The "Skeptic's Bull Market" Has Arrived — How to Prepare and Ride the Narrative?

TechFlow Selected TechFlow Selected

The "Skeptic's Bull Market" Has Arrived — How to Prepare and Ride the Narrative?

The bull market is crazier than you imagine.

Written by: IGNAS | DEFI RESEARCH

Compiled by: TechFlow

Not So Fast: Is This the Start of a New Bull Run?

Interest rates have hit their highest levels in decades, people are struggling to pay bills due to high inflation, two major wars are ongoing, and the S&P 500 has dropped 9%. As I write this, even Google’s stock is down 10%.

Despite a seemingly bearish macro environment, Bitcoin (BTC) has held steady above $34,000 for over a week. You’ve probably re-read "Wall Street Cheat Sheet: The Psychology Of Market Cycles" more than a hundred times, and now it looks like we're experiencing a bull market driven by skepticism.

Over four months ago, Delphi Digital released a compelling market research report titled "Catalyst Stacking – Will Narratives Drive Fundamentals?"

The report was paid, but I summarized it on X, explaining how narratives develop and identifying the catalysts that trigger them.

Delphi identified three key core narratives: the Fed's liquidity cycle, war, and new government policies. They explained how each would impact crypto in the short and long term. This article proved prescient—many negative events are now turning positive. Since then:

-

The SEC lost its court battle against Grayscale (and XRP), paving the way for a Grayscale BTC spot ETF and putting Gary Gensler’s position at the SEC in jeopardy. Further losses against Binance, Coinbase, and others will (hopefully) continue building momentum to fuel the bull run.

-

China has started fighting deflation by injecting 137 billion USD into the economy—a move historically beneficial for crypto through China-driven liquidity expansion.

-

Approval of spot Bitcoin ETFs from firms like BlackRock is almost certain, bringing much-needed liquidity to the crypto space.

It’s unclear when the Fed will start cutting rates, but the worst of the rate hikes appears to be behind us. Arthur Hayes believes the end of the fiat era and the rise of AI will further benefit crypto.

