Bitcoin spot ETF applications enter peak period—what will approval mean?

TechFlow Selected TechFlow Selected

Bitcoin spot ETF applications enter peak period—what will approval mean?

If spot Bitcoin ETFs are approved, it would signify broad recognition from the traditional financial world toward Bitcoin and even the Web3.0 ecosystem.

Authors: Song Jiaji, Ren Heyi, Jishi Communications

Executive Summary

Bitcoin spot ETFs use physical bitcoin as their underlying asset and serve as a compliant investment vehicle for traditional capital market investors to gain exposure to bitcoin. Whether the U.S. will approve bitcoin spot ETFs remains the most watched issue in the market. Bitcoin ETFs allow investors to gain exposure to bitcoin and related assets without researching, purchasing, or storing actual cryptocurrency (or derivative instruments), making them highly suitable for broader capital markets and investors in terms of compliance, fees, liquidity, and management costs. Therefore, the market continues to anticipate a swift approval from the U.S. SEC on bitcoin spot ETFs.

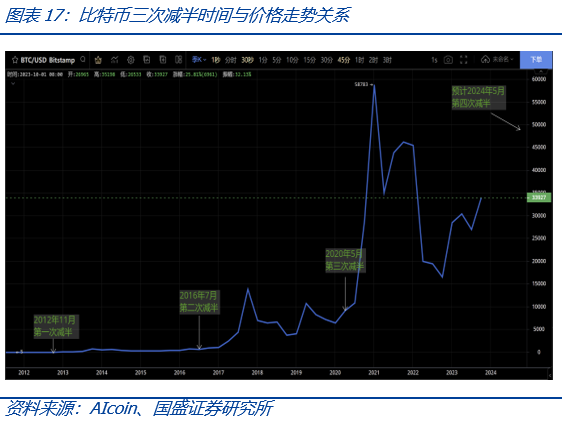

Sharp price volatility is one reason behind the SEC’s cautious approach, with key decisions on recent spot ETF applications expected by March next year. Historically, multiple bitcoin spot ETF proposals submitted to U.S. capital markets have been rejected by the SEC, primarily due to insufficient investor protection in the bitcoin market. On October 16, an industry media outlet, Cointelegraph, posted false news on X (formerly Twitter) claiming that BlackRock’s iShares bitcoin spot ETF had been approved by the SEC. This caused bitcoin’s price to surge from $27,900 to $30,000 before correcting back down—resulting in nearly $100 million worth of crypto positions being liquidated within less than an hour. Such incidents are not uncommon in the crypto market, so the SEC’s concerns are not unfounded. The U.S. SEC has successively delayed rulings on spot bitcoin ETF applications from WisdomTree, Invesco Galaxy, Valkyrie, Fidelity, VanEck, Bitwise, and BlackRock. Currently, the final review deadlines for 11 major bitcoin spot ETF applications are concentrated around mid-October, with ultimate decision dates extending into March 2024. Thus, the application process for bitcoin spot ETFs in the U.S. has entered a peak phase. With the upcoming bitcoin halving expected around late April 2024, whether these spot ETFs get approved has become the focal point of industry attention.

The launch of gold ETFs historically boosted gold prices, offering positive precedent for bitcoin spot ETFs. The introduction of gold ETFs provided a significant boost to gold prices, which offers valuable insight for bitcoin spot ETFs. It should be noted that global recognition of gold did not originate from spot ETFs; however, if bitcoin spot ETFs are approved, it would signify broad acceptance of bitcoin—and even Web3.0—by traditional wealth holders, accelerating integration between these worlds. This represents a transition from zero to one, with marginal impact far exceeding that of gold ETF approvals. Additionally, a key difference lies in supply: while bitcoin has a fixed cap of 21 million coins, gold continues to see new production. Approval of bitcoin spot ETFs in the U.S. could bring substantial inflows of new capital. According to Galaxy Digital's estimates: bitcoin is projected to rise 74% in the first year following ETF approval (starting from $26,920 on September 30, 2023); over the longer term, potential investment scale in bitcoin products could range between $125 billion and $450 billion.

