U.S. April Core PCE Meets Expectations, DJT Raises $2.5B to Buy Bitcoin | Hotcoin Research Market Insights

TechFlow Selected TechFlow Selected

U.S. April Core PCE Meets Expectations, DJT Raises $2.5B to Buy Bitcoin | Hotcoin Research Market Insights

This week, stablecoins continued to be issued, while the U.S. Bitcoin spot ETF saw net outflows, breaking several weeks of net inflows, and the Ethereum spot ETF recorded net inflows.

Author: Hotcoin Research

Cryptocurrency Market Performance

The current total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55% ($2.06 trillion). Stablecoin market cap stands at $247.3 billion, up 0.56% over the past seven days, with USDT representing 62.14%.

This week, BTC prices showed a downward trend, currently trading at $104,851; ETH remained range-bound, now priced at $2,619.

Among the top 200 projects on CoinMarketCap, a small portion rose while most declined: SPX gained 26.24% over 7 days, ZBCN surged 133.19%, WCT rose 97.2%, and SNT increased by 84.9%.

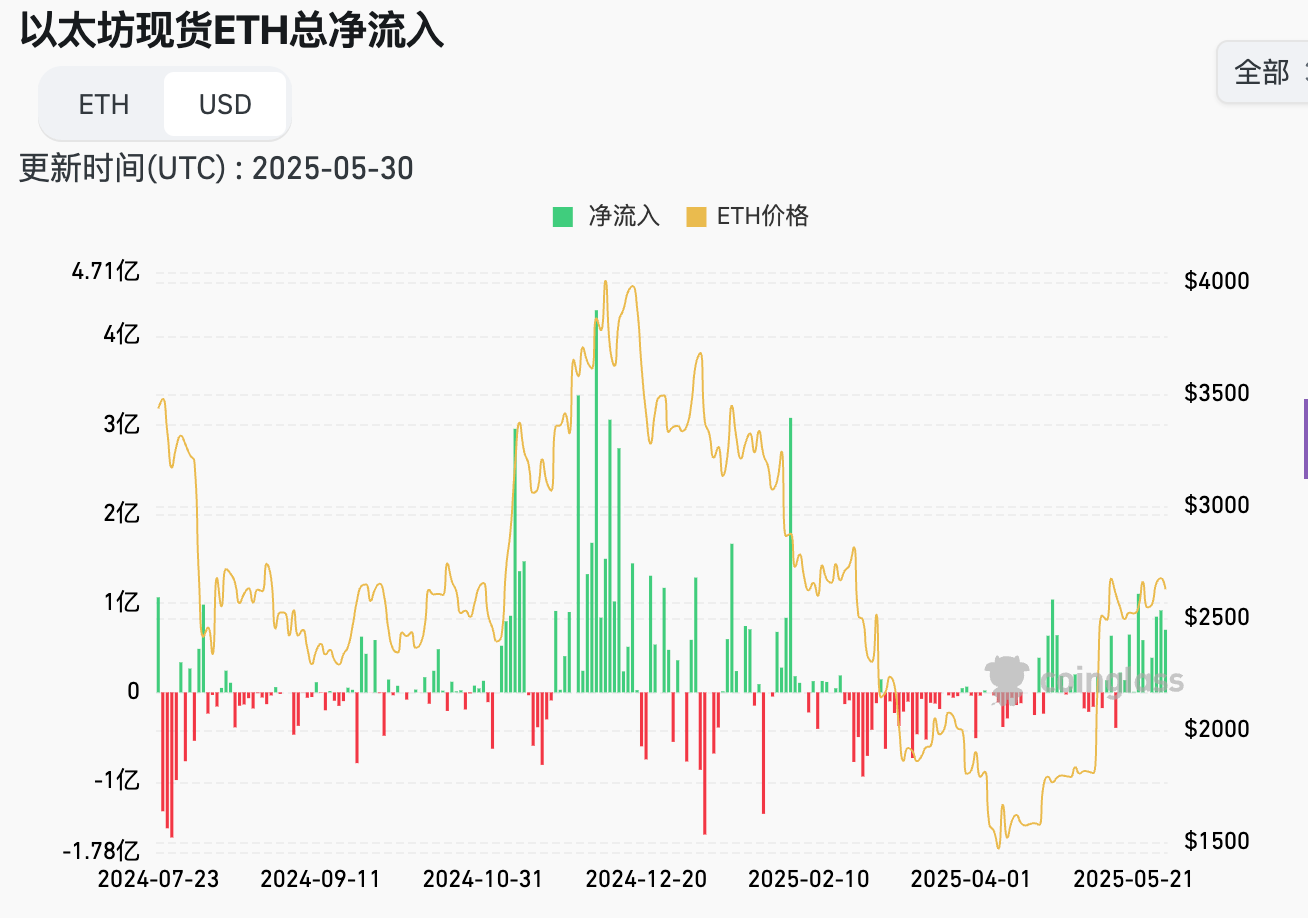

This week, U.S. Bitcoin spot ETFs saw net outflows of $145 million; U.S. Ethereum spot ETFs recorded net outflows of $285.8 million.

The "Fear & Greed Index" on May 30 stood at 61 (lower than last week), reflecting a “Greed” sentiment over the past seven days.

Market Outlook:

Stablecoins continued to expand this week. U.S. Bitcoin spot ETFs experienced net outflows, breaking several weeks of net inflows, while Ethereum spot ETFs saw net inflows. After reaching new highs last week, profit-taking addresses began realizing gains, leading to a 3.73% decline in BTC over seven days. The RSI index is at 30.63, indicating weakness, and the Altcoin Season Index is at 18. This week's release of the U.S. April core PCE price index year-on-year rate came in at 2.5%, meeting expectations. The Fear & Greed Index has returned to neutral territory.

The probability of a 25-basis-point rate cut by the Federal Reserve in June is only 2.2%. Uncertainty around tariffs continues to significantly impact markets. Typically, after Bitcoin breaks to new highs, some pullback occurs—this is normal. Over the coming week, Bitcoin is expected to trade between $95,000 and $105,000. Key focus should be placed on ETF flows and the latest tariff policies from the Trump administration.

Understanding the Present

Recap of Weekly Major Events

