TechFlow news, January 8th, according to the latest Merkle Tree Proof of Reserve (PoR) data released by Huobi HTX, as of January 1, 2026, all core assets of the platform continue to achieve 100% or more full coverage, maintaining robust, secure, and transparent asset management performance at the beginning of the new year.

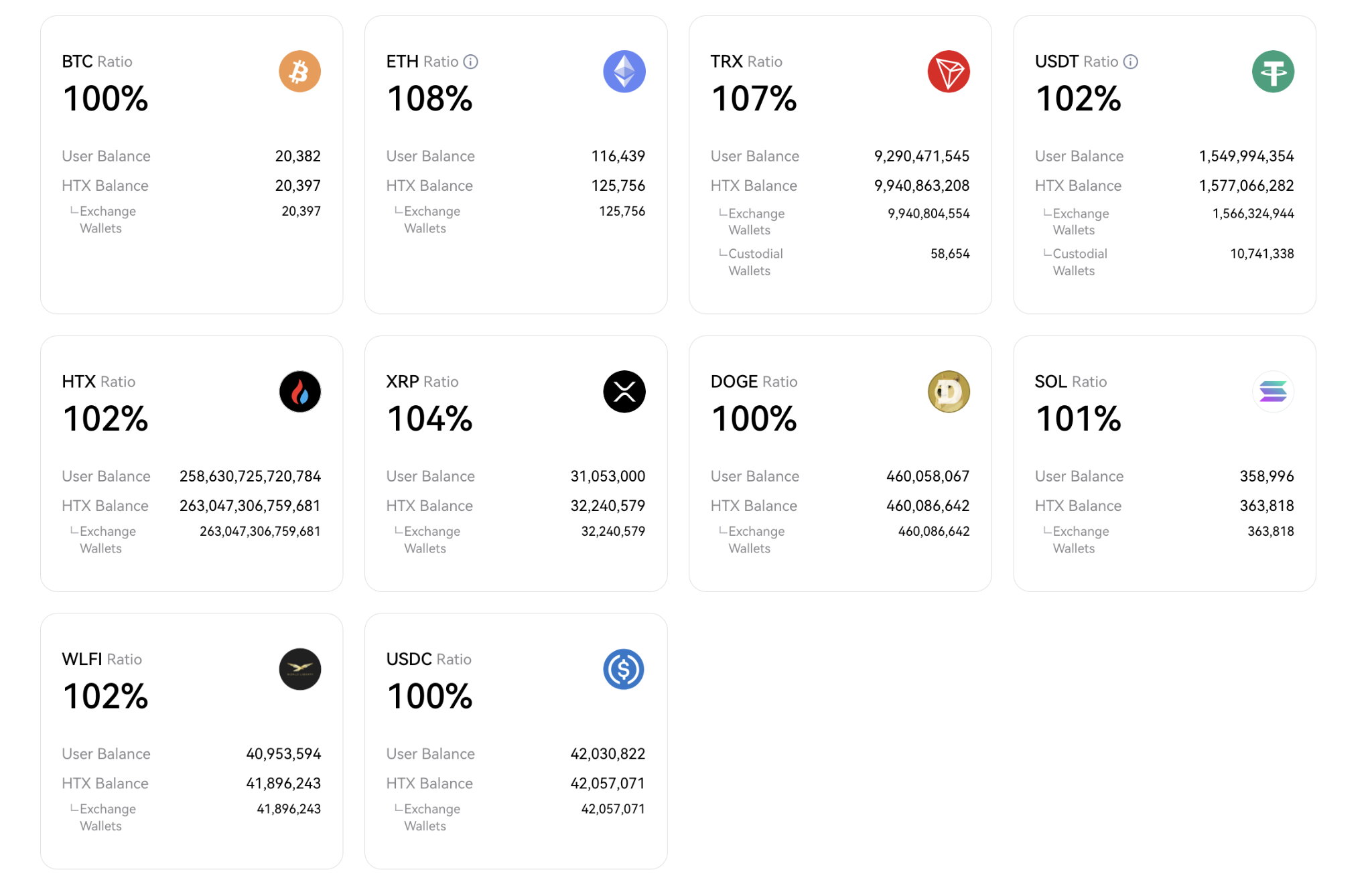

To date, Huobi HTX has regularly disclosed Merkle Tree Proof of Reserve for 39 consecutive months, with all historical data supporting independent on-chain verification. The latest reserve ratios are as follows: BTC (100%), ETH (108%), TRX (107%), USDT (102%), HTX (102%), XRP (104%), DOGE (100%), SOL (101%), WLFI (102%), USDC (100%). Users can visit the "Assets - Proof of Reserve Report" page on the Huobi HTX official website at any time to view the monthly updated Proof of Reserve reports.

According to Huobi HTX annual report data, user USDT asset scale grew by over 150% throughout 2025; user holdings of core assets such as BTC remained generally stable, providing a solid foundation for the platform's asset structure. In 2026, Huobi HTX will continue to prioritize user asset security, dynamically improve Proof of Reserve (PoR) asset coverage under a high-transparency mechanism, enhance support for third-party custody solutions, and continuously strengthen the platform's long-term stable operational capabilities.