Who Bought the Top?

TechFlow Selected TechFlow Selected

Who Bought the Top?

The beginning of a revolution means the decline of beliefs from the old era.

Author: Dovey

In 2025, the crypto industry got almost everything it had been hoping for. Structurally, this should have been a great year. But why it feels… so dead?

Not “prices didn’t go up” dead. BTC made new highs. But the vibe, the sentiment, the internal confirmation, the reflexive alt follow through, the retail heat. Maybe the most concerning, what used to be a "hot money leading asset" now has lost its appeal in both wealth effect and volatility.

Related crypto sector assets stopped syncing to BTC and ETH like past cycles:

- Memecoins topped first in 2024 Q4 to 2025 Q1, with the Trump token launch as the climax.

- Crypto stocks peaked around Circle’s IPO and rolled over between May and August 2025.

- Most altcoins never built a sustained trend at all. Asymmetry on the way up, full participation on the way down.

Zoom out one more layer and it gets even weirder.

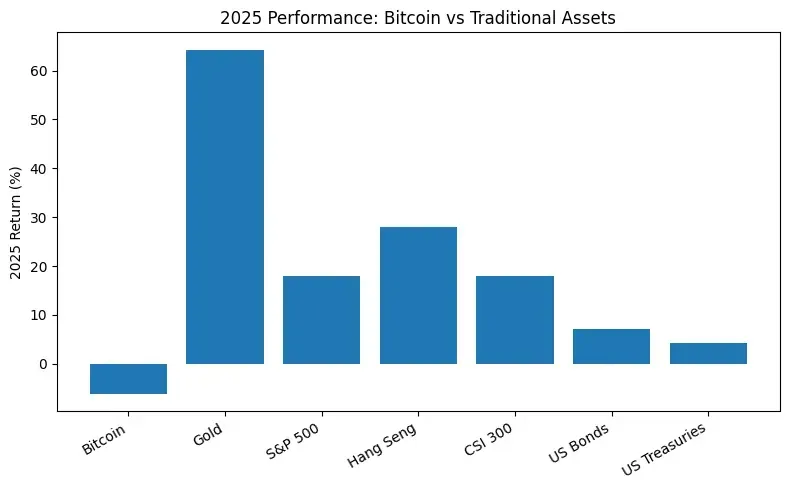

Despite a friendly policy backdrop, BTC underperformed almost every major TradFi asset in 2025. Gold, US equities, Hong Kong, A-shares, even some bond benchmarks. It was the first cycle when Bitcoin performance decoupled all other assets classes

That divergence matters: new highs in price, no internal confirmation, and better performance elsewhere. It tells you something simple and uncomfortable: Bitcoin has undergone a major liquidity supply chain changed, and the native 4 year fulfilling cycle has altered by bigger market forces elsewhere. So we dig further into who bought the top, who quite the game, and where is the floor.

