2025 Cryptocurrency Ownership Survey Report: A Digital Asset Map of 55 Million Americans – Who Is Using Cryptocurrency?

TechFlow Selected TechFlow Selected

2025 Cryptocurrency Ownership Survey Report: A Digital Asset Map of 55 Million Americans – Who Is Using Cryptocurrency?

Surveys show that cryptocurrency holders are a diverse group. People of different ages and income levels are holding and using cryptocurrencies.

Source: National Cryptocurrency Association

Translation: Yuliya, PANews

In the wave of the digital era, cryptocurrency is integrating into our daily lives at an astonishing pace. Once seen as a mysterious domain reserved for speculators and tech geeks, it has now become a significant part of ordinary people's investment portfolios. What is driving this transformation? Who is using cryptocurrency? And why have they chosen this path?

Breaking Stereotypes: Digital Assets for Everyday People

The National Cryptocurrency Association commissioned Harris Poll to conduct a large-scale survey in early 2025 of 54,000 Americans, identifying 10,000 cryptocurrency holders—the largest such user study to date. The results are striking—cryptocurrency has moved beyond niche circles and entered mainstream society.

The survey reveals that approximately 21% of American adults—about 55 million people—own some form of cryptocurrency. These holders are not the stereotypical "crypto bros" or risk-taking speculators, but ordinary individuals from all walks of life. Some use cryptocurrency as an investment tool, others apply it in art and gaming, while many simply tried it out of curiosity. Moreover, a growing number are already using crypto for everyday purchases.