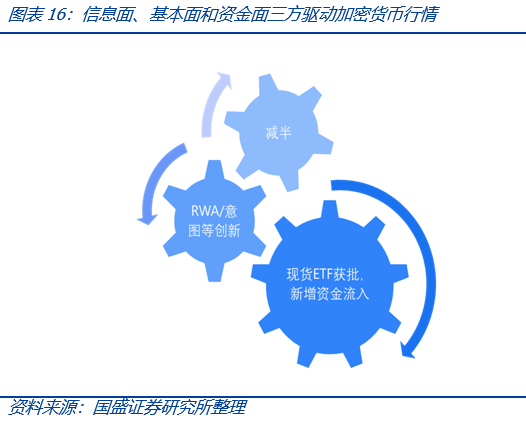

Informational, fundamental, and financial factors may converge positively next year. Reviewing the three bull-bear cycles since bitcoin’s inception, each upward trend began near a bitcoin halving event—an informational "historical tailwind." Each cycle was also supported by innovations in industry applications, while fresh capital inflows served as the foundation for bullish momentum. Presently: information-wise, the fourth halving is expected at the end of April 2024; fundamentally, innovations such as RWA and intent-based systems are driving new industry applications and building momentum; financially, approval of spot bitcoin ETFs could unlock massive new capital inflows.

Investment recommendations: Consider mining stocks BTBT/DGHI/IREN/RIOT/MARA/BITF/CSLK/HIVE/WULF/BTCM/ARBK/BTOG/MIGI/BTDR, mining equipment manufacturer CAN, cryptocurrency exchanges Coinbase (COIN), 0863.HK; and bitcoin-holding stock MSTR.

1. Key Perspectives

Bitcoin spot ETFs, backed by physical bitcoin, offer a compliant way for traditional capital market investors to access bitcoin. Over the past decade, U.S. attempts to launch bitcoin spot ETFs have repeatedly failed. However, with maturation of the crypto market and increasing acceptance of digital assets among traditional investors, sentiment is shifting. While other countries already have bitcoin spot ETFs and the U.S. hosts some bitcoin futures ETFs, approval of a U.S. spot ETF remains the central focus of market anticipation.

Reviewing the three historical bull-bear cycles since bitcoin’s creation, halving events consistently marked the beginning of upward trends—an informational “historical benefit.” Each rally was underpinned by innovation-driven fundamentals, with new capital inflows forming the base for upward momentum. Currently: informationally, the fourth halving is anticipated at the end of April 2024; fundamentally, innovations like RWA and intent are fostering new industry applications and gathering steam; financially, approval of a bitcoin spot ETF could unleash significant new capital.

2. Bitcoin Spot ETF Applications Enter Peak Phase

2.1 Why Are Bitcoin Spot ETFs Important?

Bitcoin spot ETFs use physical bitcoin as the underlying asset and represent a compliant investment tool for traditional capital market participants. A bitcoin spot ETF is an exchange-traded fund based on physical bitcoin—an index fund allowing investors exposure to bitcoin and related assets without needing to research, buy, or store actual cryptocurrency (or derivatives). They offer advantages in compliance, cost, liquidity, and management efficiency, making them ideal for mainstream capital markets and investors.

