IOSG Partners Year-End Review: The Bull Market Has Already Returned, Ethereum Is Too Big to Fail

TechFlow Selected TechFlow Selected

IOSG Partners Year-End Review: The Bull Market Has Already Returned, Ethereum Is Too Big to Fail

The convergence of factors such as the Bitcoin halving has made ecosystem prosperity an inevitability amid apparent coincidence.

Author: Jocy, Founder of IOSG

1. Scalable Growth Enabled by Effective Regulation

The regulatory resolution for Binance has been seen by many as negative news for the industry—a sign of “crypto’s largest unicorn finally compromising with regulators.” But in my view, this signifies that the biggest potential risk has been defused. The overall industry risk is now manageable, and we are moving toward a regulated market environment. This will also accelerate the approval and launch of crypto ETFs.

Let’s envision this: CME currently accounts for over 25% of total BTC futures trading volume (validating the hypothesis of massive institutional inflow). As U.S. regulation eases, compliant exchanges like Binance and Coinbase will dominate BTC trading volume. We might even see Nasdaq directly list BTC and ETH. In such a scenario, just how large could the daily BTC trading market become? Amid the U.S. debt crisis, the Federal Reserve and Democrats appear to have reached a tacit consensus on crypto governance—they may be playing a much larger strategic game. Regulatory reconciliation with the crypto market is one of the key bullish factors, paving the way for the industry to expand into a broader market.

2. Data Shows the Bull Market Is Already Returning

We can now observe three major events converging in the coming months:

-

First, the accelerated approval and launch of ETFs (an inevitable development, ensuring Wall Street will capture Bitcoin price dominance);

-

Second, the Federal Reserve beginning rate cuts as inflation peaks and declines (given current U.S. debt levels, rate cuts are becoming increasingly certain);

-

Third, internal industry developments—Bitcoin halving, and continuous innovation in Ethereum's ecosystem, particularly Layer 2 infrastructure and application-level advancements.

These three events will coincide within the next six months, signaling that the market will rebound from its current correction and potentially enter a stronger bull cycle.