The Great Divide: Onshore vs Offshore

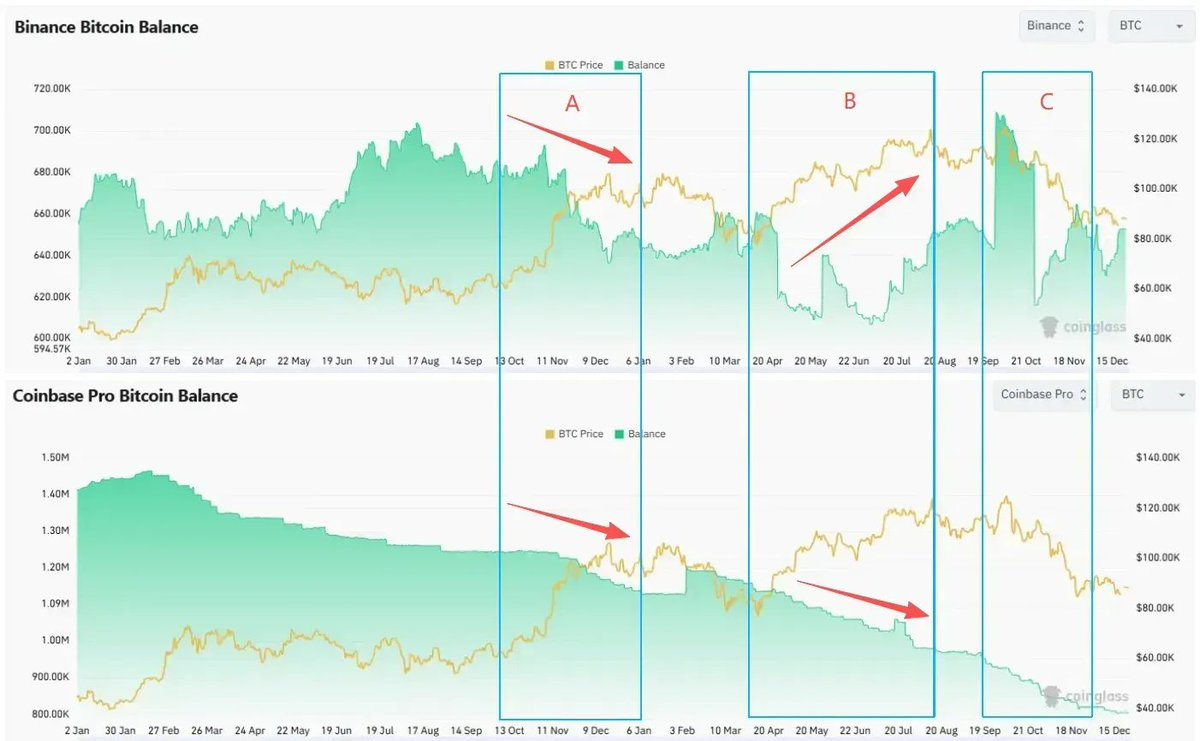

We have gone through 3 distinct phases this cycle -

Phase A (Nov 2024 to Jan 2025): Trump’s victory and a friendlier regulatory tone triggered joint onshore + offshore FOMO. BTC broke $100k for the first time.

Phase B (Apr to mid Aug 2025): After a deleveraging selloff, BTC resumed the move and cleared $120k.

Phase C (early Oct 2025): BTC printed the current local ATH in early October, then suffered the 10/10 flash crash and moved into a corrective regime. In every phases we have seen the great divide between onshore and offshore behavior -

Spot: onshore buys the breakout, offshore sells into strength

- Coinbase Premium stayed positive during phases A, B, and C. High-level buying demand originated primarily from onshore spot capital

- Coinbase BTC Balance trended downward throughout the cycle. Sellable inventory on the US side decreased

- Binance Balance rose significantly as prices rebounded during phases B and C. Offshore spot holders rebuilt inventory and potential sell pressure increased