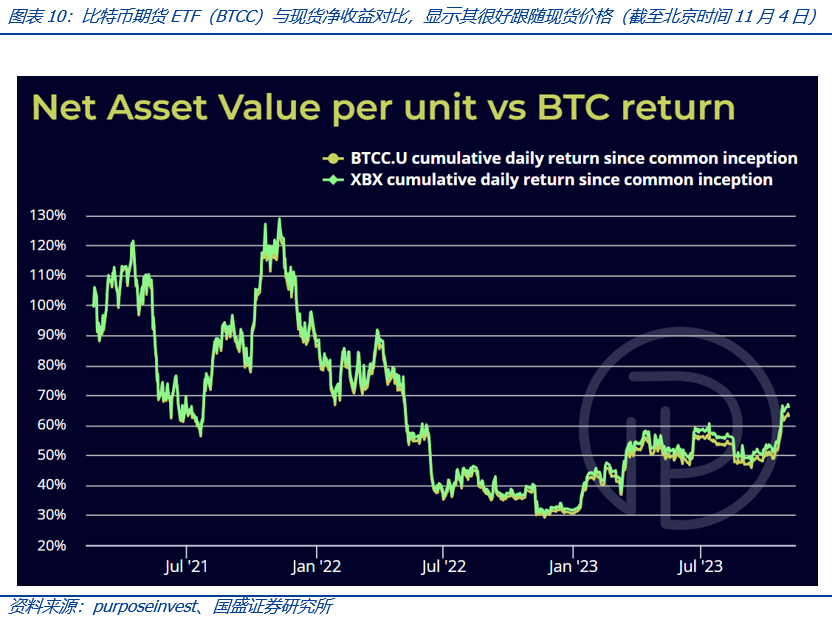

In contrast, bitcoin futures ETFs are based on bitcoin futures contracts—their core distinction lies in the underlying asset. From a price volatility perspective, both spot and futures ETFs aim to closely track BTC prices and provide investor exposure. However, futures ETFs typically carry higher fees due to the complexity of managing futures contracts. Hence, the market continues to await the SEC’s approval of a bitcoin spot ETF.

According to Coinglass data as of November 5, the combined bitcoin balance across 20 major cryptocurrency exchanges totaled 1.835 million BTC, while approximately 208,000 BTC were held by 40 public companies. As calculated by Galaxy Digital, bitcoin investment products—including ETPs and closed-end funds—held a total of 842,000 BTC as of September 30. At a bitcoin price of $35,200 on Coinbase (COIN) on November 5, this amounts to roughly $29.6 billion in value.

Existing bitcoin investment products suffer from high fees, low liquidity, and tracking errors. More critically, they still pose compliance and convenience challenges for large-scale traditional investors. Moreover, directly managing bitcoin involves administrative burdens including wallet/private key management, self-custody, and tax reporting. Thus, a bitcoin spot ETF would be a far more ideal investment vehicle.

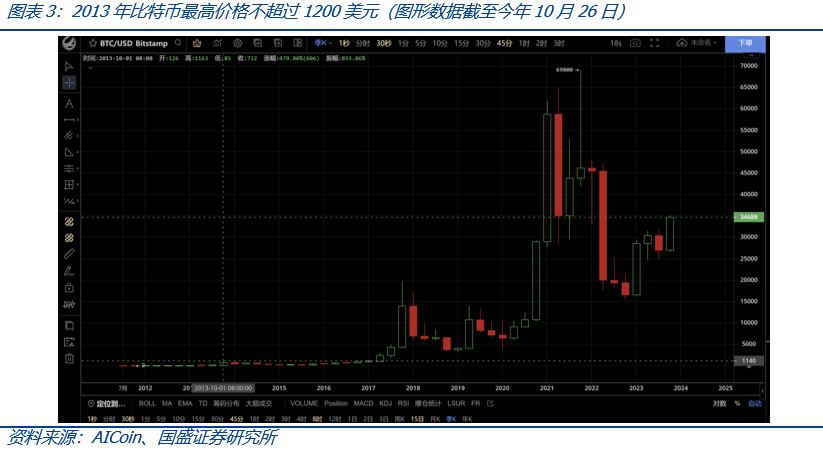

2.2 The Rocky Road Toward Bitcoin ETF Approval

The earliest attempt at a BTC spot ETF dates back to 2013 when the Winklevoss twins (Cameron and Tyler) sought to launch one. Despite multiple filings over years, all efforts failed, and the proposal remains stalled. That same year, bitcoin reached its first bull market peak at $1,163. As of November 5 this year, bitcoin surpassed $35,000. This sustained price appreciation has fueled growing interest in a bitcoin spot ETF from capital markets. Since then, numerous institutions have attempted to launch such products.

Historically, U.S. bitcoin spot ETF applications have been repeatedly rejected by the SEC, mainly citing inadequate investor protection in the bitcoin market. On October 16, industry media Cointelegraph falsely announced on X (formerly Twitter) that BlackRock’s iShares bitcoin spot ETF had received SEC approval. The rumor drove bitcoin from $27,900 to $30,000 before sharply reversing after correction, resulting in nearly $100 million in crypto positions liquidated within an hour. Such events are not rare in crypto markets, validating the SEC’s caution.

