Bitwise Chief Investment Officer: Why Diversify Crypto Asset Allocations?

TechFlow Selected TechFlow Selected

Bitwise Chief Investment Officer: Why Diversify Crypto Asset Allocations?

From a broader perspective, seize the overall development opportunities of the industry through diversified investments.

By: Matt Hougan, Chief Investment Officer at Bitwise

Translation: Luffy, Foresight News

Last week, something major happened in the crypto market: Ethereum began a strong recovery.

After months of struggling and nearly a 60% price decline, the second-largest cryptocurrency by market cap staged a significant rebound. It has surged 53% from its low on April 12, with an astonishing 37% gain just in the past week alone.

Several factors are driving Ethereum’s surge, including the successful rollout of major blockchain upgrades and a shift in overall market risk appetite.

This rally has prompted many investors to ask: Should they diversify their portfolios beyond Bitcoin?

It's definitely a question worth exploring.

Bitcoin is the king of crypto assets—highest market cap, best liquidity, and strongest market foundation. In my view, Bitcoin is "digital gold" and the only cryptocurrency with the potential to become a globally significant currency.

Still, I believe most investors should not limit themselves to Bitcoin and should consider allocating to other crypto assets as well.

Why? Looking back at history may offer some answers.

Internet Investing in 2004

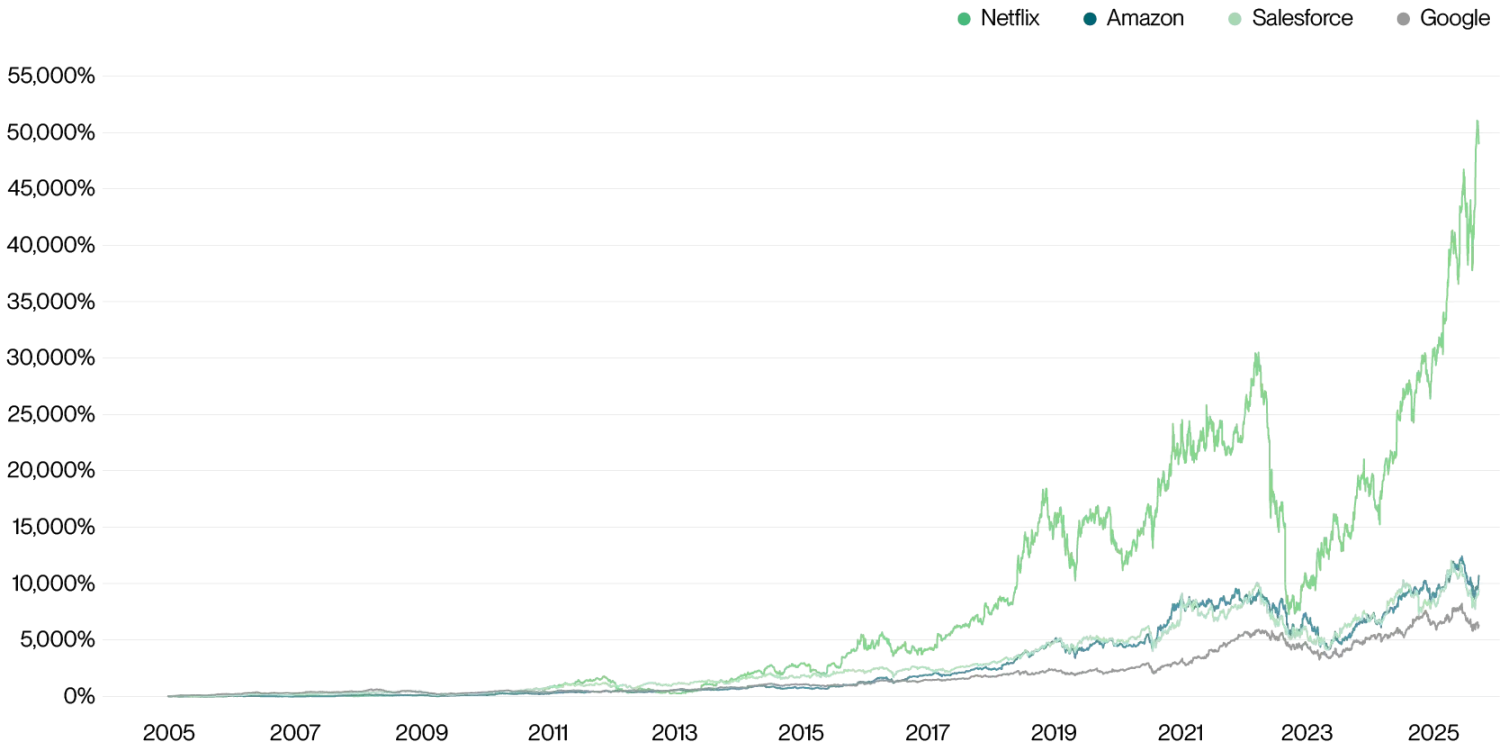

Imagine you wanted to invest in the internet in 2004. At that time, search was dominant, and Google was the industry leader.

You might have thought: The internet has massive growth potential, so I’ll invest in the leading company in this core space.

At the time, that seemed like a smart move. Over the past 20 years, Google’s stock has risen 6,309%, delivering substantial returns to investors.

But the internet is a general-purpose technology. It applies not only to search but also to retail, social media, video, and business-to-business software.

This means that in 2004, beyond Google, you could have invested in leaders across different verticals—Amazon in e-commerce, Netflix in streaming, Salesforce in enterprise software, and more.

Let’s see what kind of returns such a diversified strategy would have delivered:

Performance of tech giants (2004 to present), data source: Bitwise, Yahoo Finance