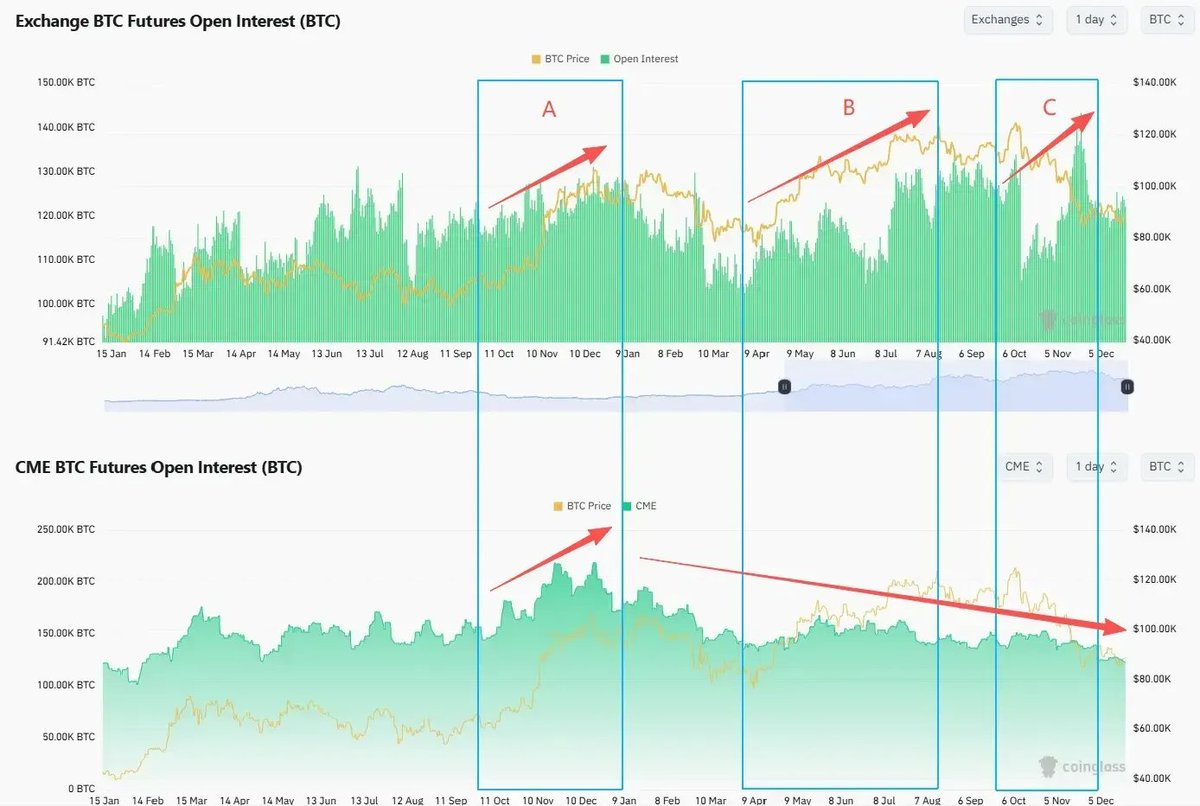

Futures: offshore leverage up, onshore positioning down

- Offshore OI (Binance and other offshore venues) climbed through phases B and C. Leverage ratios rose. Even after 10/10, leverage snapped back fast and returned to, or exceeded, prior highs (Figure 4).

- Onshore OI (CME), trended down from the start of 2025. Institutional interest did not re-risk with the new highs.

At the same time, BTC volatility diverged from price. In August 2025, when BTC first broke $120k, DVOL sat near a local low. Options markets did not pay up for continuation risk.

Every "top" seemed to be in disagreement between the onshore and offshore players. When onshore spot flows drove the breakout, offshore spot sold into it. When offshore levered capital chased the high, onshore futures and options desks reduced exposure and stayed in sideline

Where are the marginal buyers?