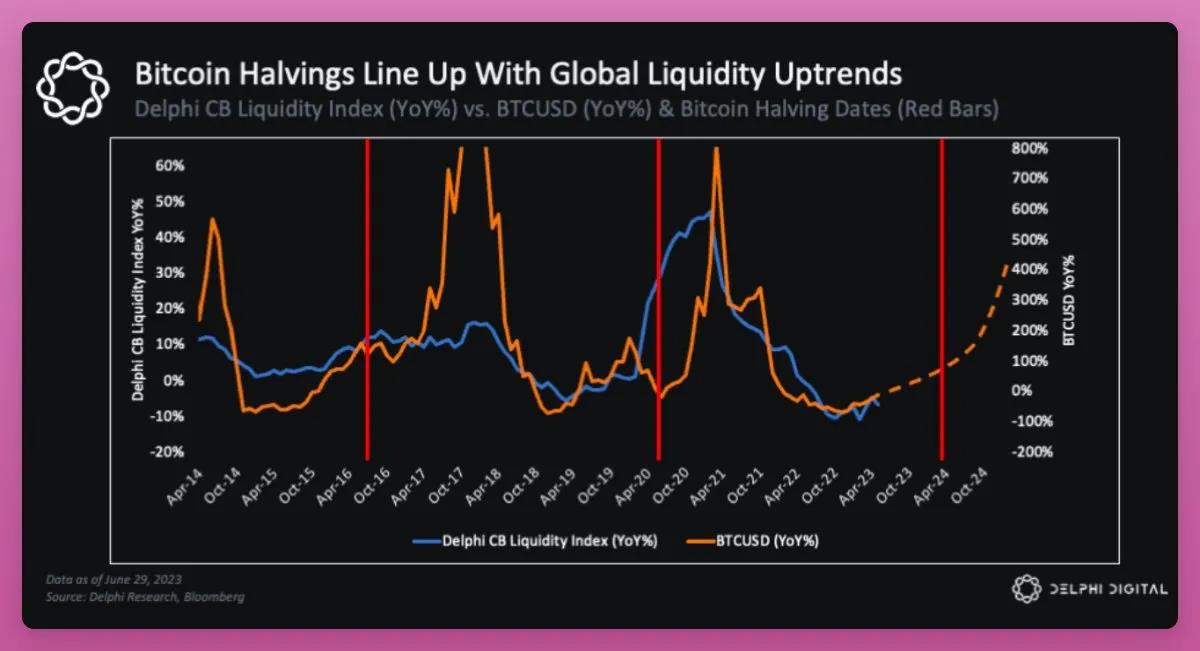

As these macro catalysts evolve, they align perfectly with Bitcoin’s halving in April 2024. The recurring nature of macro cycles explains why Bitcoin is following a similar path today as it did in previous cycles.

So, is this the beginning of a bull market? I believe so.

But even if I’m wrong, I can wait for any dip, keep learning and researching crypto, and prepare for the next bull run. I can’t afford to sit on the sidelines and miss out on a wild bull market.

Bull Markets Are More “Crazy” Than You Think

Inverse Finance ($INV) is just one example from the last crazy bull market. Yet, INV’s launch originated from the YFI token.

yEarn, a yield aggregator founded solely by Andre Cronje, required what we call “governance”—maintenance and decision-making around fees, rules, etc.

Thus, they launched YFI, “a zero-supply token with no inherent value.”

“We stress again that it has no financial value. No pre-mine, no sale, cannot be bought, won’t appear on Uniswap, no auction. We don’t have a single one.”

— YFI Blog

Anyone could provide liquidity on protocols like Curve (as far as I know) and receive YFI for free. I provided liquidity and, to my surprise, earned a 1000% annualized yield!

I couldn’t understand how a seemingly “worthless” token could trade for thousands of dollars per unit. Crypto Twitter buzzed with speculation about YFI’s price—from $0 to $1 million. But YFI was an entirely new concept, and our traditional investment frameworks didn’t apply. YFI completely changed how we think about token launches.

Eventually, I sold my YFI at around $3,000 each. A few months later, it surged to $90,000. That was a missed opportunity of 2900% potential gains. I wasn’t prepared for how crazy the market could become.

Since then, I’ve kept an open mind, especially toward things that confuse me the most. These may disappear—or they might transform industry dynamics entirely. DeFi and NFTs are prime examples, creating a generation of wealthy degens, just like early BTC and ETH buyers.

YFI is just one of seven tokens that reshaped my understanding of tokenomics. The other six are AMPL, OHM, COMP, CRV, NXM, and SNX.