Google’s performance has been outstanding, making it one of the most valuable assets globally today. But companies in other sectors have performed remarkably well too, with Netflix emerging as the top performer—an outcome almost no one could have predicted in 2004.

Blockchain Is a General-Purpose Technology

Like the internet, blockchain is a general-purpose technology.

With blockchain, people can create new forms of money like Bitcoin; build programmable networks for transferring real-world assets, such as Ethereum and Solana; develop innovative applications like DeFi and DePin; or build middleware that supports other blockchains, like Chainlink. Blockchain has also enabled traditional companies that support the crypto economy, such as Coinbase, Circle, and Marathon Digital.

I believe blockchain will give rise to many more applications we can’t yet imagine.

Because of the diverse use cases of blockchain technology, different crypto assets deliver vastly different long-term investment returns. Below are the annualized returns of Bitcoin, Ethereum, Solana, and Chainlink over the past five years:

Crypto asset performance (2020–2024), data source: Bitwise Asset Management

So which crypto asset will perform best from now until 2030? That’s a great question.

What This Means for Investors

This doesn’t mean everyone should invest beyond Bitcoin.

If you believe blockchain’s value lies solely in serving as an alternative to fiat currencies and hedging against risks in the traditional monetary system, then investing in Bitcoin alone may be sufficient. After all, Bitcoin’s dominance in the “digital currency” category is unshakable, and it’s nearly impossible for other cryptocurrencies to replace it.

But if you recognize blockchain as a general-purpose technology and believe in its future potential to bring various assets on-chain, then history suggests that a diversified portfolio of crypto assets is the better approach. Consider building a portfolio that includes Bitcoin, Ethereum, Solana, Chainlink, and others.

Finally, let me share a statistic that still impresses me—even after years in ETFs and the crypto industry: Over the past 20 years, actively managed U.S. equity funds underperformed their benchmark index 97% of the time.

In the fast-moving and uncertain world of crypto assets, this statistic is worth deep reflection for every investor.

My advice: Don’t obsess over picking winners. Think big picture and capture the broader industry opportunity through diversified investing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News