US-China Decoupling and the Rise of CeDeFi: The New Global Financial Landscape in 2025

TechFlow Selected TechFlow Selected

US-China Decoupling and the Rise of CeDeFi: The New Global Financial Landscape in 2025

Global liquidity is quietly converging into borderless decentralized financial networks.

Author: Tony

Compilation: TechFlow

Convergence and Divergence: U.S.-China Relations, CeDeFi, and De-Dollarization

Recently, intense volatility in currency markets has highlighted escalating macroeconomic tensions and significant shifts in global financial dynamics. The USD/JPY pair surged rapidly to the 145 level, primarily due to the Bank of Japan’s continued dovish stance—maintaining interest rates unchanged and offering no signal of imminent tightening—alongside the unwinding of long yen positions. Interest rate differentials remain pronounced, favoring the dollar as the Federal Reserve maintains relatively high rates while Japan adheres to loose monetary policy.

Meanwhile, the New Taiwan Dollar (TWD) appreciated over 8% against the U.S. dollar within two days—an extremely rare “19-sigma” event. This abrupt shift resulted from Taiwanese institutions swiftly rebalancing their dollar exposure, underscoring growing concerns over geopolitical risks and vividly illustrating the tangible impact of heightened U.S.-China tensions on global currency markets.

TSD/USD price chart

Earlier this month, geopolitical tensions between the U.S. and China sharply escalated when President Trump raised tariffs on Chinese imports to an unprecedented 145%. China quickly retaliated by imposing 125% tariffs on U.S. goods, further deepening economic divergence.

This escalation echoes the classic "Thucydides Trap," a historical pattern predicting inevitable conflict when a rising power challenges an established hegemon. Far beyond trade barriers, this event marks a systemic decoupling of the world’s two largest economies, generating profound secondary effects that ripple across global liquidity and the dominance of the U.S. dollar.

For decades, the ubiquity of the dollar in global trade and finance has rested on an implicit yet deep trust in American institutions—trust rooted in stable governance, predictable foreign policy, and minimal barriers to capital flows. As Bipan Rai, Managing Director at BMO Global Asset Management, noted: “There are clear signs of erosion… pointing toward structural shifts in global asset allocation away from the dollar.”

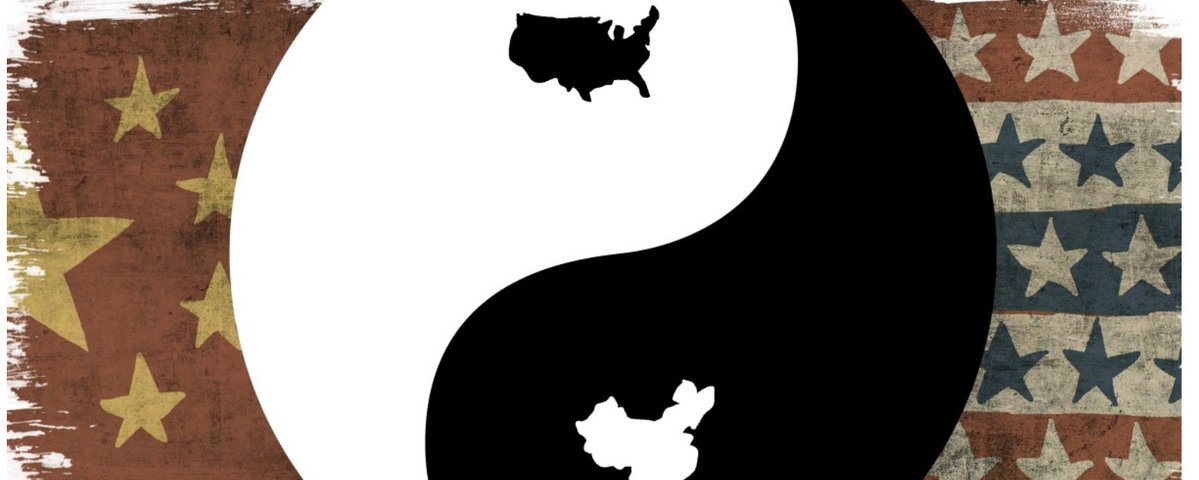

Indeed, the foundation of dollar hegemony is quietly fracturing under pressure from geopolitical volatility and increasingly unpredictable U.S. diplomatic and economic policies. Notably, despite President Trump’s stern warnings that nations abandoning dollar-based trade would face economic penalties, the dollar experienced its most severe depreciation since the Nixon era during his presidency.

This symbolic moment underscores a broader, accelerating trend: nations worldwide are actively seeking alternatives to the U.S.-dominated financial system, signaling a gradual but definitive shift toward global de-dollarization.