The U.S. Securities and Exchange Commission (SEC) has repeatedly postponed decisions on bitcoin spot ETF applications from WisdomTree, Invesco Galaxy, Valkyrie, Fidelity, VanEck, Bitwise, and BlackRock. Currently, the latest review timelines for 11 major applications converge around mid-October, with final deadlines set for March 2024. Indeed, the U.S. bitcoin spot ETF application process has entered a peak period. With the next bitcoin halving expected at the end of April 2024, whether these spot ETFs are approved has become the most critical topic in the industry. Unlike a decade ago, this wave includes established traditional financial institutions like BlackRock—indicating a clear trend of mainstream finance entering the bitcoin ETF space. If approved, future capital inflows into crypto investments may come predominantly from traditional financial players—a key shift from previous eras.

2.3 Grayscale’s Legal Victory Boosts Market Confidence

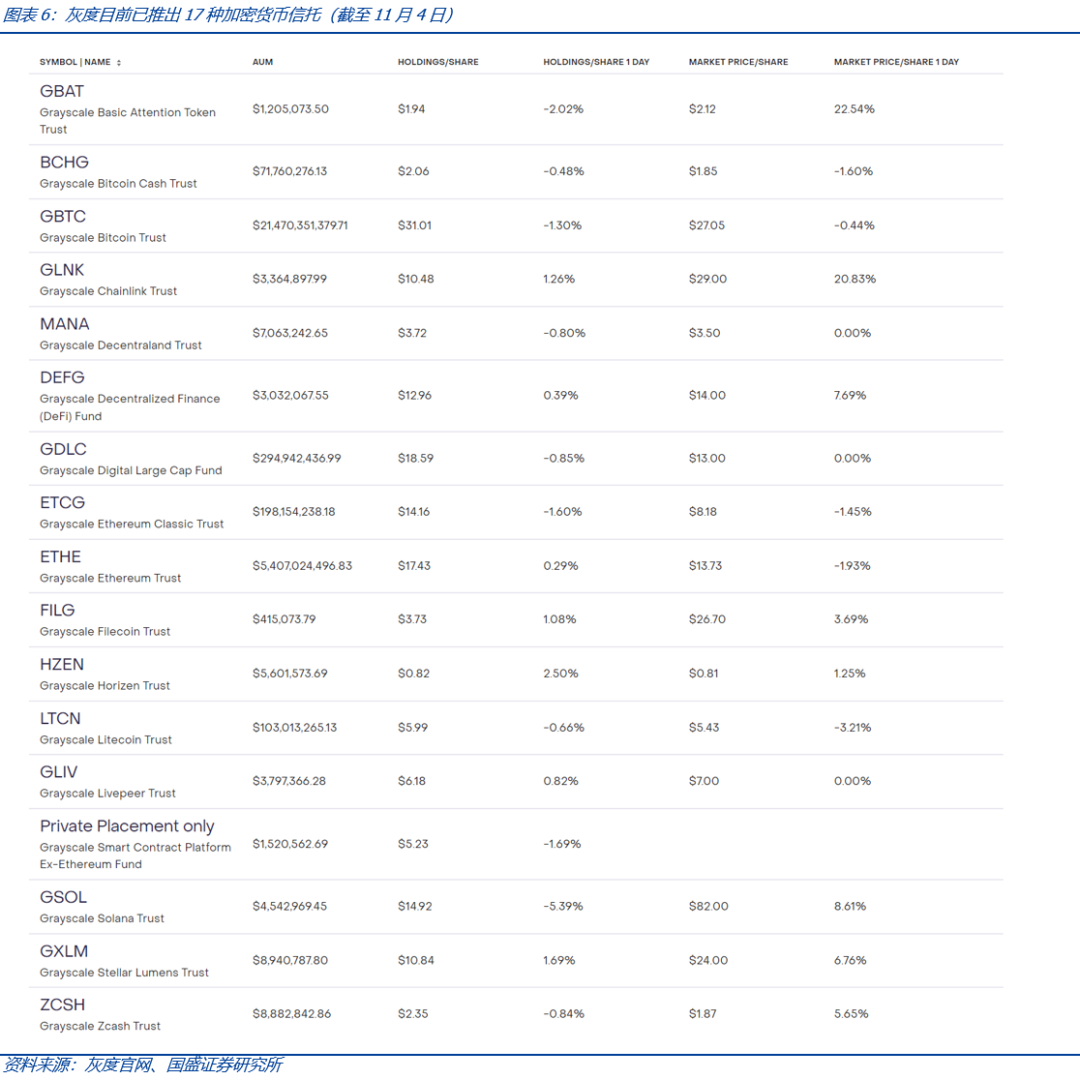

Prior to the approval of a bitcoin spot ETF, Grayscale’s cryptocurrency trusts served as alternative vehicles for traditional market investors. As of November 4, Grayscale offered various crypto trusts including those for BTC, ETH, and a broad crypto index.

Products like GBTC allow investors to trade shares on secondary markets, but as closed-end funds, they lack clear redemption mechanisms. For a prolonged period, GBTC traded at a persistent discount. To address liquidity issues, Grayscale pursued converting GBTC into an ETF. On June 29, 2022, the SEC rejected Grayscale’s application to convert its Bitcoin Trust (GBTC) into an ETF. After