-

One in five Americans owns cryptocurrency

-

39% of holders use cryptocurrency to pay for goods and services

-

76% say cryptocurrency has had a positive impact on their lives

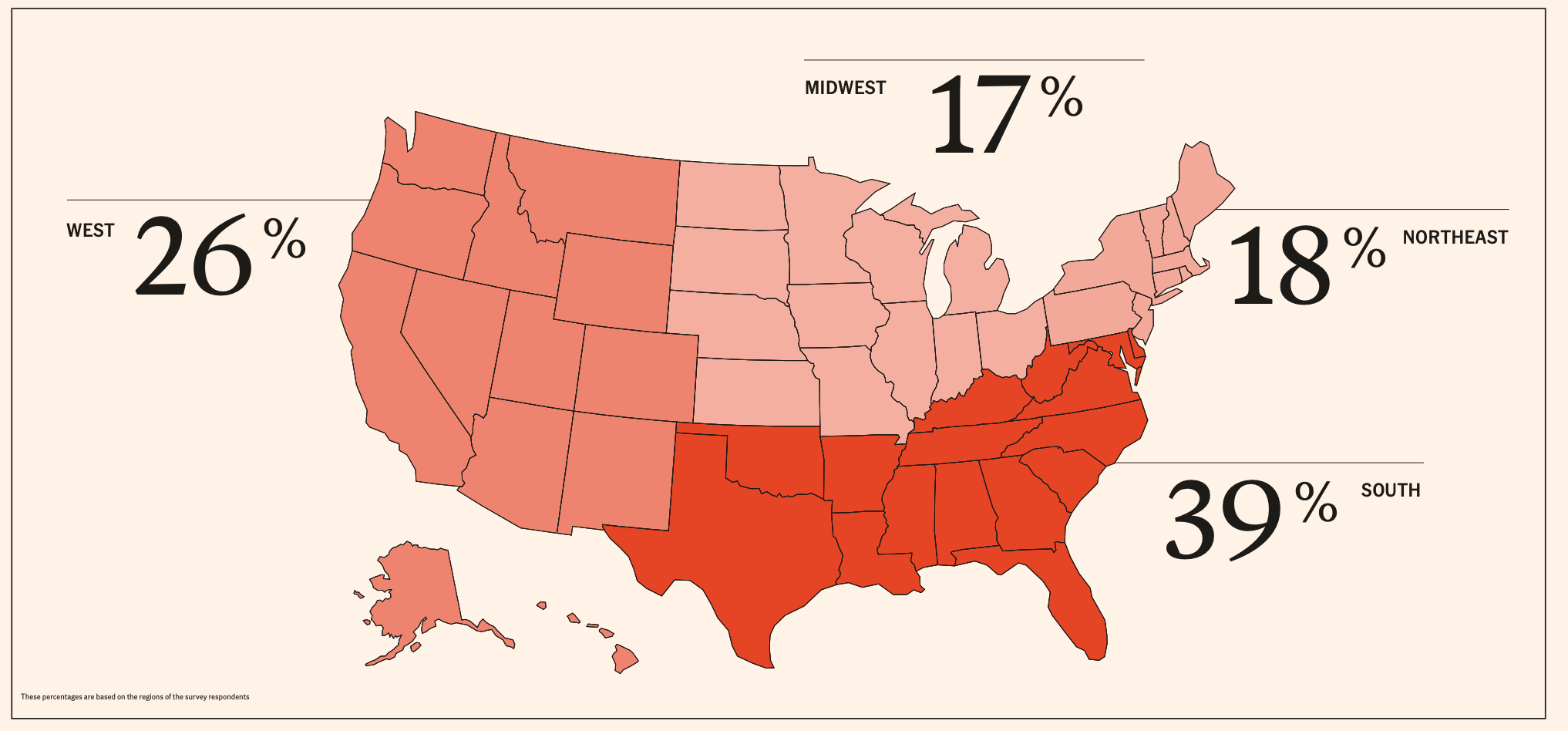

Geographic Distribution of Cryptocurrency Holders

A Diverse Community of Holders

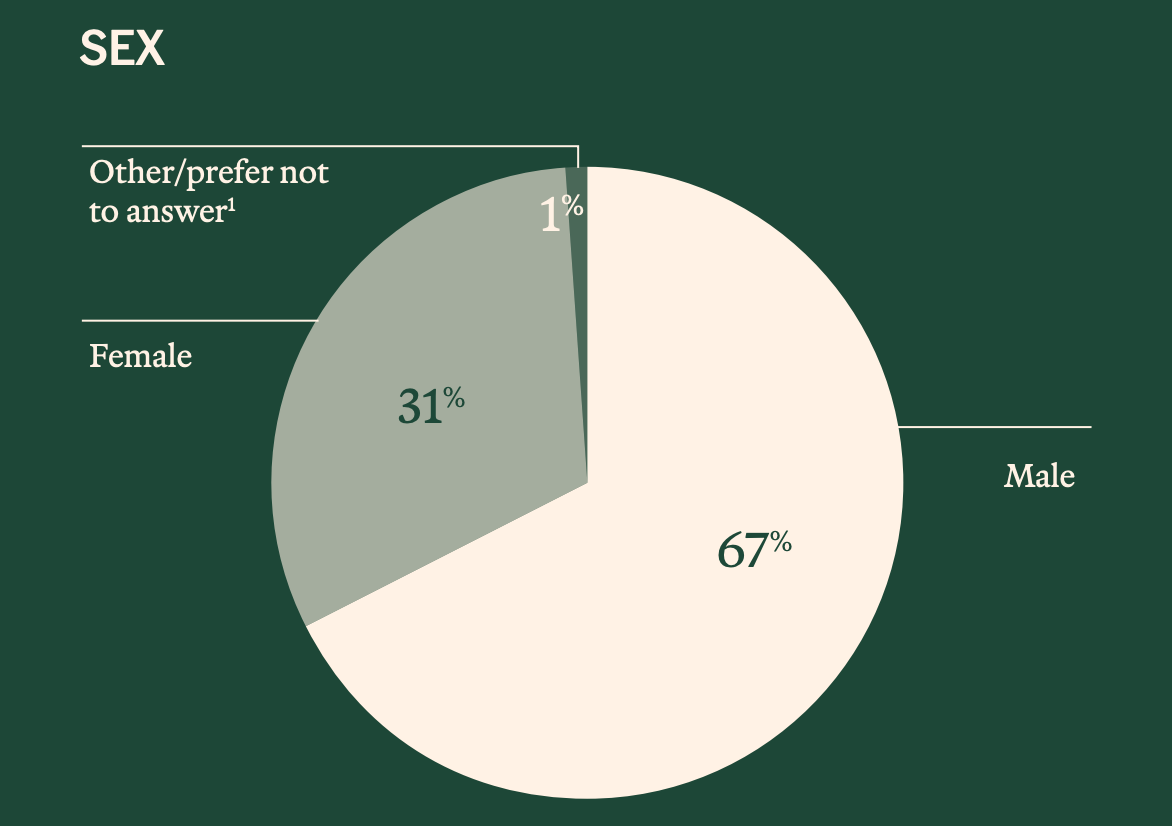

The survey shows that cryptocurrency holders represent a diverse group. People across different age groups and income levels are holding and using digital assets. While male holders dominate (67%), a substantial portion are women (31%).

