Who will capture the cryptocurrency wallet market for Southeast Asia's 600 million people amid regulatory constraints?

TechFlow Selected TechFlow Selected

Who will capture the cryptocurrency wallet market for Southeast Asia's 600 million people amid regulatory constraints?

This is not just a convenience, but a symbol of an era—the quiet unfolding of a digital revolution belonging to Southeast Asia.

Southeast Asia is home to over 600 million people, with a young population, widespread smartphone adoption, and highly inclusive internet consumption, forming a vast and digitally savvy consumer base. Traditional banking services have limited coverage in the region, creating urgent demand for alternative payment solutions, making it one of the most promising digital payment markets globally. At this moment, cryptocurrency services are offering significant convenience to these regions.

Whether it's Singapore's "licensing system," Vietnam's "gray zone," or the sandbox policies in the Philippines—and regardless of how they promote or constrain development—they have not slowed down Southeast Asian users' adoption of cryptocurrency payments. Looking at the rapid rise of crypto in Southeast Asia, its transaction volumes have already surpassed those of Europe and the U.S., revealing the next digital gold rush.

Cryptocurrency QR Code Payments: Disrupting Traditional Payment Methods

If traditional payment methods resemble complex bank transfers, then cryptocurrency QR code payments make transactions as simple as breathing. Young consumers across Southeast Asia are now using their smartphones to scan QR codes for payments—whether buying a cup of coffee or purchasing cross-border goods—gradually replacing cash and credit cards.

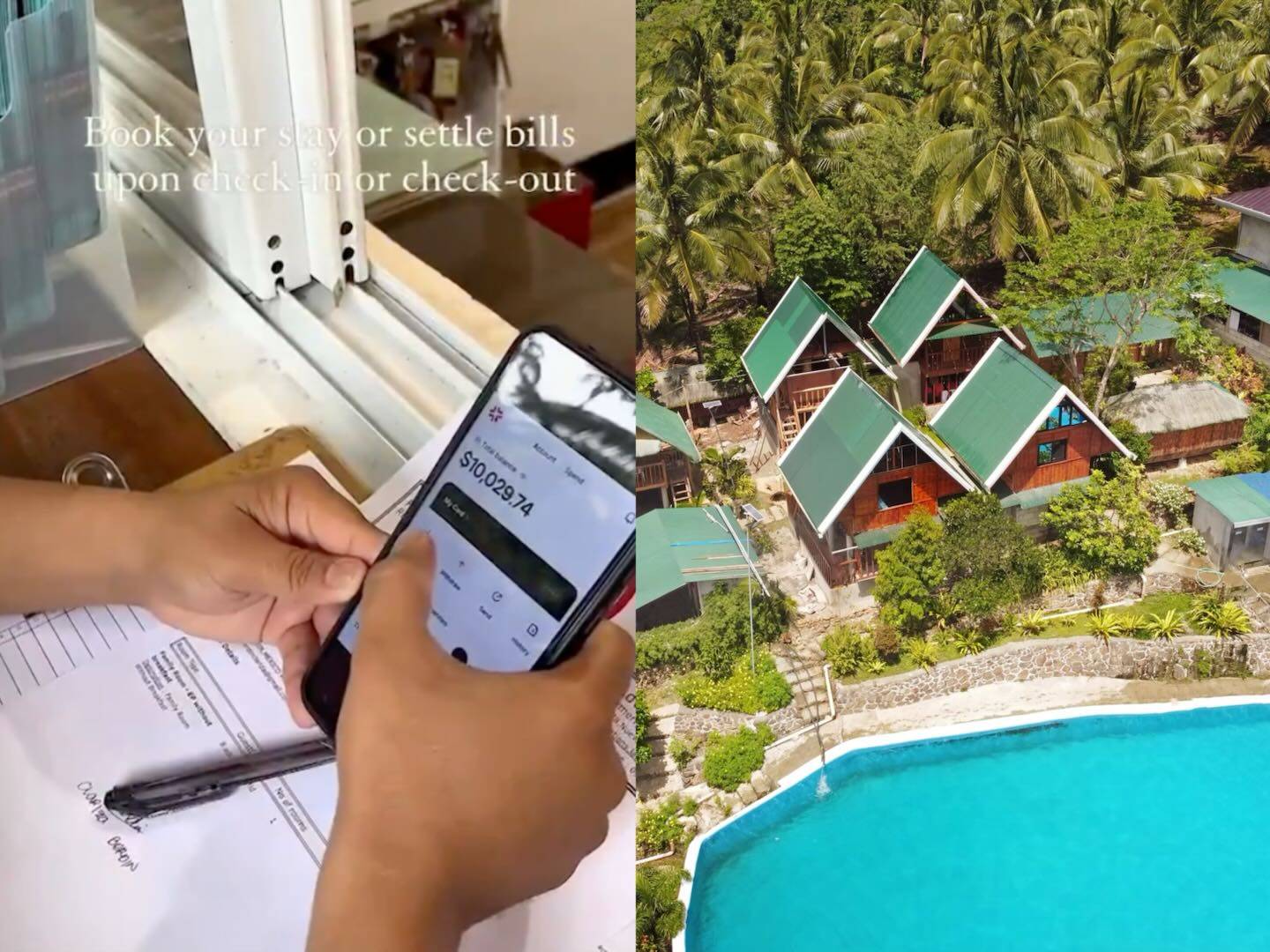

This shift is more than just a technological advancement; it represents a cultural transformation. The widespread adoption of cryptocurrency QR code payments reflects Southeast Asia’s broad embrace of digital lifestyles. Take the Philippines as an example: tourists at La Vie Adventure Trails resort can use TabiPay to directly complete payments with cryptocurrency, avoiding complicated currency exchanges and fees. This experience not only simplifies payments but also enables businesses to better serve global customers. The resort has even released video tutorials on using digital currency payments, featuring TabiPay as a case study.