1. On May 27, according to pymnts, stablecoin issuer Circle denied media reports suggesting it was engaged in informal discussions about a potential sale to Coinbase Global or Ripple, reaffirming its commitment to its IPO plan filed in April;

2. On May 27, Cetus released an official report on its theft incident, stating that on May 22, Cetus suffered an advanced smart contract attack targeting CLMM liquidity pools. Immediate mitigation measures were taken;

3. On May 27, Bloomberg reported that Trump Media & Technology Group announced plans to launch a $2.5 billion Bitcoin treasury initiative, incorporating BTC into its asset reserves for financial stability and long-term value storage;

4. On May 28, Circle’s IPO filing revealed it acquired RWA issuer Hashnote in January 2025 for $9.9 million in cash and approximately 2.9 million fully vested common shares (valued at about $99.8 million);

5. On May 29, U.S. Vice President Vance stated at the Bitcoin 2025 Conference that approximately 50 million Americans own Bitcoin, and he believes this number will soon reach 100 million;

6. On May 29, Decrypt reported that Circle, issuer of stablecoin USDC, recently froze two Solana wallet addresses associated with the LIBRA token team, involving approximately 58 million USDC;

7. On May 29, on-chain investigator ZackXBT disclosed that North Korean hacker group Lazarus Group launched a cyberattack on individual crypto traders on May 24, stealing over $5.2 million from one trader;

8. On May 29, Bloomberg reported that BlackRock plans to subscribe to 10% of Circle Internet’s IPO shares;

9. On May 29, White House officials confirmed Elon Musk’s departure from the government, with the exit process beginning locally that evening;

10. On May 30, crypto journalist Eleanor Terrett disclosed that the SEC’s Division of Corporation Finance clarified that staking activities on certain Proof-of-Stake blockchains do not constitute securities transactions;

11. On May 30, The Block reported that the U.S. SEC has filed documents with the court seeking dismissal of its lawsuit against cryptocurrency exchange Binance and its former CEO Changpeng Zhao;

12. On May 30, mobility service provider Webus International Limited (Weiba International) is exploring a strategic financing plan of up to $300 million using diversified non-equity instruments to establish an XRP reserve supporting its global payment solutions.

