When Harvard and Yale Enter: The Crypto Scene at Top Universities

TechFlow Selected TechFlow Selected

When Harvard and Yale Enter: The Crypto Scene at Top Universities

Universities have become the "martial arts sects" of the crypto world.

Authors: Yanz, Liam

In August 2025, Bitcoin surpassed $120,000, pushing the once-"fringe asset" back into the mainstream spotlight—not just driven by Wall Street hedge funds, but also by the most conservative and shrewd capital managers within Ivy League campuses.

On August 9, an SEC 13F filing revealed a detail that caught market attention: Harvard University's endowment fund (approximately $53.2 billion in size) held $116 million worth of Bitcoin ETF (IBIT) during the second quarter of 2025. This position ranked as its fifth-largest holding, trailing only Microsoft, Amazon, Booking Holdings, and Meta, even surpassing allocations to Alphabet (Google’s parent company) and Nvidia.

Harvard is not alone.

Brown University, Emory University, and the University of Texas at Austin have all publicly disclosed cryptocurrency positions.

The ivory tower's "tightwads" embracing crypto is no impulsive act—it marks the surfacing of long-term strategic positioning.

Elite universities’ capital, talent, and technology have already taken deep root in the crypto industry.

This time, they’ve simply stepped into the spotlight.

Investing in Crypto During the Bust

In 2018, the darkest hour for the cryptocurrency industry.

Following the collapse of the ICO bubble, global crypto market cap evaporated by over $630 billion, plunging to under $200 billion. Bitcoin dropped to $3,000; Ethereum fell to $80. Retail investors fled en masse, labeling cryptocurrencies as "Ponzi schemes." Even Facebook banned ads related to crypto.

At this moment of universal retreat, Yale University’s endowment fund made a decision that seemed to “betray tradition.”

Under legendary investor David Swensen, in October 2018, Yale joined Harvard, Stanford, and other top institutions in investing in Paradigm’s inaugural $450 million crypto fund—co-founded by Coinbase co-founder Fred Ehrsam and former Sequoia partner Matt Huang. Simultaneously, Yale participated in a16z’s first $400 million crypto fund.

In hindsight, this low-point investment not only shaped the trajectories of Paradigm and a16z, but also accelerated the historical progression of the crypto industry.

Paradigm originally planned to allocate 60% of funds to crypto assets and 40% to equity in crypto startups. However, after securing funding, it took a bold move—using its invested trading platform Tagomi to aggressively accumulate Bitcoin and Ethereum, with Bitcoin acquired at an average cost of around $4,000. Within months, in early 2019, Bitcoin briefly broke $10,000.

At the time, university endowments couldn’t directly purchase Bitcoin nor access compliant ETFs. Entrusting crypto holdings to Paradigm served as a “backdoor entry” strategy, allowing risk isolation on compliance and fiduciary grounds, even in case of losses.

How Matt Huang managed to convince Yale to invest in a newly formed crypto fund has remained somewhat of a mystery.

Although Matt Huang’s mother, Marina Chen, was a professor in Yale’s computer science department, there is no evidence suggesting her influence on Yale’s decision to invest in Paradigm.

Through an article Matt Huang published in 2020 titled “Preaching Bitcoin to the Enlightened Skeptics,” we may glimpse how he persuaded university fund managers.

To Matt Huang, bubbles are not flaws but necessary steps toward broader Bitcoin adoption—each bubble expanding awareness and acceptance. Bitcoin won’t challenge the dollar’s role as a medium of exchange in the short term, but will eventually stand alongside gold as a portfolio hedge held by institutional investors, until ultimately central banks might hold Bitcoin as reserves.

For the crypto industry, Paradigm is more than just a capital provider—it is a key builder.

In April 2019, Paradigm led Uniswap’s seed round with a $1 million investment. At the time, Uniswap hadn’t even incorporated as a company, and its sole developer was founder Hayden Adams—a mechanical engineer who had just been laid off from Siemens and started self-learning Solidity in 2017.

Beyond capital, Dan Robinson from Paradigm’s research team spent nearly every day in Uniswap’s Discord channel, helping resolve liquidity and smart contract issues.

Through close collaboration, the AMM model was born, igniting the DeFi summer.

Paradigm’s portfolio reads like a who’s who of crypto: StarkWare, Mina, Uniswap, Compound, MakerDAO, Yield, Optimism, Amber, Fireblocks, Synthetix, Opyn, TaxBit, BlockFi, Chainalysis, Gitcoin, Lido, dYdX, and many more.