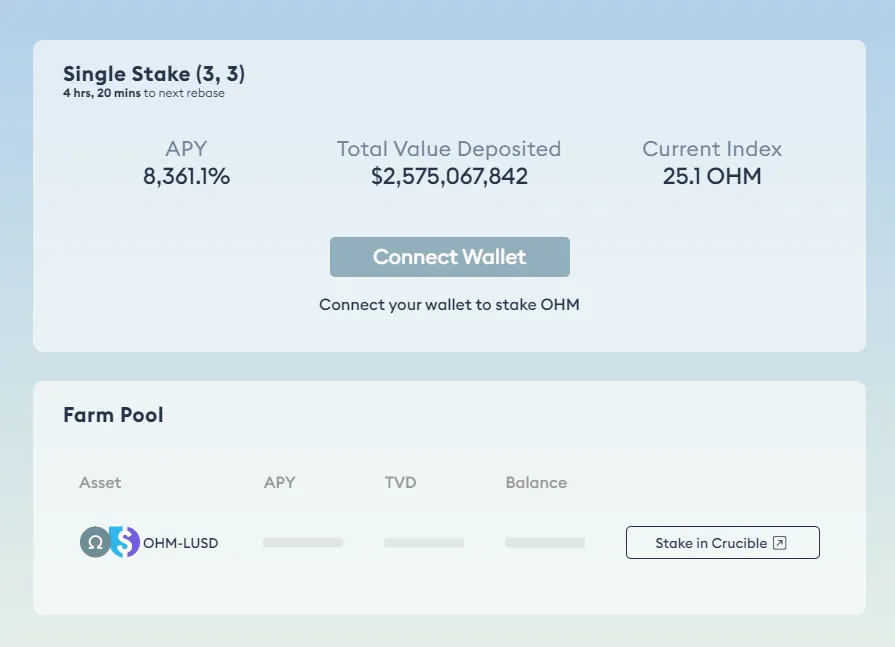

Each of these tokens has a wild story and valuable lessons. Olympus DAO offered triple-digit APYs in a Ponzi scheme that worked—until someone sold (“3,3”)—inflating OHM’s market cap to $4.3 billion! That exceeds AVAX’s current market cap.

Everything went smoothly until the Ponzi collapsed.

Olympus PTSD made me skeptical of Friend Tech’s 3.3 game. Don’t be naive about new marketing gimmicks (Olympus claimed to be DeFi 2.0). At least sell part of your profits on the way up.

When the bull market returns, there will be more bull market memes, WAGMI chants, and new Ponzi schemes promising bigger returns. You’ll hear stories of degens making massive profits. In short, we’ll get reckless—and the bull market will be crazier than you imagine.

We need to be cautious—but not too cautious, or we’ll miss once-in-a-lifetime opportunities. Adjusting our mindset is essential, though staying calm is easier said than done.

How to Navigate Narratives in the Upcoming Crazy Bull Market

In crypto, there’s always a bull market somewhere. Even during this bear market, we saw PEPE emerge suddenly, followed recently by the rise of SocialFi.

How does one identify early signals of new narratives? The Delphi article I mentioned earlier explains why narratives matter and how they form.

Narratives are crucial because they help us make sense of a complex, intimidating, and seemingly random world. When clear communication is impossible, we rely on shared knowledge, common sense, and social norms to make decisions. These often hinge on salient cues known as Schelling points.

“Two individuals face a list of numbers [2, 5, 9, 25, 69, 73, 82, 96, 100, 126, 150], and they win a reward only if they independently choose the same number. If both are mathematicians, they’ll likely pick 2—the only even prime. Non-mathematicians might choose 100—it stands out numerically, unlike the other square numbers. Illiterates might pick 69 due to its visual symmetry, appealing differently to those who care about form over math.”

— Delphi Digital

Crypto degens will likely converge on 69 for meme reasons. Do you really think Bitcoin’s all-time high of $69,000 was a coincidence?

In short, decision diversity matters—it drives markets. Though people are driven by emotions and stories, markets thrive on collective consensus and narratives. These narratives help us interpret seemingly random events.

PEPE successfully captured the imagination of a bored yet profit-hungry crypto community. In a market lacking major developments, PEPE’s compelling narrative helped it stand out, and its relatively small market cap compared to rivals like Doge and Shiba Inu gave it momentum.

Bear markets are tricky because such opportunities are rare and fleeting. In bull markets, multiple narratives coexist, creating abundant opportunities. And things will get crazier than you expect.

My advice: Keep an open mind, try out the newest things that confuse you the most, and study them. Never sell all of your newly acquired tokens at once. Even tokens criticized or viewed negatively are worth exploring. Disruptive ideas often unsettle the old guard.

That’s exactly what Bitcoin did to traditional finance (TradFi)—and what Ordinals are doing to Bitcoin maximalists today. The fact that Bitcoin purists criticize Ordinals is one reason I’m bullish on it. It shows even they recognize its significance and feel threatened by it.