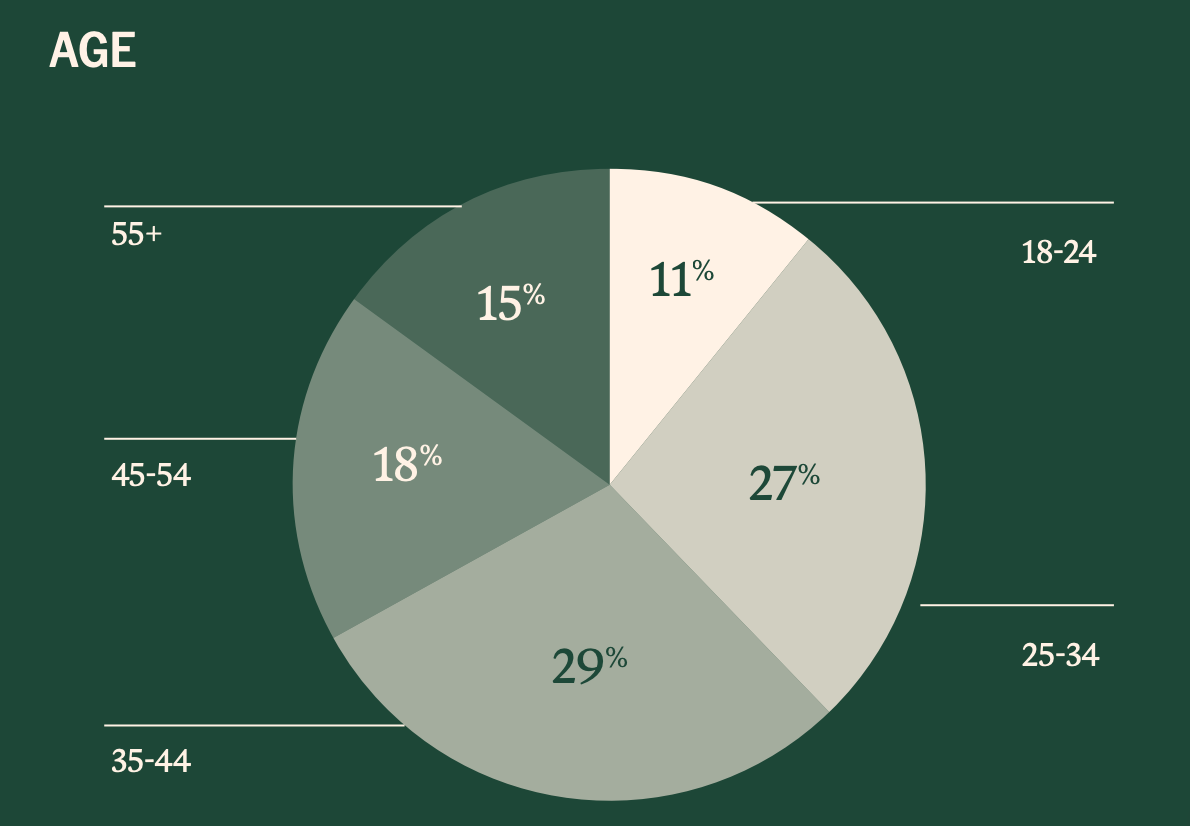

As expected, the demographic skews younger—67% of holders are under 45 years old. However, 15%—nearly 9 million people—are over 55.

Holders come from various professional backgrounds: 14% work in technology, 12% in construction—outpacing finance and manufacturing (7% each), with 6% from healthcare.