Macroeconomic Developments

1. On May 29, at around 6 p.m. EDT on May 28, the U.S. Department of State issued a statement announcing collaboration with the Department of Homeland Security to begin revoking visas for Chinese international students, including those studying in critical fields;

2. On May 30, "Fed Whisperer" Nick Timiraos noted that after a brief period of strength at the start of the year, inflation rates have continued to decline slowly overall, aligning with the Fed’s projections from last year;

3. On May 30, the U.S. April core PCE price index year-on-year rate was 2.5%, matching expectations, with the prior figure revised upward from 2.60% to 2.7%;

4. On May 31, CNN reported that Trump is currently not considering reimposing a 145% tariff on Chinese goods;

5. On May 31, according to CME’s "Fed Watch," the probability of a 25-basis-point rate cut by the Fed in June is 2.2%, while the probability of unchanged rates is 97.8%.

ETF

Data shows that between May 26 and May 30, U.S. Bitcoin spot ETFs had net outflows of $145 million. As of May 30, GBTC (Grayscale) has seen cumulative outflows of $23.168 billion, currently holding $19.425 billion, while IBIT (BlackRock) holds $69.468 billion. Total market cap of U.S. Bitcoin spot ETFs stands at $131.289 billion.

U.S. Ethereum spot ETFs had net inflows of $285.8 million.

Anticipating the Future

Event Preview

1. YZi Labs’ newly launched offline incubation program, EASY Residency, will kick off on June 2 in Silicon Valley, designed exclusively for the top 1% founders in Web3, AI, and healthcare;

2. Non Fungible Conference 2025 will take place in Lisbon, Portugal, from June 4–6, 2025;

3. NFT NYC 2026 will be held in New York, USA, from June 23–25, 2025;

4. Permissionless IV will be held in New York, USA, from June 24–26, 2025;

5. EthCC 8 will be held in Cannes, France, from June 30 to July 3, 2025.

Project Updates

1. Moonbeam’s lease period on the Polkadot parachain ends on June 5, 2025.

Key Events

1. On June 2, Federal Reserve Governor Waller will speak on the economic outlook at the 2025 Bank of Korea International Conference;

2. On June 3, the Reserve Bank of Australia will release minutes from its June monetary policy meeting;

3. On June 4, the Bank of Canada will announce its interest rate decision;

4. On June 5, the Federal Reserve will release the Beige Book on economic conditions;

5. On June 5, the European Central Bank will announce its interest rate decision.

Token Unlocks

1. Ethena (ENA) will unlock 40.63 million tokens at 15:00 on June 2, valued at approximately $15.93 million, representing 0.7% of circulating supply.

2. Gravity (G) will unlock 121 million tokens on June 5, worth about $1.57 million, or 1.01% of circulating supply;

3. Alchemy Pay (ACH) will unlock 116 million tokens on June 7, valued at around $2.47 million, or 1.17% of circulating supply;

4. Jito (JTO) will unlock 11.31 million tokens on June 7, worth approximately $18.33 million, or 1.13% of circulating supply;

5. Ethereum Name Service (ENS) will unlock 1.46 million tokens on June 8, valued at about $29.75 million, or 1.46% of circulating supply.

About Us

Hotcoin Research, as the core investment research hub within the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global digital asset investors. We offer a three-pillar service framework encompassing “trend analysis + value discovery + real-time tracking,” delivering precise market interpretations and actionable strategies through deep dives into industry trends, multidimensional evaluations of high-potential projects, and round-the-clock market monitoring. Supported by weekly dual updates via our strategy livestream “Top Coin Selection” and daily news digest “Blockchain Today Headlines,” we serve investors at all levels. Leveraging cutting-edge data analytics models and an extensive industry network, we empower novice investors to build foundational knowledge and help institutional clients capture alpha, jointly seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a rigorous risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News