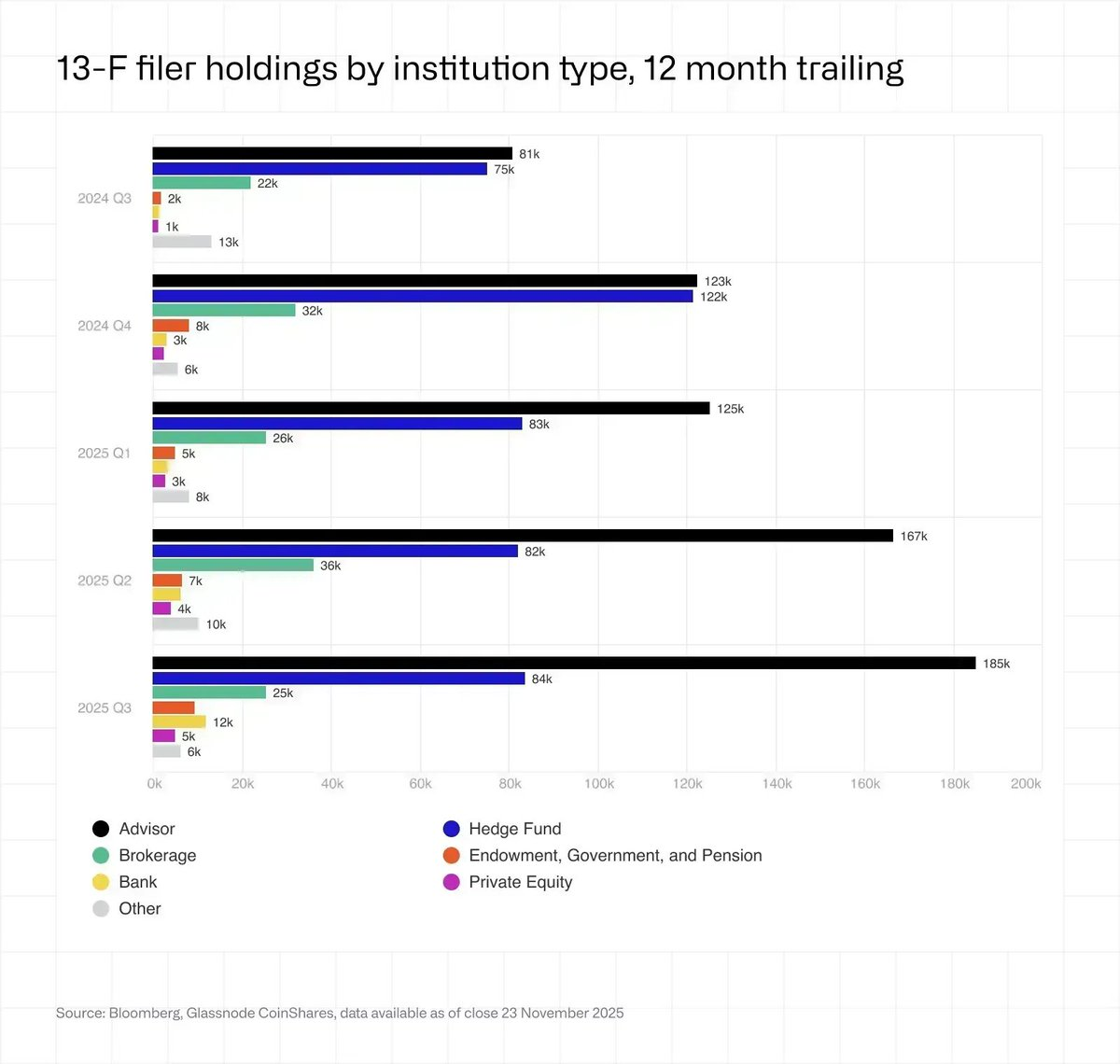

Glassnode estimates BTC held by corporations and DAT-type vehicles rose from roughly 197k coins in early 2023 to about 1.08m by end of 2025. Net increase around 890k BTC in two years. DATs became one of the biggest structural bids in the system. Another one (often misunderstood) is ETFs, nd of 2025, US spot BTC ETFs held around 1.36m BTC, up about 23% YoY and around 6.8% of circulating supply. Institutions (13F filers) hold less than a quarter of the total ETFs, and majority of them are hedge funds & advisors, apparently not our diamond hand fam.

Vanishing Retail Traffic data for Binance, Coinbase and other top exchanges tells a clear story since early 2025, and the retail fatigue is quite persistent after trump dropped its meme coins. and overall retail social sentiment is technically bear since early 2024.

- Since the 2021 peak, overall site traffic has trended lower.