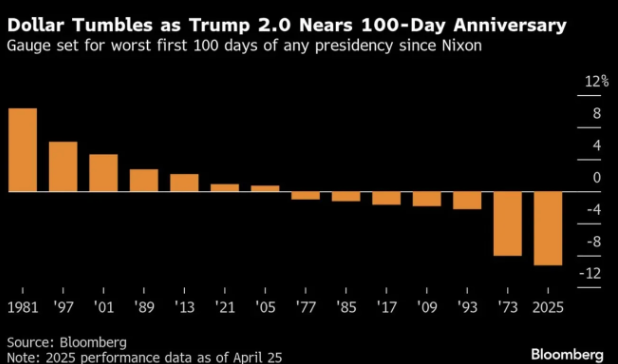

For decades, China's trade surplus dollars were recycled into U.S. Treasuries and financial markets, sustaining dollar hegemony after the collapse of the Bretton Woods system. However, as strategic trust between the U.S. and China has deteriorated sharply in recent years, this long-standing capital cycle faces unprecedented disruption.

China, traditionally the largest foreign holder of U.S. assets, has significantly reduced its exposure, with Treasury holdings dropping to approximately $760.8 billion by early 2025—nearly 40% below its 2013 peak. This shift reflects a broader strategic response by China to potential risks associated with U.S. economic sanctions, which have led to massive asset freezes—the most notable example being the freezing of around $350 billion in Russian central bank reserves in 2022.

As a result, Chinese policymakers and influential economists are increasingly advocating for diversifying the country’s reserve assets away from the dollar, fearing dollar-denominated holdings are becoming geopolitical liabilities.

This strategic realignment includes a substantial increase in gold reserves—adding approximately 144 tons in 2023 alone—and efforts to enhance the global use of the renminbi (RMB), along with exploring digital currency alternatives. This systemic de-dollarization tightens global dollar liquidity, raises international funding costs, and poses a major challenge to markets accustomed to China recycling its dollar surpluses back into Western financial systems.

Source: MacroMicro

Moreover, China is actively promoting a multipolar financial order, encouraging developing countries to increasingly use local currencies or the RMB for trade instead of the dollar. Central to this strategy is the Cross-border Interbank Payment System (CIPS), explicitly designed as a comprehensive global alternative to existing SWIFT and CHIPS networks, covering both messaging (SWIFT) and settlement (CHIPS) functions. Since its launch in 2015, CIPS has aimed to streamline internationally traded transactions directly priced in RMB, thereby reducing global reliance on U.S.-dominated financial infrastructure. Its broad adoption signals a systemic shift toward financial multipolarity: by the end of 2024, CIPS had drawn participation from 170 direct and 1,497 indirect institutional members across 119 countries and regions.

This steady growth reportedly peaked on April 16, 2025, when unconfirmed reports announced that CIPS’ daily transaction volume surpassed SWIFT for the first time, processing a record 12.8 trillion RMB (approximately $1.76 trillion).

While not officially confirmed, this milestone undoubtedly highlights the transformative potential of China’s financial infrastructure in reshaping global monetary dynamics—from a dollar-centric system toward a decentralized, multipolar framework centered on the RMB.

“Over the past decade, RMB-denominated trade has grown from zero to 30%, and half of China’s capital flows now occur in RMB—far higher than before.”

—Keyu Jin (LSE economist), speaking at a panel hosted by the Milken Institute

Liquidity Must Flow: The Convergence of CeDeFi

Yet, as geopolitical boundaries harden and traditional financial channels narrow, a parallel phenomenon is emerging: global liquidity is quietly converging into borderless decentralized financial networks. The convergence of liquidity among CeFi, DeFi, and TradFi represents a reorientation of capital flows, positioning blockchain-based networks as critical financial infrastructure in reshaping the global economy.

Specifically, the fusion of CeDeFi is driven by several gravitational forces:

-

Stablecoins act as payment instruments, bringing B2B (business-to-business) and B2C (business-to-consumer) liquidity on-chain.

-

CeFi (centralized finance) institutions offer hybrid products combining crypto and traditional financial offerings.

-

DeFi (decentralized finance) protocols bridge on-chain and off-chain yields, creating new pathways for interest rate arbitrage.

Stablecoins as Payment Infrastructure

Payments have long been cryptocurrency’s “holy grail.”

Tether, as the de facto shadow bank of offshore dollars, has become the most profitable financial institution per employee. Recent geopolitical turmoil has only intensified demand for stablecoins, as global capital increasingly seeks a censorship-resistant, borderless platform for dollar exposure. Whether Argentine savers hedge inflation with USDC or Chinese merchants settle trade using Tether outside the banking system, the motivation is the same: accessing reliable value without the friction of traditional systems.