Yale’s other early crypto bet, a16z crypto, similarly shaped industry development—investing in Coinbase, Solana, Aptos, Avalanche, Arweave, and others. Beyond capital, a16z actively influenced public policy, donating tens of millions to Fairshake, a pro-crypto Super PAC, and betting on Trump’s victory to secure a friendlier regulatory environment.

Back to late 2018—the beginning of it all—this pivotal move traces back to legendary investor David Swensen.

As the highest-paid employee at Yale, he had managed billions in endowment funds over the past 34 years, growing the fund from $1 billion to $31.2 billion with an annual return nearing 17%.

His pioneering “Yale Model” became the gold standard for university endowments worldwide. Today, leaders of Princeton, Stanford, MIT, and Penn’s endowment funds are often his former protégés—collectively known as the “Yale School.”

Yale’s move quickly triggered a chain reaction. Harvard, Stanford, MIT, and other Ivies followed suit around the same time. According to The Information’s report in late 2018, Harvard, Stanford, Dartmouth, MIT, and the University of North Carolina had all invested via their endowments in at least one crypto fund.

In many ways, Yale’s 2018 investment wasn’t just a lifeline during a crypto winter, but a bold vote of confidence in the industry’s future.

The Crypto Clans from Elite Universities

Beyond capital and endorsement, the deeper impact of top-tier universities on the crypto industry lies in people.

Wherever people gather, power structures form—and in the crypto world, many of its “warlords” and core figures hail from elite institutions, forming invisible yet powerful “university clans.”

In the Chinese-speaking world, the Tsinghua network stands out as the most influential. Huobi’s founder Li Lin graduated from Tsinghua’s Department of Automation; Conflux, a high-performance Layer1 blockchain, was built by Tsinghua’s Yao Class; CertiK’s CEO Gu Ronghui also earned his undergraduate degree at Tsinghua.

TRON founder Sun Yuchen and Bitmain co-founder Wu Jihan both studied at Peking University.

Zhejiang University alumni span across Web3 applications—from NFT marketplace Magic Eden and data platform NFTGo, to viral move-to-earn game Stepn and hardware wallet Keystone—covering multiple consumer-facing sectors.

Abroad, elite academic backgrounds are practically a prerequisite for crypto founders.

The Stanford clan, rooted in Silicon Valley, wields immense influence—producing founders of OpenSea, Alchemy, Filecoin, Story, and industry leaders like Lily Liu, President of the Solana Foundation.