appeal, on October 23, 2023, the U.S. Court of Appeals for the D.C. Circuit ruled that the SEC’s denial was “arbitrary and capricious,” ordering the commission to reconsider. This means the SEC must reevaluate Grayscale’s application and provide substantiated reasoning if rejecting it again. To emphasize the importance of this case, Grayscale created a dedicated litigation timeline page on its official website, reflecting its determination and commitment to achieving ETF status.

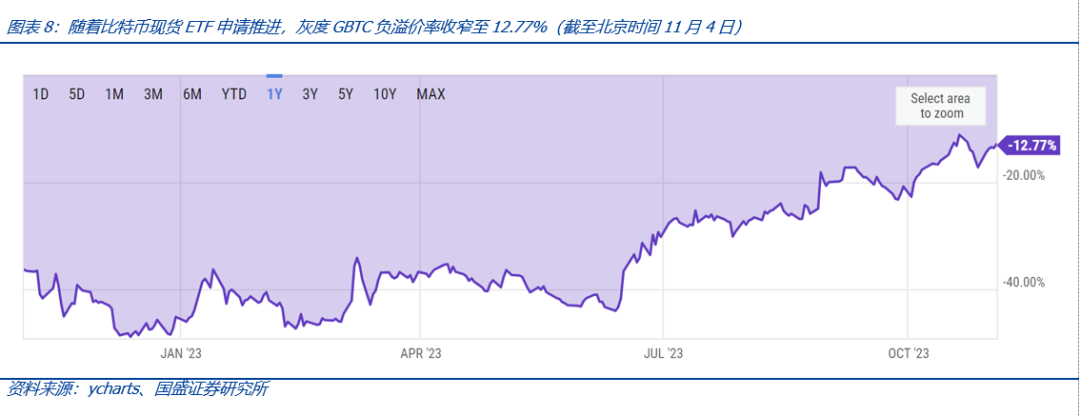

Although Grayscale’s legal win doesn’t guarantee immediate conversion of GBTC into an ETF, it significantly boosted market confidence, signaling that approval is increasingly likely. Following this development, as of November 4, GBTC’s discount narrowed to 12.77%.

Grayscale’s victory indicates there is no insurmountable legal barrier to launching a bitcoin spot ETF, greatly boosting market confidence. Consequently, the surge in new applications reflects heightened market anticipation.

3. What Does the Current Bitcoin ETF Landscape Look Like?

3.1 Status of Bitcoin Spot ETFs

While U.S. bitcoin spot ETFs face regulatory hurdles, several international markets have already approved such products. Leading examples include:

-

Purpose Bitcoin ETF (BTCC), launched in February 2021 and traded on the Toronto Stock Exchange (TSX), has remained highly popular;

-

3iQ CoinShares Bitcoin ETF (BTCQ), another bitcoin spot ETF listed on the TSX;

-

QBTC 11 by QR Asset Management (QBTC 11), Latin America’s first bitcoin ETF, launched on Brazil’s BVMF in June 2021. As of November 4, 2023, QBTC 11 holds 727 bitcoins.