I believe crypto markets reward those who spot emerging narratives early and remain open-minded enough to adapt quickly to new market dynamics. Even “real yield” tokens, seemingly fundamentals-driven, ultimately become just another narrative to sell. I’ve actually checked the performance of “real yield” tokens before and after their narratives emerged (and faded) to confirm this.

What Are the Bull Market Narratives?

I’ve said before that narratives arise from a combination of new technological innovation and compelling storytelling.

One such narrative is Bitcoin DeFi via Ordinals, Stacks, and BitVM—aiming to enhance Bitcoin’s smart contract functionality without forking.

But here are several narratives I believe could explode in the bull market, powered by 1) technological innovation and 2) token monetization potential.

-

Liquid restaking tokens.

-

AI-crypto convergence. Arthur Hayes is promoting Filecoin (FIL) due to storage needs, but Arweave (AR) or newer tokens could also break out at the right moment (both underperformed recently). The machine-to-machine micropayments narrative may also revive due to advances in AI and related technologies.

-

Modular vs. monolithic blockchains. Ethereum and Cosmos exemplify modular blockchains, though they differ in implementation. Solana leads the monolithic L1 narrative—time will tell which approach dominates the next decade.

-

Next-generation decentralized exchanges (DEXs). I’m closely watching projects recently funded by top-tier VCs. Most newly funded DeFi protocols are DEXs—unsurprising, given that speculation remains a primary use case for crypto. As trading volume rises in a bull market, DEXs and their tokens will see increased valuations.

-

Next-gen DeFi stablecoins. UST’s collapse wasn’t the final attempt to solve the stablecoin trilemma. Liquity V2 claims to do so; Frax V3 and DAI leverage RWAs for scale. Ethena offers a different (though not decentralized) scalability model. I expect new models to continue creating new paths to wealth.

Yet, in every bull market, a completely new narrative usually emerges—one that may surpass all the above. Just like Friend Tech and SocialFi seemed to appear out of nowhere.

Protocols that successfully create new narratives—and those that embrace them early—will be the winners of the next bull run.

In Al Ries and Jack Trout’s book *The 22 Immutable Laws of Marketing*, they mention the “Law of Leadership.” According to this law, it’s easier to be first in someone’s mind than to convince them your product is better than the first successful one.

So, all these SocialFi forks marketing themselves as “better Friend Tech” are actually helping FT solidify its position as the category leader.

Remember, when a new narrative emerges, it’s often wiser to bet on the original protocol rather than its forks. There are exceptions—like PancakeSwap and Velodrome—but most forks promise heaven and deliver hell.

Celestia is a great example of mastering another principle from the book—the “Law of Category.” Celestia wasn’t the first to enter the modular blockchain narrative, but while hundreds of L2s focus on the “execution layer,” Celestia focused on the data availability (DA) layer. How many DA solutions can you name?

Some forks do perform well in the short term, so avoiding them entirely might mean missing (short-term) opportunities.

Final Thoughts

Everyone’s experiences and lessons differ. That’s why there’s a saying in crypto: You need to go through three cycles to “succeed” in crypto—one to learn, one to earn, and one to achieve financial freedom.

No matter how crazy the market gets, ensure it doesn’t completely wipe you out. You can lose 10%, 20%, or even 50% of your net worth on a protocol, but if you lose everything, you’re out of the game.

Crypto markets are full of what Nassim Taleb calls “Fat Tails”—extreme events that happen frequently but are unpredictable. FTX, Celsius, Terra—once major players in the last bull market—are now cautionary tales.

Therefore, prepare for the coming wild bull market—but also prepare for the worst. Risk management sounds boring—until you lose money. My largest dollar-denominated loss occurred in the Osmosis OSMO/UST pool during Terra’s collapse. With a two-week unlock period, I couldn’t withdraw my LP, so since then, I no longer stake my “stablecoins” with time locks.

So, even if the market becomes crazier than expected, that’s no excuse for us to act recklessly or foolishly. Learn, prepare, and enjoy the ride!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News