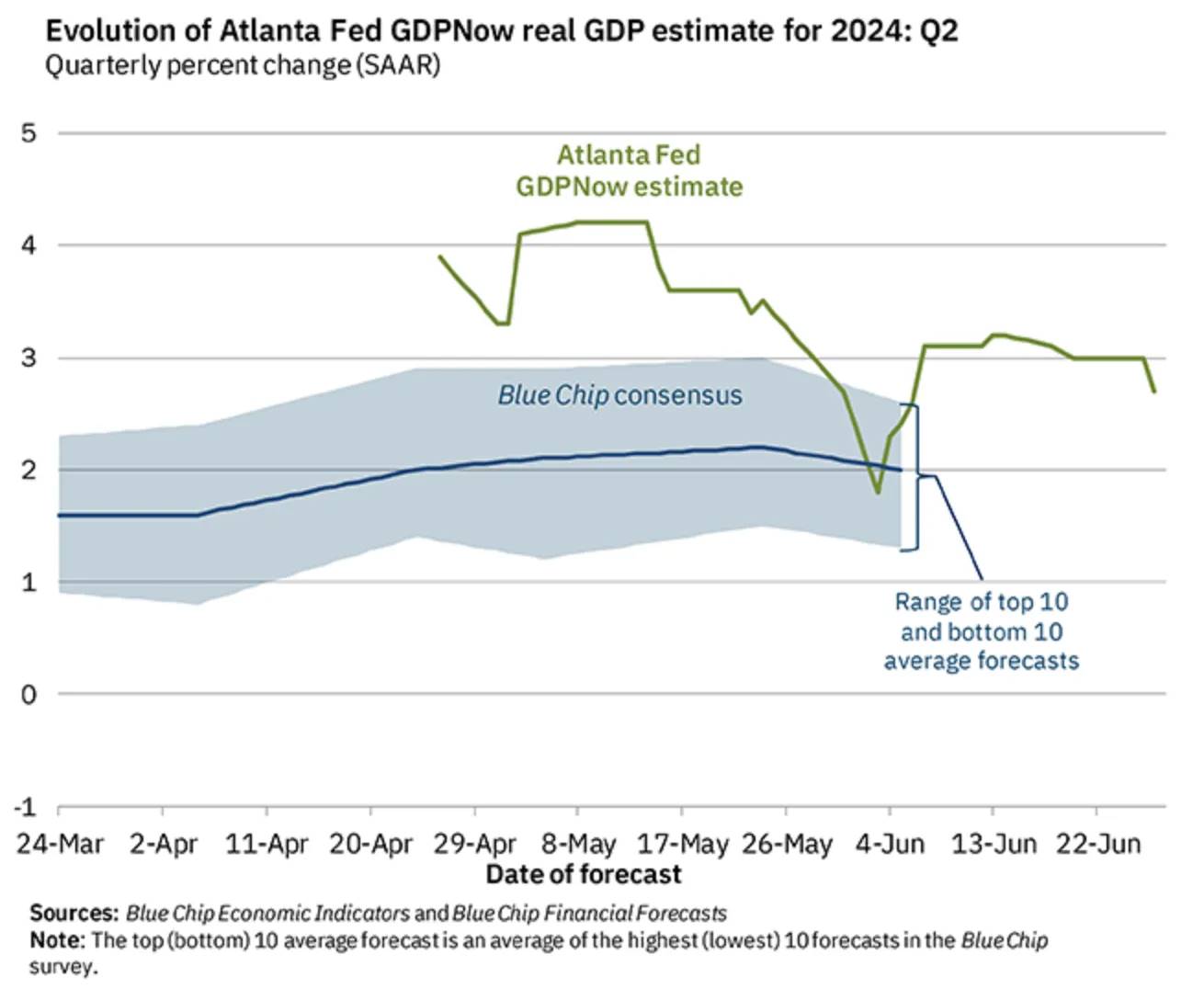

The Atlanta Fed forecasts real GDP growth of a stunning +2.7% in Q3 2024.

For those fearing Pax Americana will fall into recession, mathematically it's extremely difficult when the government spends $2 trillion beyond tax receipts—equivalent to 7.3% of 2023 GDP. For context, U.S. GDP fell 0.1% in 2008 and 2.5% in 2009 during the global financial crisis. Even if another crisis resembling 2008 hits this year, the decline in private-sector growth still wouldn’t exceed government spending. There will be no recession. This doesn’t mean many ordinary people won’t face severe financial hardship, but Pax Americana will march on.

I highlight this because I believe fiscal and monetary conditions are loose—and will remain so—making holding cryptocurrency the best way to preserve value. I am convinced today’s environment resembles the 1930s–1970s, meaning that since I can still freely move from fiat to crypto, I should do so, as devaluation driven by bank system expansion and centralized credit allocation is coming.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News