These bitcoin ETFs effectively track spot bitcoin prices, enabling investors to gain bitcoin exposure. Their success demonstrates strong investor demand. At a bitcoin price of $35,200 on Coinbase (COIN) on November 5, bitcoin’s market cap exceeds $700 billion—indicating ample room for ETF growth. Although bitcoin ETFs are already available in Canada, Brazil, and Europe, the U.S. spot bitcoin ETF remains blocked by regulation, making it the most eagerly awaited product globally.

3.2 Bitcoin Futures ETFs Have Paved the Way

As the crypto market expanded under bitcoin’s leadership, digital assets gradually attracted interest from traditional financial institutions. On December 18, 2017, the Chicago Mercantile Exchange (CME), one of the world’s largest futures exchanges, launched bitcoin futures. Just eight days earlier (December 10, 2017), the Chicago Board Options Exchange (CBOE) introduced the world’s first (traditional market) bitcoin futures contract.

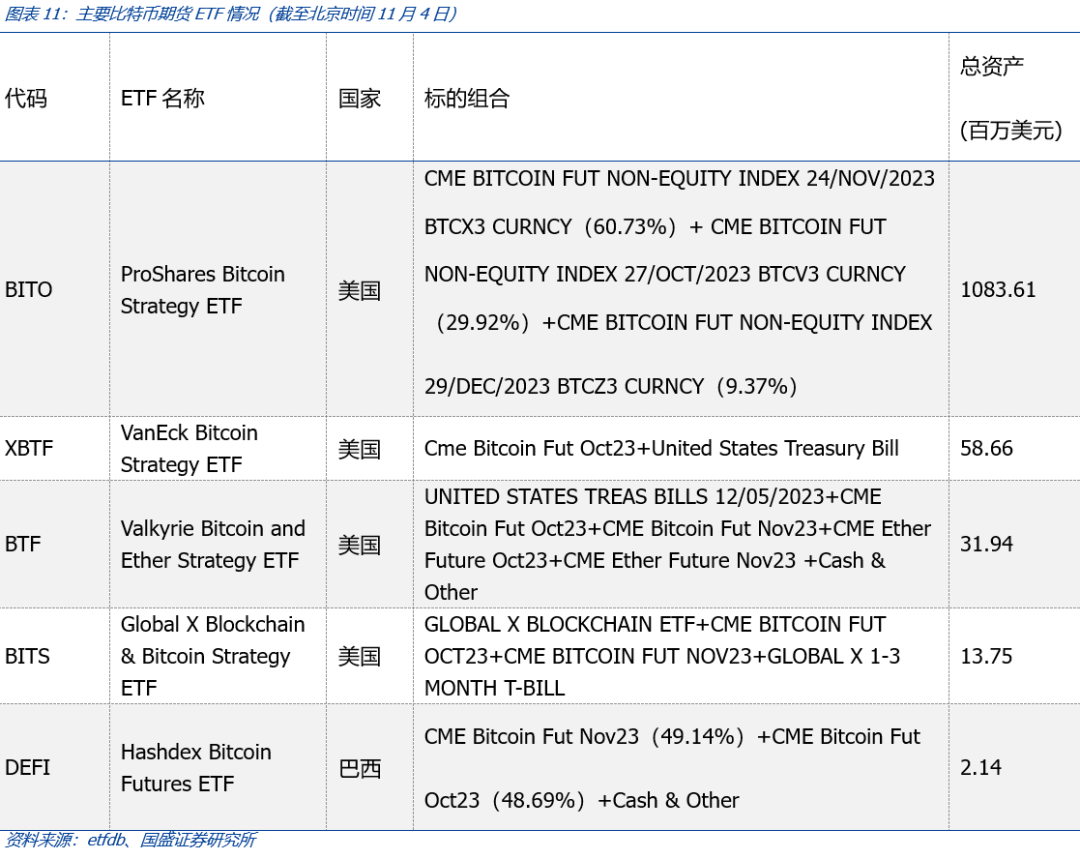

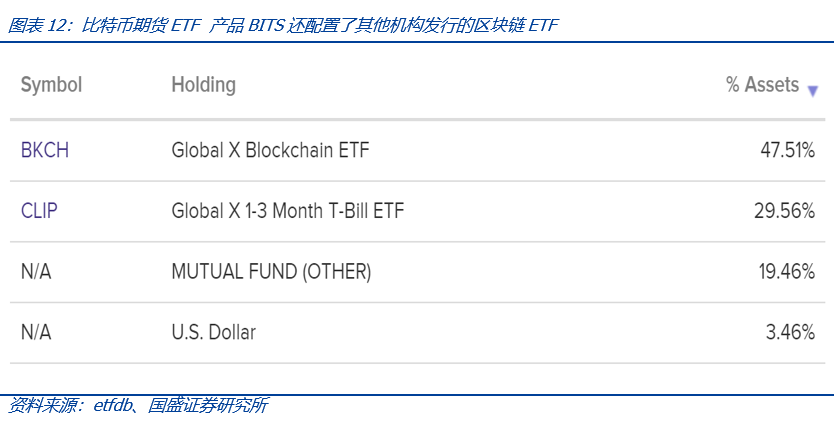

While no bitcoin spot ETF is yet available in the U.S., several bitcoin futures ETFs are already listed. As of November 4, five major futures ETFs—BITO, XBTF, BTF, BITS, and DEFI—manage a combined $1.19 billion in assets. Among them, BITO, issued by ProShares in October 2021, is the largest with $1.08 billion in assets. XBTF by VanEck and BTF by Valkyrie follow with $586.6 million and $319.4 million respectively.