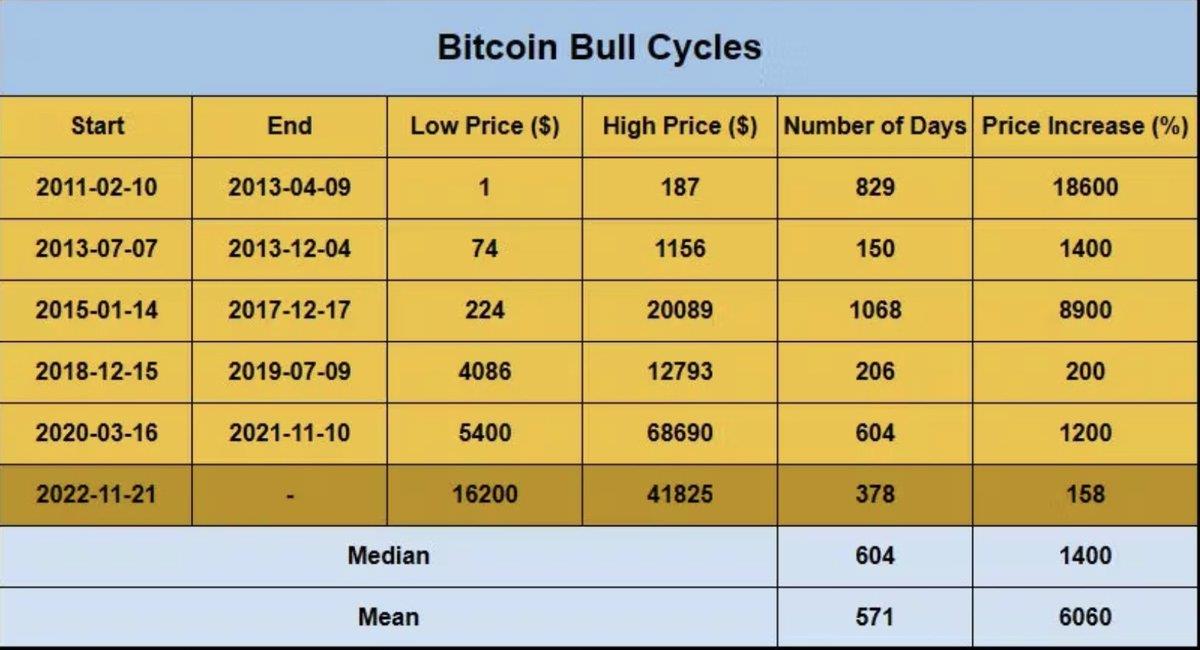

We can analyze historical bull and bear cycle data (courtesy of an internal IOSG data analyst) to validate the current market state. Historically, median bear market drawdowns were -77%, with an average decline of around -75% (the recent bear market declined exactly 77%). Median bull market gains were 15x, averaging around 60x price increases.

Regarding duration, bear markets historically lasted a median of 354 days (average: 293 days—the recent bear market closely matched the median). Bull markets had a median duration of 604 days and averaged 571 days.

Historical analysis provides valuable insight into market cyclicality. We are currently entering the mid-phase of a medium-length bull cycle—effectively stepping into the ascent phase of this crypto bull market.

3. Continuous Ecosystem Innovation: Ethereum, Too Big to Fail

On Ethereum’s ecosystem innovation, we must mention Devconnect in November—the year’s largest gathering of crypto developers and Vitalik Buterin’s most frequent public appearances. What happened at Devconnect?

Strengthening infrastructure: New technologies and niche markets emerged. During L2Day, zkDay, and the zk Accelerator, numerous ZK and Layer 2 protocols showcased their strengths across different stages. ZK rollup-based innovations like Risc0, Nil Foundation, Scroll, zkSync, and Aztec are now competing post-mainnet launch, leading to a more diverse ecosystem.

1) ZK Coprocessors represent a promising direction. Projects include Brevis, Axiom, Lagrange, and Herodotus. Brevis presents a clear use case: One key difference between CEXs and DEXs is referral programs and loyalty incentives—more users and trades mean higher rewards and fee discounts. Brevis aims to bring these features to DEXs, enabling Uniswap to securely and trustlessly track user interactions, rewarding new user acquisition and trading activity.

2) Protocols in the Layer 3 and Rollup-as-a-Service (RaaS) space—including Conduit, Caldera, Gelato—are launching application-specific chains for gaming, social, and DeFi. Despite many Jewish-background developers missing the event due to the Israel-Hamas conflict, countless founders continued promoting their RaaS solutions. It was inspiring to witness this early-stage market. Sitting in a café, I was surrounded by L2/L3 founders passionately pitching their rollup solutions—how they enable seamless app deployment and deliver Web2-like user experiences. It felt reminiscent of the early Web 1.0 era around 2000 or the pre-explosion SaaS scene circa 2012.

Many claim Ethereum’s innovation is slow, with modular development outsourced to various community teams. Yet this actually proves its powerful network effects. The mainstream L2/L3/DA projects mentioned earlier are all solving Ethereum’s scalability and use case challenges. Amid fierce technical competition, it seems the entire crypto ecosystem—infra, dApps, VCs—has effectively become unpaid contributors to Ethereum’s growth, collectively strengthening the network.

3) Emerging trends also involve hotly debated technologies like decentralized GPUs and ZKML. Bittensor’s narrative and price surge shocked many, while Gensyn—valued at $500M in seed funding—also drew attention. Both aim to provide decentralized AI computing power.