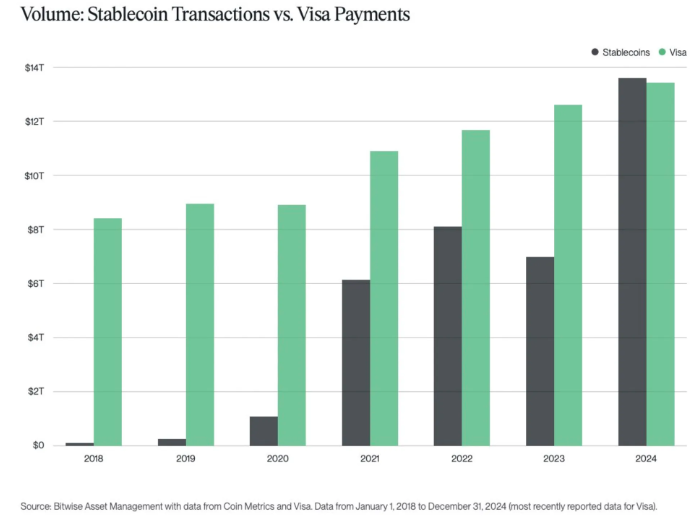

In an era of geopolitical tension and financial uncertainty, the need for “transactional autonomy” is immensely compelling. In 2024, stablecoin transaction volume surpassed that of Visa. Ultimately, crypto-based digital dollars (stablecoins) are replicating the offshore dollar network of the 20th century—providing dollar liquidity outside U.S. banking channels, especially in markets wary of American hegemony.

CeFi Platforms Offering Hybrid Traditional Finance and Crypto Products

Beyond enabling global liquidity via dollar settlement, we’re seeing CeFi platforms expand vertically into crypto, and vice versa:

-

Kraken acquired Ninja Trading to extend its offerings into traditional financial assets, eventually enabling cross-margining between traditional and crypto trading.

-

In China, major brokers such as Tiger Brokers and Futu Securities (often dubbed China’s Robinhood) have begun accepting deposits in USDT, ETH, and BTC.

-

Robinhood has strategically positioned crypto as a core growth priority, planning to launch tokenized stocks and stablecoins.

With upcoming market structure legislation providing greater regulatory clarity, horizontal expansion across crypto and traditional finance will grow increasingly important.

DeFi Protocols Bridging Crypto and Traditional Financial Yields

At the same time, we see DeFi protocols leveraging competitive on-chain yields to attract TradFi/off-chain capital, while also allowing traditional financial institutions to tap into global on-chain liquidity to execute off-chain strategies.

For example, our portfolio companies BounceBit (@bounce_bitand) and Ethena (@ethena_labs) offer basis trade yields to traditional financial institutions. Leveraging the programmability of on-chain dollars, they can package these basis trade products into synthetic dollars on-chain, directly targeting the $13 trillion fixed income market. For traditional institutions, these products may be particularly attractive as basis trade returns are negatively correlated with Treasury yields. Thus, they form a new pathway for interest rate arbitrage, forcing convergence of capital flows and interest rate markets across CeFi, DeFi, and TradFi.

Additionally, Cap Lab (@capmoney_) allows traditional financial institutions to borrow from on-chain liquidity pools to execute off-chain trading strategies, thereby granting retail investors unprecedented access to sophisticated high-frequency trading (HFT) returns. It effectively extends EigenLayer’s economic security model from on-chain activities to off-chain yield-generating strategies.

Overall, these developments drive liquidity convergence, compressing yield spreads between on-chain returns, off-chain returns, and traditional risk-free rates. Ultimately, these innovative solutions serve as powerful arbitrage tools, aligning capital flows and interest rate dynamics across DeFi, CeFi, and TradFi domains.

CeDeFi Liquidity Convergence → CeDeFi Product Offerings

The convergence of CeFi (centralized finance), DeFi (decentralized finance), and TradFi (traditional finance) liquidity into blockchain networks marks a fundamental shift for on-chain asset allocators—from primarily crypto-native traders to increasingly sophisticated institutions seeking diversified exposures beyond crypto-native assets and yields. A downstream effect of this trend is the broad expansion of on-chain financial product offerings, with more real-world asset (RWA) products being brought on-chain. As more RWAs go on-chain, it will again attract institutions globally into the ecosystem, forming a reinforcing cycle that ultimately brings all financial participants and assets onto a unified global ledger.

Historically, crypto’s trajectory has consistently incorporated higher-quality real-world assets, evolving from stablecoins and tokenized treasuries (such as Franklin Templeton’s Benji and BlackRock’s BUIDL) to increasingly complex instruments like Apollo’s recent tokenized private credit fund, with potential future expansion into tokenized equities. Declining appetite among marginal buyers for speculative crypto-native assets highlights a significant market gap and opens opportunities for institutional-grade tokenized RWAs. Against a backdrop of intensifying global geopolitical uncertainty—such as decoupling tensions between major economies like the U.S. and China—blockchain technology is emerging as a credible neutral financial infrastructure. Ultimately, all financial activity—from trading native altcoins to payments, tokenized treasuries, and equities—will converge onto this verifiable, borderless global financial ledger, fundamentally reshaping the global economic landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News