These bitcoin futures ETFs primarily track bitcoin futures contracts from the Chicago Mercantile Exchange (CME). BITO, the largest, exclusively holds CME futures and employs a “rolling” futures strategy. Other ETFs like XBTF and BTF also allocate portions to U.S. Treasuries, while BITS invests in blockchain ETFs issued by other institutions.

Prior to the approval of a bitcoin spot ETF, futures ETFs partially meet institutional demand for bitcoin-related exposure. However, with only $1.19 billion in assets versus bitcoin’s nearly $700 billion market cap, it is clear they fall far short of satisfying overall market demand. Hence, the spot ETF remains a top priority.

4.What Will a Bitcoin Spot ETF Bring?

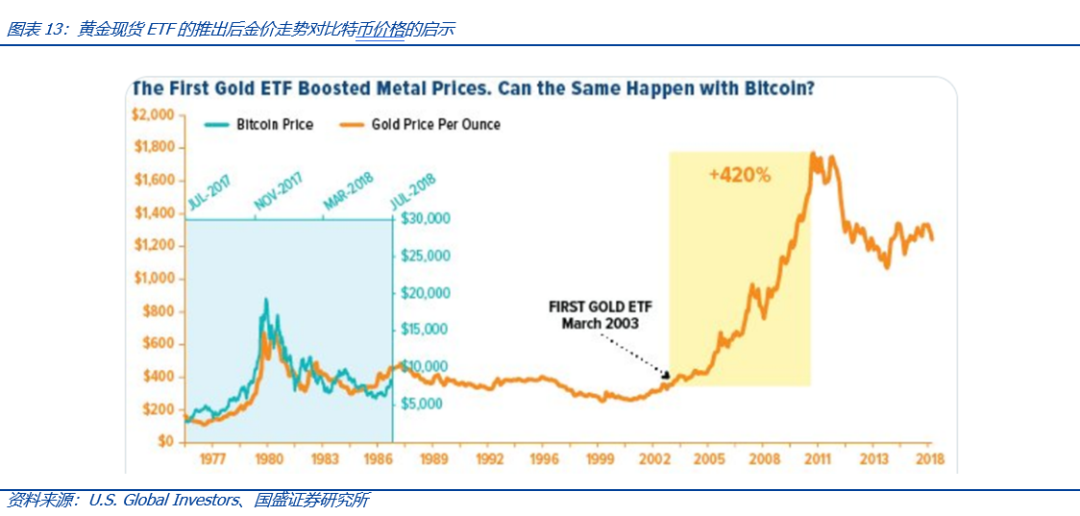

U.S. Global Investors analyzed the impact of gold ETFs and found that after the launch of gold spot ETFs in 2004, increased liquidity and algorithmic trading contributed to a 420% rise in gold prices. This experience underscores the significance of spot ETFs and offers insight into the potential market impact of a bitcoin spot ETF. Thus, the launch of a bitcoin spot ETF could open significant upside potential across relevant sectors.