This trending field isn’t speculative—it has real applications. One game developer showed me how Crypto and AI naturally integrate. They built a fully on-chain football game using ZKML, where every pass and goal is verified via ZKML and results are automatically recorded on-chain. Players can deploy different strategy models (ZKML), similar to bot/AI tactics used previously in games like Dark Forest.

While debates continue around on-chain LLMs and ZKML use cases and adoption, I believe we’ll soon see more AI-centric crypto platforms. Recently, Vitalik mentioned “d/acc” (decentralized acceleration). We’ll likely see new projects from Unibot and Stephant, former Flashbots founder, which could shift user behavior toward bot-driven trading.

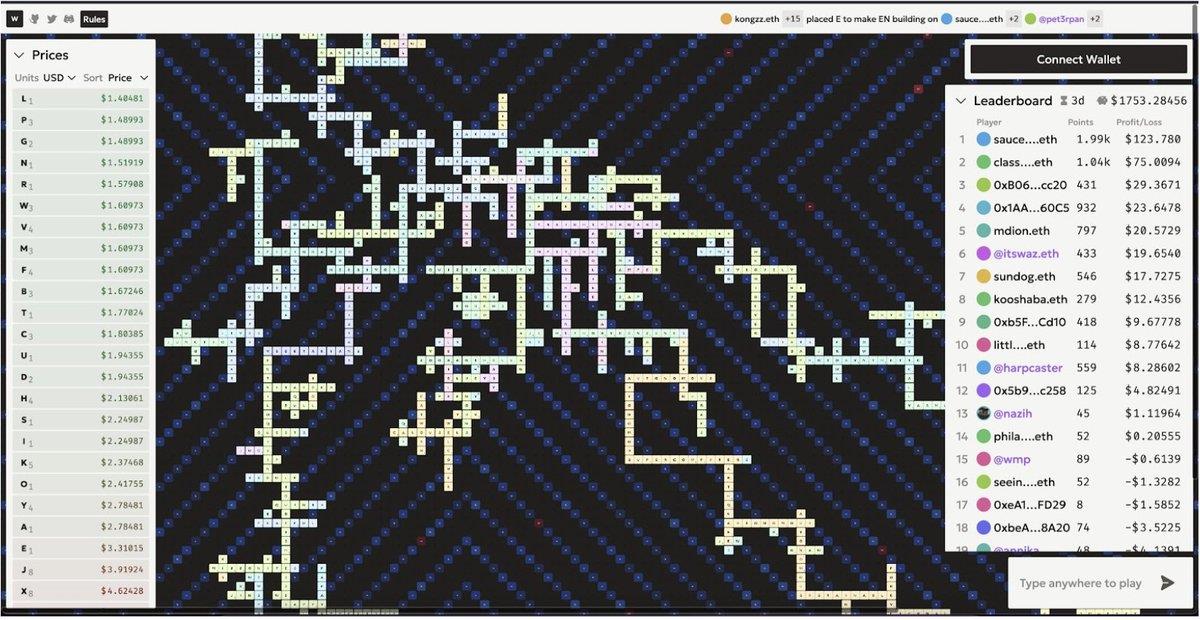

Lastly, returning to fully on-chain gaming—I want to highlight a young prodigy, Small brain, creator of clever full-chain games like Word3, Drawtech, and Gaul. Not only has he developed innovative blockchain-native gameplay, but through insightful contributions in the AW community, he’s rallied like-minded developers to rapidly iterate on MUD. Their goal: launch a new full-chain game every six weeks—already producing many exciting experiments.

Critics overlook Ethereum’s compatibility and evolutionary capacity. When new applications hit bottlenecks—whether TPS or gas fees—Ethereum quickly absorbs new tech to solve them. Competing alt-L1s offer no clear advantage in application specialization.

In this cycle, Ethereum exhibits two distinct and unprecedented network expansion models:

First, monetary and "security" export via LSD assets—akin to dollarization—flowing into Layer 2s, altchains, restaking protocols, and DA protocols. This spillover effect significantly strengthens Ethereum’s network effects, reinforcing ETH’s monetary properties and store-of-value characteristics.