La Vie Adventure Trails is a landmark destination in Philippine cultural tourism, attracting over 40% of the country's international visitors with its unique natural resources and cultural experiences, including distinctive Filipino-style accommodations and cuisine. Visitors browse souvenirs at gift shops or order coconut juice at restaurants, and the payment process is remarkably simple—they simply open their phones and complete the transaction via TabiPay. No cash is needed, nor do they have to deal with the hassle of currency exchange. This seamless experience makes travel easier and significantly improves the resort’s operational efficiency.

Recently, the resort announced a partnership with Tabichain to fully integrate the TabiPay payment solution. This move is not only a response to tourists’ payment needs but also an exploration of digital transformation in the Philippine tourism industry.

"We want our guests to focus on enjoying their trip rather than wasting time on currency exchange and payment procedures," said the resort’s management. "TabiPay simplifies payments and reduces our operating costs. It’s not just a technical tool—it’s a way to enhance service quality."

For developing countries like the Philippines, blockchain applications carry deeper implications. They not only optimize payment processes but also offer potential solutions to financial inclusion challenges. With TabiPay, transactions between tourists and merchants become more transparent and efficient. The success of this technology also provides a reference model for other industries.

Bangladesh: How Payment Transformation Is Weaving Into Every Corner of Urban Life

Customers of Aspire Developers & Properties Ltd., a real estate company in Bangladesh, are also enjoying the convenience brought by cryptocurrency payments. The company is known for developing landmark high-end residential properties and resorts in Bangladesh. Its major shareholder Sunny publicly stated on X that consumers can now directly use cryptocurrency to purchase property through TabiPay’s offline payment gateway, without worrying about exchange rate fluctuations or bank processing times. This innovative payment method is quietly reshaping the business ecosystem across Southeast Asia, making transactions more efficient and transparent. This initiative is not merely a technical experiment but also a direct response to changing consumer payment habits.

Urbanization in Bangladesh is accelerating, and younger generations are increasingly embracing digital payments. People are no longer satisfied with the cumbersome processes of traditional banking systems and instead desire the same simplicity in property transactions as buying a hot piece of fried flatbread on the street. Through its offline payment gateway and global card system, TabiPay offers Aspire’s customers options for both cryptocurrency and fiat payments. Consumers can complete transactions in just a few steps, free from exchange rate concerns and bank processing delays.

"Our customers are increasingly inclined to pay with Visa and Mastercard, but centralized payment systems sometimes create unnecessary complications," said Aspire’s management. "Introducing TabiPay allows us to offer more choices, including crypto payment cards. This flexibility is especially important for young consumers."

This collaboration is more than just a business decision by a real estate company—it’s a microcosm of Bangladesh’s evolving payment landscape. It demonstrates how blockchain technology can fundamentally transform transaction processes, making digital payments not just the domain of high-tech sectors but an integral part of everyday life for ordinary people.

How Crypto Payments Are Taking Over Southeast Asian Life: From Buying Durians to Cross-Border Remittances, A Silent Digital Revolution

On the streets of Southeast Asia, the owner of Durianss2 durian stall skillfully opens up golden fruit flesh, releasing an enticing aroma that draws passersby to stop. Customers take out their phones, scan a QR code, and complete the payment. This seemingly ordinary scene quietly reflects the economic transformation underway in Southeast Asia—from cash to digital payments, from tradition to innovation—with blockchain technology and cryptocurrency payments acting as the driving force behind the scenes.

The vendor says that foreign tourists account for more than half of his total customers. In his observation, many travelers use digital currencies during their trips, with some specifically using TabiPay to scan and pay in cryptocurrency. Among these tourists are numerous travel bloggers and content creators. Digital currency payments make it convenient for travelers to pay across different countries without visiting banks for currency exchange—simply scanning a local international payment code allows them to buy durians with stablecoins.

Southeast Asia boasts one of the youngest consumer demographics globally and rapidly expanding internet services. From street vendors to cross-border trade, from cultural tourism to real estate investment, changes in payment methods are not only impacting the economy but also transforming daily life. Through technological innovation and strategic partnerships, blockchain payment platform TabiPay is injecting new possibilities into Southeast Asia’s future.

How is crypto payment reshaping everyday life in Southeast Asia? The region’s digital payment ecosystem is evolving rapidly.

Statistics show that over 140 million people already use digital payment services, and blockchain technology is adding fresh momentum to this trend. From real estate in Bangladesh to tourism in the Philippines, TabiPay’s use cases demonstrate how crypto payments are moving from technological innovation into daily reality.

This is not merely a technological revolution, but a cultural shift. It makes payments as natural as breathing, turning transactions from a burden into an experience. From buying durians on the street to sending cross-border remittances, crypto payments are transforming the way people live in Southeast Asia, while offering important insights for the future of the global digital economy.

Perhaps next time you're buying durians at a market in Southeast Asia, you’ll find yourself completing the transaction via blockchain instead of using cash. That’s not just convenience—it’s a symbol of the times. A digital revolution uniquely Southeast Asian is quietly unfolding.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News