- New BTC ATHs did not pull visits back to prior levels

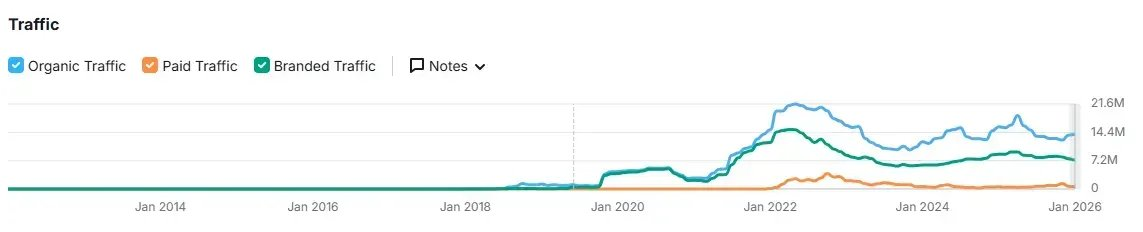

Binance Traffic

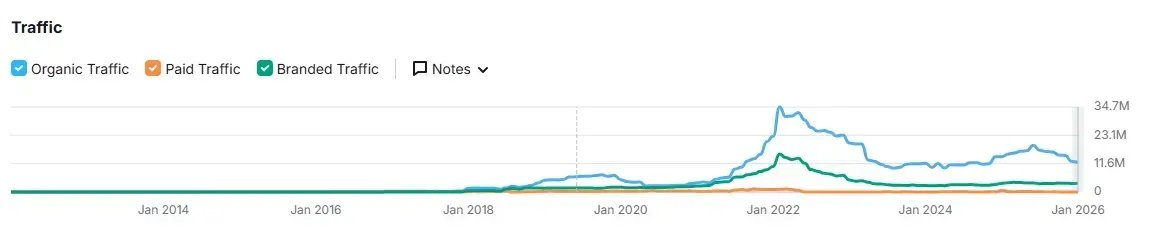

Coinbase Traffic

You can read more about this topic in our last year's article "Were are the marginal buyers"

Exchanges strategies have adapted accordingly. Facing high acquisition costs and low activity from legacy users, exchanges have pivoted from "fighting for growth" to "retaining existing capital via yield products and multi-asset trading" (aggressively listing US stocks, Gold, Forex)

Bull Market Elsewhere, Everywhere

The real “wealth effect” of 2025 sat outside crypto: the S&P 500 (+18%), Nasdaq (+22%), Nikkei (+27%), Hang Seng (+30%), KOSPI (+75%) and even A shares is up 19%, all delivered strong gains. Gold (+70%) and silver (+144%) have also ripped, making“digital gold" look almost clownish by comparison.

And it's appeal is tripled killed by AI stocks, 0DTE and commodities like Gold and Silver.

Degen capital did not rotate into alts. Many quit entirely and went back to equity vol, and new degen have been happily printing in US stock market or their domestic stocks.

Even the Korean retail army retreated from Upbit to bet on KOSPI and US stocks: Upbit average daily volume in 2025 fell around 80% versus 2024.Over the same period, KOSPI rallied more than 75%, and Korean retail net-bought roughly $31bn of US equities

The Sellers

Every cycle there are OG whales sell into the local top, but this cycle the sellers timing are interestingly coincided with RS divergence BTC has been tracking US growth tech closely, until around August 2025, BTC started lagging ARKK and NVIDIA materially and then suffered the 10/10 Crash, and has yet to recover the gap. Timely right before this divergence, In late July, Galaxy disclosed in its earnings and media briefings that it had executed a >80k BTC sell order on behalf of an OG holder. That transaction brought “Satoshi Era whales taking profit” into public view

Miners sell into AI capex

From the 2024 halving through late 2025, miner reserves saw their most persistent drawdown since 2021. By year end, reserves stood near 1.806m BTC. Hash rate down roughly 15% YoY.

- Under the “AI exodus plan,” miners moved about $5.6bn equivalent in BTC to exchanges to fund AI data center builds.

- Bitfarms, Hut 8, Cipher, Iren are converting sites into AI and HPC campuses, signing 10 to 15 year compute contracts, treating power and land as “AI era gold.”

- Riot, a HODL poster child, announced in April 2025 it would begin selling all monthly production.

Estimates suggest by end of 2027, around 20% of mining power capacity could be redeployed to AI workloads.