Second, technological absorption and consolidation. Each cycle, Ethereum integrates new paradigms built on past platform failures—whether PoS, observed and refined over years before implementation, or scaling solutions evolving from Plasma and sharding to various rollups. By learning from failed projects, Ethereum leverages what amounts to tens of billions in R&D sunk costs across competitors—effectively turning their losses into its investment capital. Few platforms, if any—not even Bitcoin—benefit from this dynamic as much as Ethereum. Fortunately, this cycle, Ethereum continues absorbing and consolidating.

Given all this, why doubt Ethereum? Even during bear markets, countless projects and developers build products and protocols on Ethereum. Tens of thousands contribute new modules without immediate returns. Every Web3 fund and investor inevitably engages with Ethereum’s ecosystem. Meaning, despite ETH’s current valuation in the hundreds of billions, they will continue investing billions more into Ethereum-based projects. Ethereum will grow ever larger—and too big to fail!

4. The Inevitable Rise of the BTC Ordinals Ecosystem

As the market recovers rapidly, Bitcoin—the crown jewel of crypto—is seeing a surge of ecosystem projects vying for attention. Attempting to assess Ordinals’ value from a Bitcoin purist perspective is extremely difficult. Bitcoin, as crypto’s totem, fundamentally serves as a store of value. With broader societal consensus, rising valuations, institutional adoption, ETF expectations, and the upcoming halving, ecosystem growth is an inevitable byproduct. Whether Bitcoin L2s, Ordinals, or other protocol applications—all must first respect and protect Bitcoin’s core function: value storage.

The rise of Bitcoin memes and NFT-like assets is deeply tied to a retail-driven movement against VC dominance—demanding “fair launches.” Under VC control, retail investors often get scraps while VCs take the profits. Compared to the ICO era (Ethereum’s 2014 ICO valued at just $23M), today’s projects often reach multi-billion FDVs at launch, leaving retail with minimal equity.

This structural imbalance sparked today’s crypto “Occupy Wall Street” movement. However, this trend itself is unhealthy. During DeFi Summer, many “fair launch” projects emerged, but most were short-lived pump-and-dumps—crude forks lasting from “one-month wonders” to “one-day wonders,” driving out quality projects.

Eventually, after the dust settles, few “fair launch” projects survive long-term. The enduring ones remain battle-tested projects with solid funding structures. Sustainable ecosystems require long-term capital and risk-taking. Short-lived “fair launches” cannot support sustained development. Major crypto institutions haven’t heavily invested in Bitcoin’s tech ecosystem because there’s little meaningful technical scalability—most activity is retail sentiment driven by the “fair launch” label (though some institutions and exchanges may exploit such sentiment).

We do not support technical applications that threaten Bitcoin’s native network robustness. Speculative hype is unsustainable. The BRC20 protocol still has significant technical shortcomings. As institutional investors, we discourage speculation but support builders creating meaningful, ecosystem-enriching protocols.

Thus, the crypto market is a melting pot. Current tokens like Ordi and other BRC20s amplify speculation and price manipulation. Many will profit, but when we engage in profit-driven trading without a sound thesis, we risk losing ourselves—and eventually losing money on similar projects.

So, if you’re sharing this with newcomers—or friends/family FOMO-ing into the market—please help them understand the risks. Advise them to stick with BTC and ETH: the simplest and safest path. Sticking to principles in investing is hard. Memes and speculation create wealth effects, but true industry participants must look beyond hype and support protocols with real value propositions and long-term potential. That is our responsibility and duty.

Thanks to Mindao, Wendy, and Fiona for their editing suggestions.

[Disclaimer] Markets are risky; invest with caution. This article does not constitute investment advice. Readers should consider whether any opinions, views, or conclusions herein align with their personal circumstances. Investment decisions are your own responsibility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News