Fed Holds Rates Steady in June as Markets Trade in Narrow Range | Hotcoin Research Market Insights

TechFlow Selected TechFlow Selected

Fed Holds Rates Steady in June as Markets Trade in Narrow Range | Hotcoin Research Market Insights

This week, stablecoins continued to see issuance growth, while the U.S. spot Bitcoin ETF recorded substantial net inflows and the spot Ethereum ETF saw net inflows.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies stands at $3.34 trillion, with BTC accounting for 61.55%, or $2.06 trillion. Stablecoin market cap is $251.7 billion, up 0.33% over the past seven days, with USDT representing 62.23%.

This week, BTC has traded in a range-bound manner, currently priced at $106,000; ETH has also been range-bound, currently at $2,555.

Among the top 200 projects on CoinMarketCap, a small number rose while most declined: AERO gained 40.29% over 7 days, KAIA rose 27.7%, T increased by 24.32%, and PNUT climbed 11.06%.

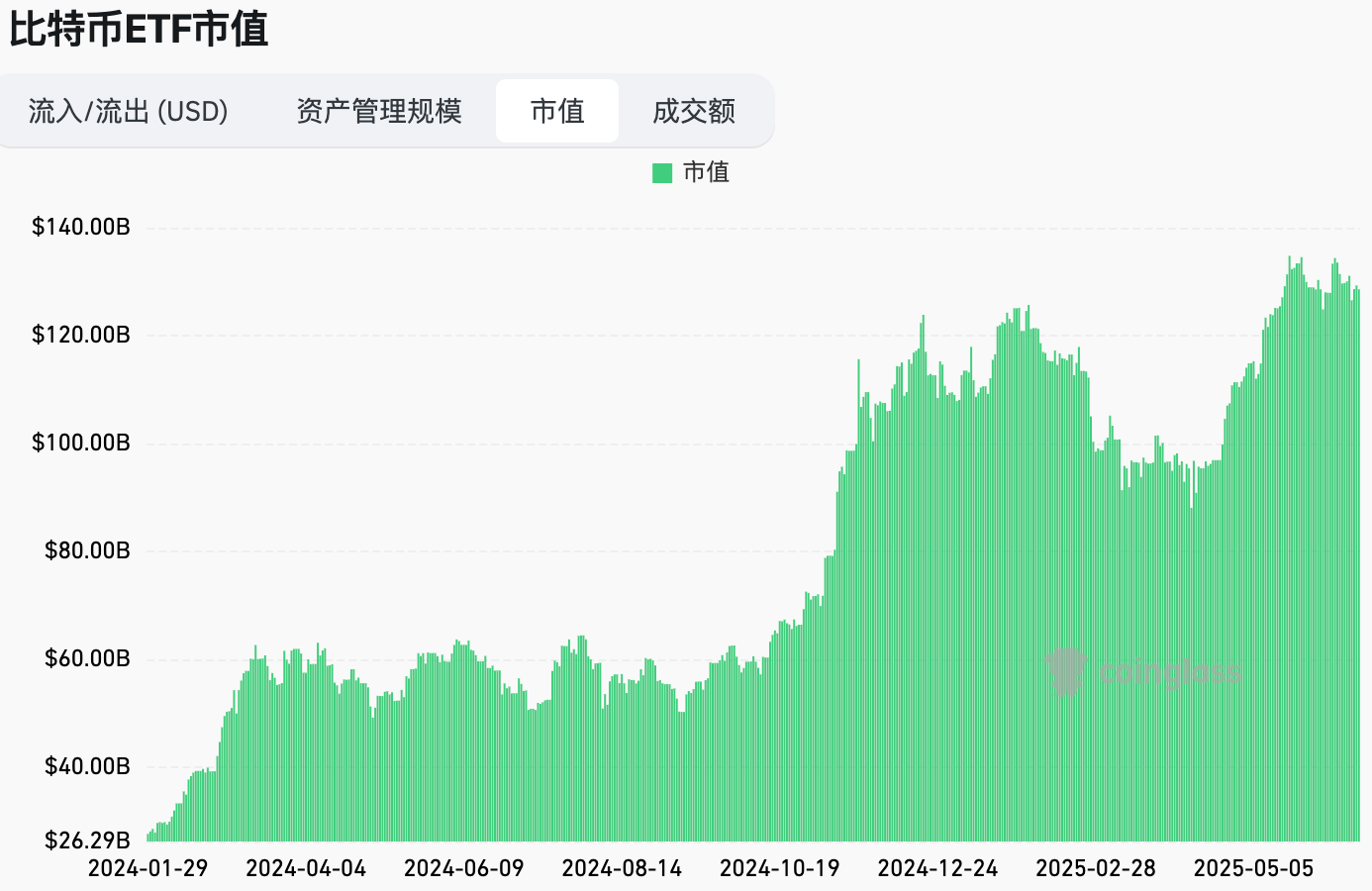

This week, U.S. spot Bitcoin ETFs recorded net inflows of $1.0454 billion; U.S. spot Ethereum ETFs saw net inflows of $40.3 million.

The "Fear & Greed Index" on June 20 stood at 48 (lower than last week), reflecting neutral sentiment throughout the week.

Market Outlook:

This week witnessed continued stablecoin issuance, significant net inflows into U.S. spot Bitcoin ETFs, and positive inflows into spot Ethereum ETFs. Both BTC and ETH remained range-bound. The RSI index stands at 40.86, indicating neutrality. The U.S. Federal Reserve's June interest rate decision was announced this week, aligning with market expectations, resulting in no major price swings. The Fear & Greed Index remains neutral.

Although institutions and public companies continue purchasing BTC, invisible selling pressure persists, and community sentiment remains subdued. In the short term, upward momentum appears weak. Next week’s BTC price range is expected to be between $100,000 and $105,000. At this stage, it is advisable to accumulate small positions during dips. From June to July, unless major macroeconomic policies intervene, the market is likely to remain range-bound until August—when either the U.S. stablecoin bill is formally enacted or the Fed begins rate cuts—which could trigger substantial gains. This period may represent “trading dead time,” but new token opportunities are worth watching. Platforms like Hotcoin often host on-chain wealth-generating opportunities that merit attention.

Understanding the Present

Weekly Major Events Recap

1. On June 15, Michael Saylor posted updated information about the Bitcoin Tracker on X, stating “Bigger orange dot, better.” Typically, the day after such posts, Strategy discloses its latest Bitcoin accumulation data;