China added a harsher layer. In December 2025, Xinjiang was targeted again by PBoC and ministries. Roughly 400k ASICs forced offline, cutting global hash rate by 8 to 10% in days

Grey Whales: Black Bitcoin Hang Over

Similar to PlusToken scam materially made the 2021 cycle, several large-scale fraud and gambling cases in 2025, including Qian Zhimin’s ponzi/cult network and Cambodia’s Prince Group/CHEN Zhi are likely the major hidden forces in building up the bitcoin chart. Both cases have revealed seizures in the tens of thousands of BTC, with totals at or above the 100k-coin black bitcoin hang over. Read more on Who is CHEN Zhi, the man who has never went to college but richer than CZ ..

This might also add potential government sell pressure, also, will have major chilling effect on mega size grey market holding bitcoin for long-term, which might be a shock in the sell pressure for short to mid term but generally positive in the long run

2026 Outlook

Under this new structure, the old "4 year halving cycle" is no longer a viable self-fulling path

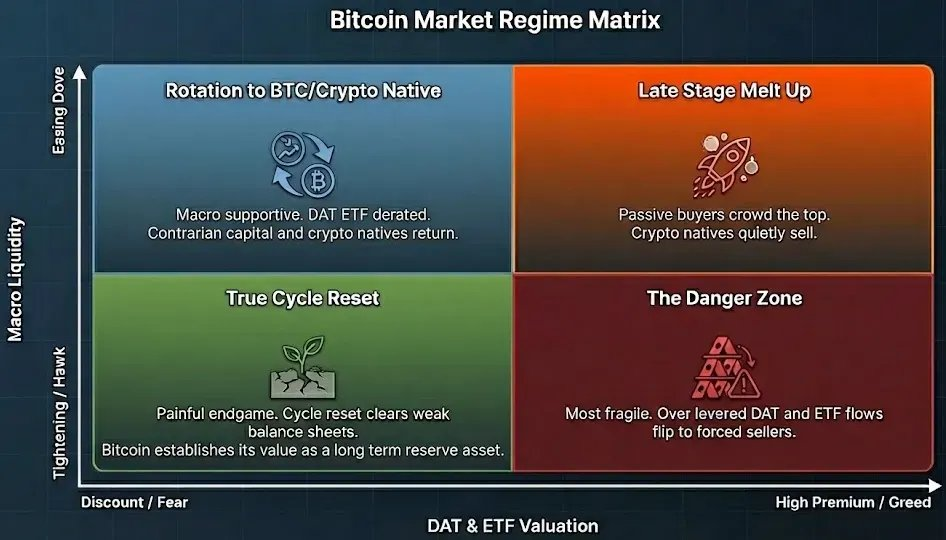

The next regime is driven primarily by two axes

- Vertical: macro liquidity and credit conditions, rates, fiscal stance, the AI investment cycle.

- Horizontal: valuation and premium levels across DATs, ETFs and other BTC proxies

Early BTC winners, OGs, miners, Asian grey whales, are handing coins to passive ETF holders, DAT structures and long-dated state capital. Think Bitcoin will follow the path starts to look like FAANG from 2013 to 2020.

A slow rotation from a high beta story driven by early retail and growth funds into passive allocation dominated by index funds, pensions and sovereigns Bitcoin is now the easiest crypto asset to own without touching crypto. You can buy it through a brokerage account, custody it like an ETF, account for it cleanly, and explain it to an tradfi investment committee in five sentences. While most other crypto assets have not earned their valuation through real utility or legitimacy on both mainstreet and wallstreet. We are always wishful for another bull run, but if this time the bull run is more than just the price bull but also the utility bull that can converts the ETF era’s legitimacy into onchain demand, that turns passive holdings into active usage, that makes capital return because it’s real yield generation, not because it’s a on-going musical chair of narratives. If that's built, today’s “top buyers” will look less like the end of one cycle and more like the first investors in a new one Bitcoin has finally become nation states' reserve Code is eating the banks Crypto still has to become a new civilizational tool

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News