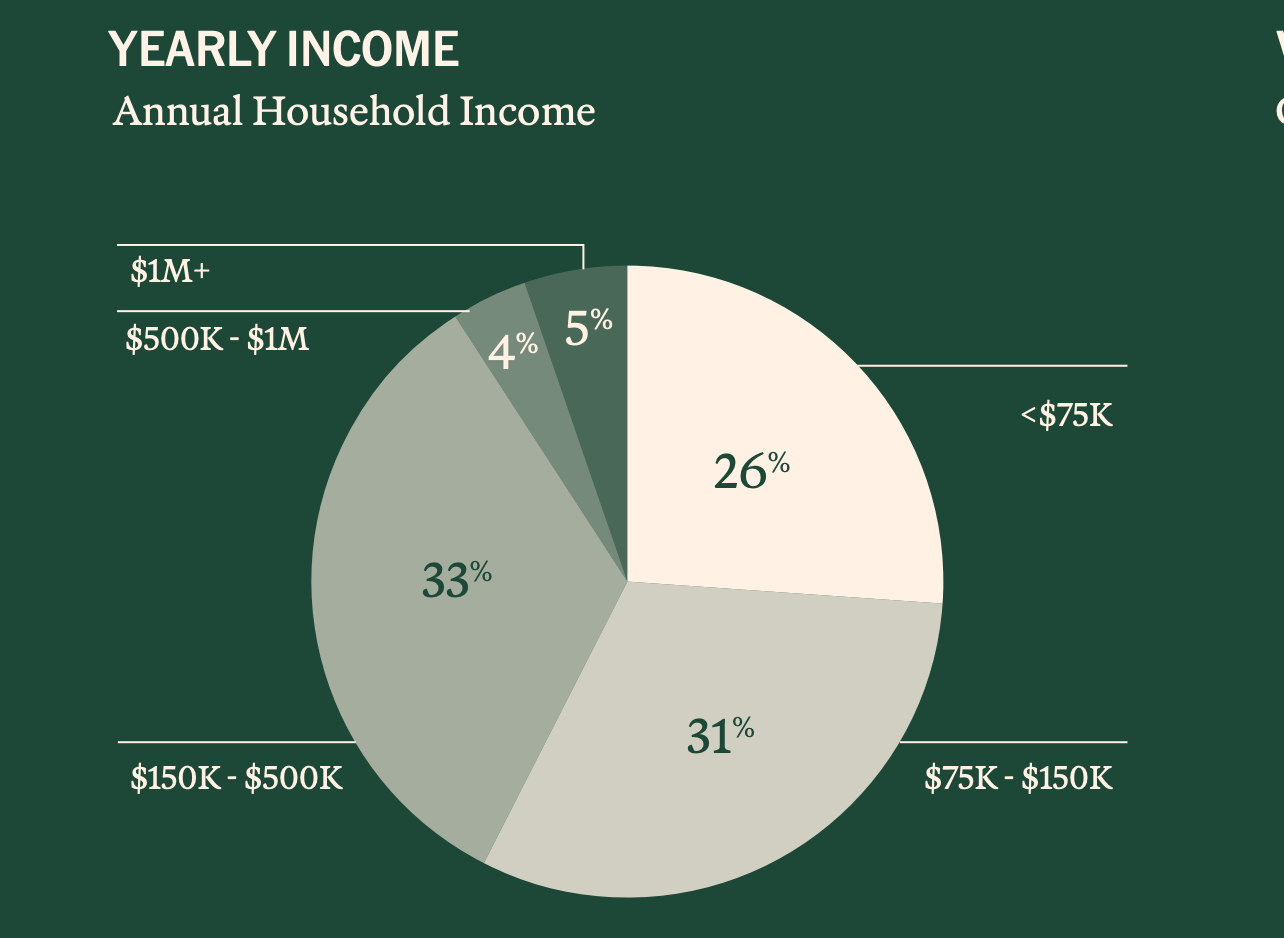

On income, 26% of crypto-owning households earn less than $75,000 annually, indicating this is far from being just a rich person’s game.

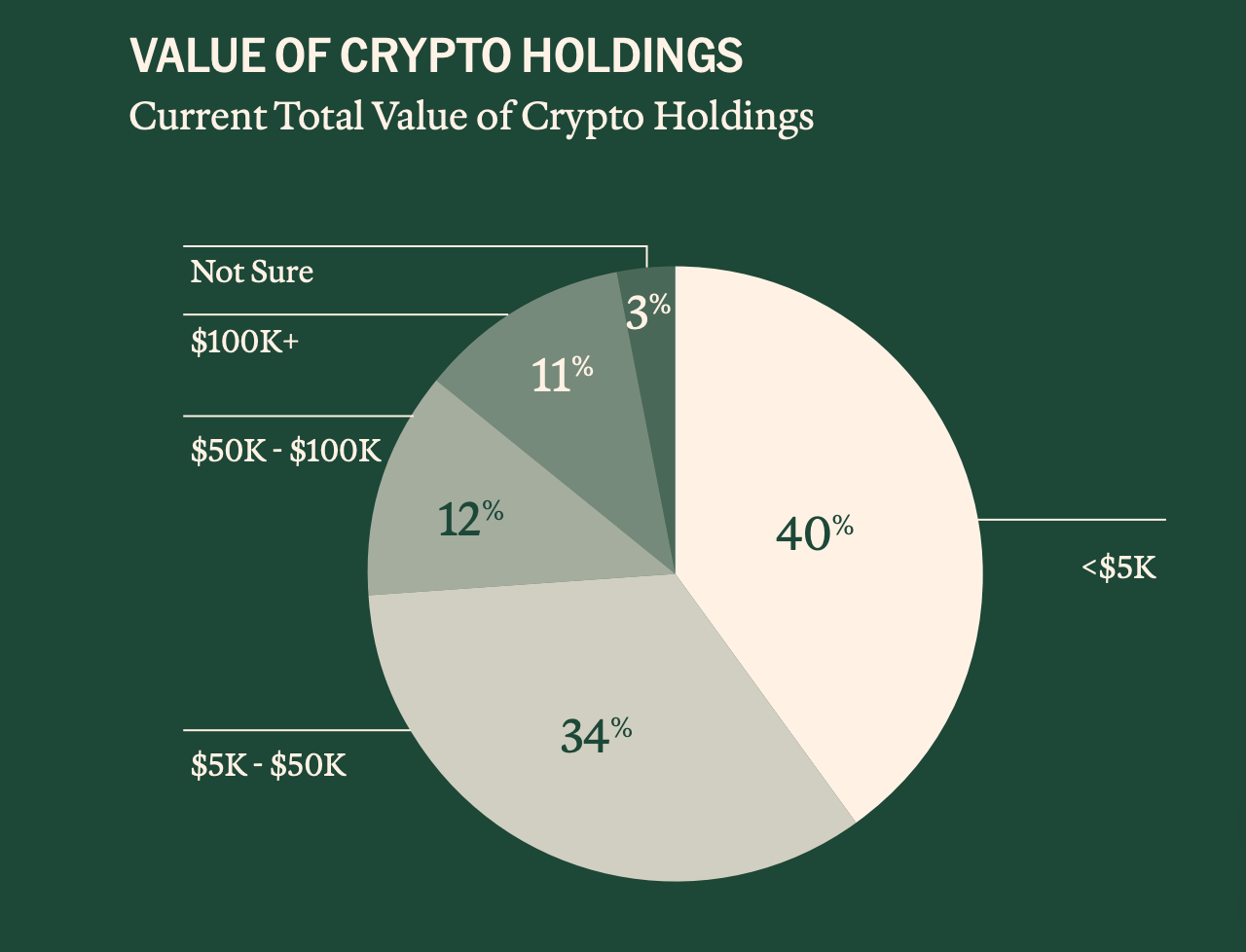

The low entry barrier is key to broad adoption. While 11% hold more than $100,000 in crypto assets, most holdings are modest—55% own less than $10,000, and 15% hold under $500. This diversified ownership clearly shows that cryptocurrency has become a financial tool accessible to people across all demographics.