2. On June 16, Tron announced plans to go public via a reverse merger with SRM Entertainment, which is listed on Nasdaq. The deal is being managed by Dominari Securities, a boutique investment bank based in New York linked to Donald Trump Jr. and Eric Trump;

3. On June 18, the U.S. Senate passed the landmark cryptocurrency legislation known as the GENIUS Act, aimed at fostering industry growth. This marks a historic lobbying victory for digital asset firms, as it was the first comprehensive crypto regulatory reform vote in the Senate.

The Senate approved the bill by a vote of 68 to 30, with 18 Democrats joining most Republicans in supporting its advancement to the House of Representatives;

The bill, led by Republican Senator Bill Hagerty of Tennessee, will establish the first U.S. regulatory framework for dollar-pegged stablecoins;

4. On June 18, JPMorgan Chase & Co. launched a pilot program for a token called JPMD, representing dollar deposits from the world's largest bank, signaling deeper institutional engagement in digital assets. JPMD will be piloted on a blockchain associated with Coinbase;

5. On June 18, VanEck’s Solana spot ETF appeared on DTCC’s website under the ticker VSOL, with creation/redemption marked as D.

While this listing does not imply regulatory approval or any definitive sign of imminent launch, inclusion on DTCC’s site is part of the standard process for launching new ETFs;

6. On June 17, Coinbase sought SEC approval to offer stock trading services using blockchain technology;

7. On June 19, X CEO Linda Yaccarino stated users would soon be able to invest or trade directly on the platform. X is also exploring integration of credit or debit card functionality;

8. On June 20, London-based fintech giant Revolut confirmed it is actively exploring plans to issue its own stablecoin. Serving 55 million individual users and 500,000 business clients across 160 countries, Revolut recently reached a valuation of $48 billion and launched its EU crypto trading platform Revolut X in 2024. Two sources confirmed Revolut has initiated discussions with at least one native crypto firm regarding the stablecoin initiative;

9. On June 20, Plasma announced plans to launch its mainnet by “late summer,” a blockchain specifically optimized for stablecoins;

10. On June 19, analysis of official documents from World Liberty Financial revealed that a company affiliated with Donald Trump reduced its stake in the crypto project from 60% to 40% over the previous 11 days;

11. On June 19, more than 16 billion login credentials from major online service providers including Apple, Google, and Facebook were leaked. This large-scale data breach could have serious implications for cryptocurrency holders. Login credentials include usernames, passwords, or other authentication data.