Note that global recognition of gold did not stem from spot ETFs. However, approval of a bitcoin spot ETF would signal broad acceptance of bitcoin—and even Web3.0—by traditional wealth holders, accelerating convergence between these ecosystems. This is a transformative zero-to-one moment, with marginal impact surpassing that of gold ETF approval. On another note, a key difference exists: bitcoin’s supply is capped at 21 million, whereas gold continues to see ongoing production.

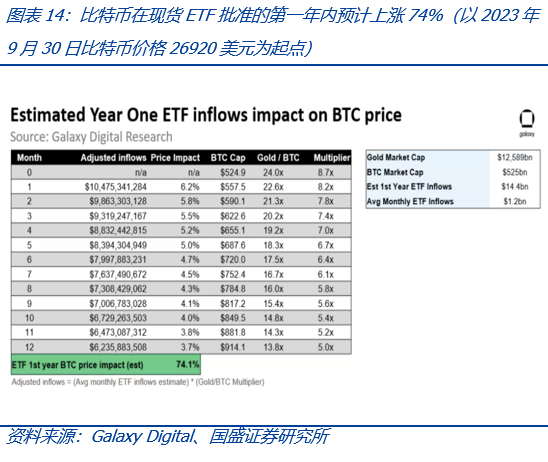

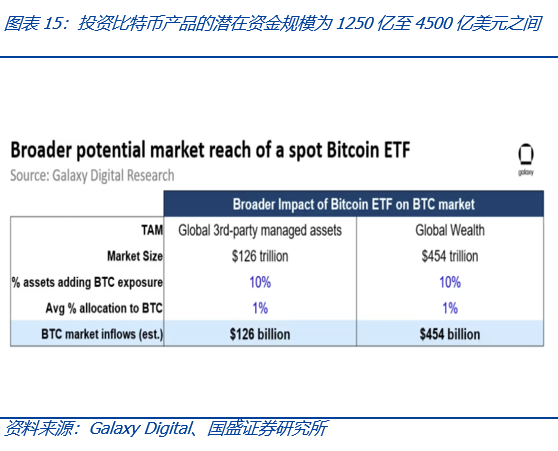

Approval of a bitcoin spot ETF in the U.S. could unlock meaningful new capital. As of October 2023, the U.S. wealth management market managed $48.3 trillion in assets—$27.1 trillion by brokers, $11.9 trillion by banks, and $9.3 trillion by registered investment advisors. Based on this, Galaxy Digital projects:

-

Bitcoin is expected to rise 74% in the first year after ETF approval (starting from $26,920 on September 30, 2023);

-

Over the longer term, potential capital inflows into bitcoin investment products could range between $125 billion and $450 billion.

Reviewing the three bull-bear cycles since bitcoin’s inception, each upward move began near a halving event—an informational “historical tailwind.” Each cycle was driven by waves of industry innovation (first altcoin emergence, then Ethereum smart contracts enabling early applications, followed by DeFi and metaverse innovations), with new capital inflows serving as the catalyst. Currently:

-

Informational: The fourth halving expected at end of April 2024;

-

Fundamental: Innovations in RWA and intent are spawning new applications and building momentum;

-

Financial: Approval of a bitcoin spot ETF could unleash massive new capital inflows

Therefore, from a three-driver model perspective, we believe that approval of a bitcoin spot ETF could generate strong positive momentum in the market.

As final SEC decision deadlines approach, the market is increasingly focused on the outcomes and specific rationale behind approvals or rejections. According to reports by Fox Business journalists, the SEC has proposed new conditions during meetings with ETF applicants—such as requiring cash-based creation mechanisms—for spot bitcoin ETFs. This reflects continued progress toward a potential U.S. listing, making it the most pressing issue in the crypto market today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News