Using Cryptocurrency in Daily Life

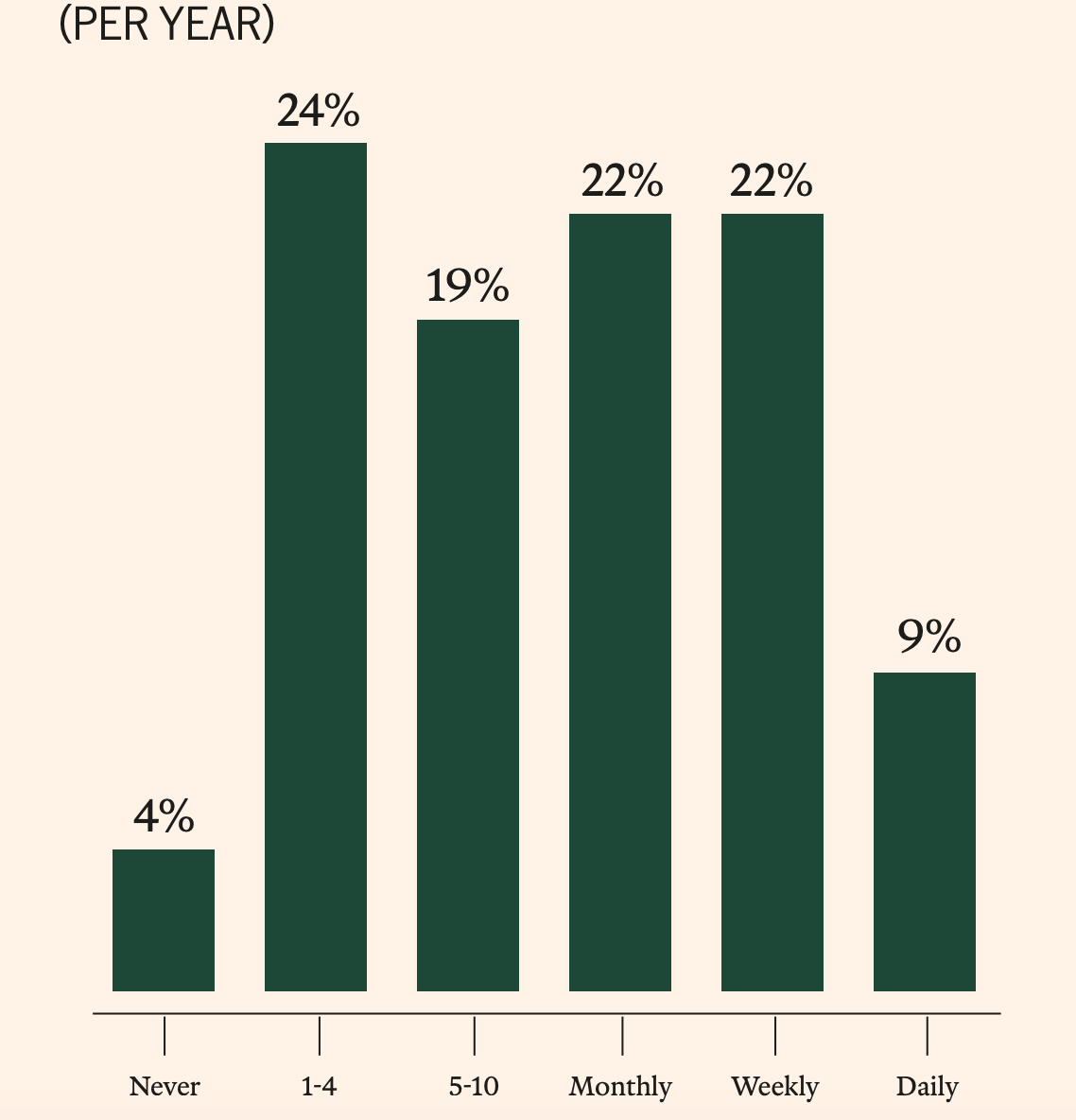

Surprisingly, many are using cryptocurrency as actual money. In fact, 39% of holders report using it to buy goods and services, with 96% doing so at least once per year. This practical utility is also a primary motivator for initial adoption—27% said they first acquired crypto specifically for online transactions.

Frequency of Cryptocurrency Usage

Beyond shopping, cryptocurrency is used in these scenarios:

-

Buying, selling, or using blockchain NFTs: 32%

-

Sending crypto to family members: 31%

-

Accepting crypto payments for business: 31%

-

Developing systems or products like new cryptocurrencies: 22%

-

Acquiring or trading digital collectibles and art: 21%

-

Participating in decentralized games: 20%

-

Buying or selling artwork: 17%

-

Purchasing real estate via blockchain tokenization: 15%

Looking ahead, holders say their top interest over the next two to three years (52%) remains investing for their financial future. But others plan to use crypto for sending money to friends and family, participating in decentralized online games, accepting payments for business, and even improving enterprise-level transaction speed and accuracy. These varied applications show that cryptocurrency is evolving from a pure investment asset into a practical financial tool.

As one respondent put it: "I didn’t realize you could do so much with cryptocurrency." This shift in perception is driving more people to explore its full potential.