Macroeconomic Developments

1. On June 19, the Federal Reserve held its benchmark interest rate steady at 4.25%-4.50%, marking the fourth consecutive meeting without a change, in line with market expectations;

2. On June 19, the Fed’s dot plot indicated it still expects a 50-basis-point rate cut in 2025, but only a 25-basis-point reduction in 2026—down from a previously projected 50 bps. It now forecasts 25-basis-point cuts each in 2026 and 2027;

3. On June 19, the Bank of England kept its policy rate unchanged at 4.25%, consistent with expectations, maintaining rates at their highest level in over two years;

4. On June 18, Canadian crypto asset manager 3iQ launched the 3iQ XRP ETF (XRPQ) on the Toronto Stock Exchange. The fund will waive management fees for the first six months and is accessible through registered accounts in Canada. Its listing on the TSX allows global qualified investors to participate, subject to local regulations;

5. On June 17, Canadian publicly traded company LQWD Technologies Corp. announced an additional purchase of 5 BTC, bringing its total holdings to approximately 166 BTC.

ETF Developments

Data shows that between June 16 and June 20, U.S. spot Bitcoin ETFs recorded net inflows of $1.0454 billion. As of June 20, GBTC (Grayscale) has experienced cumulative outflows of $23.197 billion and currently holds $19.126 billion in assets. IBIT (BlackRock) holds $70.27 billion. The total market value of U.S. spot Bitcoin ETFs stands at $128.573 billion.

U.S. spot Ethereum ETFs recorded net inflows of $40.3 million.

Anticipating the Future

Upcoming Events

1. NFT NYC 2026 will take place in New York, USA, from June 23 to 25, 2025;

2. Permissionless IV will be held in New York, USA, from June 24 to 26, 2025;

3. EthCC 8 will take place in Cannes, France, from June 30 to July 3, 2025;

4. IVS2025 KYOTO will be hosted in Kyoto, Japan, from July 2 to 4, 2025.

Project Milestones

1. Chiliz’s Web3 sports app and wallet, Socios.com, announced a partnership with esports team Ninjas in Pyjamas (NIP) to launch the DOJO fan token. The Fan Token Offering (FTO) is scheduled for June 24, 2025, offering rewards through NIP’s loyalty platform, The Dojo;

2. The Cygnus stablecoin wcgUSD yield pool on Pendle will mature on June 26;

3. Spanish coffee chain Vanadi Coffee SA will request authorization at its board meeting on June 29 to implement a Bitcoin reserve strategy, planning to invest over $1.1 billion in BTC and seeking financing authority. The company has already completed its first purchase, acquiring 5 BTC for $500,000.

Key Events

1. South Korea’s central bank (BOK) Governor Lee Chang-yong will meet with commercial bank CEOs at the Bankers’ Club in Seoul’s Jung-gu district on June 23 to discuss issuing a won-denominated stablecoin;

2. On June 24 at 22:00, Fed Chair Jerome Powell will deliver testimony before the House Financial Services Committee on the semiannual monetary policy report;

3. On June 26 at 20:30, the U.S. will release the weekly initial jobless claims (in thousands) for the week ending June 21;

4. On June 27 at 20:30, the U.S. will publish the year-over-year core PCE price index for May.

Token Unlocks

1. Eigenlayer (EIGEN) will unlock 1.29 million tokens on June 25, valued at approximately $1.43 million, representing 0.42% of circulating supply;

2. IOTA (IOTA) will unlock 15.1 million tokens on June 25, valued at around $2.42 million, or 0.39% of circulating supply;

3. Venom (VENOM) will unlock 59.13 million tokens on June 25, worth about $9.58 million, accounting for 2.84% of circulating supply;

4. Moca Network (MOCA) will unlock 2.43 million tokens on June 27, valued at approximately $173,000, or 0.08% of circulating supply.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News