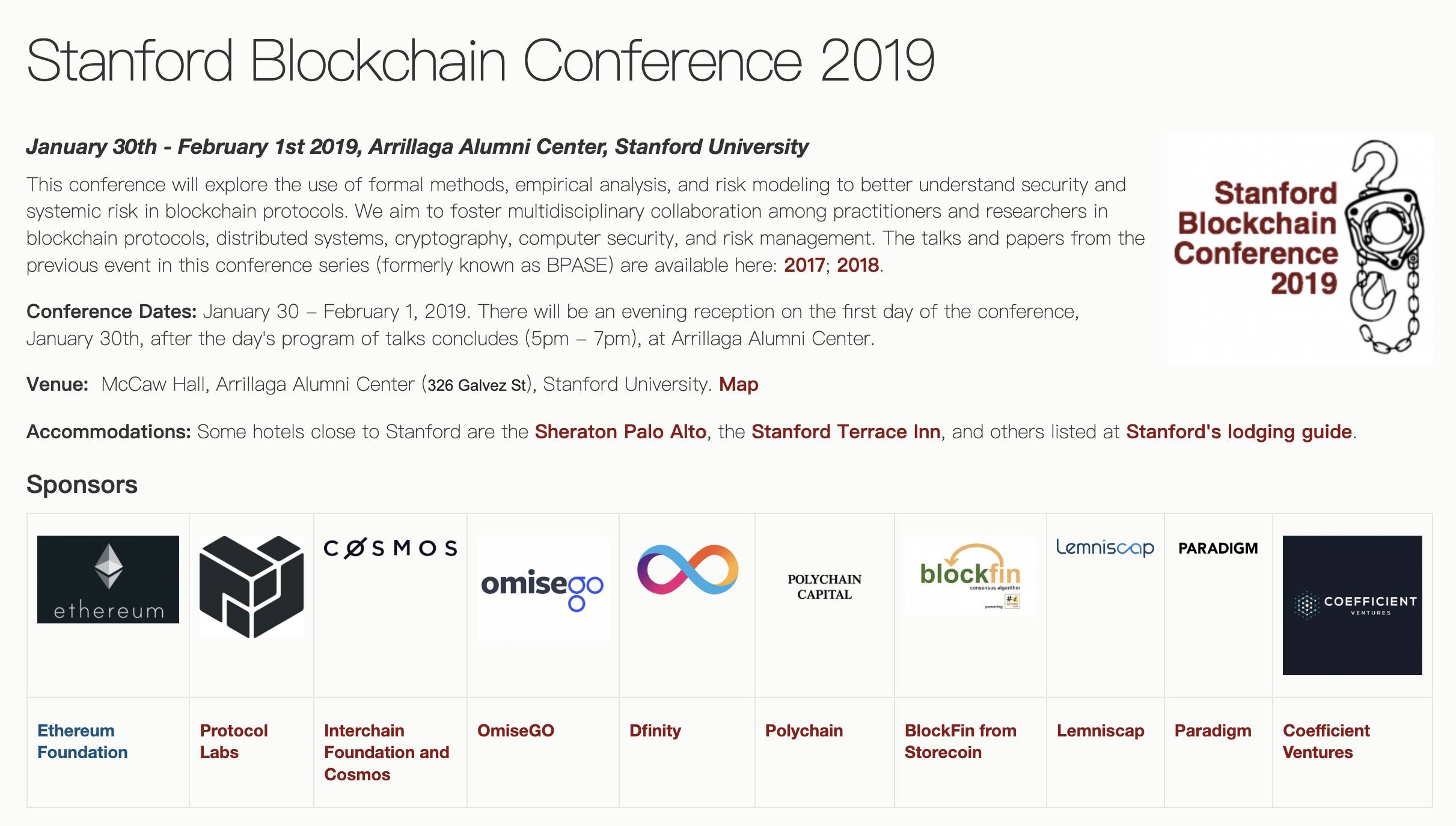

The 2019 Stanford Blockchain Conference featured marquee sponsors including Ethereum, Cosmos, and Polychain, rivaling major crypto events in scale and prestige.

The MIT clan excels in technical research. MIT’s Digital Currency Initiative contributed to Zcash’s development, which was named one of MIT’s Top 10 Breakthrough Technologies in 2018. Zero-knowledge proofs (ZK), a cryptographic milestone, were first proposed by MIT researchers in the 1980s.

Silvio Micali, MIT professor and Turing Award winner, personally founded high-performance public chain Algorand in 2017.

MIT’s alumni roster reads like a “crypto hall of fame”: Paradigm’s Matt Huang, MicroStrategy’s Michael Saylor, StarkWare’s Uri Kolodny, Litecoin’s Charlie Lee, and FTX’s SBF—all MIT graduates.

UC Berkeley (UCB) thrives in entrepreneurship and incubation.

In January 2019, Berkeley launched the Berkeley Blockchain Xcelerator—a joint initiative by Haas School of Business, SCET Engineering, and Berkeley Blockchain—with the goal of nurturing early-stage crypto projects. To date, it has accelerated over a hundred startups. Professor Dawn Song personally founded privacy-focused public chain Oasis Network. Other notable UCB projects include Galxe, Osmosis, Sei Network, Opyn, Ampleforth, and Kadena.

The Princeton clan holds significant sway in investment circles.

In 2022, four classmates from the class of 1987—Ethereum co-founder Joseph Lubin, Pantera Capital’s Daniel Morehead, Galaxy Digital’s Michael Novogratz, and Fortress Investment Group’s Peter Briger—jointly donated $20 million to launch a blockchain research program at their alma mater.

Notably, when Morehead founded Pantera, he received early backing from Briger and Novogratz. Today, Pantera manages over $5 billion in assets, ranking among the top crypto funds.

In an industry that champions “Don’t Trust, Verify,” interpersonal trust remains invaluable. Alumni ties serve as natural bonds of trust: founders prefer hiring classmates; investors favor backing alumni—forming invisible barriers of “clan culture.”

After founding Huobi, Li Lin brought in classmates Lan Jianzhong and Zhu Jiawei. Over half of the executive team came from Tsinghua, including former CEO Qiye and CFO Zhang Li. Wu Jihan similarly relied heavily on Peking University peers at Bitmain.

Today, blockchain courses are standard offerings at universities, while student blockchain clubs and alumni networks weave invisible webs of talent and capital.

Stanford’s CBR Conference, Berkeley’s Xcelerator, MIT’s DCI hackathons—they continuously funnel fresh blood into the crypto ecosystem.

Universities are no longer just “early investors” in the industry—they have become the martial arts sects of the crypto world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News