Multifaceted Benefits of Cryptocurrency

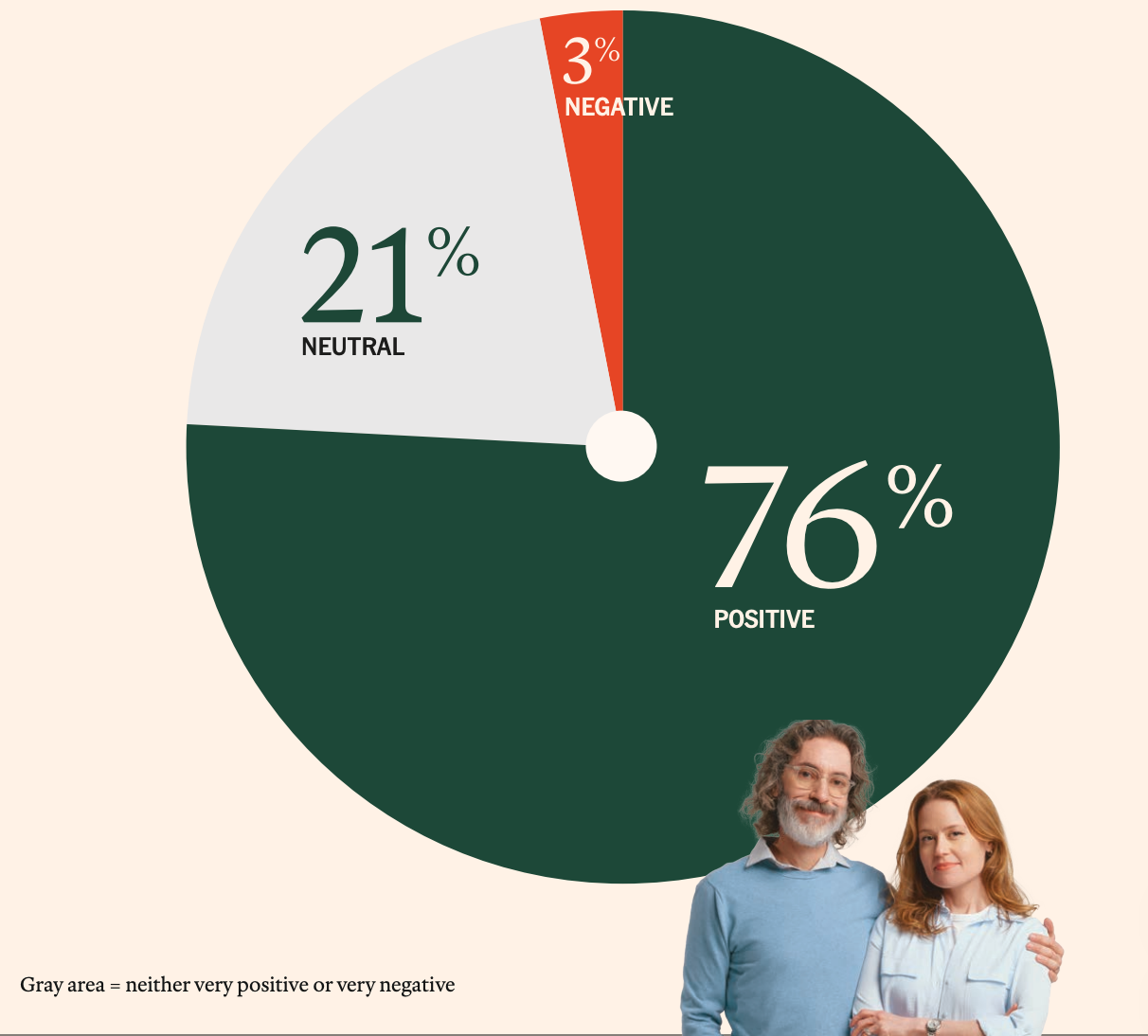

The survey reveals widespread optimism among holders. A full 76% say cryptocurrency has positively impacted their lives, with 46% describing the effect as “very positive.”

These benefits manifest in several ways: increased financial independence (49%), opportunities for learning and personal growth (45%), portfolio diversification (42%), satisfaction from investment returns (44%), and excitement about participating in innovative fields (45%). For artist Autumn, blockchain technology allows her to track ownership, automate royalty distribution, and ensure fair recognition for creators: "Even after I leave this planet, my artwork will continue to make an impact."

Beyond individual gains, respondents believe crypto contributes positively to society—including greater financial inclusion (45%), enhanced digital transactions (45%), technological innovation (38%), support for sustainable economic practices (38%), and improved international trade and cooperation (33%). This indicates that cryptocurrency is increasingly viewed not just as an investment vehicle, but as a force for broader societal progress.

Enhancing the Global Financial System

Holders generally see cryptocurrency as complementary to traditional finance. A striking 76% say their trust in crypto equals or exceeds that in traditional banks. They recognize its potential to reduce transaction costs (45%), increase transaction speed (44%), and improve transparency (44%).

How can cryptocurrency better support traditional financial systems?

-

Lower transaction costs and fees: 45%

-

Greater transparency and security: 44%

-

Faster and more efficient transactions: 44%

-

Providing alternatives during economic instability: 39%

-

Diversifying financial products and services: 39%

-

Expanding financial inclusion: 34%

-

Promoting global financial connectivity and collaboration: 33%

Regarding the future of crypto in the U.S., respondents express strong support and high expectations. 73% want the U.S. to lead globally in cryptocurrency, while 64% believe government regulation is important. Yet, 67% also worry excessive regulation could stifle innovation. This balanced view suggests holders favor a regulatory framework that protects consumers without hindering innovation.

