The Wall Street Journal: Why Does the U.S. Government Hold $5 Billion in Bitcoin?

TechFlow Selected TechFlow Selected

The Wall Street Journal: Why Does the U.S. Government Hold $5 Billion in Bitcoin?

The U.S. has been surprisingly slow in converting its bitcoin into dollars, with these bitcoins being more of a byproduct of an extended legal process rather than a strategic plan.

Author | Vicky Ge Huang, WSJ

Translated by | Wu Shuo Blockchain

The U.S. government is one of the largest holders of bitcoin in the world, but unlike other major cryptocurrency whales, it doesn't care about price fluctuations of the digital currency.

That’s because Uncle Sam’s stash of roughly 200,000 bitcoins was seized from cybercriminals and darknet markets. These are primarily stored in encrypted, password-protected devices known as hardware wallets controlled by the Department of Justice, IRS, or other agencies.

How the federal government handles its bitcoin has long been a topic of interest among crypto traders, as any sale could potentially impact prices or create ripple effects across the $1 trillion digital asset market.

The U.S. has been surprisingly slow in converting its bitcoin into dollars. It's neither HODLing (crypto slang for holding with no intention to sell) nor waiting for bitcoin to "moon" so it can sell its holdings at a high price. Instead, this massive pile of bitcoin is more of a byproduct of a lengthy legal process than a strategic plan.

“We don’t play the market. We’re basically set up to follow our procedures,” said Jarod Koopman, director of the IRS’s Cyber and Forensic Services unit, which oversees all activities related to cybercrime.

Just three recent seizures have added more than 200,000 bitcoins to the government’s coffers, according to public filings analyzed by the crypto firm 21.co. The analysis shows that even after selling around 20,000 bitcoins, the U.S. holdings are still worth over $5 billion. The government’s total holdings could be significantly larger.

The legal process—from seizing illicit bitcoin to receiving final court orders to liquidate tokens into cash—can take years. In some cases, this works in the government’s favor, as cryptocurrency values surge dramatically during that time.

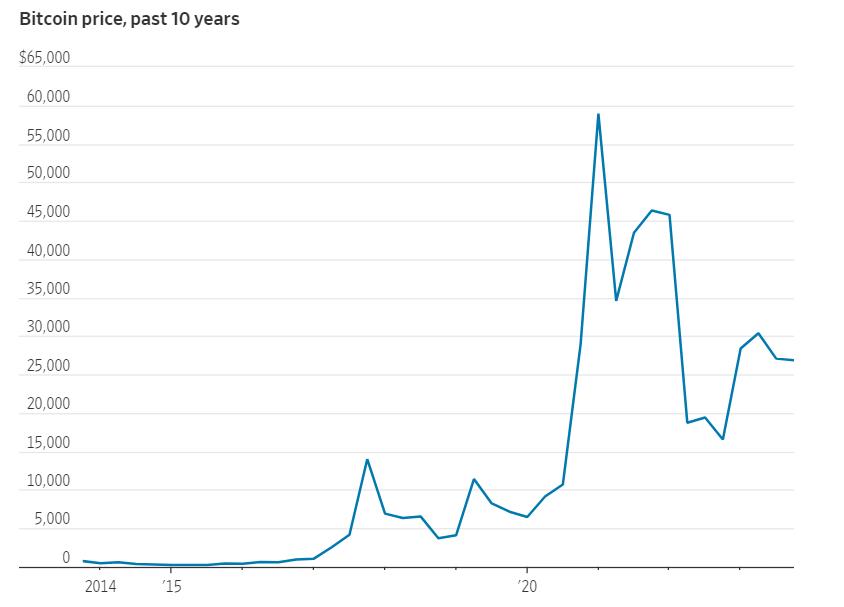

For example, when the cryptocurrency exchange Bitfinex was hacked by convicted tech entrepreneur Ilya Lichtenstein in 2016, bitcoin traded at around $600. By the time Lichtenstein and his wife Heather Morgan were arrested in 2022, and the Department of Justice announced its largest financial seizure ever—about 95,000 bitcoins—the token price had risen to $44,000. Today, it hovers around $30,000.

Heather Morgan was arrested last year over alleged Bitcoin crimes. Source: Reuters

The U.S. government did not seize any cryptocurrency during last year’s collapse of the FTX exchange, but it did take control of hundreds of millions of dollars in assets, primarily cash and shares in brokerage Robinhood Markets. Robinhood repurchased the seized shares from the U.S. Marshals Service in August. FTX’s crypto assets are part of its bankruptcy estate; the company is expected to eventually use these funds to cover its $8 billion shortfall in customer funds or restart the exchange.

When government agencies take custody of crypto assets, Uncle Sam does not immediately own them. Ownership only transfers to the government after a court issues a final forfeiture order, at which point the tokens are moved to the U.S. Marshals Service, the primary agency responsible for liquidating seized assets.

While cases are ongoing, the government holds the bitcoin as evidence or proceeds of crime. Since shutting down the online drug marketplace Silk Road in 2013, the Department of Justice has been storing seized bitcoin on hardware wallets. In recent years, the agency has recovered 69,000 bitcoins once belonging to Silk Road founder Ross Ulbricht, as well as 50,676 bitcoins from a man in Georgia who admitted to stealing them from Silk Road.

“The government usually disposes of these assets very slowly because they have to do a lot of due diligence, the cases are often complex, and there’s a lot of red tape,” said Nicolas Christin, a computer science professor at Carnegie Mellon University.

As the crypto industry has evolved, so too has the Marshals Service’s liquidation process. In the early days of cryptocurrency, the agency held auctions, directly selling crypto to interested buyers—many of whom made substantial paper profits.

Wall Street Journal illustration

Venture capitalist Tim Draper, who made a fortune investing in cryptocurrencies, bought more than 30,000 bitcoins from the government through two auctions in 2014. In one auction, he paid $632 per coin when they were trading at $618. When bitcoin dropped to around $180, he paid about $191 per coin in another auction. That same year, DRW’s crypto division Cumberland won 27,000 bitcoins in an auction.

In January 2021, the Marshals Service decided for the first time to liquidate its seized cryptocurrency inventory on crypto exchanges. Historically, it sells crypto assets in multiple batches rather than all at once to avoid adverse market impacts from large sell orders. Under current practices, the agency takes additional steps to ensure minimal market disruption, including spreading out crypto liquidations over longer time windows.

In March, the government sold 9,861 bitcoins via Coinbase. The Marshals Service confirmed the sale. Coinbase declined to comment.

“Our goal is to dispose of assets promptly at fair market value,” said a representative of the agency.

In many cases, government proceeds from sales go toward compensating victims. Bitfinex said in July that it received over $300,000 in cash and 6.917 Bitcoin Cash (BCH), then worth about $1,900, from the Department of Homeland Security. Government agencies may also seek funding to support investigations into more complex crimes, such as licensing fees for blockchain tracing software.

“We struggle to adapt quickly,” said Koopman from the IRS. “The changes cryptocurrency has undergone in less than 10 years would have taken the financial industry 100 years.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News