As one participant noted: "Regulation gives the industry a chance to prove its credibility... but it must be smart regulation, not something that kills innovation."

The Starting Point of the Crypto Journey

Every holder has a unique story of entry. The survey finds 56% obtained cryptocurrency between 2020 and 2025. Investment motives (60%) and curiosity about the technology (50%) were the main reasons people considered crypto. But the actual trigger for first-time purchase was often more personal—recommendations from friends or family (43%) were the biggest catalyst, followed by interest in blockchain tech (38%) and financial news or market trends (36%).

What triggered your decision to acquire cryptocurrency for the first time?

-

Family or friends discussing or using cryptocurrency: 43%

-

Interest in blockchain/crypto technology or developments: 38%

-

Financial news or market trends: 36%

-

Economic events (e.g., inflation, financial crisis): 27%

-

Peer influence or social norms (cultural shift toward digital money): 23%

-

Advice or recommendation from a financial advisor/expert: 23%

-

Marketing campaigns or promotions by crypto companies: 22%

-

Educational content (articles, tutorials, courses): 20%

-

Influencer endorsements or celebrity investments: 20%

-

Political events or changes (e.g., elections, regulatory shifts): 15%

Notably, despite heavy media attention on celebrity promotions, their real-world influence appears limited—only 20% of respondents said these factors affected their decisions. This suggests the perceived impact of celebrity endorsements may be overstated compared to personal recommendations and expert opinions.

Main reasons for acquiring cryptocurrency:

-

Investment purposes: 60%

-

Curiosity about the technology: 50%

-

Recommendation from family or friends: 36%

-

For online transactions: 27%

-

Social media or influencer/celebrity impact: 21%

Nonprofit worker Max sees new opportunities for charitable causes: "It’s all upside—more transparency, more accessibility—but most importantly, access to this emerging blockchain movement of crypto donors."

The Gap Between Security Concerns and Actual Experience

Although 75% of respondents expressed concern about scams and security in the crypto space, the rate of negative experiences is surprisingly low—only 3% reported any adverse effects, and fewer than one-third of those personally experienced fraud or a security breach. This gap between perception and reality suggests media coverage may exaggerate the security risks associated with cryptocurrency.

Barriers to wider participation vary: concerns about volatility (15%), lack of funds (15%), security fears (13%), tax implications (10%), limited acceptance (9%), and insufficient public understanding (8%). These obstacles indicate the industry still needs to improve user education, risk management, and market awareness.

Top concerns:

(Among the 3% who reported at least some negative experience)

-

Financial loss due to market volatility: 48%

-

Difficulty understanding crypto technology and markets: 35%

-

Stress or anxiety related to managing or tracking investments: 32%

-

Negative experiences with fraud or security breaches: 32%

-

Regulatory or legal challenges related to using or owning crypto: 29%

Content creator Hunter found crypto solved his cross-border payment issues: "I want to collaborate with people no matter where they are. If you have something great for my project, I want to work with you. I want to pay you." With cryptocurrency, he can instantly pay editors worldwide, keeping production seamless.

Thirst for Knowledge

Despite enthusiasm, holders openly acknowledge knowledge gaps. 81% say they want to learn more about cryptocurrency, and 40% follow news updates daily.

This desire spans multiple areas: nearly half (47%) seek investment strategies, but many also want clarity on fundamentals such as regulations (34%), security measures (38%), blockchain technology (38%), and tax implications (39%).

Practicality matters too—holders feel the industry fails to effectively communicate real-world uses. Many want to know what else they can do with crypto. For instance, a quarter still seek basic understanding, one-third want to learn how to use it in daily transactions, and another third are interested in non-financial use cases.

They turn to various sources: 60% use YouTube to deepen knowledge, while 40% rely on traditional outlets like The New York Times and The Wall Street Journal. Notably, expert commentary is preferred over peer insights—discussion threads on platforms like Discord (22%) and Reddit (33%) are less popular. This suggests professional authority carries more weight than community opinions. As one respondent said: "I feel there aren't enough educational tools about crypto—you really have to do your own research."

Which areas require more information?

-

Investment strategies for cryptocurrency: 47%

-

Tax implications of crypto investments: 39%

-

Understanding blockchain technology: 38%

-

Security measures to protect crypto investments: 38%

-

Risks and rewards of crypto investing: 37%

-

Scam prevention and best security practices: 36%

Popularity and Awareness of Major Tokens

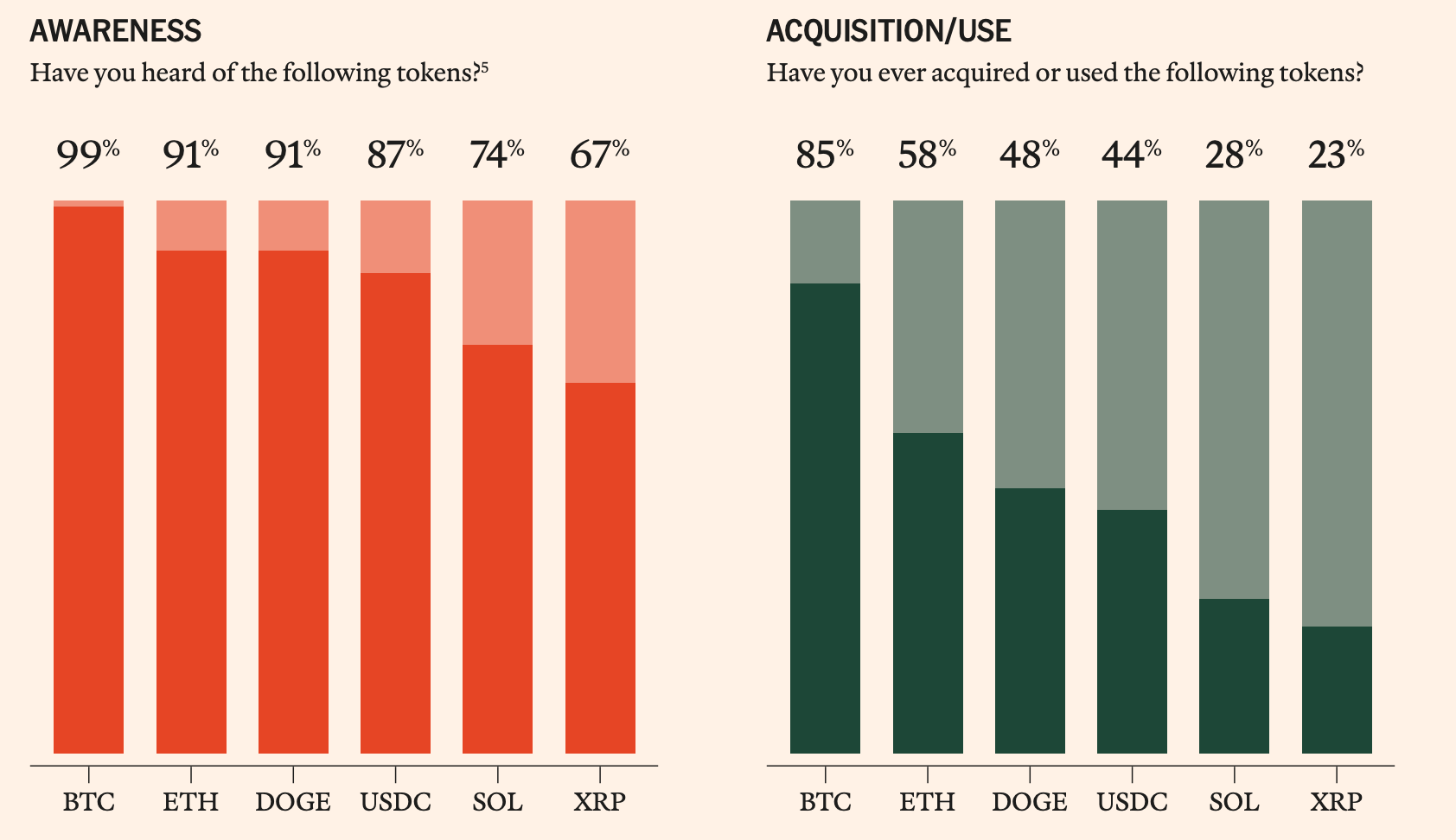

Today, thousands of cryptocurrencies exist across global blockchains. Beyond well-known names like Bitcoin, the ecosystem includes tokens for smart contracts (ETH), instant payments (XRP), stablecoins (USDC), meme coins (DOGE), and DeFi platforms (SOL). The survey shows holders are broadly familiar with these assets.

-

BTC (Bitcoin): The first and most widely recognized cryptocurrency.

-

ETH (Ethereum): Used for transactions and gas fees on the Ethereum network; supports smart contracts and decentralized applications.

-

DOGE (Dogecoin): A meme-based cryptocurrency that began as a joke but gained strong community support.

-

USDC: A dollar-pegged stablecoin whose value remains fixed at $1.

-

SOL (Solana): A popular blockchain platform in DeFi, NFTs, and payments.

-

XRP (Ripple): Designed for fast, low-cost cross-border payments and used by financial institutions.

Looking Ahead: The Path to Mass Adoption

As cryptocurrency continues entering the mainstream, a more inclusive and diverse community of holders is emerging. They are no longer marginalized tech enthusiasts or speculators, but ordinary people from all backgrounds who see crypto as a tool to improve their lives and participate in the future economy.

The value of cryptocurrency lies not only in its investment potential but also in the innovation it brings to the financial system. Increased transparency, faster transactions, and expanded financial inclusion are key features valued by users.

With gradual improvements in regulatory frameworks and deeper user education, cryptocurrency is poised for further adoption in the coming years, becoming an integral part of the global financial landscape. As the survey reveals, cryptocurrency is no longer a futuristic concept—it’s happening now, reshaping how we interact with money, art, games, and each other.

In this rapidly evolving era of digital assets, understanding the real story of cryptocurrency holders is more important than ever. They are not the caricatured "crypto bros," but regular people around us—exploring and shaping a more open, efficient financial future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News